- United States

- /

- Software

- /

- NasdaqGS:WDAY

Workday (WDAY): Reassessing Valuation After Buy Upgrade, 2026 Guidance Lift, and AI‑Driven Growth Momentum

Reviewed by Simply Wall St

Workday (WDAY) is back in the spotlight after a fresh upgrade to a Buy, with investors reassessing the stock as management lifts 2026 revenue guidance and leans into a sizable buyback.

See our latest analysis for Workday.

The upgrade lands after a choppy stretch, with the share price down around 11% year to date and a 1 year total shareholder return of roughly minus 18%. However, Workday’s solid three year total shareholder return of about 28% suggests longer term momentum is still intact as investors warm to its higher 2026 guidance, accelerating AI driven deal activity, and sizable buyback at a share price of $224.04.

If Workday’s reset has you rethinking growth software, this is a good moment to explore other high growth tech and AI names using high growth tech and AI stocks.

After a reset in expectations, investors are asking whether Workday’s softer growth outlook and upgraded guidance are now fully reflected in the share price, or if today’s discount still leaves room for a fresh leg of upside.

Most Popular Narrative Narrative: 18.7% Undervalued

Against Workday’s last close of $224.04, the most followed narrative points to a materially higher fair value, built on sustained growth and expanding margins.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $12.9 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 52.9x, assuming you use a discount rate of 8.6%.

Curious how this story gets to a higher fair value from here? The linchpin is the mix of steady revenue expansion and a richer profit profile. Want to see exactly how those moving parts, from top line assumptions to future earnings multiples, stack up to justify that target?

Result: Fair Value of $275.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapidly intensifying AI driven competition, along with heavier regulatory and compliance demands, could compress margins and challenge Workday’s premium growth and valuation narrative.

Find out about the key risks to this Workday narrative.

Another Lens on Value

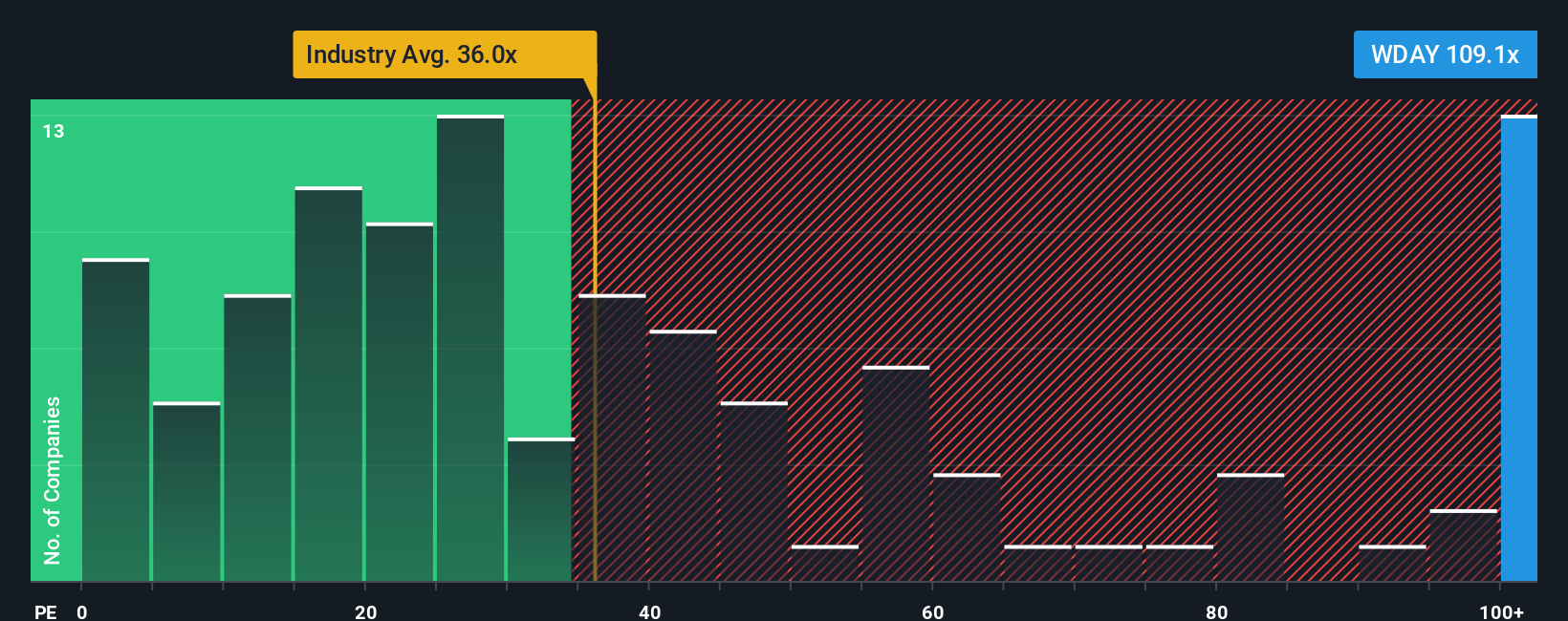

While the narrative points to upside, our valuation checks paint a tougher picture. Workday trades on a P/E of 91.8x, which is far richer than the US Software industry at 31.9x, peers at 40.3x, and even its own fair ratio of 48.6x. This raises questions about how much future success is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Workday Narrative

If you see things differently or simply want to dive into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, take a moment to uncover fresh opportunities across the market using targeted screeners on Simply Wall St’s powerful stock search tools.

- Capture potential multi-baggers early by scanning these 3608 penny stocks with strong financials with robust balance sheets and improving fundamentals before the wider market catches on.

- Position yourself at the forefront of automation and data intelligence by filtering for these 25 AI penny stocks that align with your risk and growth appetite.

- Explore opportunities with stronger risk and reward profiles by reviewing these 12 dividend stocks with yields > 3% that can add both income and resilience to a diversified portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion