- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

US Growth Companies With High Insider Ownership In December 2024

Reviewed by Simply Wall St

As the United States markets experience a Santa Claus rally, with major indices like the Nasdaq Composite and S&P 500 posting gains, investors are keenly observing growth companies that are making significant strides. In this buoyant market environment, high insider ownership in growth stocks can indicate confidence from those closest to the company, making them an area of interest for many investors seeking potential opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 34.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

| Myomo (NYSEAM:MYO) | 13.7% | 69.1% |

We'll examine a selection from our screener results.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation develops a software-based platform aimed at improving marketing and monetization for advertisers both in the United States and globally, with a market cap of approximately $114.72 billion.

Operations: The company's revenue segments consist of $1.49 billion from Apps and $2.80 billion from its Software Platform.

Insider Ownership: 35.5%

Revenue Growth Forecast: 19% p.a.

AppLovin demonstrates significant growth potential, with earnings forecasted to grow at 32.6% annually, outpacing the US market. Despite a high level of debt and recent insider selling, the company shows robust financial performance, evidenced by a substantial increase in net income and sales over the past year. Recent strategic moves include a $996.89 million fixed-income offering and its addition to the NASDAQ-100 Index, reflecting market confidence in its growth trajectory.

- Take a closer look at AppLovin's potential here in our earnings growth report.

- The valuation report we've compiled suggests that AppLovin's current price could be inflated.

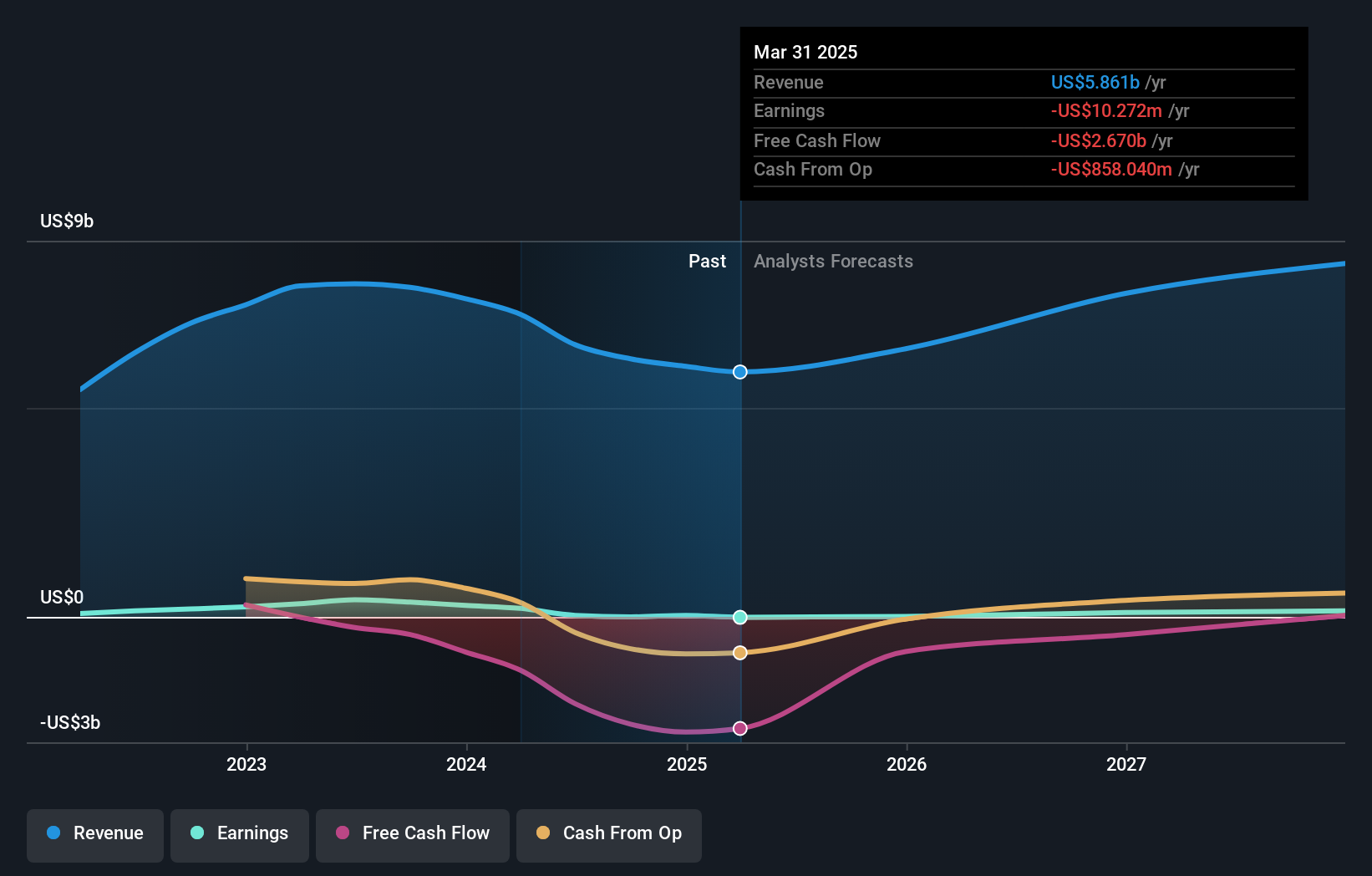

Canadian Solar (NasdaqGS:CSIQ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canadian Solar Inc., along with its subsidiaries, offers solar energy and battery energy storage products and solutions across Asia, the Americas, Europe, and internationally, with a market cap of approximately $781.39 million.

Operations: Canadian Solar's revenue is primarily derived from its CSI Solar segment, contributing $6.49 billion, and its Recurrent Energy segment, which adds $188.76 million.

Insider Ownership: 21.2%

Revenue Growth Forecast: 13.7% p.a.

Canadian Solar is positioned for growth with earnings projected to rise significantly at 74.18% annually, surpassing the US market average. Despite a recent net loss and revenue decline, the company secured substantial agreements with Sunraycer Renewables for solar modules and battery storage projects in Texas, indicating strategic expansion efforts. However, Canadian Solar faces legal challenges from Trina Solar over patent infringement claims that could impact its operations in the U.S., adding potential risks to its growth outlook.

- Click here to discover the nuances of Canadian Solar with our detailed analytical future growth report.

- Our valuation report unveils the possibility Canadian Solar's shares may be trading at a discount.

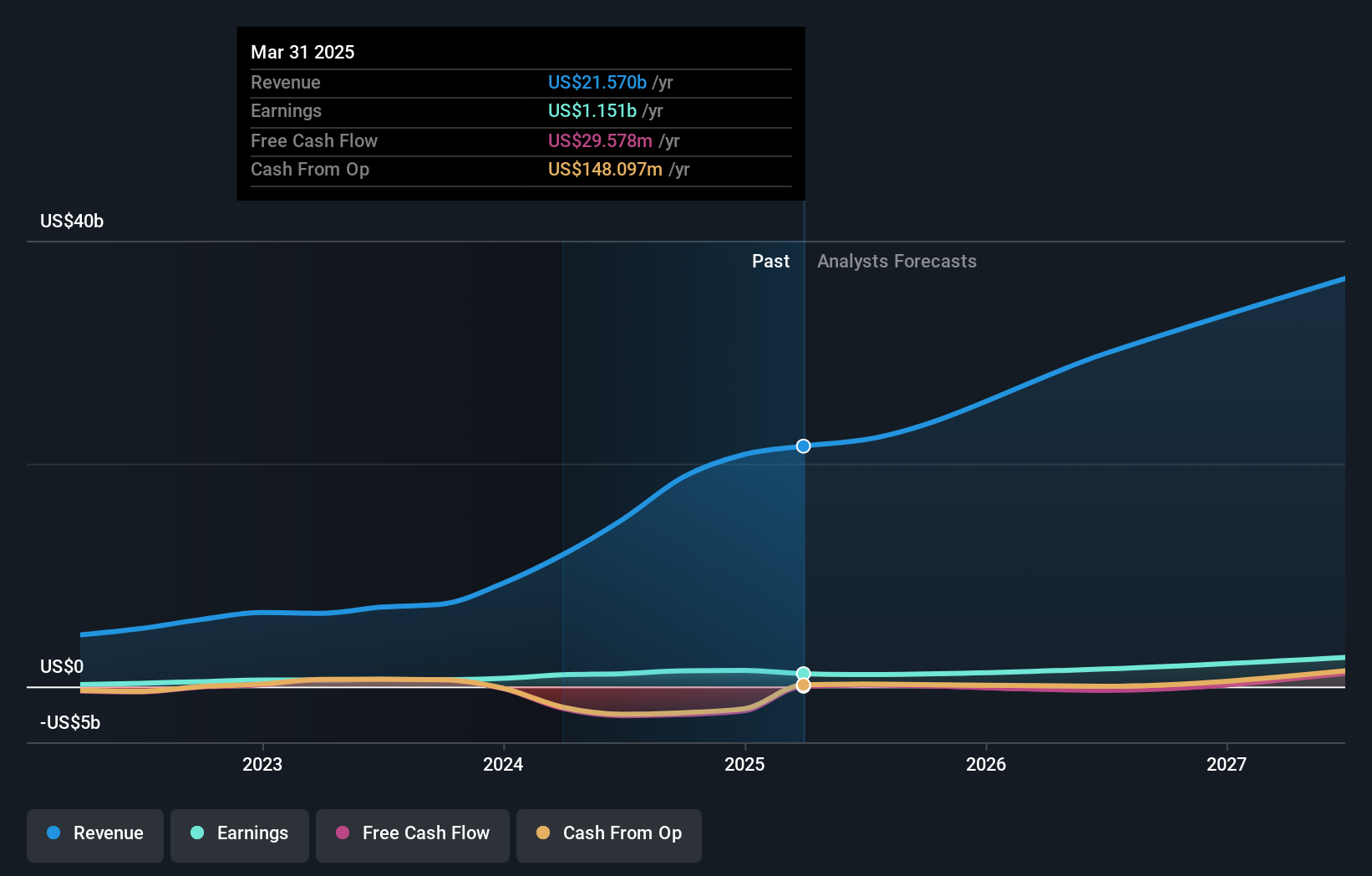

Super Micro Computer (NasdaqGS:SMCI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Super Micro Computer, Inc. develops and manufactures high-performance server and storage solutions based on modular and open architecture, serving markets in the United States, Europe, Asia, and internationally with a market cap of $20.10 billion.

Operations: The company's revenue is primarily derived from developing and providing high-performance server solutions, totaling $14.94 billion.

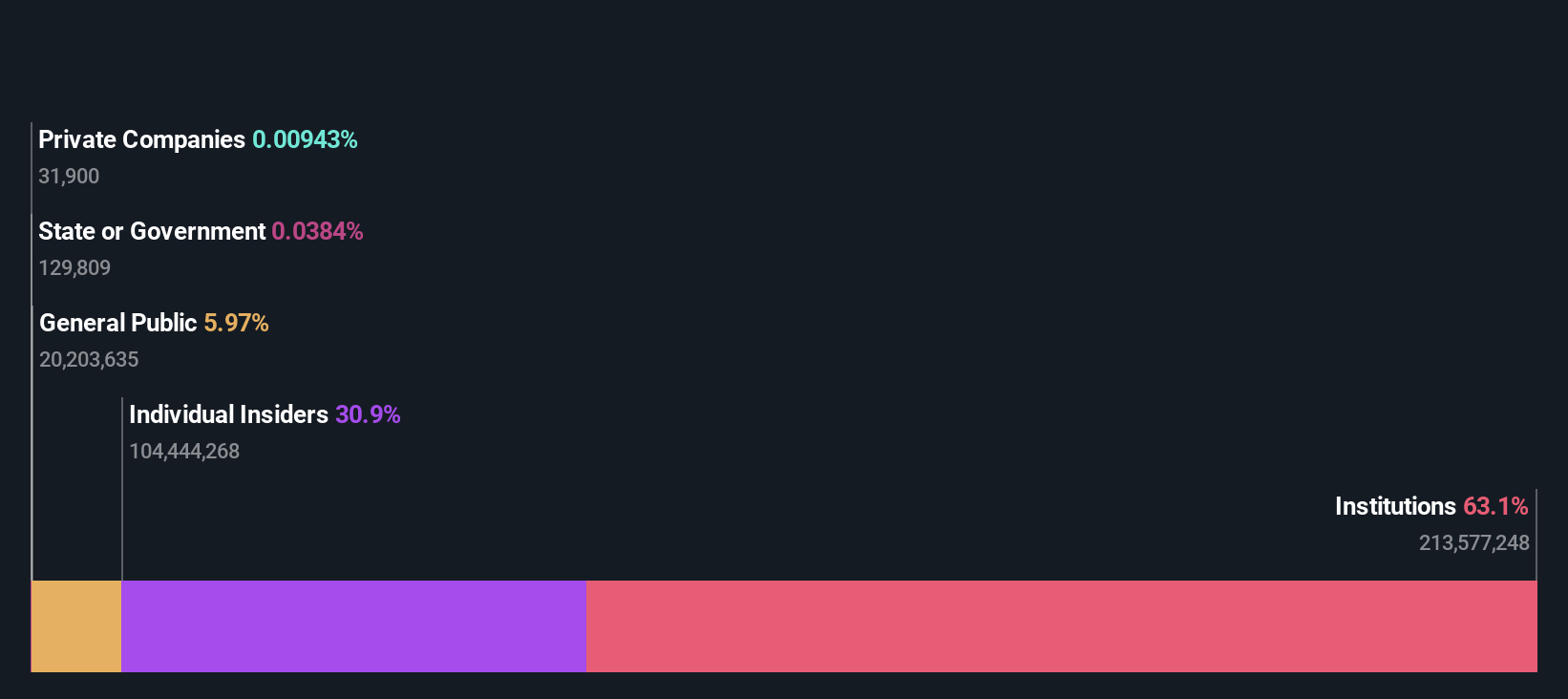

Insider Ownership: 14.4%

Revenue Growth Forecast: 24.1% p.a.

Super Micro Computer faces challenges with delayed SEC filings and recent removal from the NASDAQ-100 Index, raising concerns about its compliance status. Despite these setbacks, the company is projected to achieve significant earnings growth of 24.3% annually, outpacing the US market. Recent product innovations in liquid-cooled data centers and AI infrastructure underscore its strategic focus on high-performance computing solutions. Legal issues and supply chain constraints remain potential risks to this growth trajectory.

- Unlock comprehensive insights into our analysis of Super Micro Computer stock in this growth report.

- According our valuation report, there's an indication that Super Micro Computer's share price might be on the cheaper side.

Turning Ideas Into Actions

- Dive into all 200 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives