- United States

- /

- Software

- /

- NasdaqGS:CYBR

US High Growth Tech Stocks to Watch

Reviewed by Simply Wall St

Amidst a backdrop of heightened market volatility driven by tariff uncertainties, the U.S. tech sector has experienced significant fluctuations, with major indices like the Nasdaq Composite seeing dramatic shifts in response to recent economic policies. In such an environment, high growth tech stocks that demonstrate resilience through innovation and adaptability become particularly noteworthy for investors seeking opportunities amidst broader market turbulence.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.56% | 65.75% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.76% | 58.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.73% | 58.77% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| AVITA Medical | 28.21% | 56.12% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Advanced Energy Industries (NasdaqGS:AEIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Advanced Energy Industries, Inc. specializes in delivering precision power conversion, measurement, and control solutions globally with a market capitalization of approximately $3.61 billion.

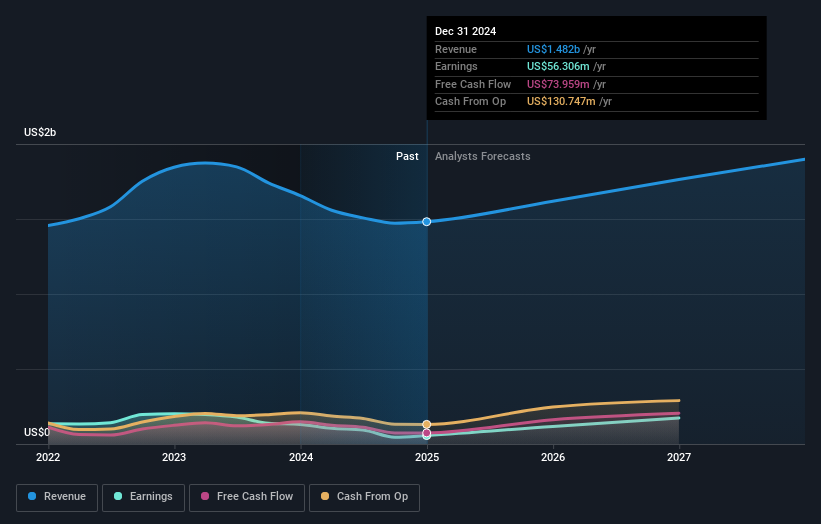

Operations: AEIS generates revenue primarily from its Power Electronics Conversion Products segment, which reported $1.48 billion in sales. The company's focus is on providing advanced power solutions across various industries worldwide.

Advanced Energy Industries (AEIS) demonstrates a nuanced growth trajectory with its earnings forecast to surge by 53.7% annually, outpacing the broader US market's 13.6%. This robust earnings growth contrasts starkly with its more modest revenue increase of 8.4% per year, which still slightly exceeds the national average of 8.3%. Strategically, AEIS is leveraging its strong balance sheet for potential acquisitions that could enhance its technological breadth and market position in sectors like industrial medical. Recent financials reveal a mixed picture: while Q4 sales rose to $415.4 million from $405.27 million year-over-year, annual sales dipped to $1,482 million from $1,655 million previously. Despite this fluctuation in revenue streams, AEIS's proactive management strategies and investment in R&D could position it favorably within the high-tech landscape as it navigates through these evolving market dynamics.

- Click here to discover the nuances of Advanced Energy Industries with our detailed analytical health report.

Learn about Advanced Energy Industries' historical performance.

CyberArk Software (NasdaqGS:CYBR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CyberArk Software Ltd. is a company that specializes in developing and selling software-based identity security solutions and services across various regions globally, with a market cap of $17.32 billion.

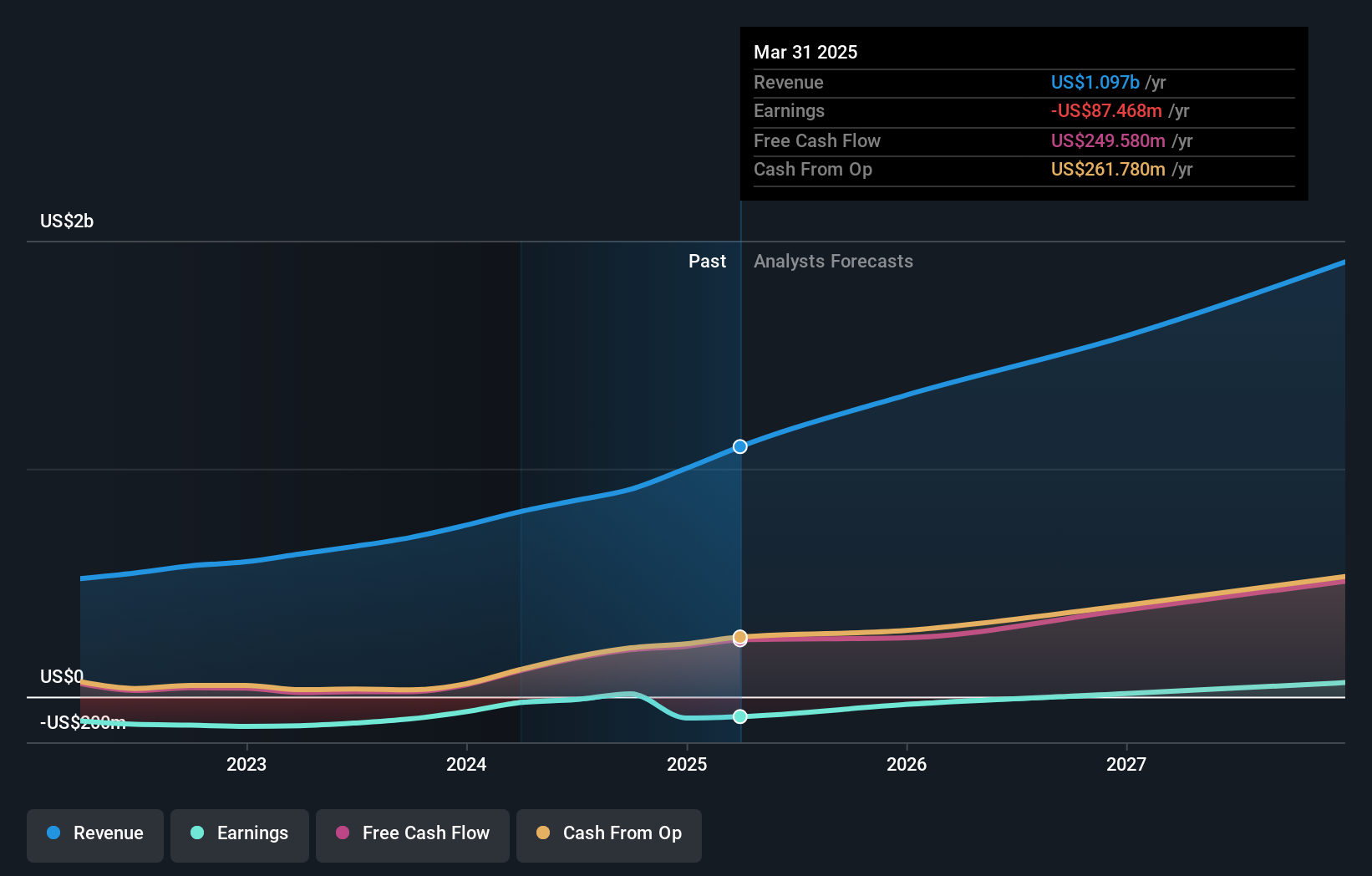

Operations: The company generates revenue primarily from its security software and services segment, amounting to $1 billion.

CyberArk Software, amid a challenging landscape for unprofitable tech firms, is poised for transformation with expected profitability in three years and revenue growth outpacing the US market at 17.6% annually. Recent innovations unveiled at the IMPACT 2025 Conference highlight CyberArk's commitment to securing identities across humans, machines, and AI—critical as digital ecosystems evolve. Notably, its R&D focus sharpens on identity security solutions that integrate seamlessly with evolving technologies like AI agents, ensuring robust defense mechanisms against emerging cyber threats. This strategic direction not only addresses immediate security needs but also positions CyberArk favorably as enterprises increasingly adopt complex multi-identity environments.

- Dive into the specifics of CyberArk Software here with our thorough health report.

Gain insights into CyberArk Software's past trends and performance with our Past report.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $30.23 billion.

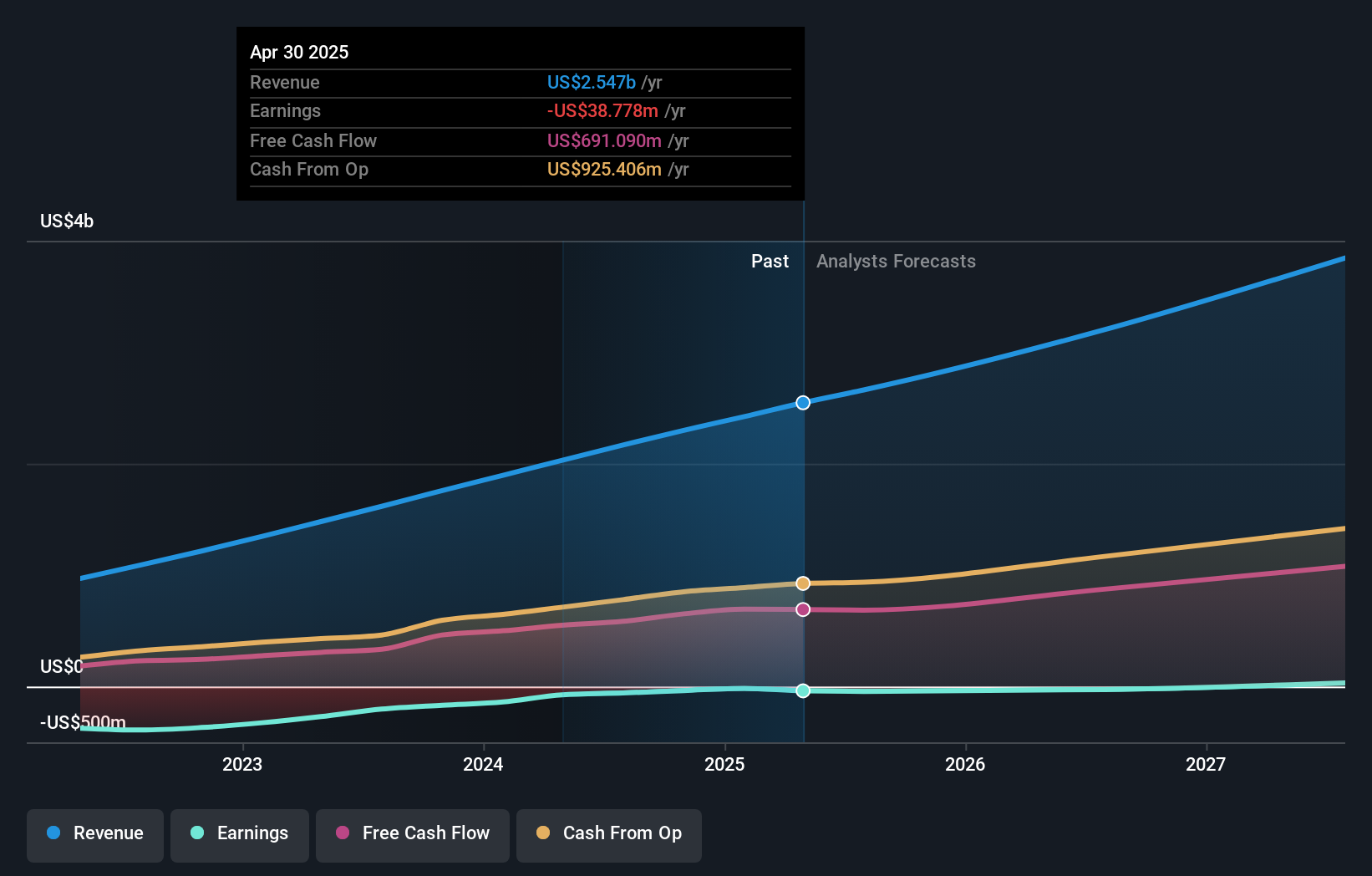

Operations: The company generates revenue primarily through the sales of subscription services to its cloud platform and related support services, amounting to approximately $2.42 billion.

Zscaler's strategic collaboration with T-Mobile, deploying its AI-powered Zscaler Zero Trust Exchange™, underscores its innovative approach in the cybersecurity space. This partnership, enhancing T-Mobile's security by retiring traditional VPNs and shifting towards secure cloud environments, reflects Zscaler’s pivotal role in advancing zero trust architectures. With a robust annual revenue growth of 16.5% and an impressive forecasted return on equity of 27.1%, the company is set to capitalize on growing demands for sophisticated cyber solutions. Moreover, recent executive appointments and targeted R&D investments signal Zscaler’s commitment to maintaining technological leadership in a rapidly evolving industry.

- Click here and access our complete health analysis report to understand the dynamics of Zscaler.

Understand Zscaler's track record by examining our Past report.

Taking Advantage

- Investigate our full lineup of 231 US High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives