- United States

- /

- Software

- /

- NasdaqGS:MNDY

monday.com (MNDY) Sees 11% Price Jump Last Week Amid Broader Tech Market Volatility

Reviewed by Simply Wall St

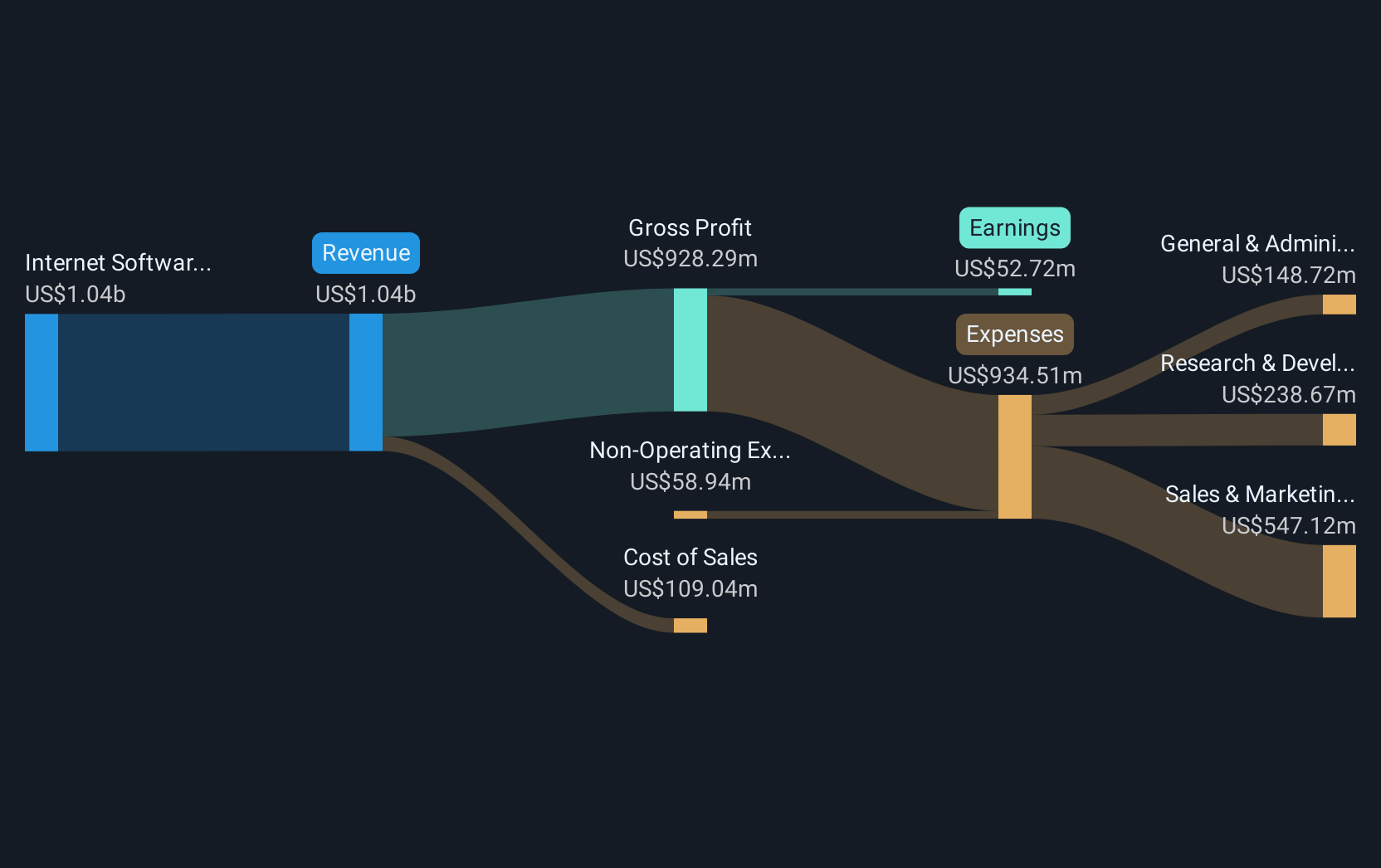

monday.com (MNDY) recently announced a strategic integration with Proggio, enhancing project management capabilities by offering real-time sync and cross-board visibility. Meanwhile, the company's financial performance showed solid revenue growth but a decline in net income for the second quarter. Despite broader tech market volatility, notably a drop in major players like Nvidia and Broadcom, Monday's share price rose 11% last week, outpacing the market's overall gain of 2%. This suggests that the recent developments and their potential future impact on user experience and efficiency were positively received by investors.

Buy, Hold or Sell monday.com? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent integration with Proggio is poised to enhance monday.com’s project management capabilities, potentially improving customer retention and engagement. This could bolster revenue and earnings forecasts, aligning with the narrative’s emphasis on platform differentiation and upselling opportunities. Expanding their AI and automation features might further strengthen their market position by attracting more enterprise clients, as highlighted in the narrative.

Over the past three years, monday.com’s total shareholder return was 71.95%, reflecting robust long-term performance. However, its one-year return underperformed both the US market and the US Software industry. Despite this, the recent 11% share price increase indicates positive investor reception of the company’s strategic developments compared to broader market volatility.

The current share price of $189.51 highlights a discrepancy from the analyst consensus price target of $282.46, indicating potential undervaluation in the eyes of some analysts. If the integration and AI advancements drive the expected improvements in customer engagement and efficiency, these factors could gradually align the share price closer to its target as projected metrics materialize over time.

Learn about monday.com's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion