- United States

- /

- Software

- /

- NasdaqGM:SOUN

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 5.3% and is up 12% over the past year, with earnings forecasted to grow by 14% annually. In this context of robust market performance, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for revenue expansion and innovation in line with these positive trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 27.17% | 38.44% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Travere Therapeutics | 25.39% | 64.80% | ★★★★★★ |

| Blueprint Medicines | 21.36% | 61.84% | ★★★★★★ |

| AVITA Medical | 27.21% | 60.66% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

SoundHound AI (NasdaqGM:SOUN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SoundHound AI, Inc. develops independent voice artificial intelligence solutions for various industries, including automotive and IoT, to enhance conversational experiences globally, with a market cap of $4.42 billion.

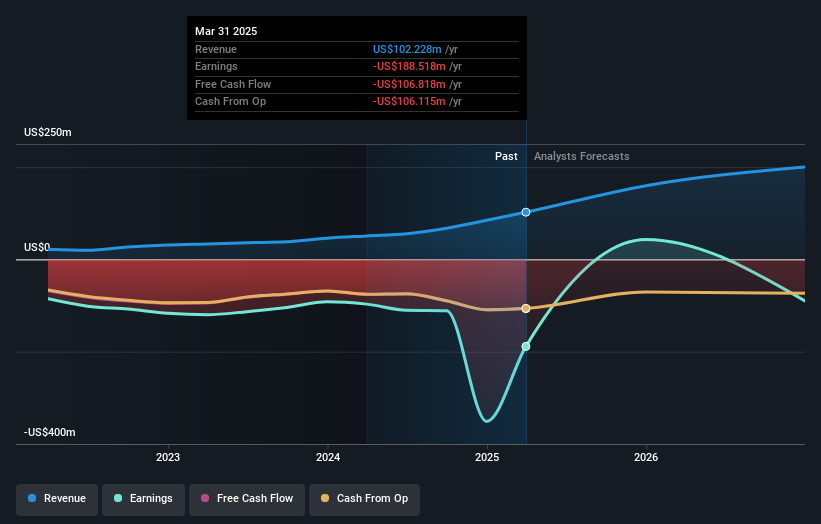

Operations: SoundHound AI focuses on providing voice AI solutions to industries such as automotive, TV, and IoT, generating revenue primarily from its Internet Software & Services segment, which amounted to $102.23 million. The company operates in markets including the United States, Korea, France, Japan, and Germany.

SoundHound AI, a player in the voice AI sector, is making significant strides with its innovative platforms and strategic partnerships. Recently, the company reported a substantial increase in quarterly sales to $29.13 million from $11.59 million year-over-year and swung to a net income of $129.93 million from a previous loss. These figures underscore a robust annual revenue growth forecast of 36.1%. Additionally, SoundHound's collaboration with Tencent Intelligent Mobility aims to enhance automotive cloud-based solutions with advanced voice AI, broadening its market reach and reinforcing its growth trajectory amidst competitive pressures in tech innovation.

- Dive into the specifics of SoundHound AI here with our thorough health report.

Assess SoundHound AI's past performance with our detailed historical performance reports.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform designed to improve marketing and monetization for advertisers globally, with a market cap of $117.72 billion.

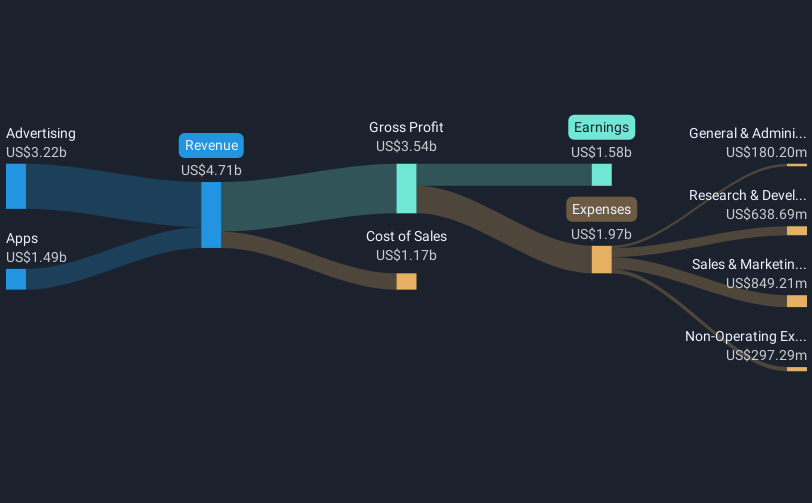

Operations: The company generates revenue primarily through its advertising segment, which brought in $3.70 billion, alongside its apps segment contributing $1.43 billion.

AppLovin has demonstrated a notable rebound, with its Q1 2025 sales surging to $1.48 billion from $1.06 billion year-over-year, reflecting a robust growth trajectory in the tech advertising sector. This performance is complemented by an impressive net income increase to $576.42 million, up from $236.18 million in the previous year, underpinned by strategic expansions and innovative ad solutions like AXON 2.0. Despite facing recent legal challenges and allegations of misleading advertising practices, AppLovin's aggressive share repurchase program—buying back nearly 21% of shares for approximately $3.4 billion since February 2022—signals confidence in its financial health and future prospects.

- Take a closer look at AppLovin's potential here in our health report.

Review our historical performance report to gain insights into AppLovin's's past performance.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $37.36 billion.

Operations: Zscaler generates revenue primarily through the sale of subscription services to its cloud platform and related support services, totaling approximately $2.42 billion.

Zscaler's strategic partnership with T-Mobile, deploying AI-driven Zero Trust Exchange solutions, underscores its innovative approach in cybersecurity, enhancing secure access across networks irrespective of location. This collaboration not only boosts Zscaler's service offerings but also aligns with evolving enterprise needs for robust security architectures. Despite a challenging fiscal environment marked by a net loss reduction to $19.78 million from $61.95 million over six months, Zscaler's forward-looking initiatives like appointing an EVP of AI Innovations signal its commitment to technological leadership and market responsiveness. The firm is set to achieve revenues between $2.64 billion and $2.65 billion for FY2025, reflecting its potential in the high-growth tech sector despite current unprofitability.

- Unlock comprehensive insights into our analysis of Zscaler stock in this health report.

Explore historical data to track Zscaler's performance over time in our Past section.

Next Steps

- Delve into our full catalog of 235 US High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SOUN

SoundHound AI

Develops independent voice artificial intelligence (AI) solutions that enables businesses across automotive, TV, and IoT, and to customer service industries to deliver high-quality conversational experiences to their customers in the United States, Korea, France, Japan, Germany, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)