- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

US High Growth Tech Stocks to Watch for Potential Expansion

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, driven by positive earnings reports and anticipation of tariff news, the tech-heavy Nasdaq Composite has notably climbed 2.3%, reflecting investor optimism particularly in the technology sector. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong earnings potential and resilience amid economic uncertainties, positioning them well for potential expansion in the evolving market landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.29% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.05% | 37.69% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.08% | 58.88% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.84% | 59.74% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

CoreWeave (NasdaqGS:CRWV)

Simply Wall St Growth Rating: ★★★★★★

Overview: CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI with a market cap of $17.87 billion.

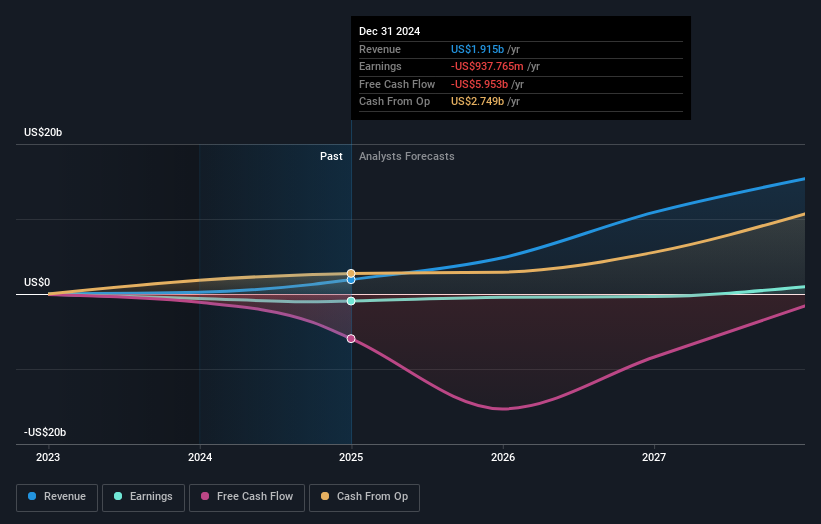

Operations: CoreWeave, Inc. generates revenue primarily through its cloud platform services, particularly in data processing, which contributed $1.92 billion. The company's operations are centered on enhancing GenAI capabilities through scalable and supportive infrastructure solutions.

CoreWeave, a frontrunner in AI cloud solutions, recently showcased its technological prowess by setting new industry benchmarks with NVIDIA GB200 Grace Blackwell Superchips. Achieving a remarkable 800 tokens per second on the Llama 3.1 model, CoreWeave has demonstrated its capability to deliver superior AI performance. This aligns with their strategic expansion, evidenced by a substantial $11.9 billion contract with OpenAI to enhance compute capacity for AI model training on a massive scale. These developments not only highlight CoreWeave's commitment to innovation but also position it as an essential infrastructure provider in the rapidly evolving tech landscape, where annual revenue growth is projected at 35.4%, and profitability is expected within three years.

- Click here and access our complete health analysis report to understand the dynamics of CoreWeave.

Explore historical data to track CoreWeave's performance over time in our Past section.

Roku (NasdaqGS:ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market capitalization of approximately $9.13 billion.

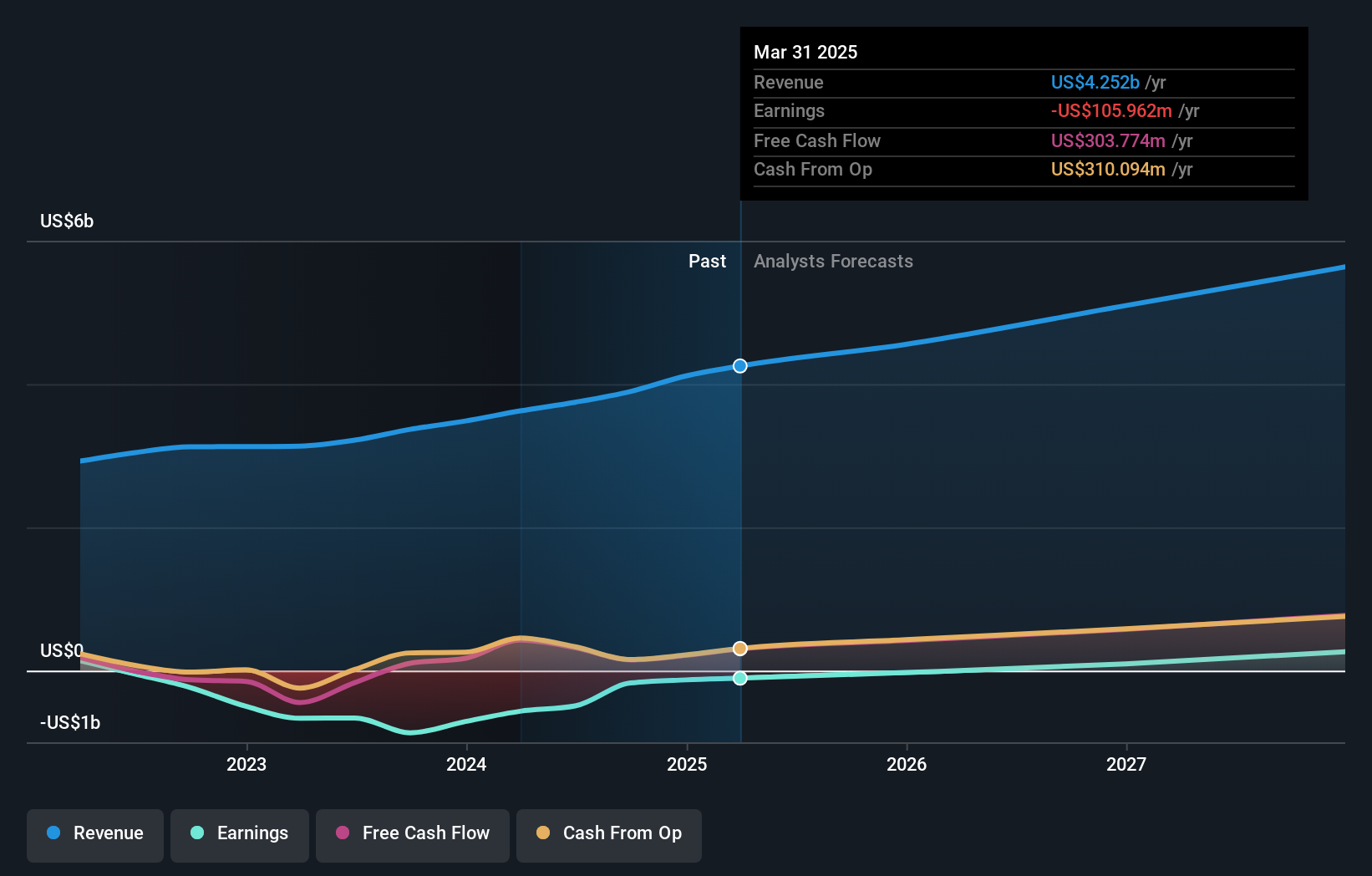

Operations: Roku generates revenue primarily through its Platform segment, which accounts for $3.52 billion, significantly surpassing the Devices segment at $590.12 million.

Roku's recent unveiling of a new device lineup and software updates signifies its commitment to enhancing the streaming experience, underscoring its innovative edge in a competitive market. With these advancements, Roku not only caters to over 90 million households globally but also solidifies its role in transforming how content is consumed. Financially, Roku anticipates robust growth with projected annual revenue reaching $4.61 billion by year-end 2025, alongside an expected shift from a net loss of $40 million to positive operating income by 2026. This trajectory is supported by strategic investments in R&D, crucial for maintaining technological leadership and driving future profitability.

- Delve into the full analysis health report here for a deeper understanding of Roku.

Review our historical performance report to gain insights into Roku's's past performance.

Snap (NYSE:SNAP)

Simply Wall St Growth Rating: ★★★★☆☆

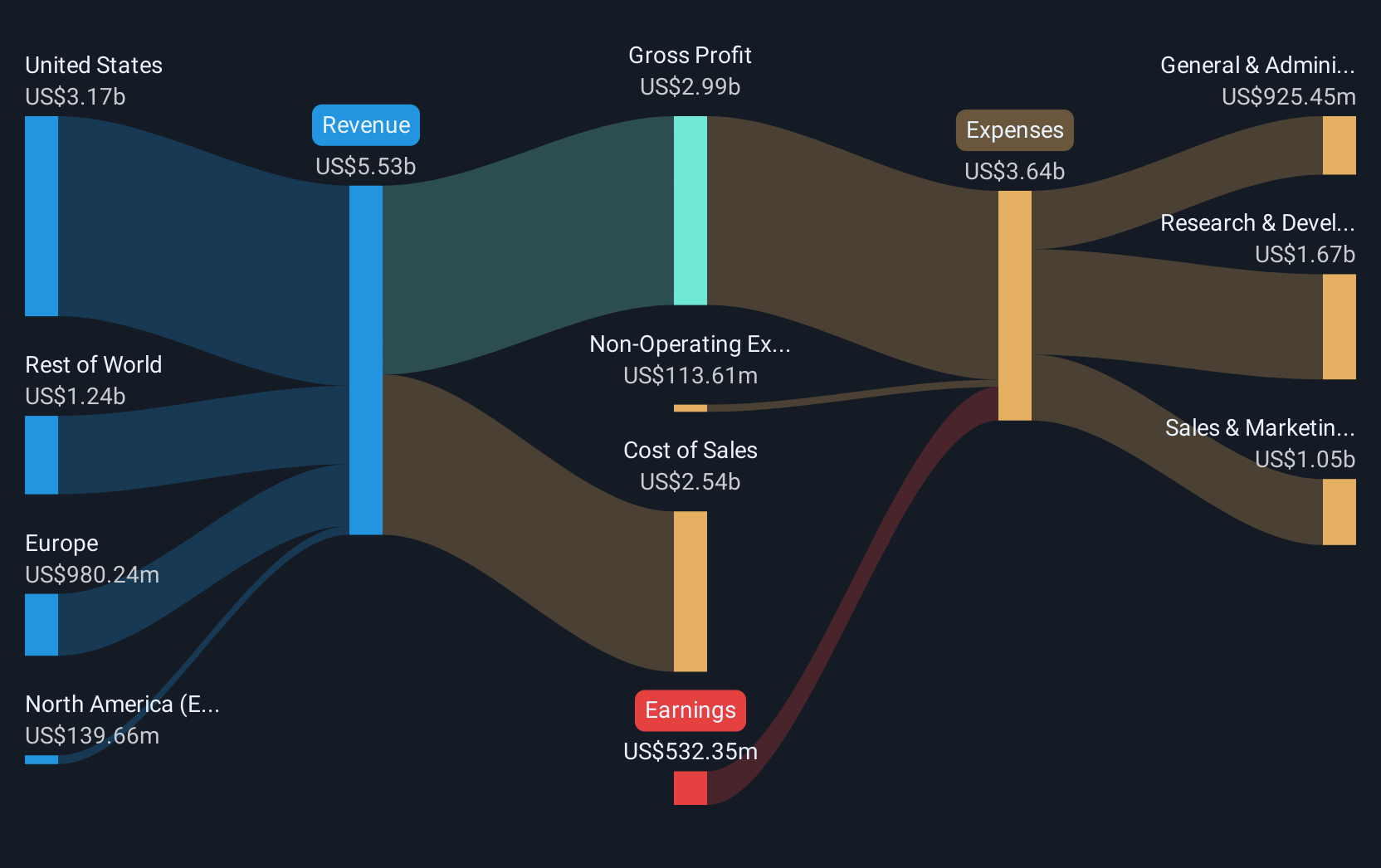

Overview: Snap Inc. is a technology company that provides multimedia messaging services across North America, Europe, and internationally, with a market capitalization of $13.32 billion.

Operations: Snap generates revenue primarily from its Software & Programming segment, which contributed $5.36 billion. The company's operations span North America, Europe, and other international markets.

Snap Inc. is navigating a transformative path in the tech industry, notably through its strategic partnerships and innovative advertising solutions. Recently, Snap's collaboration with Later to integrate Snapchat's APIs marks a significant enhancement in how brands engage with digital content creators, potentially boosting user interaction and monetization avenues. Financially, Snap is on an upward trajectory with expected revenue growth of 10.2% annually, outpacing the US market average of 8.1%. Moreover, the company's move towards profitability is underscored by a robust forecasted annual earnings growth rate of 56.15%. This financial optimism is further bolstered by their recent $1.5 billion debt financing aimed at repurchasing convertible notes, which could stabilize its capital structure and support sustained growth initiatives.

- Dive into the specifics of Snap here with our thorough health report.

Gain insights into Snap's historical performance by reviewing our past performance report.

Make It Happen

- Click this link to deep-dive into the 234 companies within our US High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United states and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives