- United States

- /

- Capital Markets

- /

- NasdaqGM:FUTU

Futu Holdings And 2 High Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market experiences a lift led by banks and tech stocks, despite ongoing trade tensions with China, investors are keenly observing companies that can sustain growth amidst such volatility. In this climate, growth companies with significant insider ownership often attract attention due to their potential for strong alignment between management and shareholder interests, making them noteworthy contenders in today's market landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.2% |

| Hims & Hers Health (NYSE:HIMS) | 13.3% | 21.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.3% | 64.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Red Cat Holdings (NasdaqCM:RCAT) | 19.4% | 122.6% |

| Clene (NasdaqCM:CLNN) | 19.5% | 63.1% |

| Niu Technologies (NasdaqGM:NIU) | 36.2% | 82.8% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.2% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

Let's review some notable picks from our screened stocks.

Futu Holdings (NasdaqGM:FUTU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Futu Holdings Limited operates as a digitalized securities brokerage and wealth management product distributor in Hong Kong and internationally, with a market cap of approximately $11.09 billion.

Operations: The company generates revenue primarily from its online brokerage services and margin financing services, which amounted to HK$11.97 billion.

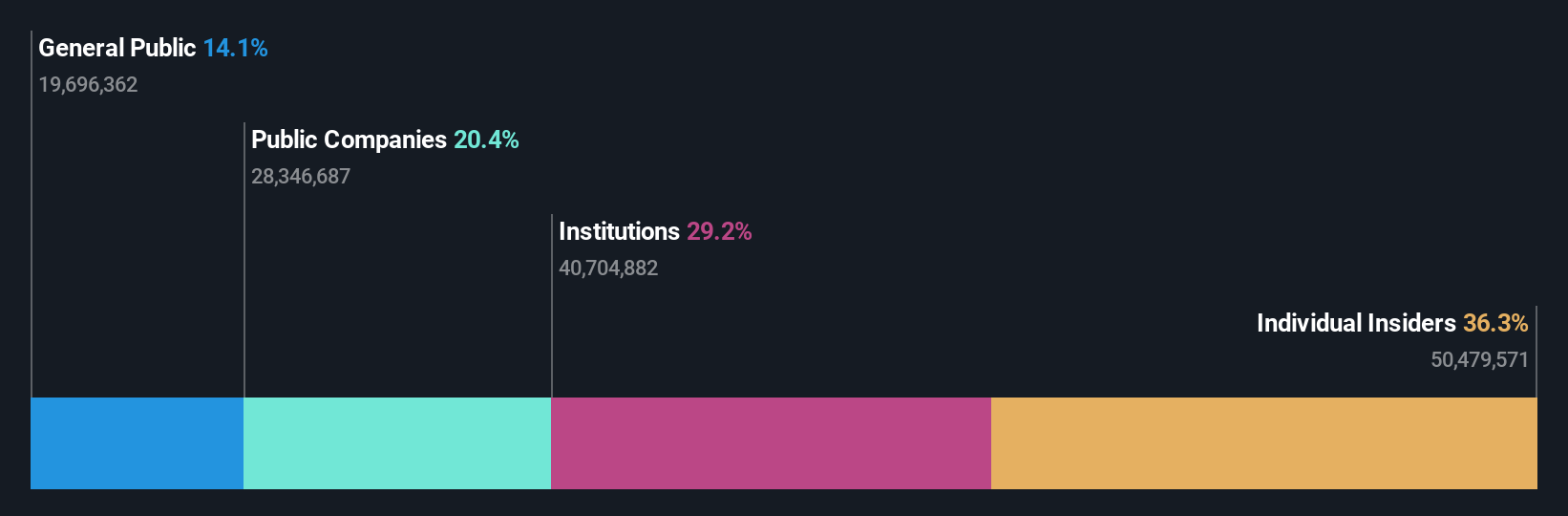

Insider Ownership: 36.6%

Return On Equity Forecast: 21% (2027 estimate)

Futu Holdings has demonstrated strong financial performance, with revenue and net income growth in 2024. Despite high share price volatility, its earnings are forecast to grow at 19.6% annually, surpassing the US market average. The stock is trading at a significant discount to its estimated fair value, with analysts projecting a potential price increase of 68.7%. While insider trading activity has been minimal recently, Futu's substantial insider ownership aligns interests with shareholders.

- Dive into the specifics of Futu Holdings here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Futu Holdings' current price could be quite moderate.

Elastic (NYSE:ESTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elastic N.V. is a search artificial intelligence company offering hosted and managed solutions for hybrid, public, private, and multi-cloud environments globally, with a market cap of approximately $8.34 billion.

Operations: The company's revenue is primarily generated from its Software & Programming segment, totaling $1.43 billion.

Insider Ownership: 12.6%

Return On Equity Forecast: 22% (2028 estimate)

Elastic's revenue is forecast to grow at 12.4% annually, outpacing the US market average. Despite recent losses and legal challenges, its earnings are expected to improve significantly over the next three years. The stock trades below its estimated fair value and analysts anticipate a price increase of 66.7%. Recent product developments enhance Elastic's capabilities in AI observability and monitoring, potentially driving future growth despite substantial insider selling in the past quarter.

- Get an in-depth perspective on Elastic's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Elastic is trading behind its estimated value.

Karman Holdings (NYSE:KRMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Karman Holdings Inc., with a market cap of $4.36 billion, operates in the United States through its subsidiary to design, test, manufacture, and sell mission-critical systems.

Operations: Revenue Segments (in millions of $):

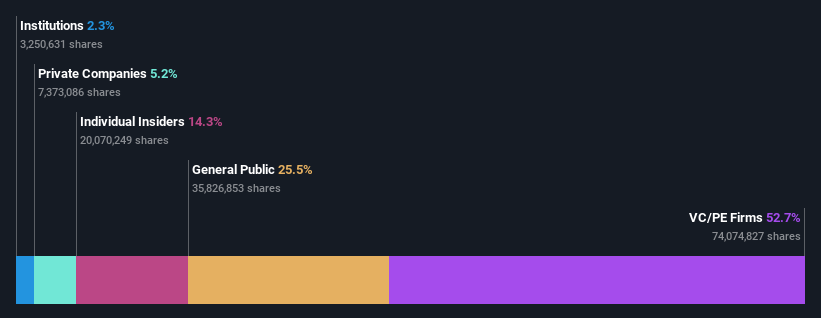

Insider Ownership: 14.3%

Return On Equity Forecast: 23% (2027 estimate)

Karman Holdings shows strong growth potential with earnings expected to rise significantly, outpacing the US market. Recent results highlight a 191.3% increase in net income, reaching US$12.7 million for 2024. The company opened a new clean room to support its space vehicle assembly capabilities, indicating strategic expansion efforts. However, interest payments remain poorly covered by earnings and significant insider selling has occurred recently, despite forecasts of robust revenue growth surpassing the market average.

- Delve into the full analysis future growth report here for a deeper understanding of Karman Holdings.

- Our comprehensive valuation report raises the possibility that Karman Holdings is priced higher than what may be justified by its financials.

Taking Advantage

- Click this link to deep-dive into the 198 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 20 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FUTU

Futu Holdings

Provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion