- United States

- /

- Software

- /

- NasdaqGS:RDWR

Radware (RDWR): Assessing a Premium Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Radware (RDWR) shares have been drifting after a mixed stretch, with gains over the month offset by weakness over the past 3 months and year. Still, the longer term picture looks different.

See our latest analysis for Radware.

At around $23.18 per share, Radware’s recent pullback contrasts with its modest year to date share price gain and positive three year total shareholder return. This hints that sentiment has cooled even as the longer term story remains constructive.

If Radware’s mixed momentum has you rethinking your watchlist, this might be a good moment to scout other cybersecurity and infrastructure names through high growth tech and AI stocks.

With Radware trading below analyst targets but only modestly discounted on intrinsic measures, investors face a familiar dilemma: is this a mispriced cybersecurity grower, or has the market already captured its future upside?

Price-to-Earnings of 60.4x: Is it justified?

Radware trades at $23.18, but its lofty 60.4x price to earnings multiple places it well above both software peers and the broader US Software sector.

The price to earnings ratio compares what investors pay today to the company’s current earnings, a key yardstick for profitable, mature software and cybersecurity names. For Radware, the high multiple suggests the market is baking in a meaningful recovery in profitability after a stretch of weak earnings, even though recent history shows pressure on the bottom line.

In that context, Radware’s 60.4x price to earnings stands in sharp contrast to the US Software industry average of 32x and a peer average of just 24.1x. This implies investors are paying a significant premium for each dollar of earnings.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 60.4x (OVERVALUED)

However, slowing revenue growth or renewed earnings pressure, especially if cybersecurity spending normalizes, could challenge the premium valuation that investors currently assign to Radware.

Find out about the key risks to this Radware narrative.

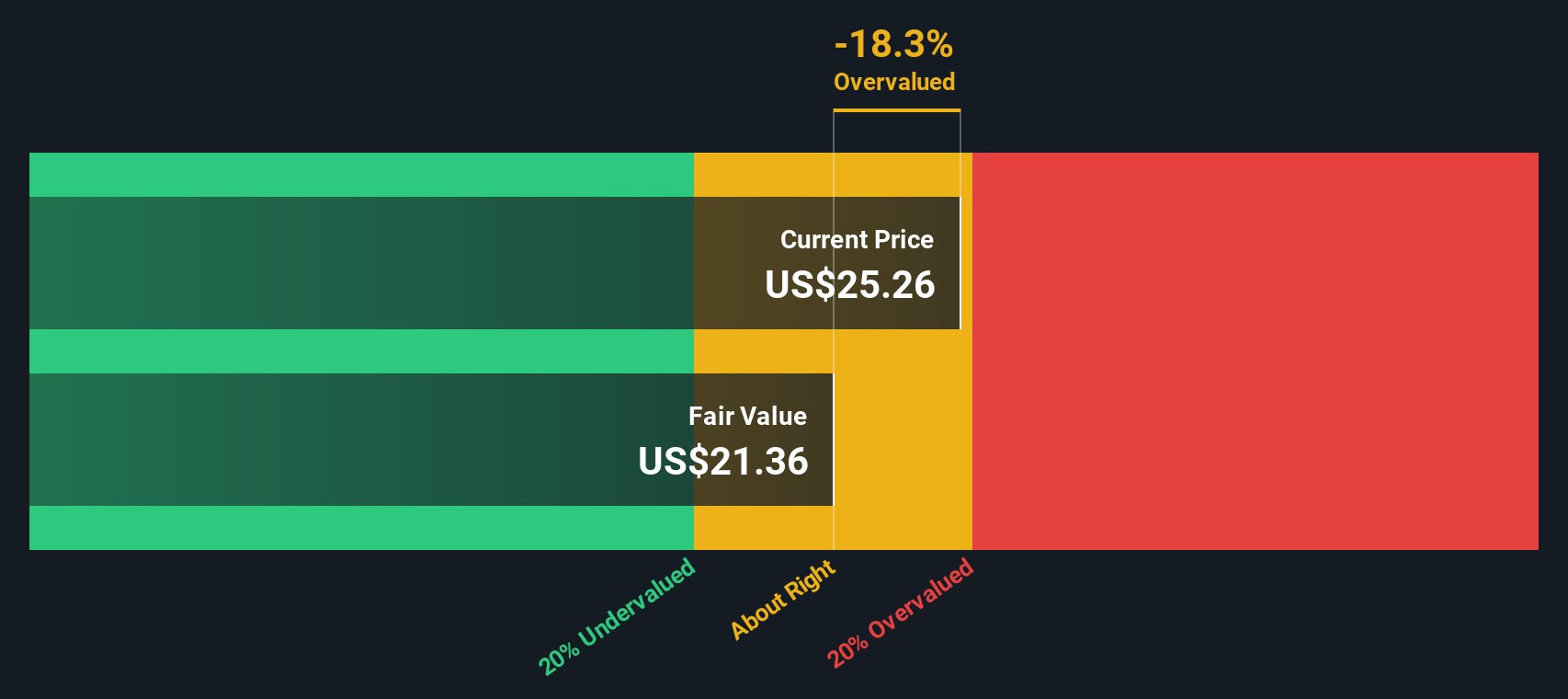

Another View: Our DCF Model Paints a Different Picture

While the earnings multiple flags Radware as expensive, our DCF model is a bit more forgiving, putting fair value around $22.78 versus the current $23.18. That small premium suggests the stock is only slightly overvalued. Is the downside really as large as the P E implies?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Radware for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Radware Narrative

If you see the numbers differently or want to examine the assumptions yourself, you can build a personalized view in minutes by starting with Do it your way.

A great starting point for your Radware research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Radware now; expand your opportunity set using the Simply Wall Street Screener so you are not the one who misses the next move.

- Capture potential mispricings by scanning these 928 undervalued stocks based on cash flows that may offer stronger upside than the usual large cap names on your radar.

- Tap into cutting edge innovation by targeting these 25 AI penny stocks positioned to benefit from rapid adoption of artificial intelligence across industries.

- Strengthen your income strategy by focusing on these 14 dividend stocks with yields > 3% that can support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RDWR

Radware

Develops, manufactures, and markets cyber security and application delivery solutions for cloud, on-premises, and software defined data canters.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026