- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Exec Departure as Shares Drop 5%

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) experienced a 9% price increase over the last quarter, possibly influenced by recent executive changes, such as the resignation of Christine Pambianchi, and the appointment of Lip-Bu Tan as CEO. The broader market climate, marked by a downturn due to tariff-related tensions and a 5% decline in major indices like the Dow Jones and Nasdaq, suggests Intel's growth might stand out amid tech sector volatility. Furthermore, Intel's recent collaborations, product launches, and acquisition rumors might have bolstered investor confidence against a backdrop of global trade concerns and market corrections.

Buy, Hold or Sell Intel? View our complete analysis and fair value estimate and you decide.

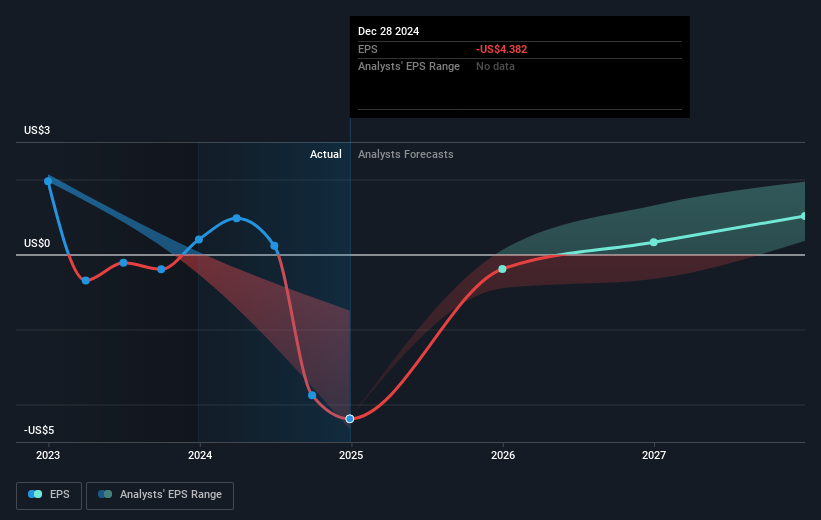

Over the past year, Intel's total shareholder return, including dividends, declined by 42.95%. This performance lagged behind both the US Semiconductor industry, which experienced a 3.9% decline, and the broader US market, which managed a 3.3% gain during the same period. Several key factors likely contributed to Intel's underperformance. Notably, Intel faced a 197% quarterly decline in net income for Q4 2024, reporting a loss of US$126 million compared to the US$2.67 billion net income of the previous year. The decision to suspend its dividend starting in Q4 2024 may have also affected investor sentiment.

The introduction of new products, such as the Xeon 6 processors in February 2025 and the expanded partnership with Wind River, underscored Intel’s commitment to innovation but may not have immediately translated into investor confidence needed to stabilize its share price. Executive transitions, with Lip-Bu Tan taking the helm as CEO, added another layer of uncertainty, potentially influencing market reactions and longer-term shareholder value perspectives.

Evaluate Intel's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)