- United States

- /

- Metals and Mining

- /

- NYSE:MP

Growth Companies With High Insider Ownership On US Exchanges

Reviewed by Simply Wall St

As the U.S. stock market experiences a downturn, with major indices like the S&P 500 and Nasdaq Composite extending their slump amid declines in technology shares, investors are increasingly focused on identifying resilient growth companies. In this environment, stocks characterized by high insider ownership can be particularly appealing, as they often indicate strong alignment between company executives and shareholder interests, which may provide stability during volatile market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.8% |

| Astera Labs (NasdaqGS:ALAB) | 16.1% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Enovix (NasdaqGS:ENVX) | 12.6% | 56.0% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.2% | 33.6% |

Here we highlight a subset of our preferred stocks from the screener.

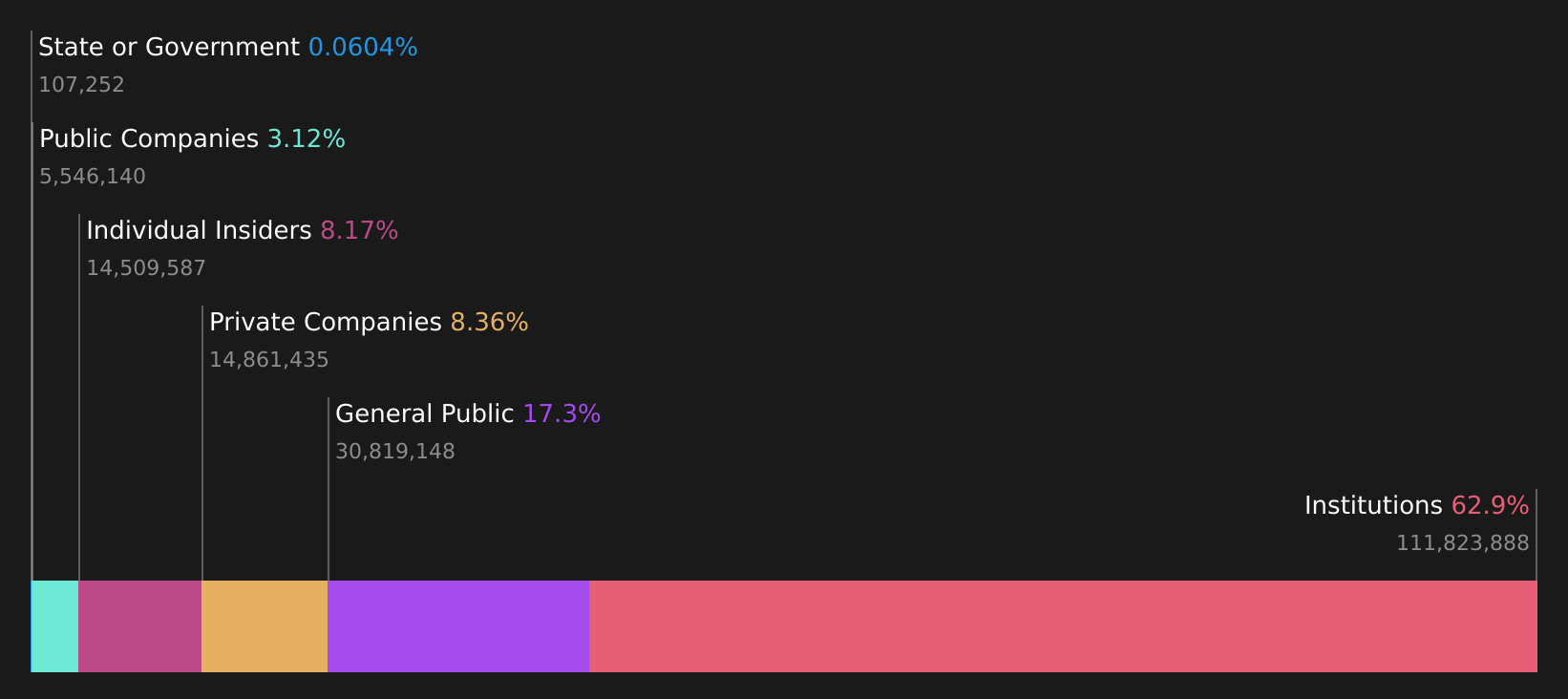

BigCommerce Holdings (NasdaqGM:BIGC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BigCommerce Holdings, Inc. provides a software-as-a-service platform for enterprises, small businesses, and mid-markets across various regions globally, with a market cap of approximately $489.51 million.

Operations: Revenue for BigCommerce Holdings is primarily generated from its Internet Information Providers segment, amounting to $332.93 million.

Insider Ownership: 17.3%

BigCommerce Holdings is experiencing a transformative phase with strategic leadership hires and innovative product developments like Catalyst, enhancing its ecommerce capabilities. Despite a net loss reduction to US$27.03 million in 2024, revenue growth lags the market at 5.1% annually. However, profitability is expected within three years with high projected returns on equity of 45.2%. The company trades significantly below estimated fair value, presenting potential investment opportunities amidst evolving market dynamics.

- Get an in-depth perspective on BigCommerce Holdings' performance by reading our analyst estimates report here.

- Our valuation report here indicates BigCommerce Holdings may be undervalued.

Li Auto (NasdaqGS:LI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Li Auto Inc. operates in the energy vehicle market in the People’s Republic of China with a market cap of approximately $27.39 billion.

Operations: The company generates revenue primarily from its auto manufacturing segment, which reported CN¥141.92 billion.

Insider Ownership: 30.4%

Li Auto has demonstrated impressive growth, with earnings increasing by 61.3% last year and expected to grow at 20.9% annually, outpacing the US market. Despite a lower forecasted return on equity of 18.8%, its revenue growth is projected at 17.3%, surpassing market averages. Recent delivery figures show strong performance with over one million vehicles delivered cumulatively by January 2025. Insider trading activity shows more shares bought than sold recently, though not in substantial volumes.

- Navigate through the intricacies of Li Auto with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Li Auto is trading beyond its estimated value.

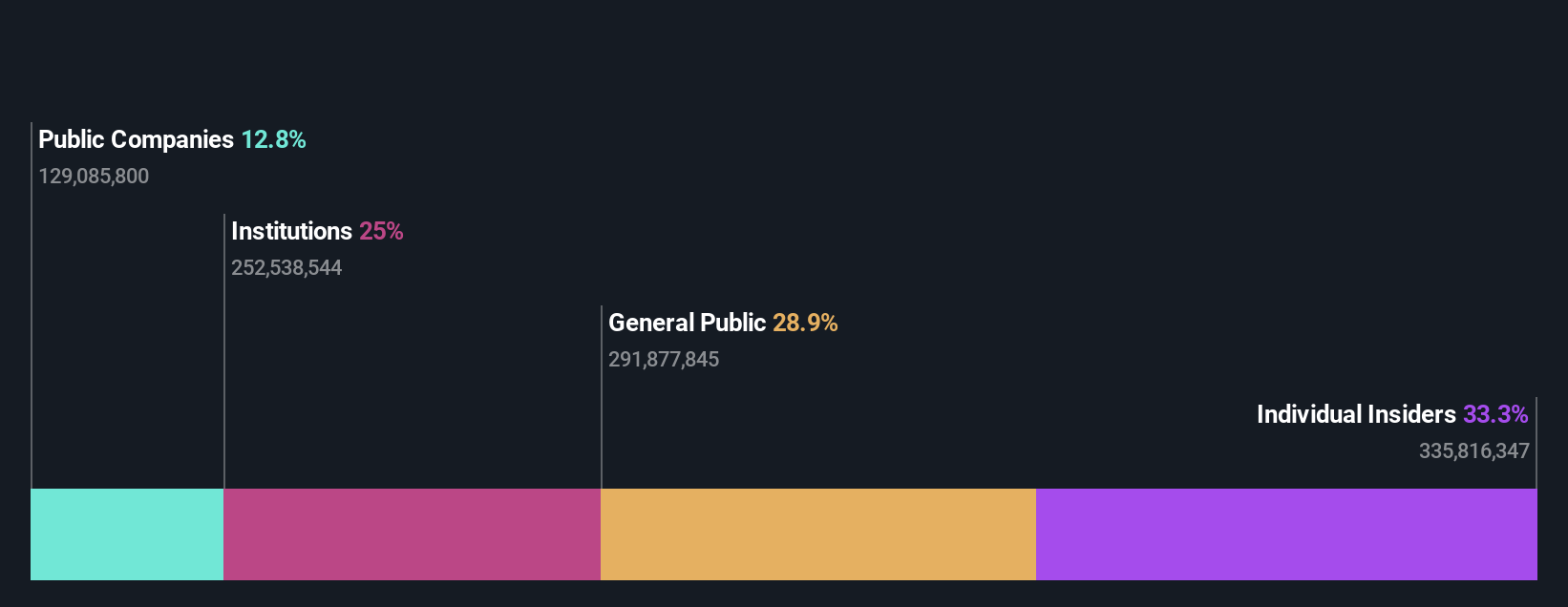

MP Materials (NYSE:MP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MP Materials Corp., along with its subsidiaries, is involved in the production of rare earth materials and has a market cap of approximately $3.97 billion.

Operations: The company's revenue is primarily derived from its Materials segment, which generated $203.86 million.

Insider Ownership: 10.9%

MP Materials is poised for significant growth with its revenue expected to rise by 34% annually, surpassing market averages. Despite recent financial losses, the company's strategic expansion into NdPr and NdFeB magnet production in Texas marks a critical step towards establishing a domestic supply chain. While insider trading shows more shares bought than sold recently, substantial selling has occurred over the past quarter. The company trades at 61.1% below its estimated fair value, indicating potential undervaluation.

- Click here and access our complete growth analysis report to understand the dynamics of MP Materials.

- Upon reviewing our latest valuation report, MP Materials' share price might be too optimistic.

Taking Advantage

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 194 more companies for you to explore.Click here to unveil our expertly curated list of 197 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives