- United States

- /

- IT

- /

- NYSE:CINT

3 US Stocks Possibly Trading Below Their Estimated Value In February 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility with major indices experiencing fluctuations, investors are keenly observing opportunities amid recent declines in technology shares and broader economic uncertainties. In such an environment, identifying stocks that may be trading below their estimated value can offer potential advantages, as these equities might provide a favorable entry point for those looking to invest with an eye on long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SouthState (NYSE:SSB) | $98.74 | $193.86 | 49.1% |

| Brookline Bancorp (NasdaqGS:BRKL) | $11.58 | $22.29 | 48% |

| Northwest Bancshares (NasdaqGS:NWBI) | $12.42 | $24.55 | 49.4% |

| Old National Bancorp (NasdaqGS:ONB) | $23.27 | $45.45 | 48.8% |

| Cadre Holdings (NYSE:CDRE) | $33.35 | $64.79 | 48.5% |

| Similarweb (NYSE:SMWB) | $9.45 | $18.06 | 47.7% |

| Advanced Micro Devices (NasdaqGS:AMD) | $108.11 | $214.13 | 49.5% |

| Fluence Energy (NasdaqGS:FLNC) | $6.59 | $12.84 | 48.7% |

| Verra Mobility (NasdaqCM:VRRM) | $25.84 | $49.08 | 47.4% |

| Nutanix (NasdaqGS:NTNX) | $68.43 | $133.03 | 48.6% |

We'll examine a selection from our screener results.

Bel Fuse (NasdaqGS:BELF.A)

Overview: Bel Fuse Inc. is a company that designs, manufactures, markets, and sells products for powering, protecting, and connecting electronic circuits with a market cap of approximately $1.08 billion.

Operations: The company's revenue segments include Magnetic Solutions at $68.87 million, Connectivity Solutions at $220.37 million, and Power Solutions and Protection at $245.55 million.

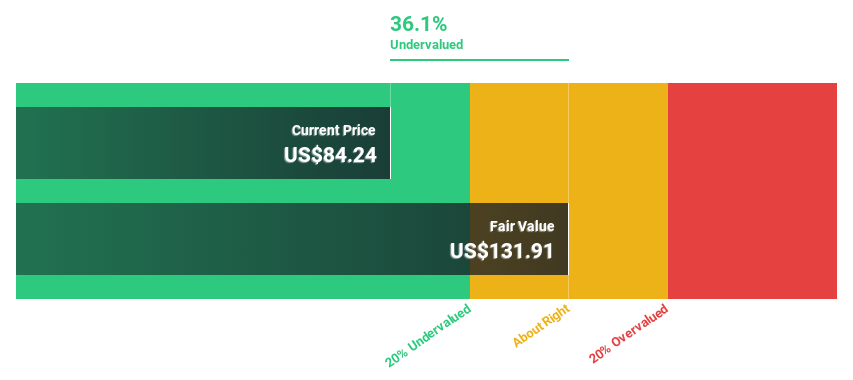

Estimated Discount To Fair Value: 36.1%

Bel Fuse is trading at US$84.24, significantly below its estimated fair value of US$131.91, suggesting it may be undervalued based on cash flows. Despite a decline in net income to US$40.96 million from US$73.83 million the previous year, earnings are projected to grow 22.9% annually, outpacing the broader U.S. market's growth rate of 14.3%. However, high debt levels and reduced profit margins present challenges amidst leadership transitions with Farouq Tuweiq becoming CEO in May 2025.

- Our comprehensive growth report raises the possibility that Bel Fuse is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Bel Fuse.

CI&T (NYSE:CINT)

Overview: CI&T Inc. offers strategy, design, and software engineering services to support digital transformation for businesses globally, with a market cap of approximately $978.74 million.

Operations: CI&T's revenue primarily comes from its Computer Services segment, which generated R$2.23 billion.

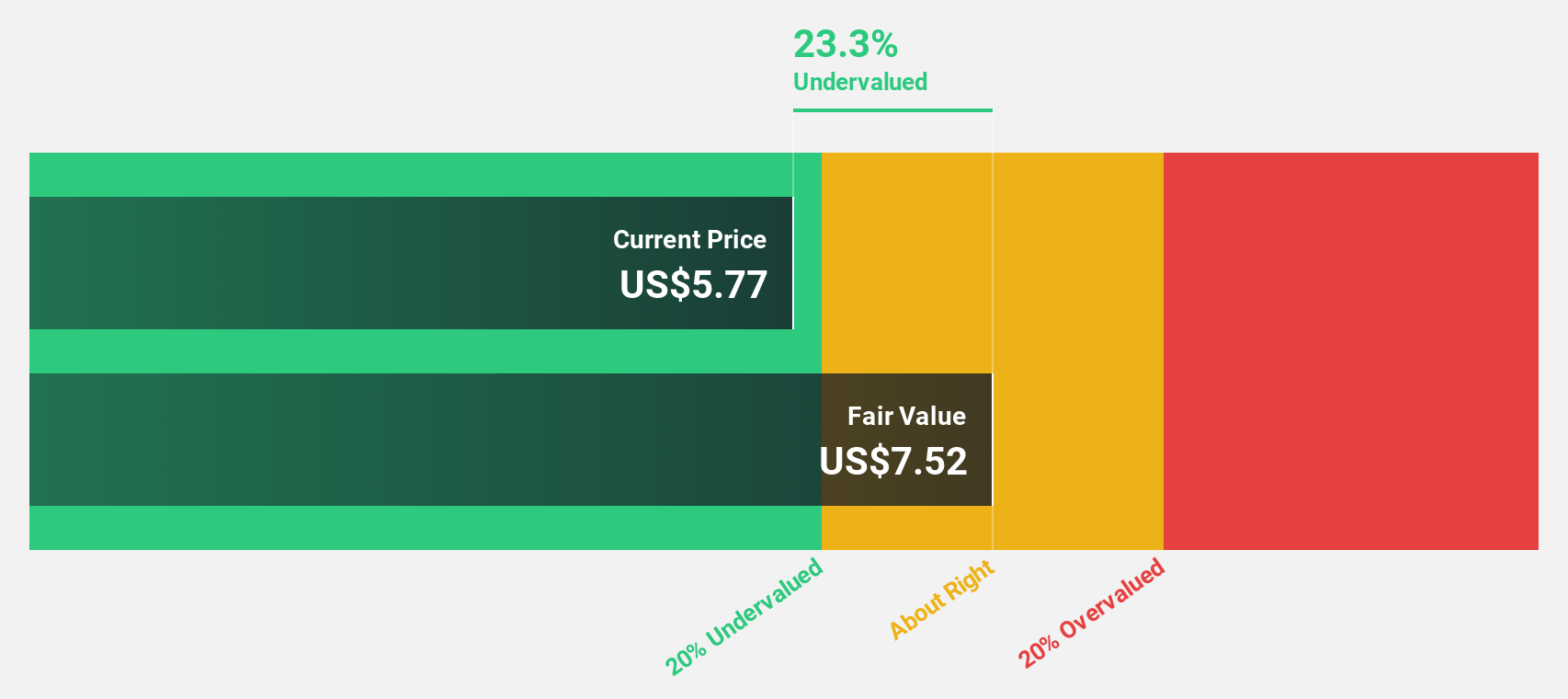

Estimated Discount To Fair Value: 25.6%

CI&T is trading at US$7.42, over 25% below its fair value estimate of US$9.97, highlighting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 32.1% annually, surpassing the U.S. market's growth rate of 14.3%. Recent leadership appointments in North America aim to boost growth in financial services and healthcare sectors, while a share repurchase program supports shareholder value amidst these strategic expansions.

- The growth report we've compiled suggests that CI&T's future prospects could be on the up.

- Click here to discover the nuances of CI&T with our detailed financial health report.

Enfusion (NYSE:ENFN)

Overview: Enfusion, Inc. offers software-as-a-service solutions for the investment management industry across various regions including the United States, Europe, the Middle East, Africa, and Asia Pacific with a market cap of approximately $1.48 billion.

Operations: The company generates revenue from its online financial information provider services, amounting to $195.16 million.

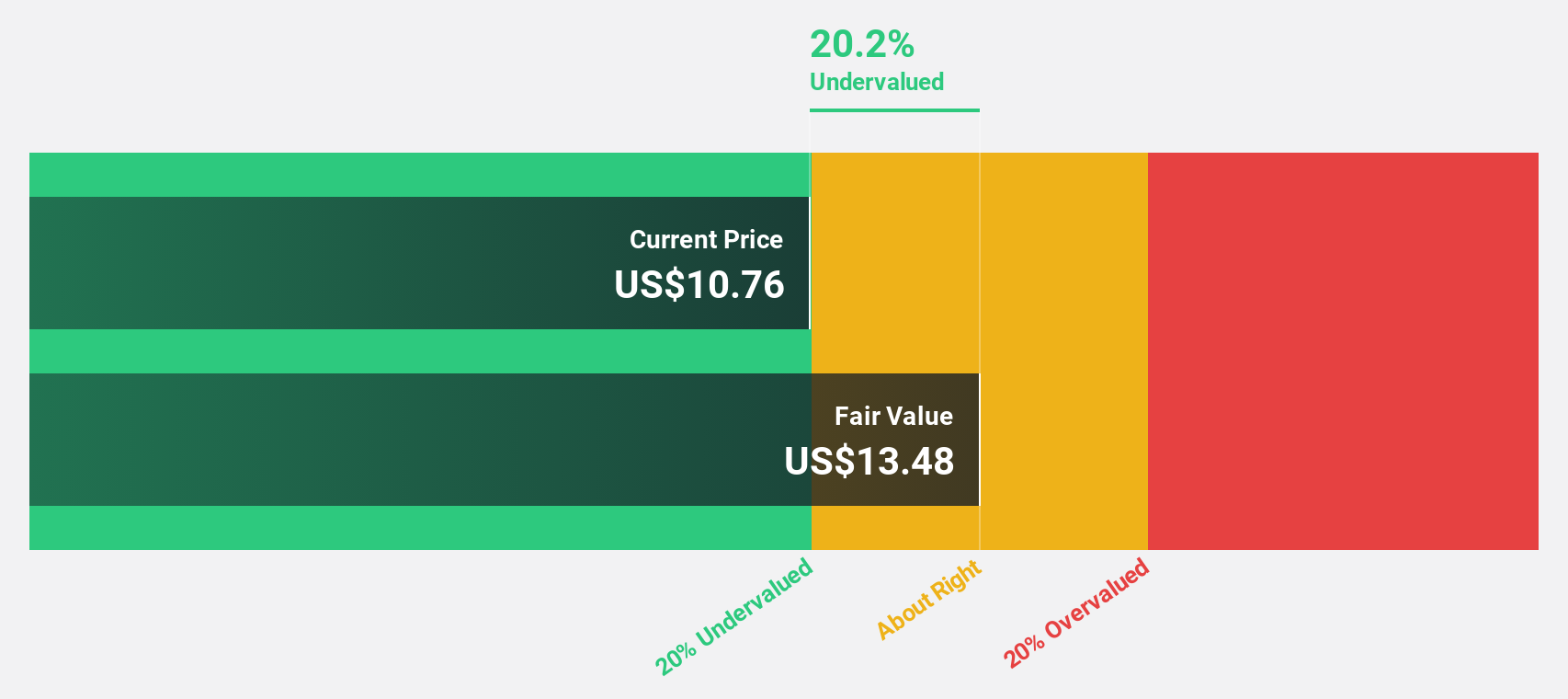

Estimated Discount To Fair Value: 18.2%

Enfusion is trading at US$11.44, approximately 18.2% below its estimated fair value of US$13.98, suggesting potential undervaluation based on cash flows. Despite recent insider selling and a decrease in profit margins from 3.6% to 1.4%, earnings are forecasted to grow significantly at 74.8% annually over the next three years, outpacing the broader U.S. market's growth rate of 14.3%. The upcoming acquisition by Clearwater Analytics for $1.1 billion could further influence valuations and strategic direction.

- Our expertly prepared growth report on Enfusion implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Enfusion.

Turning Ideas Into Actions

- Navigate through the entire inventory of 172 Undervalued US Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CINT

CI&T

Engages in the provision of strategy, design, and software engineering services worldwide.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives