- United States

- /

- Software

- /

- NYSE:ESTC

Elastic (ESTC): Evaluating Valuation After Strong Results and Upbeat Growth Guidance

Reviewed by Simply Wall St

Most Popular Narrative: 23.2% Undervalued

According to the consensus narrative, Elastic is currently trading well below what analysts consider to be its fair value, thanks to its strong positioning in key digital trends and improving financial outlook.

Ongoing platform consolidation trends, where enterprises seek unified solutions for search, observability, and security, are enabling Elastic to displace legacy providers and drive cross-selling of its integrated offerings. This is leading to deeper customer relationships and improved net dollar retention rates.

The secret behind Elastic’s bullish price target? It is not just about rapid top-line growth. There is a bold calculation at play, hinging on aggressive earnings expansion and a punchy future profit multiple that most companies only dream of. Want to see which assumptions are critical to this forecast and what makes the consensus so confident? The full breakdown reveals some surprising projections you do not want to miss.

Result: Fair Value of $120.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from cloud giants and ongoing pricing pressures could quickly erode Elastic's expected growth momentum and narrow its profit margins.

Find out about the key risks to this Elastic narrative.Another View: What Do Market Multiples Say?

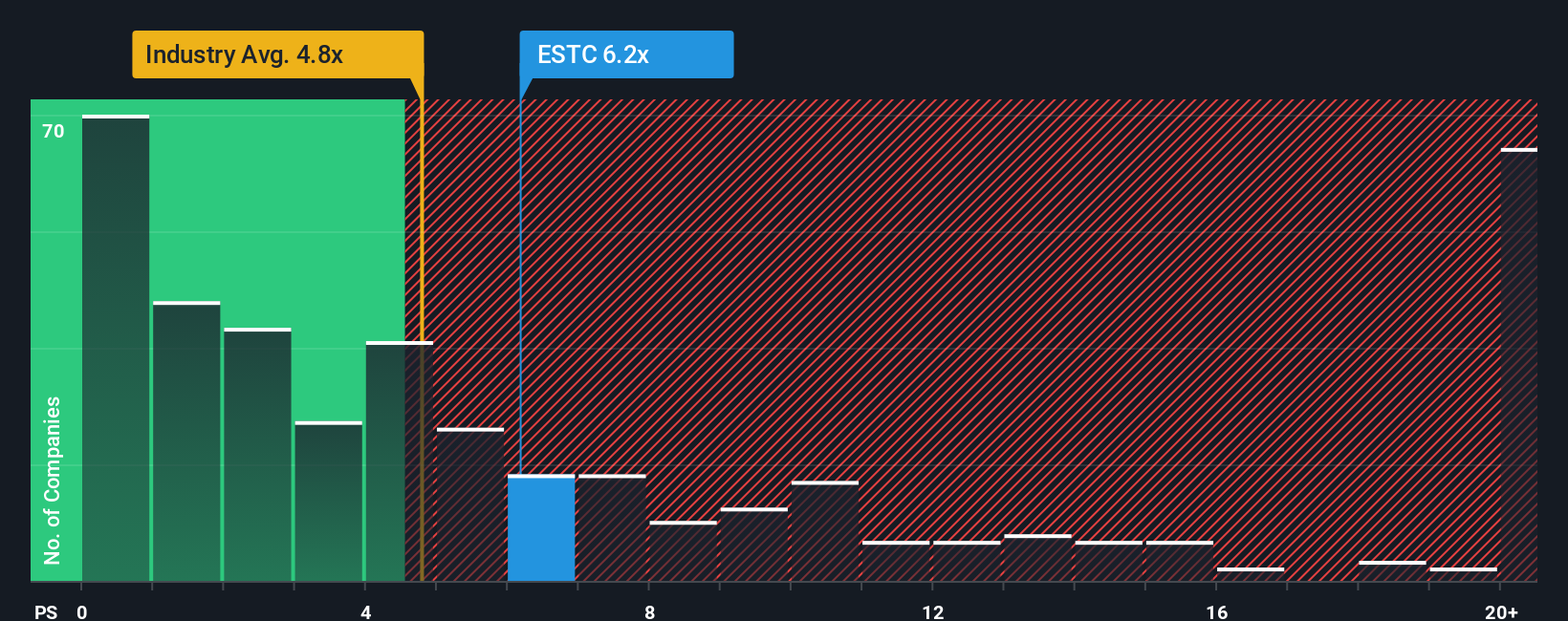

While the previous outlook points to Elastic trading below its fair value, comparing its share price to industry sales multiples paints a different picture. In this comparison, Elastic appears more expensive than many of its software peers. Could the market be expecting even more growth, or is this a signal to pause?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Elastic to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Elastic Narrative

If you want to put these perspectives to the test or craft your own outlook, it's easy to dive in and build your own narrative in just a few minutes. Do it your way

A great starting point for your Elastic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass you by. Smart investors know that beyond Elastic, other compelling stocks could help you get ahead of the curve. Get started with these handpicked themes using the Simply Wall Street Screener:

- Tap into the earnings potential of companies with impressive yields by checking out dividend stocks with yields > 3%.

- Join the surging trend of future-defining technologies as you scan for standout innovators in AI penny stocks.

- Uncover tomorrow’s giants trading below their worth and review unique opportunities with our guide to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, provides software platforms to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026