- United States

- /

- IT

- /

- NasdaqGS:SHOP

Joe Natale Elected as Director at Shopify (NasdaqGS:SHOP) Annual Shareholders Meeting

Reviewed by Simply Wall St

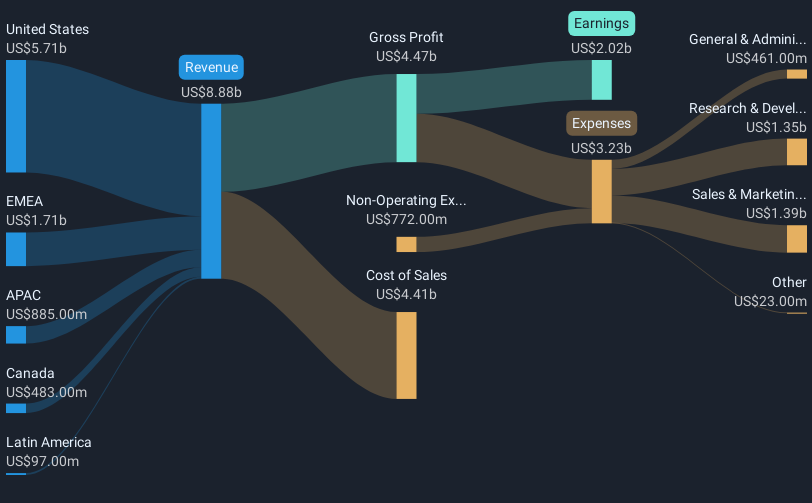

Shopify (NasdaqGS:SHOP) recently added Joe Natale to its board of directors, potentially bringing valuable insights to the company's strategic direction. Over the last quarter, Shopify's stock price increased by 4%, largely in line with the broader market, which saw a 10% rise over the past year. While broader market trends were predominantly influential, Shopify’s inclusion in major indexes and solid partnerships likely supported this upward movement. However, ongoing factors such as heightened net losses and antitrust lawsuits may counteract positive sentiments, reflecting a complex interplay of influences on its overall shareholder returns.

The appointment of Joe Natale to Shopify's board could significantly impact its strategic initiatives, aligning with its efforts to enhance merchant efficiency and expand globally. Natale's experience may provide insights beneficial to managing partnerships and international growth, potentially influencing future revenue and earnings positively.

Over the last three years, Shopify's total shareholder return reached 213.02%, a impressive performance compared to recent one-year stock market movements. In the previous year, the company's share price outperformed the US IT industry, which returned 38.3%, highlighting its resilience amidst market fluctuations.

The news of board changes and partnerships, such as those with FC Barcelona and Reebok, may further support market position improvements. Analysts' earnings forecasts anticipate $2.7 billion in earnings by 2028, with an annual revenue growth forecast of 21.9% over the next three years. The inclusion of seasoned leaders could aid in achieving these ambitious growth targets.

Shopify's current share price, at US$109.82, is trading below the consensus price target of US$134.54. This indicates a path for potential price appreciation of approximately 18.4% if the company meets market expectations. However, investors should consider the inherent uncertainties in these forecasted outcomes and the operational challenges that rapid expansion might present.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHOP

Shopify

A commerce technology company, provides tools to start, scale, market, and run a business of various sizes in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)