- United States

- /

- IT

- /

- NasdaqGS:OKTA

High Growth Tech Stocks To Watch In The US April 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of mixed performance, with major indices like the Dow Jones experiencing fluctuations due to ongoing tariff uncertainties, investors are closely watching the tech sector for potential opportunities. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and innovation amidst economic challenges and market volatility.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.29% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.39% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.08% | 58.88% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.78% | 59.70% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Okta (NasdaqGS:OKTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Okta, Inc. is a global identity management company that provides secure access solutions for enterprises, with a market capitalization of approximately $17.07 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $2.61 billion.

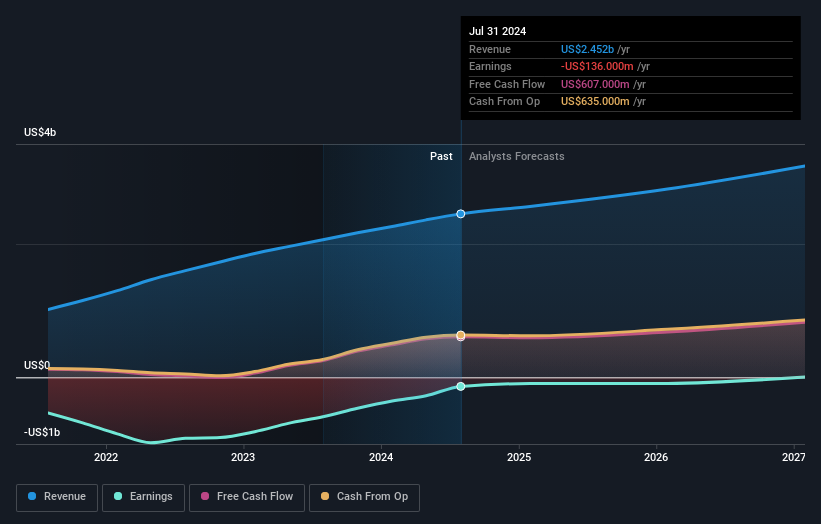

Okta's recent pivot towards enhancing security in generative AI applications marks a strategic expansion in high-growth tech sectors. By introducing Auth for GenAI, Okta addresses critical gaps in AI-driven application security, catering to the burgeoning demand for robust identity verification systems. This move not only diversifies Okta's product offerings but also positions it favorably within an industry shifting rapidly towards AI integration. Financially, Okta has turned a corner with its latest annual report showing a swing to a net income of $28 million from a previous net loss of $355 million, reflecting significant operational improvements and potential for sustained growth.

- Delve into the full analysis health report here for a deeper understanding of Okta.

Understand Okta's track record by examining our Past report.

Kyndryl Holdings (NYSE:KD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kyndryl Holdings, Inc. is a global technology services company specializing in IT infrastructure services, with a market cap of approximately $7.22 billion.

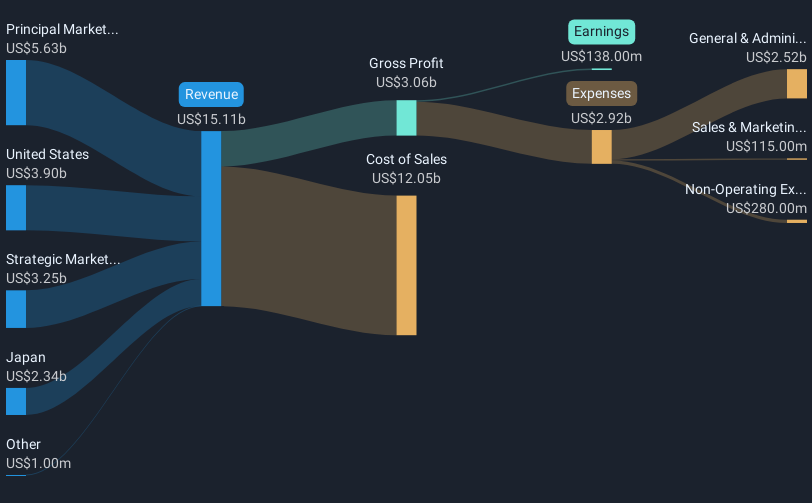

Operations: The company generates revenue primarily from its IT infrastructure services across various regions, with the United States contributing $3.90 billion and Principal Markets adding $5.63 billion to its revenue streams.

Kyndryl Holdings, recently profitable, is navigating the high-growth tech landscape with strategic initiatives in AI and data security. The company's launch of Kyndryl Consult Data Security Posture Management with Microsoft Purview underscores its commitment to enhancing data protection capabilities across hybrid environments. This move, coupled with a suite of AI private cloud services developed in collaboration with NVIDIA, positions Kyndryl to capitalize on enterprise-grade AI solutions demand. Despite modest revenue growth at 1.1% annually, Kyndryl's earnings are expected to surge by 47.8% per year, showcasing a significant turnaround in profitability and operational efficiency.

- Unlock comprehensive insights into our analysis of Kyndryl Holdings stock in this health report.

Assess Kyndryl Holdings' past performance with our detailed historical performance reports.

TKO Group Holdings (NYSE:TKO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TKO Group Holdings, Inc. is a sports and entertainment company with a market capitalization of approximately $25.85 billion.

Operations: TKO Group Holdings generates revenue primarily through its UFC and WWE segments, contributing approximately $1.41 billion and $1.40 billion, respectively. The company operates within the sports and entertainment industry, leveraging these major brands to drive its financial performance.

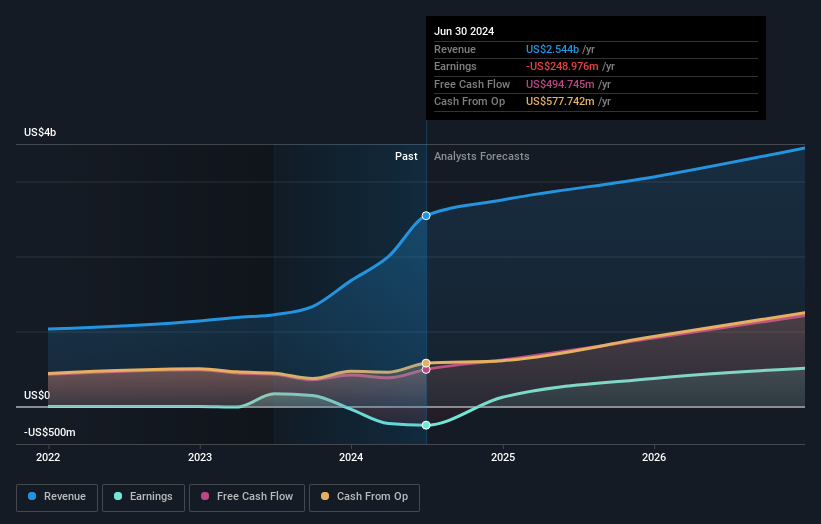

TKO Group Holdings has demonstrated a robust trajectory in the high-growth tech sector, notably with its recent earnings turnaround and strategic licensing expansions. In 2024, the company not only reversed its net losses, posting a net income of $31 million from a previous loss but also increased its sales to $642.2 million from $614 million year-over-year. This financial revitalization is underscored by an aggressive revenue target of up to $3 billion for 2025, reflecting an annual growth rate of 16.8%. Additionally, TKO's strategic move to extend its licensing agreement with WWE and Mattel ensures continued penetration into diverse global markets, leveraging popular culture for sustained growth. This blend of financial health and strategic partnerships positions TKO well within the competitive tech landscape.

Next Steps

- Dive into all 234 of the US High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Okta, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives