- United States

- /

- IT

- /

- NasdaqGS:WIX

3 Stocks Estimated To Be 10% To 27.3% Below Intrinsic Value

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has seen a notable rise of 15% over the past year, with earnings projected to grow by another 15% annually. In this environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Royal Gold (RGLD) | $154.76 | $298.88 | 48.2% |

| Robert Half (RHI) | $41.86 | $82.60 | 49.3% |

| Repligen (RGEN) | $116.25 | $224.90 | 48.3% |

| Rapid7 (RPD) | $22.31 | $43.54 | 48.8% |

| e.l.f. Beauty (ELF) | $117.63 | $229.71 | 48.8% |

| Carter Bankshares (CARE) | $18.17 | $35.50 | 48.8% |

| Camden National (CAC) | $42.27 | $83.80 | 49.6% |

| Atlantic Union Bankshares (AUB) | $33.22 | $65.45 | 49.2% |

| ACNB (ACNB) | $43.03 | $85.02 | 49.4% |

| Acadia Realty Trust (AKR) | $18.55 | $36.68 | 49.4% |

Here we highlight a subset of our preferred stocks from the screener.

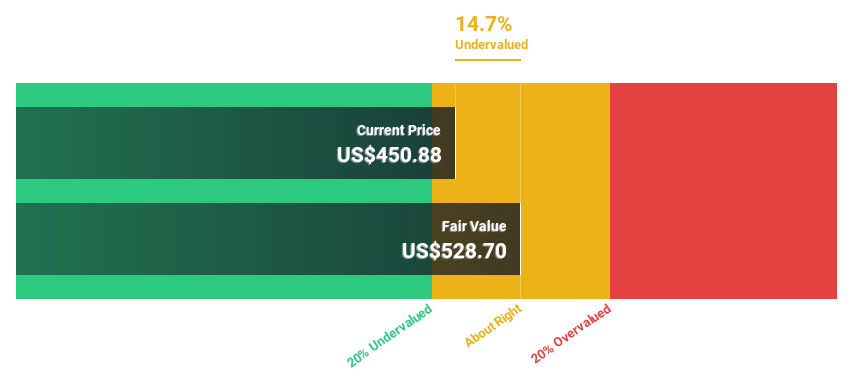

Autodesk (ADSK)

Overview: Autodesk, Inc. offers 3D design, engineering, and entertainment technology solutions globally, with a market cap of approximately $63.55 billion.

Operations: The company's revenue primarily comes from its CAD / CAM Software segment, generating $6.35 billion.

Estimated Discount To Fair Value: 14.3%

Autodesk is trading at US$297.03, below its estimated fair value of US$346.63, suggesting it may be undervalued based on cash flows. Earnings are forecasted to grow 17.34% annually, outpacing the U.S. market average of 14.7%. Despite significant insider selling and a recent decline in net income from US$252 million to US$152 million year-on-year, Autodesk's revenue growth remains robust at 9.8%, surpassing the broader market's growth rate.

- The analysis detailed in our Autodesk growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Autodesk.

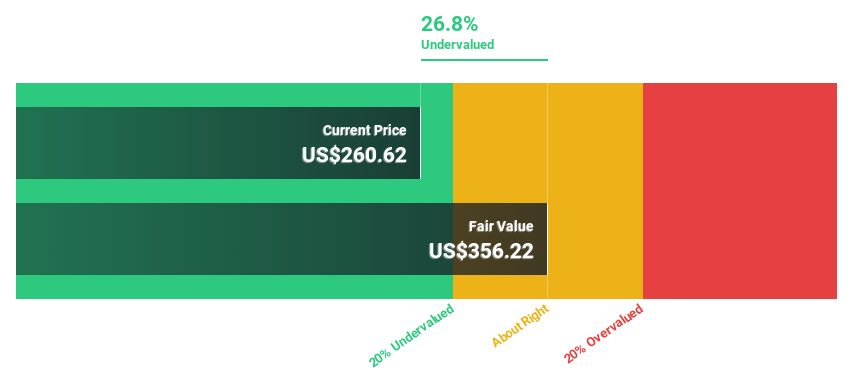

Synopsys (SNPS)

Overview: Synopsys, Inc. offers electronic design automation software for designing and testing integrated circuits, with a market cap of $108.21 billion.

Operations: The company generates revenue from two primary segments: Design IP, contributing $1.90 billion, and Design Automation, accounting for $4.32 billion.

Estimated Discount To Fair Value: 27.3%

Synopsys, trading at US$584.76, is significantly undervalued with an estimated fair value of US$804.11. Recent strategic moves, including the acquisition of Ansys and collaborations with Tata Elxsi and Broadcom, position it well in a growing market landscape. Earnings are expected to grow 21.7% annually, outpacing the U.S. market average of 14.7%. Despite recent earnings fluctuations, Synopsys' revenue growth forecast remains strong at 19.9%, exceeding the broader market's rate.

- Our earnings growth report unveils the potential for significant increases in Synopsys' future results.

- Dive into the specifics of Synopsys here with our thorough financial health report.

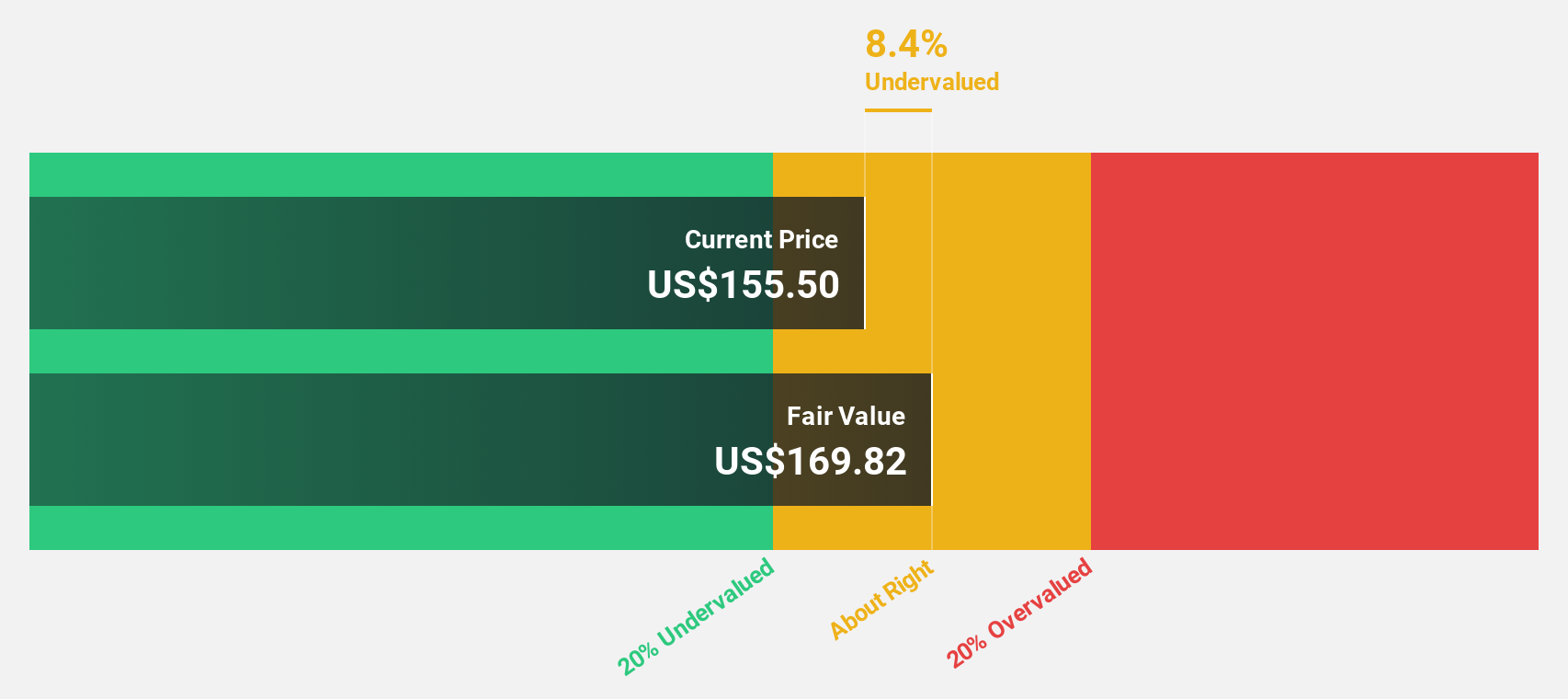

Wix.com (WIX)

Overview: Wix.com Ltd. operates a cloud-based web development platform for users and creators globally, with a market cap of approximately $8.67 billion.

Operations: Wix.com Ltd.'s revenue is primarily derived from its Internet Software & Services segment, totaling approximately $1.81 billion.

Estimated Discount To Fair Value: 10%

Wix.com, priced at US$155.05, trades below its fair value estimate of US$172.29, indicating potential undervaluation based on cash flows. Its earnings are projected to grow significantly at 26.3% annually, outpacing the U.S. market average of 14.7%. Recent initiatives like the AI Visibility Overview and strategic partnerships with Alibaba.com enhance its competitive edge in a rapidly evolving digital landscape despite high debt levels and slower revenue growth compared to industry leaders.

- Upon reviewing our latest growth report, Wix.com's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Wix.com with our comprehensive financial health report here.

Turning Ideas Into Actions

- Reveal the 173 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wix.com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WIX

Wix.com

Operates a cloud-based web development platform for registered users and creators worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives