- United States

- /

- Software

- /

- NasdaqGS:WDAY

Workday (WDAY) Vs. Microsoft's (MSFT) LinkedIn: Companies "Selling Shovels" in a High Turnover Environment

Analysis summary:

- Human capital management is undergoing additional disruption after 2021 and more businesses are relying on this service to optimize their cost structure.

- WDAY and MSFT (with LinkedIn) are key western peers within the HCM space, both growing their segment revenues at 21.4% and 28% respectively.

- WDAY's 27% earnings beat may indicate that the HCM segment is entering an upwards growth cycle.

- The key difference is that WDAY's is a growth company with most of its value in the future, while MSFT is a stable and profitable business, possibly trading at a premium relative to WDAY.

Investors looking into the HCM - human capital management segment have multiple companies to chose from. In this analysis, we will compare Workday, Inc. ( NASDAQ:WDAY ) with Microsoft's ( NASDAQ:MSFT ) LinkedIn as the top human capital management platforms.

The human capital landscape is transforming again since 2021 and the changes in employment practices in the U.S. and Europe are becoming more complex with the emergence of hybrid and remote work. This opens business opportunities for HCM platforms, as some companies have realized that the new work environment can be a cost saving opportunity if deployed effectively. Companies also have an increased need to post job offerings and find scarce talent, which drives the need for well polished hiring workflows.

We start our analysis with a breakdown of the business model for each company.

Workday's Product and Fundamentals

Workday delivers cloud applications for companies. Within their product portfolio, it offers a suite of financial management applications, human capital management (HCM) solution, spend management solutions, etc. In essence, Workday helps businesses with their internal operations, and is mainly known for their HCM solution which is meant to manage the entire employee lifecycle. This enables HR teams to hire, onboard, pay, develop, and conduct other employee solutions.

Q2 Earnings Results

The company posted its second quarter 2023 results on the 27th August.

Here are the key highlights:

- $0.25 loss per share (down from $0.43 profit in 2Q 2022). Beat analyst estimates by 27%.

- Revenue: $1.54b (up 22% from 2Q 2022). Slight beat of 1.1%. Up 21.4% on a TTM basis.

- Net loss: $64.2m (down 161% from profit in 2Q 2022).

You can learn more on how to use these earnings postings from our educational resources .

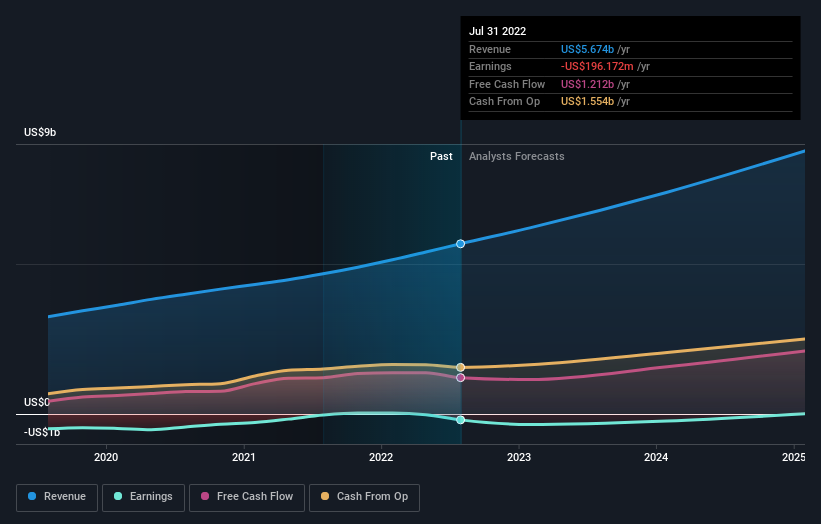

While earnings are close to negative, the company is still bringing in cash and their free cash flows have reached $1.212b in the last 12 months. This may be an indication of the future free cash flows capacity of the company once the costs structure shifts away from non-cash expenses like stock based compensation.

We can see the latest results put into context with past performance and the future estimates from the 33 analysts covering the company:

Check out our latest analysis for Workday

Analysts are now forecasting revenues of $6.20b in 2023, implying a growth of 9.3% in sales compared to the last 12 months. Per-share losses are expected to increase, reaching $1.46 per share. Free cash flows are also expected to be down to $1.147b.

While we can see that the top line is growing, investors will need to wait some time before the company yields stable profits. We will explore the possible causes for this in the later comparison.

Microsoft's LinkedIn as a HCM Platform

LinkedIn is one of the top HCM platforms in the world, which is owned by Microsoft. As a % of sales, LinkedIn brought in 6.9%, 6.1%, 5.6% in 2022, 2021, and 2020 respectively, and is currently envisioned to be a leading platform for companies to conduct their HCM, marketing and PR. This shows a healthy increase in the importance of LinkedIn as a core part of Microsoft's services.

There are multiple services in-place within the LinkedIn ecosystem, including: Talent solutions, marketing solutions, premium subscriptions, and sales solutions. These help companies attract employees, find leads, manage their brand's PR and market themselves and their products. The company is positioning LinkedIn to be the world's professional network, and with 850 million plus members, the fundamentals are showing continuous growth.

Additionally, in their latest development cycle, they integrated their learning resources, certification opportunities, and job-seeker tools between LinkedIn, GitHub and Microsoft Learn.

In the last three years, LinkedIn gained the following revenue:

- 2022: $13.816b, up 28% YoY.

- 2021: $10.289b, up 27.4% YoY.

- 2020: $8.077b.

LinkedIn also entered the freelance service space by allowing people to market their personal services to companies, much like Upwork ( NASDAQ:UPWK ) and Fiverr ( NYSE:FVRR ).

While LinkedIn is the key competitor to Workday, Microsoft also has the Dynamics platform, which is an ERP product that has many commonalities with the Workday ERP platform. This means that the two peers are competing in more than one segment, and the overlap between their services is increasing.

LinkedIn vs. Workday

The key difference between the two platforms is that Workday has more customization options for clients, and integrates with the client's existing systems, while Microsoft is offering LinkedIn as an all-in-one solution.

Workday gives clients the ability to customize the job application and management process, which can be suitable for large enterprise clients which want more control over their HR processes. Microsoft on the other hand has an edge when it comes to the platform's reach, and it's ability to filter for talent.

It seems that LinkedIn is the service that strives to have a better user experience, while Workday gives clients a more customizable set of tools to control the HCM process. A confident comparison is hard to make between the two peers, as the rise of service offerings and reach from LinkedIn may put pressure on Workday's profit margins.

Relative Valuation Metrics

Considering that Workday doesn't have a meaningful price to earnings ratio, we will compare both companies based on the price to sales.

In the U.S. software industry, the price to sales average is 4.8x . Workday's P/S is 7.4x , while Microsoft has a P/S of 9.9x . Workday's P/S is 25% lower than Microsoft's but 54% higher than the industry's. This shows us that there is too much of a divergence in price multiples to make a conclusion of the relative value of the peers. Comparing them to the industry, it seems that Microsoft trades at a higher premium, but we have to take into account the larger offering of software versus Workday's main HCM focus.

Another way we can compare both companies is to look at their expected growth rates. A company with a high price to sales is generally expected to have higher future growth.

Growth Comparison

Forecasts expect a continuation of Workday's historical trends, as the 20% annualized revenue growth to the end of 2023 is roughly in line with the 21% annual revenue growth over the past five years. On the other hand, Microsoft is expected to grow revenues 11% annually, while LinkedIn's growth may be faster as the product has been growing more than 27% in the last 2 years. In that regard, it seems that LinkedIn may continue to outperform Workday, however the company may find a way to differentiate itself and present a valuable and cost-effective service to clients in the industry.

Comparing this with the software industry , which analyst estimates (in aggregate) suggest will see revenues grow 13% annually. I t's clear that both platforms are forecasted to grow substantially faster than the industry. This may imply that HCM stocks are a possible industry-subset that investors can explore independently for their portfolios.

Comparing Profitability

While we can see that Microsoft has a lower growth rate, this needs to be viewed in conjunction with the profit margins of the company, as MSFT has a profit margin of 36.7% , while Workday is striving to stay above zero. While not directly comparable, Workday does have a free cash flow margin of 21.3%.

It seems that investors are comfortable paying a premium for the stability and margins of Microsoft, while Workday investors may have to wait some time before the company becomes comfortably profitable.

Conclusion

We can see that Workday is more reasonably priced than Microsoft. However, that comes with an additional set of risks, as LinkedIn's expansion may leave little in terms of profitability for Workday.

The two companies are fairly differentiated but starting to offer even more services that overlap between each other - Workday is increasing its focus as an ERP system, while Microsoft in developing their HCM platform. This is great for users, but investors may find that their profitability is reduced as competition intensifies.

In cases like this, sometimes there is no clear winner and a possible thing to consider is diversifying across multiple peers. Investors that believe that there is significant development possible within the human capital management industry may choose to go with multiple peers instead of just one company and reap the growth benefits from the entire segment.

For a wider list of peers within this industry, you can also consider:

- Recruit holdings ( TSE:6098 )

- Upwork ( NASDAQ:UPWK )

- Fiverr ( NYSE:FVRR )

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Broadcom - A Fundamental and Historical Valuation

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026