- United States

- /

- Software

- /

- NYSE:HUBS

HubSpot (HUBS) Launches AI-Driven Loop Marketing Playbook For Growth

Reviewed by Simply Wall St

HubSpot (HUBS) recently introduced "The Loop," a novel AI-centric marketing framework aimed at evolving traditional strategies into modern, personalized approaches. This development highlights the company's commitment to harnessing AI for enhanced business growth. Over the past week, the company's stock has remained largely flat at 0.69%, aligning with broader market trends where the tech-heavy indices have shown mild gains. While HubSpot's new AI initiative might have added some interest, it didn't significantly diverge from general market activity, which continues to be influenced by prevailing economic conditions and broader corporate earnings forecasts.

Buy, Hold or Sell HubSpot? View our complete analysis and fair value estimate and you decide.

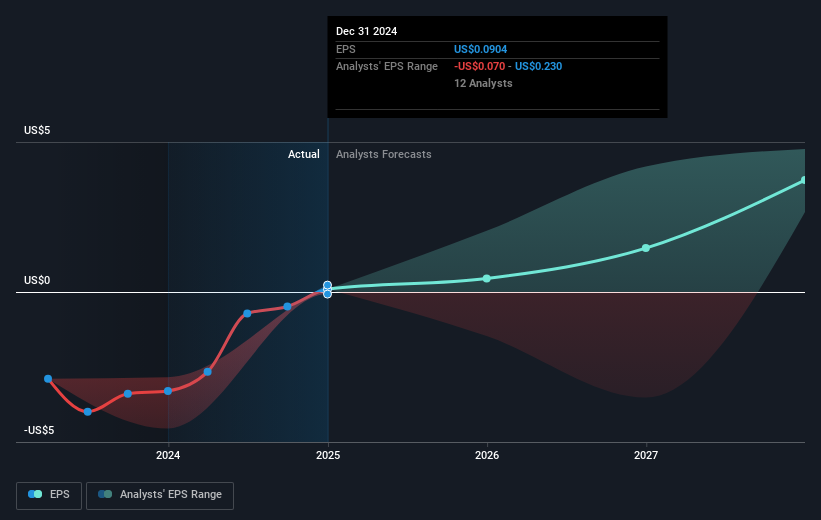

HubSpot's introduction of "The Loop" AI-centric marketing framework marks an ambitious effort to optimize marketing strategies through advanced technology. This development aligns with the company's ongoing pivot towards AI and integrated cloud platforms, enhancing its potential for long-term growth by targeting higher recurring revenue and improved margins from larger, enterprise-level deals. The company's total shareholder return over the past five years stands at 66.38%, indicating robust growth compared to its recent one-year performance, where it underperformed both the US market, which gained 18.1%, and the US Software industry, which returned 28%.

The impact of "The Loop" could positively influence HubSpot's revenue and earnings forecasts. The company's projected shift to higher profit margins and substantial revenue growth are essential components for achieving analyst expectations. Analysts have set a consensus price target of US$695.33, suggesting a 47.1% increase from the current share price of US$472.71, highlighting optimistic outlooks for future performance. However, achieving this target depends on sustained adoption of AI initiatives and success in overcoming challenges posed by global economic conditions and rising competition. Whether HubSpot meets these expectations will be observed through its ability to monetize AI capabilities effectively and maintain its growth trajectory in the evolving market landscape.

Gain insights into HubSpot's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)