- United States

- /

- IT

- /

- NasdaqGS:CRWV

High Growth Tech Stocks in US for June 2025

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it is up 10.0% over the past year with earnings forecasted to grow by 15% annually. In this context, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation and adaptability in an evolving economic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 21.03% | 60.42% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Legend Biotech | 26.68% | 57.96% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.61% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 227 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

ARS Pharmaceuticals (SPRY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing and commercializing treatments for severe allergic reactions, with a market cap of $1.55 billion.

Operations: SPRY specializes in developing and commercializing treatments for severe allergic reactions. The company operates within the biopharmaceutical sector with a focus on innovative therapies to address unmet medical needs.

ARS Pharmaceuticals is making significant strides in the high-growth tech sector, particularly with its innovative neffy® nasal spray, a needle-free epinephrine delivery system for severe allergic reactions. Recently approved by the FDA and now marketed across the U.S., this product stands out not only for its user-friendly design but also for its potential to transform emergency allergy treatments. The company's aggressive expansion includes a strategic co-promotion agreement with ALK-Abello A/S targeting 9,000 pediatricians, which could significantly boost market penetration ahead of the school season. Despite reporting a net loss of $33.94 million in Q1 2025, ARS Pharmaceuticals' revenue growth rate at 40.4% annually and projected earnings growth of 60.57% per year underscore its potential in an underserved market segment.

CarGurus (CARG)

Simply Wall St Growth Rating: ★★★★☆☆

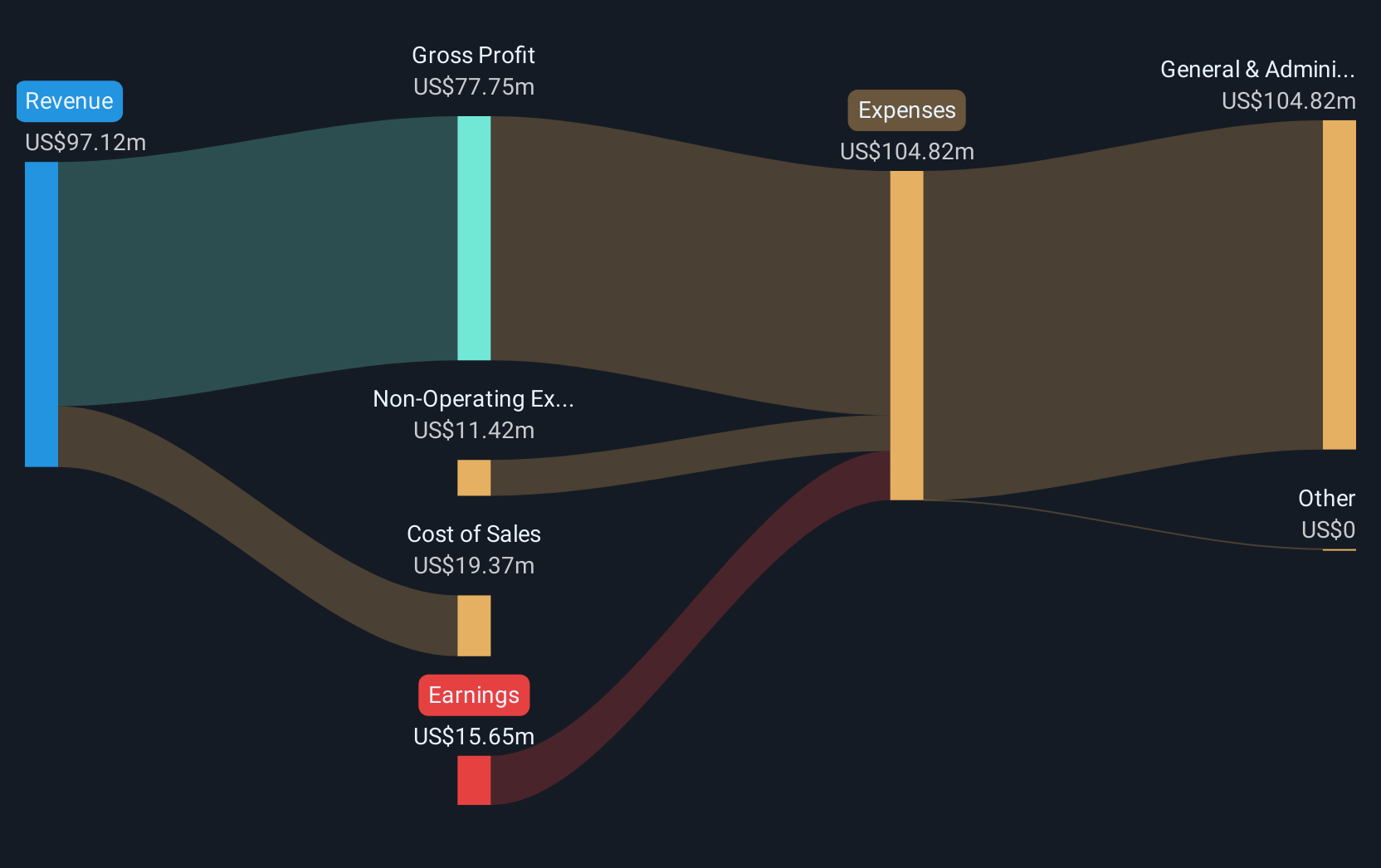

Overview: CarGurus, Inc. operates an online automotive platform facilitating vehicle transactions both in the United States and internationally, with a market cap of approximately $3.17 billion.

Operations: The company generates revenue primarily through its U.S. Marketplace segment, which accounts for $755.93 million, and its Digital Wholesale segment, contributing $82.13 million.

CarGurus is harnessing AI to redefine the car buying experience, recently launching an AI-powered search tool that enhances user interaction through conversational searches. This move not only boosts its platform's attractiveness but also leverages machine learning for better vehicle recommendations and dealer insights. Financially, CarGurus showed robust performance with Q1 2025 revenues rising to $225.16 million from $215.8 million year-over-year, and net income more than doubling to $39.05 million. Additionally, the company strategically repurchased 5.69% of its shares for $184.21 million, underscoring a commitment to shareholder value amidst technological advancements and market expansion efforts.

- Delve into the full analysis health report here for a deeper understanding of CarGurus.

Gain insights into CarGurus' past trends and performance with our Past report.

CoreWeave (CRWV)

Simply Wall St Growth Rating: ★★★★★☆

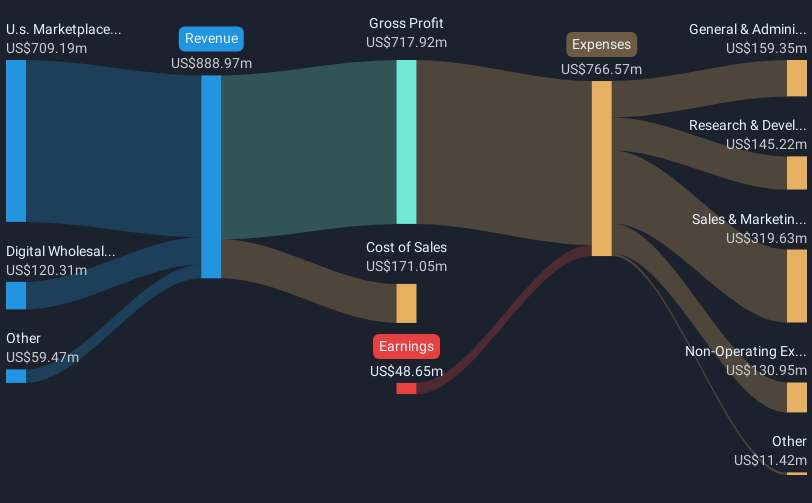

Overview: CoreWeave, Inc. operates a cloud platform focused on scaling, support, and acceleration for GenAI with a market cap of $88.11 billion.

Operations: CoreWeave, Inc. generates revenue primarily through its data processing services, amounting to $2.71 billion. The company focuses on providing scalable solutions for GenAI applications within its cloud platform.

CoreWeave's recent advancements underscore its commitment to shaping the AI cloud sector. At the Weights & Biases Fully Connected Conference, CoreWeave unveiled three new AI cloud software products, enhancing capabilities for AI developers and engineers to develop and deploy AI applications more efficiently. This strategic move, leveraging its acquisition of Weights & Biases, positions CoreWeave at the forefront of AI innovation with a robust platform designed for high scalability and rapid iteration in AI model training and deployment. Additionally, their collaboration with NVIDIA and IBM on the MLPerf® Training v5.0 submission using NVIDIA Blackwell GPUs showcases their capability to deliver superior performance in demanding AI workloads, reinforcing their market position by setting new industry benchmarks in training speeds.

- Get an in-depth perspective on CoreWeave's performance by reading our health report here.

Evaluate CoreWeave's historical performance by accessing our past performance report.

Taking Advantage

- Navigate through the entire inventory of 227 US High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)