- United States

- /

- Leisure

- /

- NYSE:BC

3 Stocks Estimated To Be Trading At A Discount Of Up To 49.9%

Reviewed by Simply Wall St

As the U.S. stock market faces a downturn with major indices like the Dow Jones and S&P 500 experiencing notable declines, investors are grappling with concerns over tariffs and economic uncertainty. In such volatile conditions, identifying stocks that may be undervalued can present opportunities for those looking to invest at a discount; these stocks often have solid fundamentals that might not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (NasdaqGS:WSBC) | $30.56 | $60.76 | 49.7% |

| International Paper (NYSE:IP) | $49.38 | $98.63 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | $37.81 | $75.38 | 49.8% |

| Brunswick (NYSE:BC) | $57.44 | $114.54 | 49.9% |

| Afya (NasdaqGS:AFYA) | $15.89 | $31.62 | 49.7% |

| Midland States Bancorp (NasdaqGS:MSBI) | $18.23 | $35.77 | 49% |

| Coastal Financial (NasdaqGS:CCB) | $82.49 | $162.87 | 49.4% |

| Sotera Health (NasdaqGS:SHC) | $11.38 | $22.32 | 49% |

| Grindr (NYSE:GRND) | $16.31 | $31.91 | 48.9% |

| First Advantage (NasdaqGS:FA) | $13.00 | $25.35 | 48.7% |

Here we highlight a subset of our preferred stocks from the screener.

Brunswick (NYSE:BC)

Overview: Brunswick Corporation designs, manufactures, and markets recreation products globally, with a market cap of approximately $3.86 billion.

Operations: Brunswick's revenue segments include Boat at $1.55 billion, Propulsion at $2.07 billion, Navico Group at $800.20 million, and Engine Parts & Accessories at $1.16 billion.

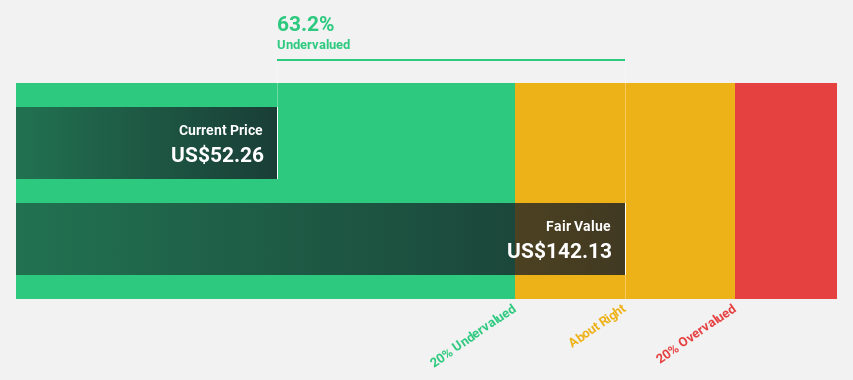

Estimated Discount To Fair Value: 49.9%

Brunswick is trading at US$57.44, significantly below its estimated fair value of US$114.54, indicating potential undervaluation based on discounted cash flow analysis. Despite recent insider selling and a decline in profit margins from 6.8% to 2.9%, the company forecasts strong earnings growth of 25.4% annually over the next three years, outpacing the broader U.S. market's expected growth rate of 13.8%.

- The growth report we've compiled suggests that Brunswick's future prospects could be on the up.

- Navigate through the intricacies of Brunswick with our comprehensive financial health report here.

Blend Labs (NYSE:BLND)

Overview: Blend Labs, Inc. provides a cloud-based software platform for financial services firms in the United States and has a market cap of approximately $823.57 million.

Operations: The company's revenue segments include $46.26 million from Title services and $115.76 million from the Blend Platform, both in millions of dollars.

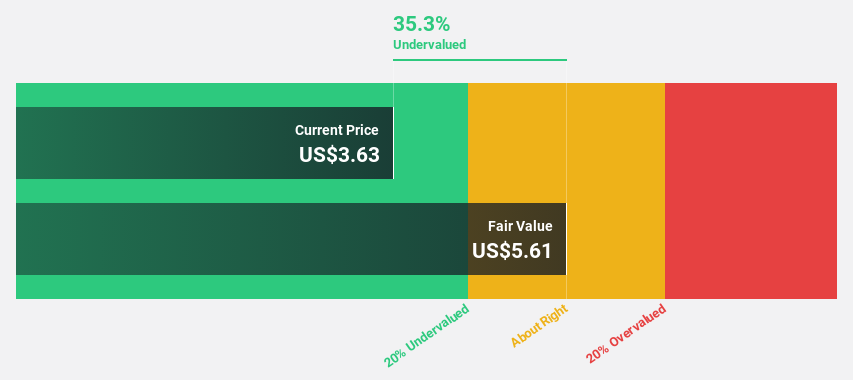

Estimated Discount To Fair Value: 42.3%

Blend Labs is trading at US$3.32, substantially below its estimated fair value of US$5.76, highlighting potential undervaluation based on discounted cash flow analysis. The company reported a reduced net loss and improved revenue in the latest earnings release. Strategic partnerships with Talk’uments and Truework enhance Blend's mortgage technology suite and verification capabilities, potentially boosting operational efficiency and borrower satisfaction. Revenue is projected to grow 17.1% annually, surpassing the U.S. market average growth rate.

- According our earnings growth report, there's an indication that Blend Labs might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Blend Labs.

Modine Manufacturing (NYSE:MOD)

Overview: Modine Manufacturing Company offers thermal management products and solutions across the United States, Italy, Hungary, China, the United Kingdom, and internationally with a market cap of approximately $4.06 billion.

Operations: Modine Manufacturing's revenue is primarily derived from its Climate Solutions segment, generating $1.31 billion, and Performance Technologies segment, contributing $1.26 billion.

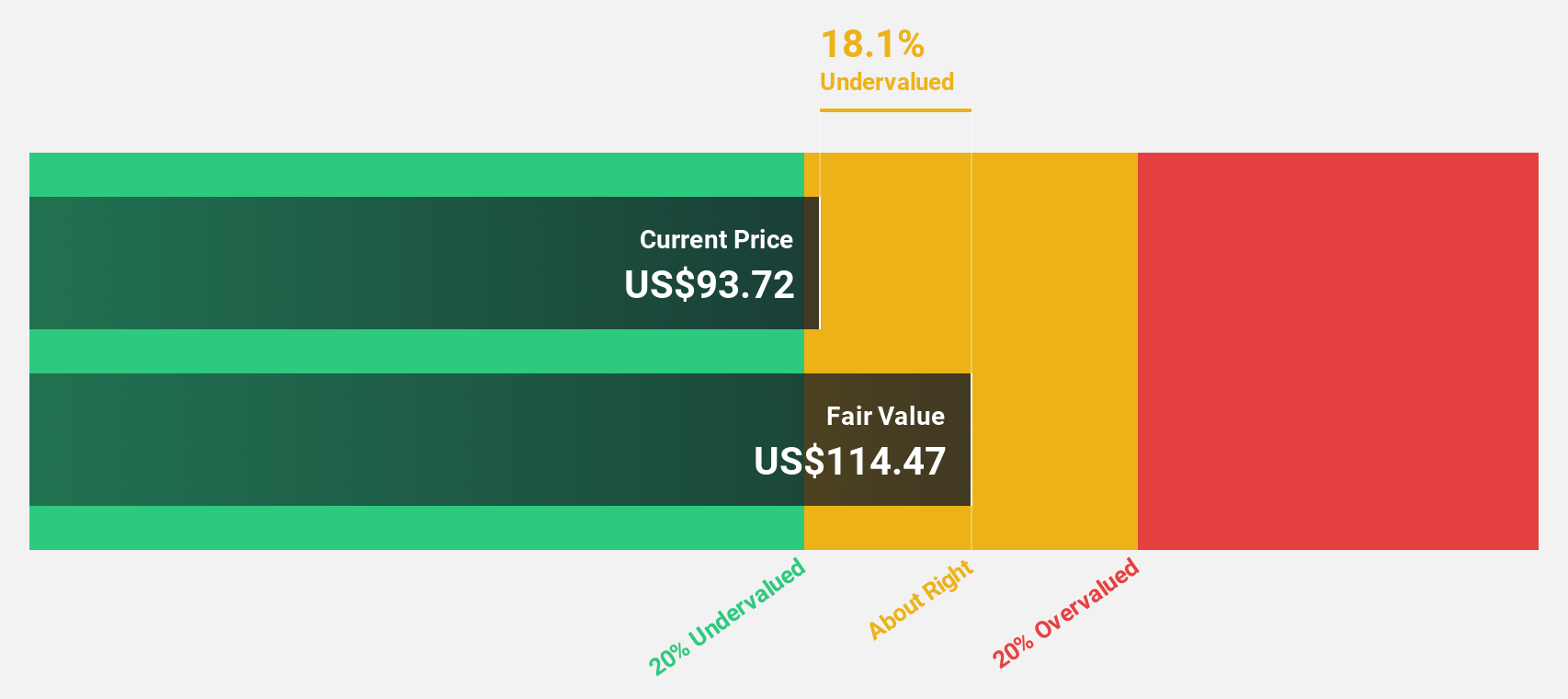

Estimated Discount To Fair Value: 36.4%

Modine Manufacturing is trading at US$80.07, significantly below its estimated fair value of US$125.88, suggesting undervaluation based on discounted cash flow analysis. Despite recent volatility and insider selling, Modine's earnings are forecast to grow 30.2% annually, outpacing the U.S. market average growth rate of 13.8%. Recent buyback announcements and substantial data center cooling orders underscore strategic initiatives aimed at enhancing shareholder value and leveraging growth in AI infrastructure demand.

- In light of our recent growth report, it seems possible that Modine Manufacturing's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Modine Manufacturing.

Next Steps

- Discover the full array of 189 Undervalued US Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Brunswick, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brunswick might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BC

Brunswick

Designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally.

Established dividend payer slight.

Similar Companies

Market Insights

Community Narratives