- United States

- /

- Software

- /

- NYSE:FICO

Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

In the last week, the United States market has stayed flat, yet it is up 25% over the past year with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks that align with these optimistic earnings projections can be crucial for investors seeking opportunities in a dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 64.24% | 20.95% | ★★★★★★ |

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 54.85% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Bitdeer Technologies Group | 50.44% | 122.48% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.43% | 56.40% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation develops a software-based platform designed to help advertisers improve marketing and monetization strategies for their content globally, with a market cap of $107.76 billion.

Operations: AppLovin generates revenue through its two primary segments: Apps, contributing $1.49 billion, and Software Platform, which brings in $2.80 billion.

AppLovin, a key figure in the tech industry, has demonstrated robust growth with a remarkable 1005.6% increase in earnings over the past year, significantly outpacing the software industry's average of 30.2%. This surge is supported by an aggressive R&D strategy that not only fuels innovation but also aligns with anticipated revenue growth of 17.9% annually, surpassing the US market projection of 8.9%. Recently, AppLovin has been active in capital markets with multiple fixed-income offerings totaling nearly $4 billion, underscoring its strategic financial management to bolster future expansions. Moreover, its inclusion in the NASDAQ-100 index highlights its rising prominence and investor confidence amidst a volatile market environment marked by significant insider selling and high debt levels.

- Click to explore a detailed breakdown of our findings in AppLovin's health report.

Assess AppLovin's past performance with our detailed historical performance reports.

Fair Isaac (NYSE:FICO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fair Isaac Corporation specializes in developing software with analytics and digital decisioning technologies to automate and enhance business decisions globally, with a market cap of $47.47 billion.

Operations: Fair Isaac Corporation generates revenue primarily through its Scores and Software segments, with Scores contributing $919.65 million and Software $797.88 million. The company focuses on providing analytics and digital decisioning technologies across various global markets.

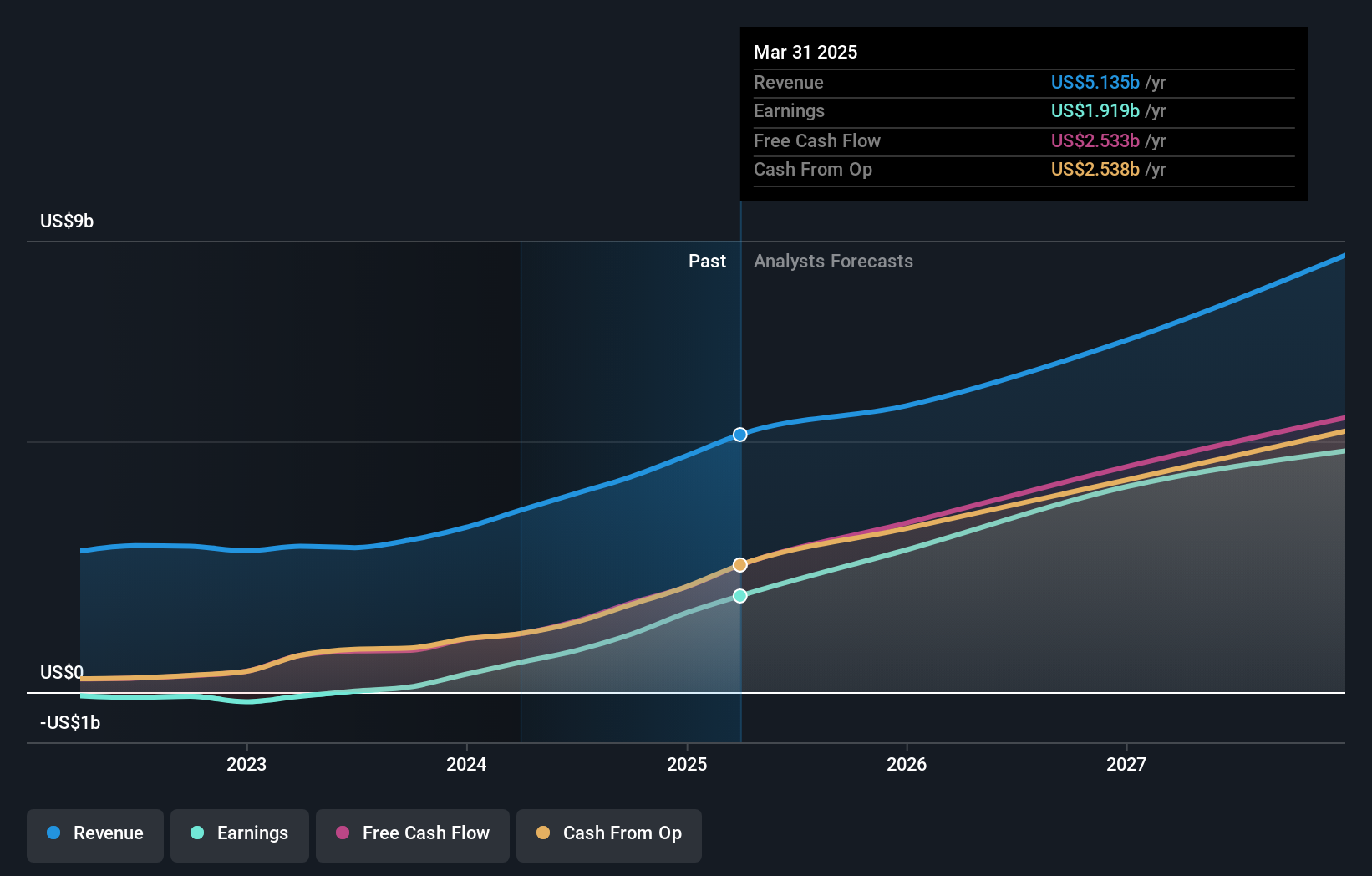

Fair Isaac, known for its predictive analytics and credit scoring services, is navigating a competitive landscape with strategic agility. In 2024, the company reported a significant revenue increase to $1.72 billion from $1.51 billion the previous year, underpinned by robust net income growth to $512.81 million from $429.38 million. These financial achievements are bolstered by innovative product launches like the FICO® Score 10 T and collaborations such as those with MCT for mortgage asset transactions, enhancing lending precision and risk management in real estate finance. Moreover, Fair Isaac's commitment to R&D is evident in its recent initiatives with Tata Consultancy Services (TCS) to develop advanced decision management solutions across various industries, highlighting its focus on integrating AI into practical business applications while addressing broader market needs such as climate-related risk assessments.

- Dive into the specifics of Fair Isaac here with our thorough health report.

Examine Fair Isaac's past performance report to understand how it has performed in the past.

Spotify Technology (NYSE:SPOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market capitalization of $93.68 billion.

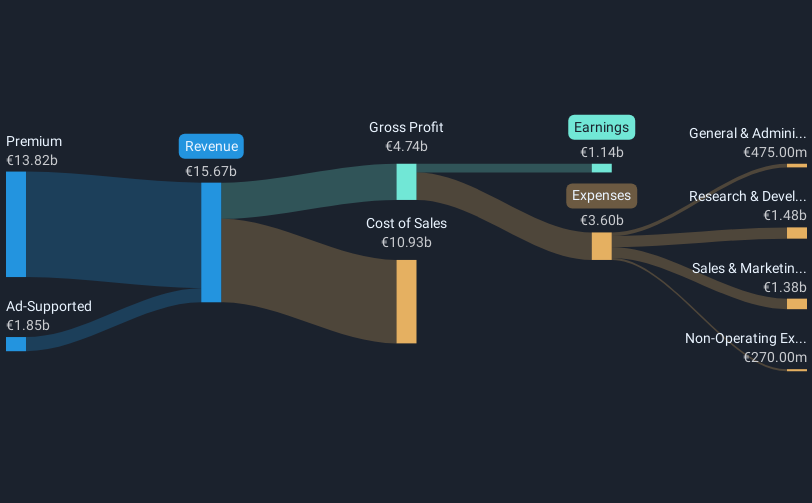

Operations: Spotify generates revenue primarily from its Premium subscription service, which accounts for €13.28 billion, and its Ad-Supported segment, contributing €1.82 billion.

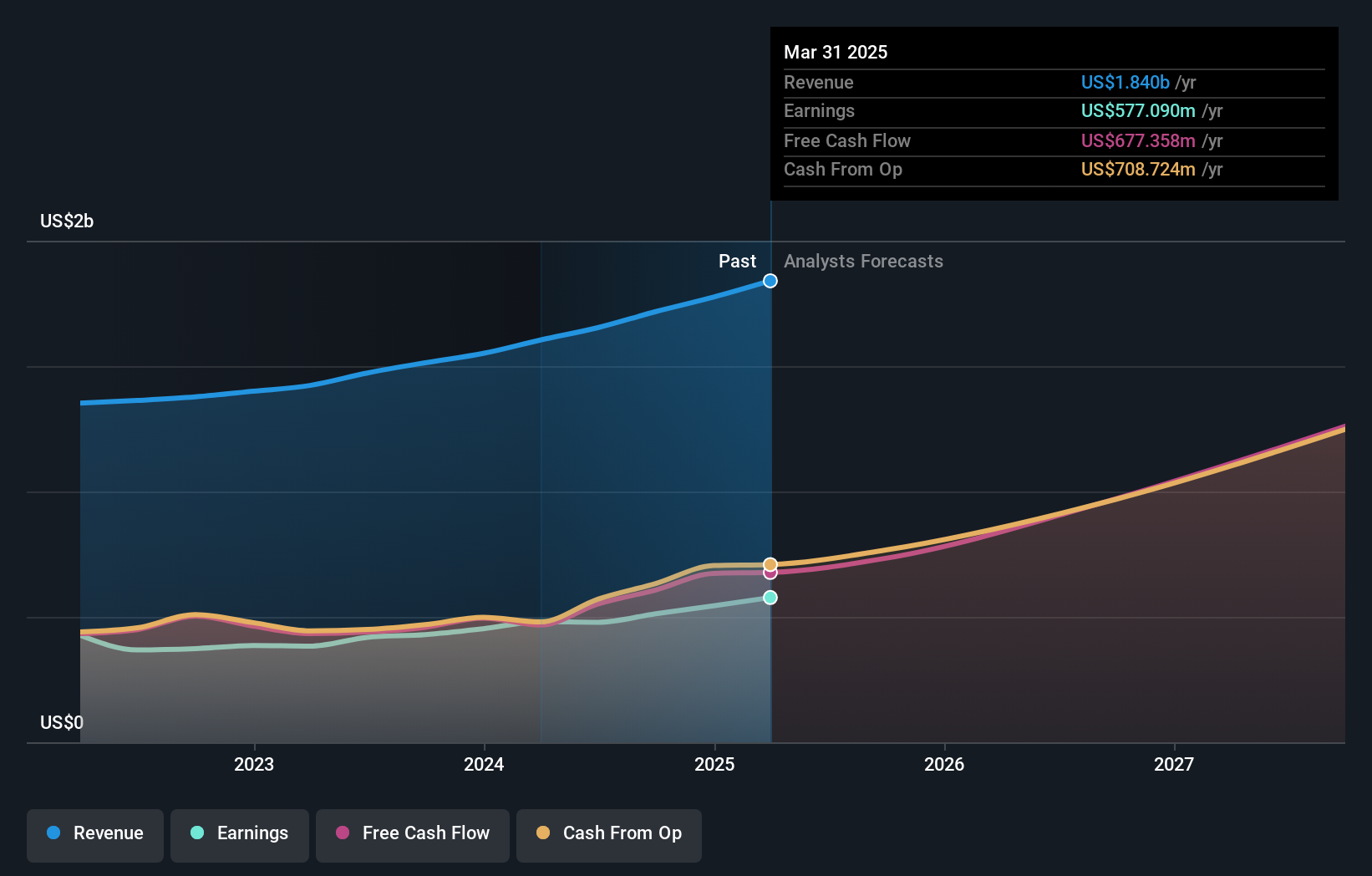

Spotify Technology's trajectory in the tech landscape is marked by strategic partnerships and robust financial growth. Recently, Spotify enhanced user engagement by integrating with Opera's browser, making it the default music service—a move that taps into user habits of streaming music while browsing. Financially, Spotify has shown impressive growth; its revenue surged to €3.99 billion in Q3 2024 from €3.36 billion the previous year, alongside a net income increase to €300 million from €65 million. This performance is underpinned by a significant annual earnings growth forecast at 30.4%, outpacing the US market average of 14.9%. Moreover, with R&D focused on innovative streaming technologies and premium service offerings, Spotify is not just growing financially but also enhancing its product value and market position.

- Delve into the full analysis health report here for a deeper understanding of Spotify Technology.

Gain insights into Spotify Technology's past trends and performance with our Past report.

Summing It All Up

- Unlock our comprehensive list of 231 US High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives