- United States

- /

- Software

- /

- NYSE:PATH

UiPath (NYSE:PATH) Expands Partnership With Redis to Enhance Agentic Automation Solutions

Reviewed by Simply Wall St

UiPath (NYSE:PATH) recently announced an expanded collaboration with Redis to enhance its agentic automation solutions, which may have supported the company's stock increase of 5% over the last week. This stock movement comes amid a broader market upswing driven by robust earnings reports and easing tariff concerns, with major indices like the Nasdaq climbing 2.3%. UiPath's enhanced offerings in automation and AI, alongside Redis's augmented support for the company's high-availability add-ons, likely resonated with investor optimism. While broader market trends lifted tech stocks generally, UiPath's news could have complemented these upward forces.

UiPath's recent collaboration with Redis could strengthen its automation offerings, potentially enhancing customer engagement and broadening market prospects. This aligns with UiPath's ongoing focus on agentic automation and cloud-driven products, crucial for its growth trajectory. However, despite a short-term share price increase, the stock remains under its consensus price target of US$12.31, suggesting that investors might be either cautious about, or pending further developments to fully capitalize on, these opportunities.

Over the last three years, UiPath's total return declined by 40.8%, contrasting sharply with its recent gains. This longer-term decline indicates challenges within a rapidly evolving tech landscape, including geopolitical and economic uncertainties impacting financial targets. Comparatively, in the past year, UiPath underperformed both the broader US market return of 5.9% and the Software industry's 2.2% return.

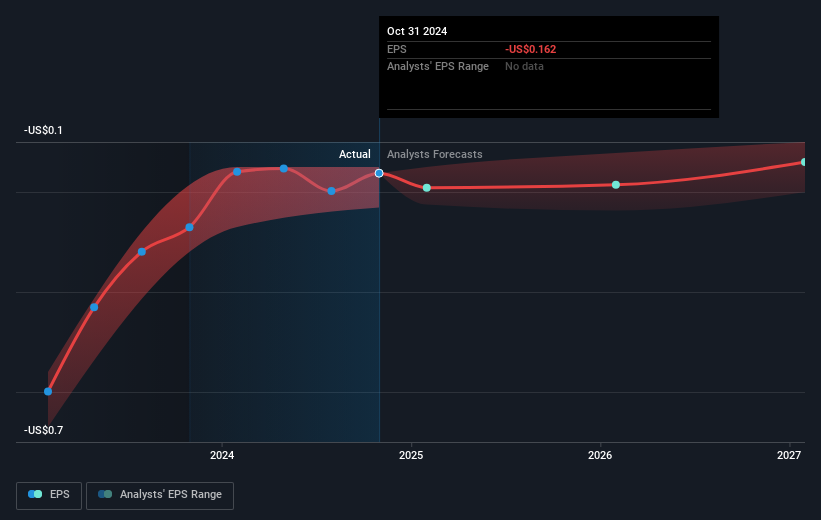

Analysts anticipate that the expanded collaboration and strategic realignments could contribute to a sustained revenue increase, forecasted at 7.5% annually. However, persistent macroeconomic and revenue challenges may affect near-term earnings growth, limiting profitability projections. The current price of US$10.38 indicates a cautious market stance relative to the projected price target, underscoring investor skepticism or potential for future bullish momentum if growth targets are met.

The valuation report we've compiled suggests that UiPath's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives