- United States

- /

- Consumer Finance

- /

- NasdaqGS:OPRT

3 US Penny Stocks With Market Caps Under $200M

Reviewed by Simply Wall St

As the Dow Jones Industrial Average hits record highs, while the S&P 500 and Nasdaq Composite experience declines due to tech stock tumbles, investors are exploring diverse opportunities in the market. Penny stocks, often associated with smaller or newer companies, remain a relevant area for those seeking potential growth at lower price points. Despite their vintage name, these stocks can offer surprising value when backed by solid financial foundations and strong fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7805 | $5.74M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $142.61M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2255 | $8.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $4.27 | $559M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.15M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9511 | $80.94M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.98 | $435.65M | ★★★★☆☆ |

| VCI Global (NasdaqCM:VCIG) | $1.79 | $5.64M | ★★★★★☆ |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CuriosityStream (NasdaqCM:CURI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CuriosityStream Inc. operates as a factual content streaming service and media company with a market cap of $99.86 million.

Operations: The company generates revenue of $51.78 million from its factual content streaming service.

Market Cap: $99.86M

CuriosityStream Inc. has a market cap of US$99.86 million and reported revenue of US$51.78 million, with recent quarterly sales at US$12.6 million, down from US$15.63 million the previous year. Despite being unprofitable, the company has reduced its losses over five years and maintains a sufficient cash runway for more than three years due to positive free cash flow growth. A recent strategic partnership with Off The Fence aims to expand content distribution in China, Hong Kong, and Macau, potentially enhancing revenue streams despite its current volatile share price and insider selling activities.

- Dive into the specifics of CuriosityStream here with our thorough balance sheet health report.

- Explore CuriosityStream's analyst forecasts in our growth report.

Oportun Financial (NasdaqGS:OPRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oportun Financial Corporation offers financial services and has a market cap of approximately $124.46 million.

Operations: The company's revenue primarily comes from its Financial Services - Consumer segment, generating $796.99 million.

Market Cap: $124.46M

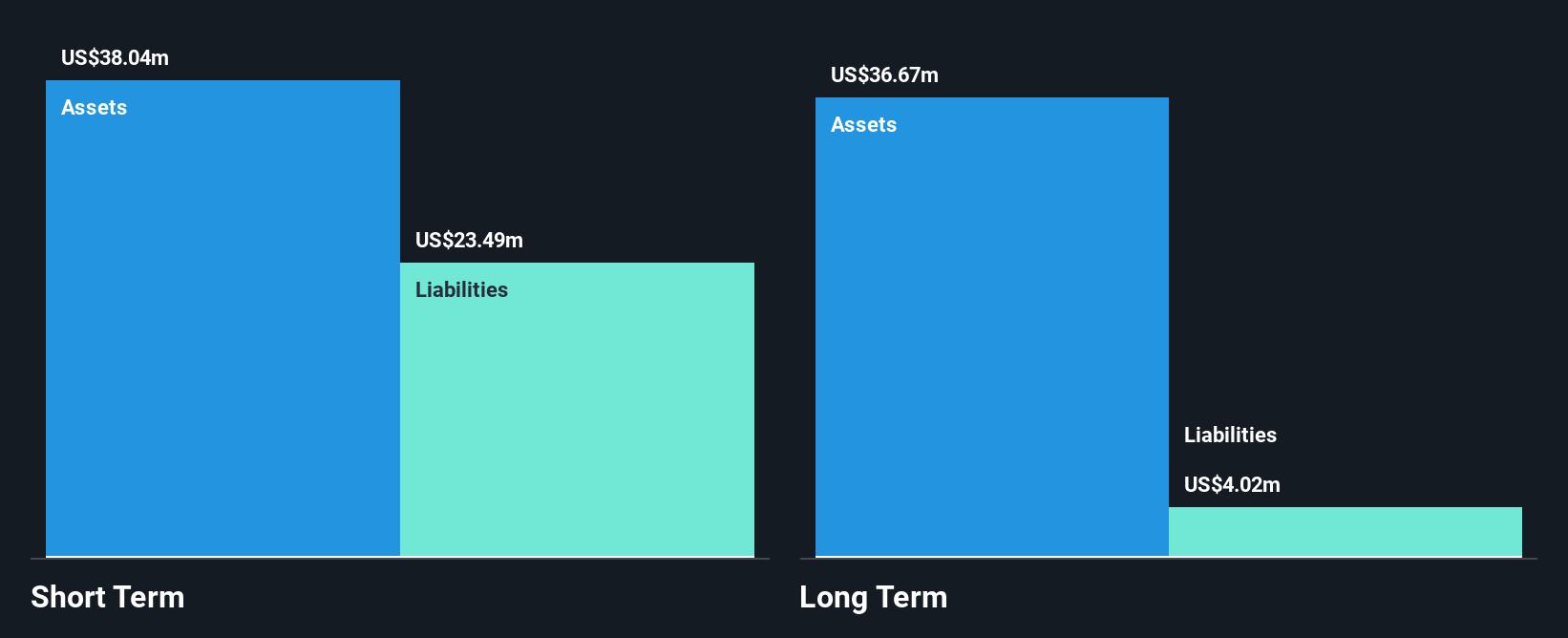

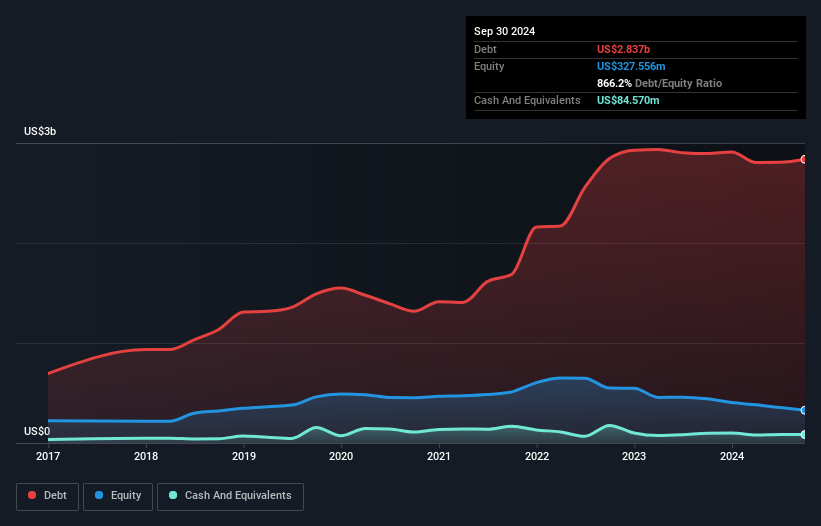

Oportun Financial Corporation, with a market cap of US$124.46 million, reported third-quarter revenue of US$249.95 million, down from US$268.2 million the previous year, alongside a net loss increase to US$29.96 million. Despite being unprofitable and having a high net debt to equity ratio of 840.3%, the company has sufficient cash runway for over three years due to positive free cash flow growth and strong short-term asset coverage exceeding liabilities by significant margins. The seasoned management team and guidance for improved earnings in 2025 indicate potential stability amidst shareholder dilution concerns and increased debt levels over five years.

- Click here and access our complete financial health analysis report to understand the dynamics of Oportun Financial.

- Examine Oportun Financial's earnings growth report to understand how analysts expect it to perform.

Magnachip Semiconductor (NYSE:MX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Magnachip Semiconductor Corporation designs, manufactures, and supplies analog and mixed-signal semiconductor solutions for various applications including communications and automotive, with a market cap of approximately $148.44 million.

Operations: The company's revenue segments include Transitional Fab 3 Foundry Services, which generated $17.94 million.

Market Cap: $148.44M

Magnachip Semiconductor, with a market cap of US$148.44 million, reported third-quarter revenue growth to US$66.46 million but remains unprofitable with increasing net losses. Despite this, the company has improved its financial position by achieving positive shareholder equity and maintaining more cash than its total debt. Short-term assets significantly exceed both short- and long-term liabilities, providing a solid financial cushion alongside a strong cash runway for over three years based on current free cash flow trends. The experienced management team and board contribute to stability despite challenges in profitability and declining earnings forecasts.

- Navigate through the intricacies of Magnachip Semiconductor with our comprehensive balance sheet health report here.

- Gain insights into Magnachip Semiconductor's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Take a closer look at our US Penny Stocks list of 717 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRT

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives