- United States

- /

- Interactive Media and Services

- /

- NYSE:SNAP

3 US Stocks That May Be Trading At A Discount

Reviewed by Simply Wall St

As the United States stock market begins 2025 on a cautious note, extending a recent slump with major indices like the S&P 500 and Nasdaq Composite experiencing consecutive losing sessions, investors are keenly observing potential opportunities amidst the downturn. In this environment, identifying undervalued stocks becomes crucial as these may offer attractive entry points for those looking to capitalize on discrepancies between current market prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | $27.04 | $53.41 | 49.4% |

| Argan (NYSE:AGX) | $143.32 | $279.51 | 48.7% |

| Burke & Herbert Financial Services (NasdaqCM:BHRB) | $60.50 | $118.65 | 49% |

| German American Bancorp (NasdaqGS:GABC) | $38.85 | $77.34 | 49.8% |

| Camden National (NasdaqGS:CAC) | $42.25 | $84.44 | 50% |

| Cadence Bank (NYSE:CADE) | $33.70 | $65.46 | 48.5% |

| Kanzhun (NasdaqGS:BZ) | $13.64 | $26.99 | 49.5% |

| HealthEquity (NasdaqGS:HQY) | $96.81 | $189.22 | 48.8% |

| Repligen (NasdaqGS:RGEN) | $143.05 | $281.09 | 49.1% |

| Zillow Group (NasdaqGS:ZG) | $70.08 | $137.46 | 49% |

Let's take a closer look at a couple of our picks from the screened companies.

First Solar (NasdaqGS:FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic (PV) solar energy solutions across the United States, France, Japan, Chile, and other international markets with a market cap of approximately $18.87 billion.

Operations: The company's revenue primarily comes from its Modules segment, which generated $3.85 billion.

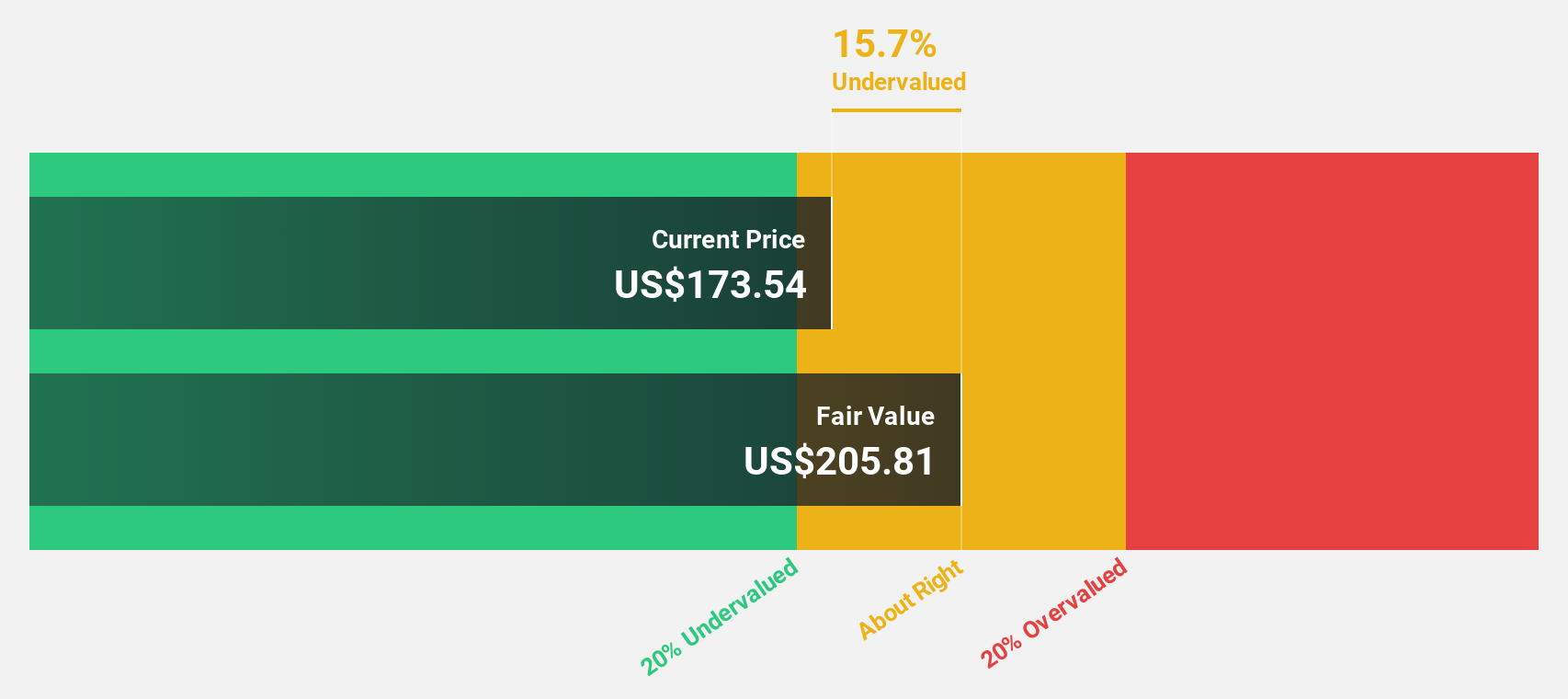

Estimated Discount To Fair Value: 47.3%

First Solar is trading at US$186.47, significantly below its estimated fair value of US$354.11, suggesting it may be undervalued based on cash flows. The company's earnings are projected to grow 23.92% annually over the next three years, outpacing both revenue growth and the broader US market's profit growth rate. Recent earnings reports show robust performance with net income for the third quarter rising to US$312.96 million from US$268.4 million year-on-year.

- Our expertly prepared growth report on First Solar implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of First Solar here with our thorough financial health report.

Natera (NasdaqGS:NTRA)

Overview: Natera, Inc. is a diagnostics company that develops and commercializes molecular testing services globally, with a market cap of approximately $20.90 billion.

Operations: The company generates revenue of approximately $1.53 billion from its molecular testing services worldwide.

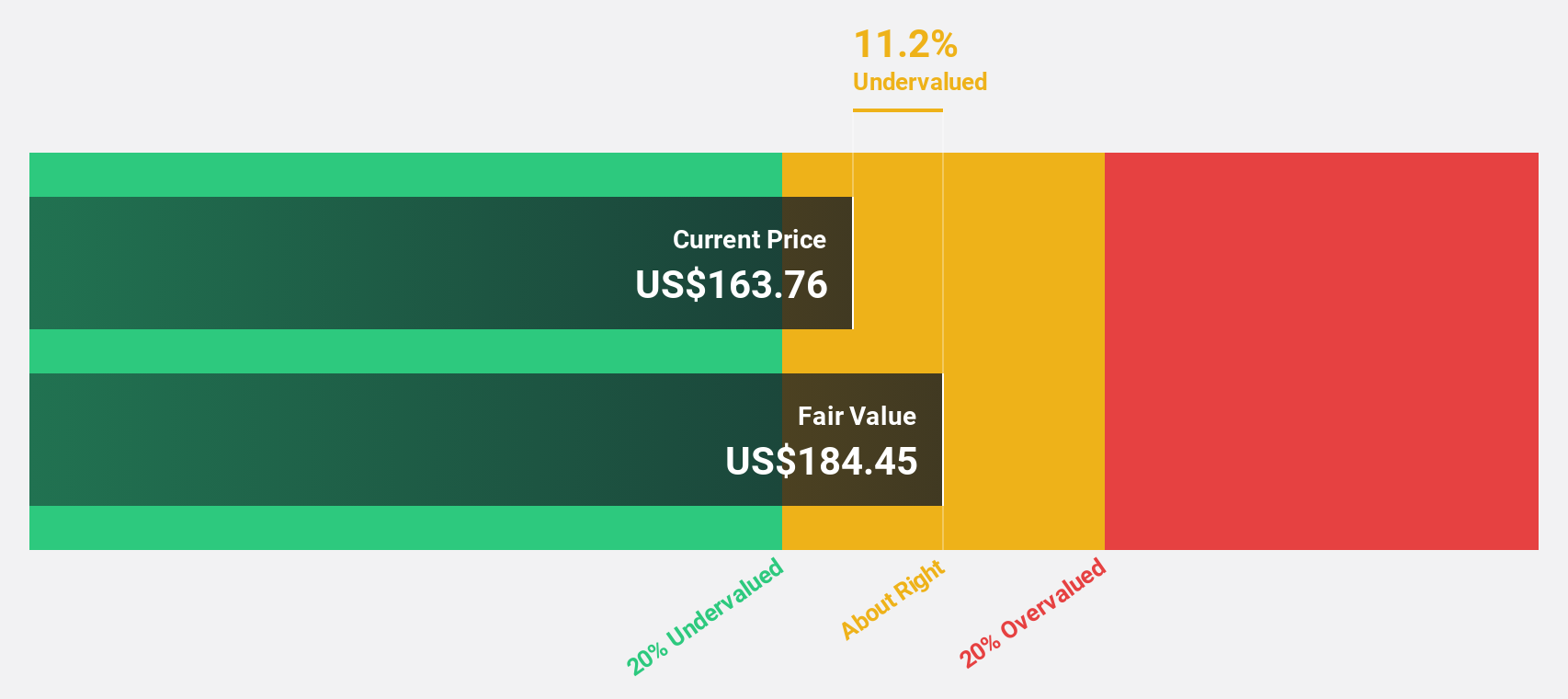

Estimated Discount To Fair Value: 18.1%

Natera's current trading price of US$160.6 is 18.1% below its estimated fair value of US$196.04, indicating potential undervaluation based on cash flows. Despite a forecasted low return on equity and recent insider selling, Natera anticipates becoming profitable within three years with earnings projected to grow 58.5% annually. Recent legal setbacks include a significant false advertising verdict against the company, which may affect financial performance and investor sentiment moving forward.

- Upon reviewing our latest growth report, Natera's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Natera's balance sheet health report.

Snap (NYSE:SNAP)

Overview: Snap Inc. is a technology company operating in North America, Europe, and internationally with a market cap of approximately $18.06 billion.

Operations: Snap Inc.'s revenue primarily comes from its Software & Programming segment, generating $5.17 billion.

Estimated Discount To Fair Value: 39.5%

Snap is trading at US$11.24, significantly below its estimated fair value of US$18.58, suggesting potential undervaluation based on cash flows. Despite insider selling, Snap's earnings are projected to grow 58.21% annually with profitability expected within three years, outpacing average market growth. Recent results show improved financials with reduced net losses and a share repurchase program of up to US$500 million funded by existing cash reserves, reflecting strategic capital management efforts.

- According our earnings growth report, there's an indication that Snap might be ready to expand.

- Click here to discover the nuances of Snap with our detailed financial health report.

Turning Ideas Into Actions

- Investigate our full lineup of 175 Undervalued US Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNAP

Snap

Operates as a technology company in North America, Europe, and internationally.

High growth potential with excellent balance sheet.