- United States

- /

- Software

- /

- NasdaqGS:WDAY

Seattle University Chooses Workday (NasdaqGS:WDAY) to Enhance Campus Operations and Student Experience

Reviewed by Simply Wall St

Workday (NasdaqGS:WDAY) has been in the spotlight as Seattle University recently selected its solutions to enhance operations, which underscores the company's foothold in the educational sector. Despite this positive development, the company's share price saw a 4% decline over the last quarter. This movement could have been influenced by a mix of recent earnings, which showed a rise in revenue but a decline in net income, and ongoing market uncertainties related to U.S. trade policies. Market indices remained close to record highs, yet broader economic concerns may have added pressure to Workday's stock performance.

Be aware that Workday is showing 2 warning signs in our investment analysis.

Workday's recent engagement with Seattle University underscores its influence in the educational sector, potentially strengthening its longer-term revenue outlook. Despite a 4% quarterly share price decline, the company's three-year total return of 61% highlights robust historical performance. For context, over the past year, Workday underperformed both the US Software industry and the broader US market, which showed returns of 18.9% and 11.4%, respectively, pointing to challenges in maintaining momentum amidst industry competition and macro concerns.

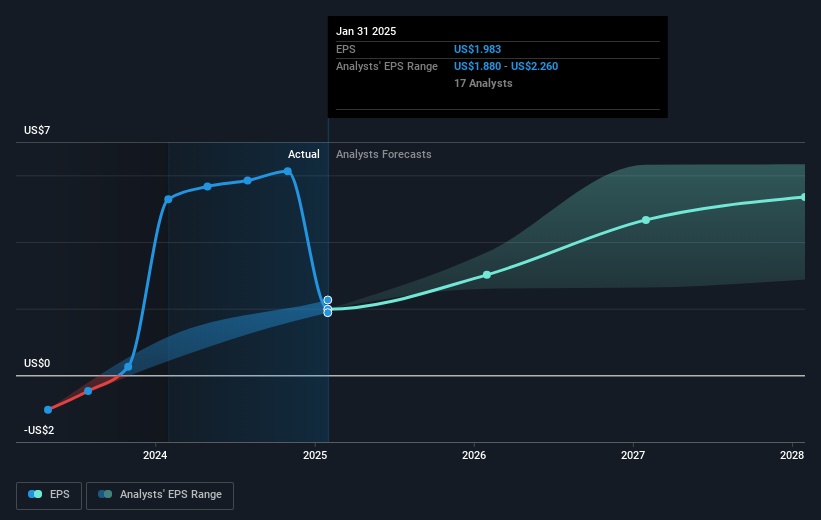

The university partnership could offer significant revenue growth potential by reinforcing Workday's foothold in education and potentially expanding the demand for its AI-driven solutions across similar institutions. With revenue standing at US$8.70 billion and earnings at US$487 million, market participants anticipate growth in these figures, influenced by AI expansion and efficiency improvements. The share's current price of US$247.79 places it approximately 17% below the analyst consensus price target of US$298.61, suggesting potential upside if projected growth materializes.

Review our growth performance report to gain insights into Workday's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)