- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Is It Too Late To Consider Lam Research After A 132% Year To Date Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Lam Research is still worth buying after its massive run, you are not alone. This article is going to focus squarely on what the current price implies about future returns.

- The stock has climbed 5.3% over the last week, 1.1% over the last month, and an eye catching 132.3% year to date, adding to a 117.1% gain over the past year and 270.8% over three years.

- That kind of performance has pushed Lam firmly into the market spotlight, with investors increasingly treating it as a key way to play long term demand for advanced chipmaking equipment. At the same time, shifting expectations around interest rates and AI related capex have made the ride more volatile. This makes a clear view on valuation even more important.

- Right now Lam Research scores just 2 out of 6 on our valuation checks, suggesting only a couple of metrics flag it as undervalued and the rest look more demanding. We will unpack what that means using multiple valuation approaches and then circle back at the end to a more intuitive way to think about what the market is really pricing in.

Lam Research scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lam Research Discounted Cash Flow (DCF) Analysis

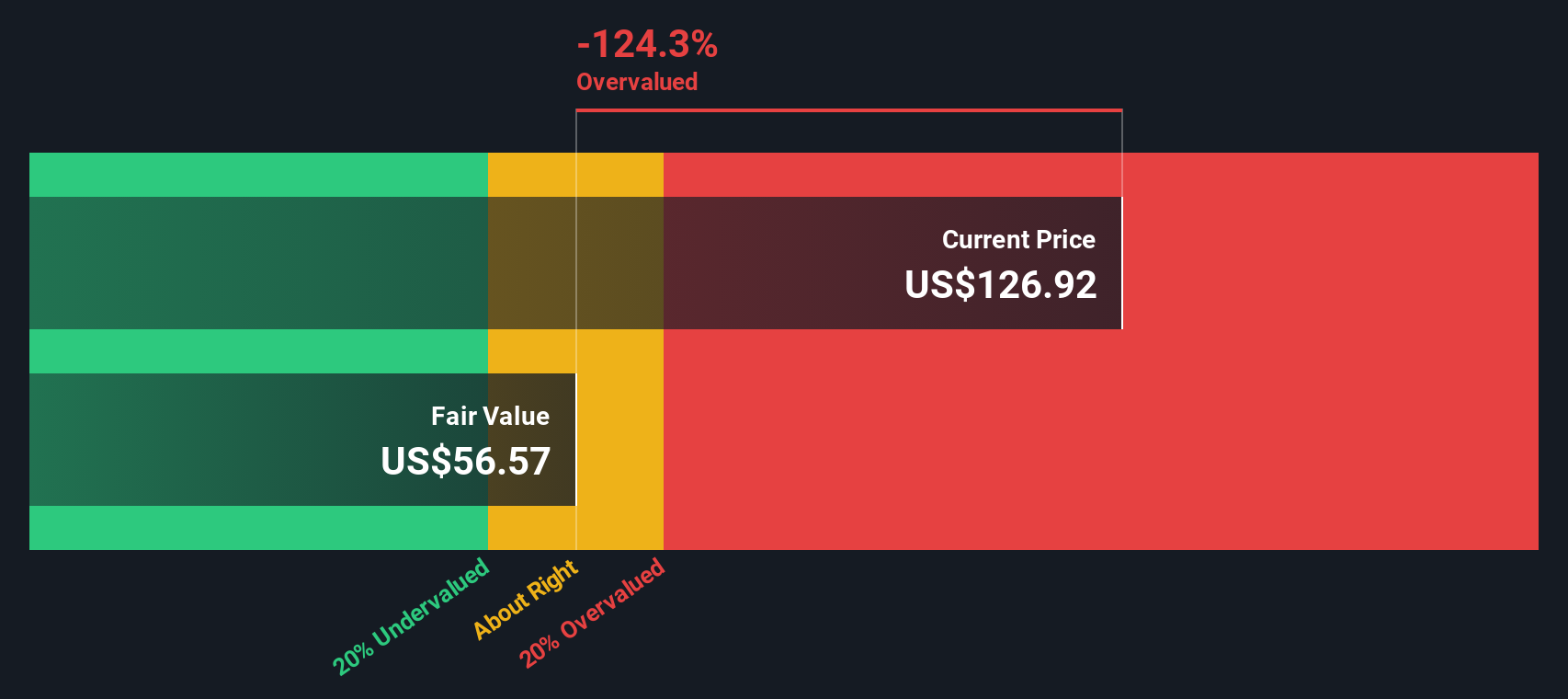

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Lam Research, the 2 Stage Free Cash Flow to Equity model starts with current Free Cash Flow of about $5.7 billion and then applies analyst forecasts for several years, with later years extrapolated by Simply Wall St.

Those projections see Free Cash Flow rising to roughly $7.8 billion by 2030, before growth moderates in the following years. All of these cash flows are converted into today’s dollars using a required return that reflects risk and interest rates. When summed, this yields an estimated intrinsic value of about $66.94 per share.

Compared to the current share price, this DCF suggests Lam Research is roughly 151.4% overvalued, meaning the market is paying far more than what these cash flow projections imply.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lam Research may be overvalued by 151.4%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lam Research Price vs Earnings

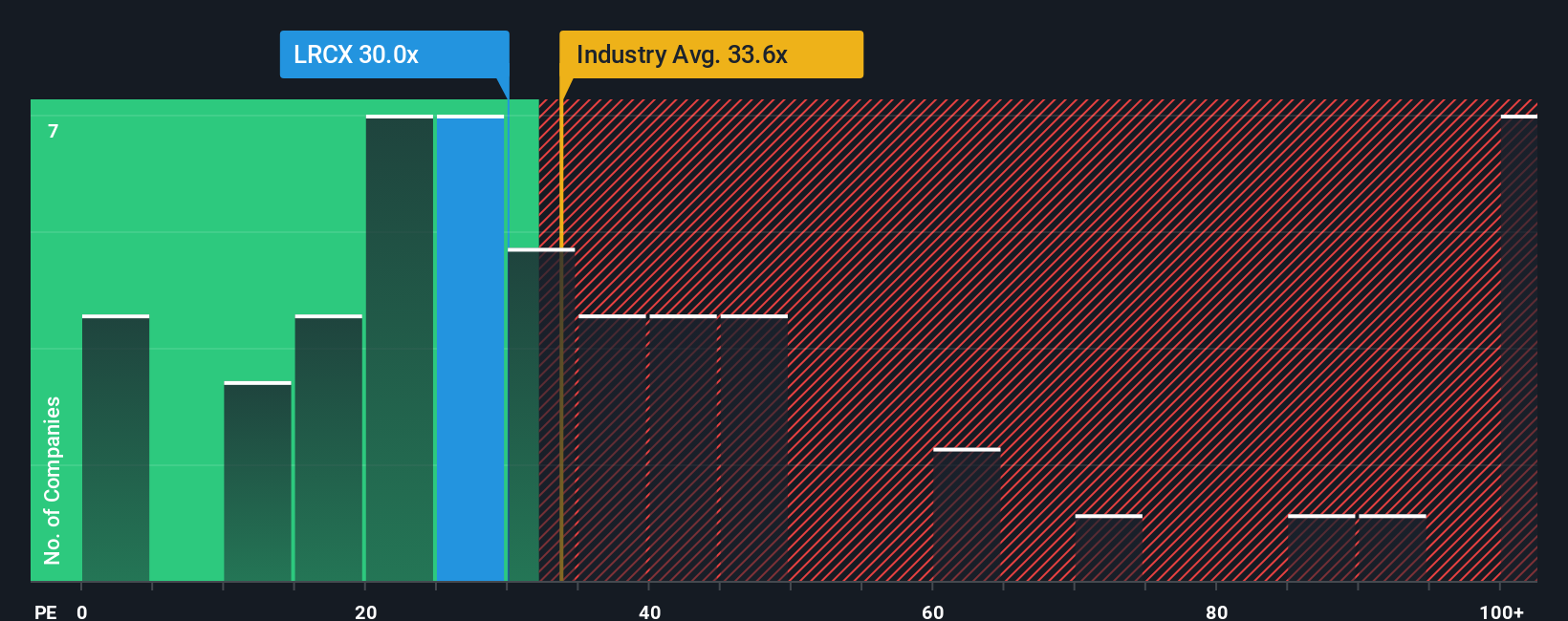

For a profitable, mature business like Lam Research, the price to earnings ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current profits. In broad terms, faster and more reliable earnings growth can justify a higher PE ratio, while cyclical, uncertain, or slower growing earnings usually deserve a lower one.

Lam currently trades on a PE of about 36.4x, which sits below the semiconductor industry average of roughly 38.1x and also under the peer group average of about 41.1x. That might initially suggest the stock is not especially expensive relative to its sector. However, Simply Wall St also calculates a Fair Ratio of 31.0x. This is the PE multiple Lam might reasonably deserve once you factor in its specific earnings growth outlook, profit margins, scale, industry position, and risk profile.

This Fair Ratio is more tailored than a simple comparison with peers or the broad industry, because it adjusts for Lam’s own fundamentals instead of assuming it should trade like the average chip stock. With the actual PE (36.4x) standing well above the Fair Ratio (31.0x), this approach points to the shares being somewhat overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lam Research Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page where you describe the story you believe about Lam Research, link that story to specific assumptions for future revenue, earnings and margins, and automatically translate those assumptions into a Fair Value you can compare with today’s share price. You can then see if your view suggests buy, hold or sell, with the numbers updating dynamically as new news or earnings arrive. For example, a more bullish investor might build a Narrative where AI driven wafer fab demand and margins stay strong enough to justify something close to the most optimistic fair value around $160 per share. A more cautious investor could instead set slower growth, thinner margins and a lower future PE, ending up nearer the most conservative targets closer to $80. Both investors can clearly see how their different stories produce different forecasts and valuations, instead of relying only on static PE or DCF snapshots.

Do you think there's more to the story for Lam Research? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026