- United States

- /

- Semiconductors

- /

- NYSE:TSM

TSMC (NYSE:TSM) Valuation Check After Strong Year-to-Date Share Price Run

Reviewed by Simply Wall St

Taiwan Semiconductor Manufacturing (TSM) has quietly added another solid week, with the stock up about 5% over the past month and nearly 20% in the past 3 months, extending a strong year-to-date run.

See our latest analysis for Taiwan Semiconductor Manufacturing.

That steady 1 month share price return around 5% sits within a much bigger move, with the stock now at about $310 and a powerful year to date share price return north of 50%. This reinforces the sense that momentum is still building rather than fading.

If TSM has you thinking more broadly about chips and compute, this is a good moment to scan other high growth tech and AI stocks that might share similar tailwinds.

Yet with earnings rebounding, revenue growing double digits, and the share price still nearly 20% below the average analyst target, investors face a familiar dilemma: Is TSM undervalued today or already pricing in tomorrow’s growth?

Most Popular Narrative Narrative: 0% Overvalued

According to oscargarcia, the narrative fair value sits almost exactly at today’s $310 share price, setting up a finely balanced valuation story.

TSMC is the central pillar of the global semiconductor ecosystem, powering the AI revolution with unmatched scale, cutting edge process technology, and disciplined execution. With record profits, dominant client base, and massive expansion underway, both in Taiwan and abroad, it stands as a low risk way to own the AI infrastructure wave.

Curious how this narrative justifies today’s price tag, almost to the dollar? The answer weaves together explosive profit growth, fortress like margins, and ambitious expansion math.

Result: Fair Value of $310.0 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions and rising costs from overseas fabs could quickly compress margins and cool sentiment if demand for AI technologies ever disappoints.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.

Another Lens on Value

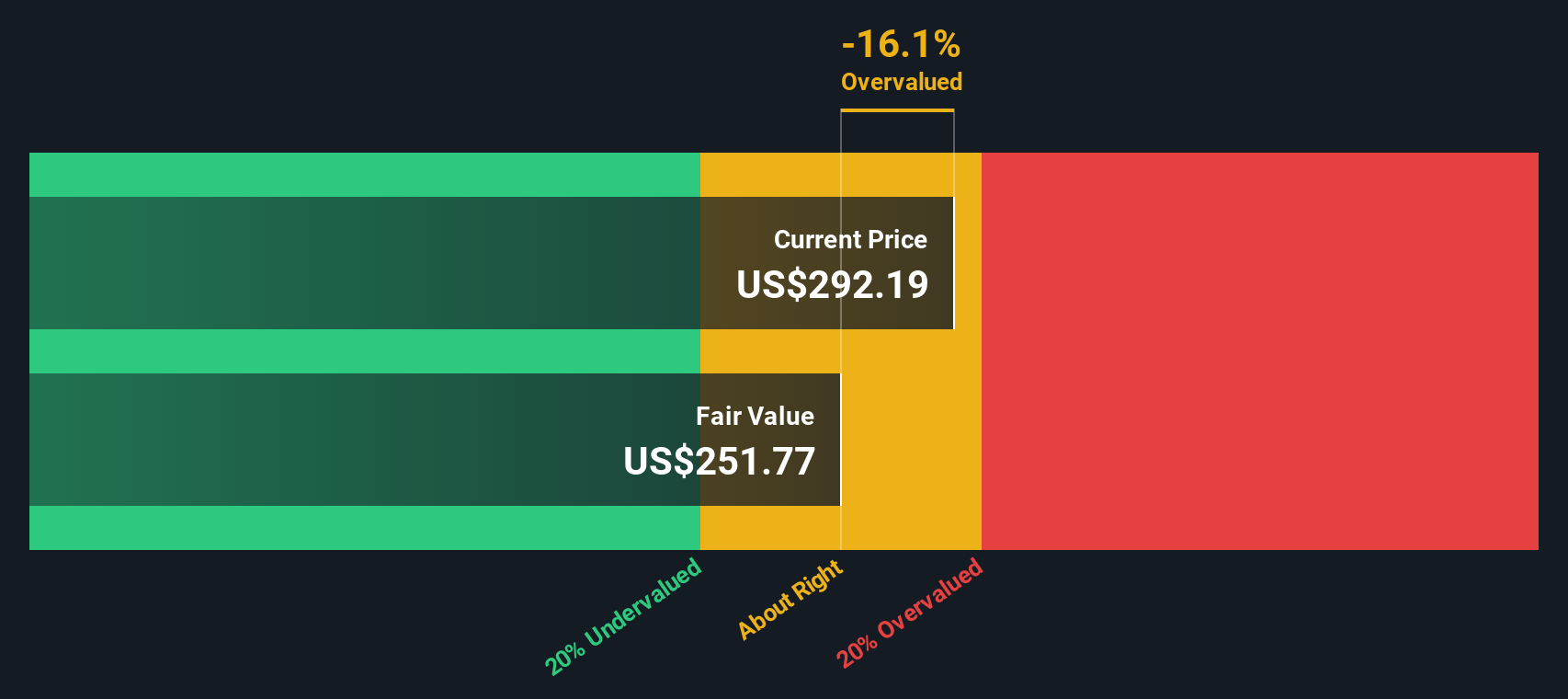

While the narrative pins fair value right at $310, our DCF model paints a cooler picture, putting fair value closer to $225. At today’s price, that implies TSM may be trading rich, not cheap, which raises the question: how much AI optimism is already in the price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Taiwan Semiconductor Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one great company. Put Simply Wall Street to work and lock in fresh, data backed ideas before other investors spot them.

- Capture under the radar value by scanning these 907 undervalued stocks based on cash flows that the market has not fully priced for their future cash flows.

- Ride powerful innovation trends by targeting these 26 AI penny stocks positioned at the heart of the AI transformation.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that can potentially keep paying you through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026