- United States

- /

- Banks

- /

- NYSE:GBCI

3 Prominent Stocks Estimated To Be Trading At Up To 38.9% Below Intrinsic Value

Reviewed by Simply Wall St

The United States market has shown robust performance recently, climbing 3.4% in the last week and rising 14% over the past year, with earnings projected to grow by 15% annually. In this context, identifying stocks that are trading below their intrinsic value can be an effective strategy for investors looking to capitalize on potential growth opportunities while minimizing risk.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (WSBC) | $31.67 | $62.21 | 49.1% |

| TXO Partners (TXO) | $15.22 | $29.95 | 49.2% |

| Lyft (LYFT) | $15.72 | $30.55 | 48.5% |

| Ligand Pharmaceuticals (LGND) | $114.15 | $225.70 | 49.4% |

| GeneDx Holdings (WGS) | $91.10 | $176.72 | 48.4% |

| Fiverr International (FVRR) | $28.64 | $56.80 | 49.6% |

| First Busey (BUSE) | $23.22 | $45.96 | 49.5% |

| ConnectOne Bancorp (CNOB) | $23.40 | $46.57 | 49.8% |

| Associated Banc-Corp (ASB) | $24.44 | $47.52 | 48.6% |

| ACNB (ACNB) | $43.00 | $84.89 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

Pagaya Technologies (PGY)

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and proprietary AI-powered technology to serve financial services and other providers across the United States, Israel, and the Cayman Islands, with a market cap of $1.62 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $1.08 billion.

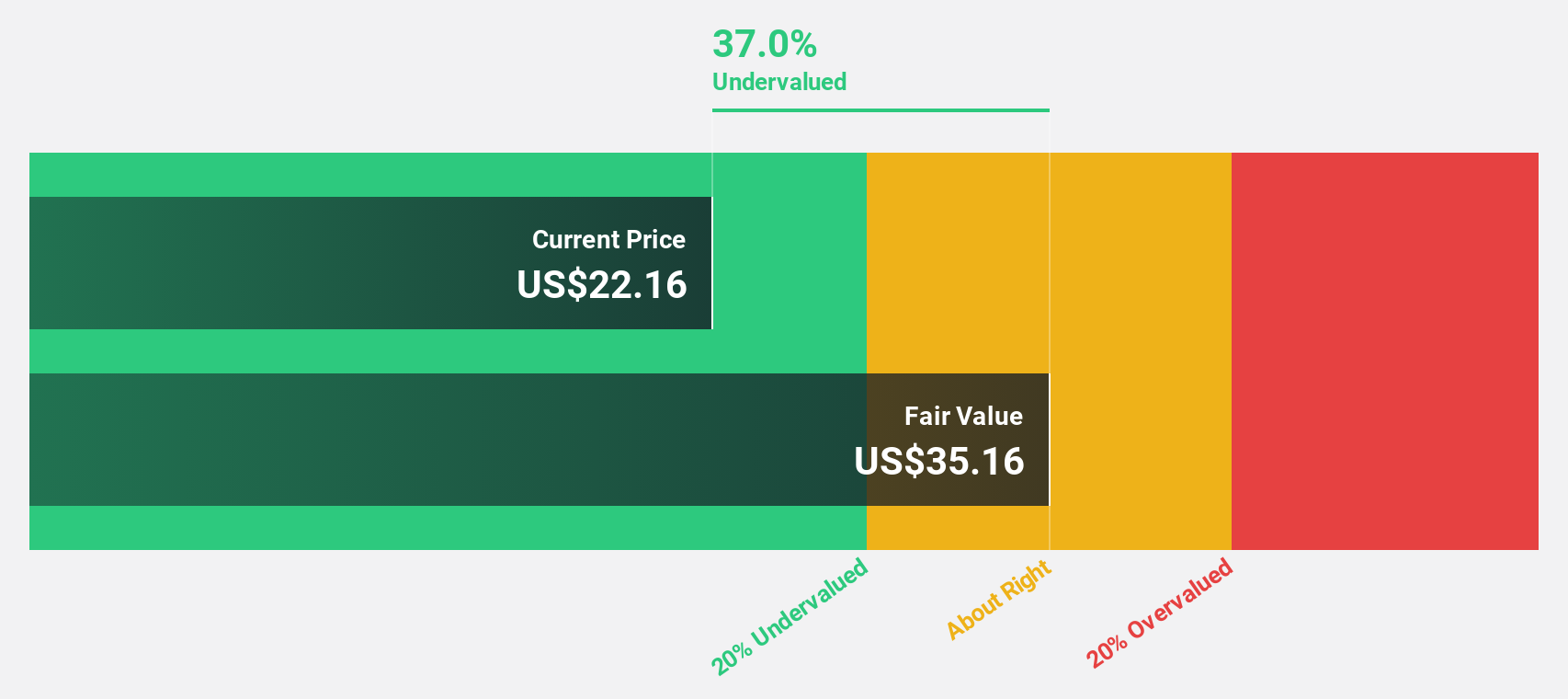

Estimated Discount To Fair Value: 38.9%

Pagaya Technologies appears undervalued, trading at 38.9% below its estimated fair value of US$35.02, with a share price of US$21.39. Despite recent volatility and index reclassifications favoring growth over value indices, Pagaya's revenue is expected to grow 14.5% annually, surpassing the US market average of 8.8%. The company recently launched a $300 million asset-backed securitization program to enhance point-of-sale financing capabilities, potentially boosting cash flows and capital efficiency further.

- Our comprehensive growth report raises the possibility that Pagaya Technologies is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Pagaya Technologies' balance sheet health report.

Atlassian (TEAM)

Overview: Atlassian Corporation, with a market cap of $53.11 billion, designs, develops, licenses, and maintains various software products globally through its subsidiaries.

Operations: Atlassian's revenue primarily comes from its Software & Programming segment, which generated $4.96 billion.

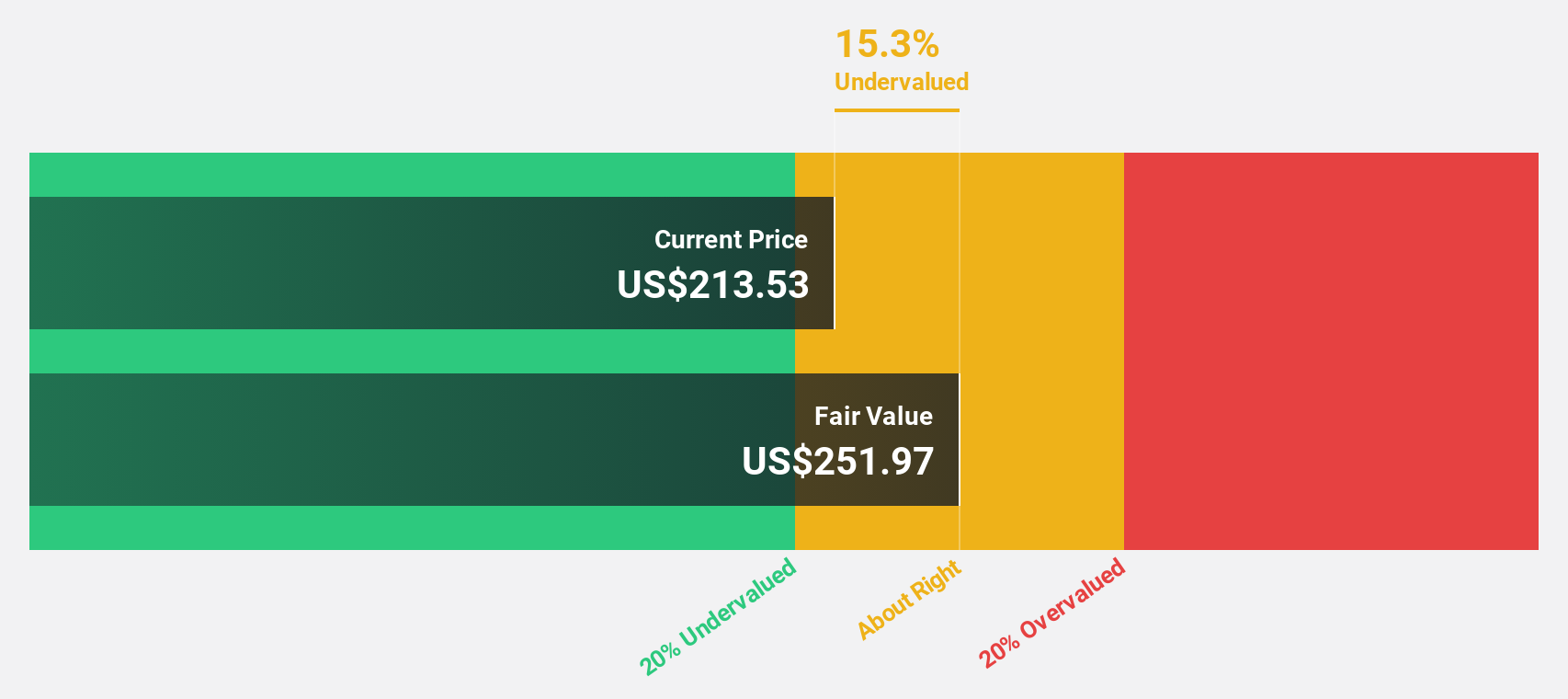

Estimated Discount To Fair Value: 14.4%

Atlassian trades at US$202.32, below its estimated fair value of US$236.48, suggesting it may be undervalued based on cash flows. Despite a net loss of US$70.81 million in Q3 2025, revenue grew to US$1.36 billion from the previous year’s US$1.19 billion. The company forecasts 14.9% annual revenue growth and expects profitability within three years, with high projected returns on equity enhancing its investment appeal despite recent insider selling concerns.

- The analysis detailed in our Atlassian growth report hints at robust future financial performance.

- Click here to discover the nuances of Atlassian with our detailed financial health report.

Glacier Bancorp (GBCI)

Overview: Glacier Bancorp, Inc. is a bank holding company for Glacier Bank, offering commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States with a market cap of approximately $5.08 billion.

Operations: The company's revenue is primarily derived from its banking services segment, totaling $827.82 million.

Estimated Discount To Fair Value: 23%

Glacier Bancorp, trading at US$42.82, is priced below its estimated fair value of US$55.6, reflecting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 34.5% annually over the next three years, outpacing the broader U.S. market growth rate of 14.6%. Recent index additions and a stable dividend declaration enhance its profile despite an unstable dividend history and recent net charge-offs totaling US$1.8 million in Q1 2025.

- Our expertly prepared growth report on Glacier Bancorp implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Glacier Bancorp's balance sheet by reading our health report here.

Make It Happen

- Discover the full array of 173 Undervalued US Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBCI

Glacier Bancorp

Operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives