- United States

- /

- IT

- /

- NasdaqCM:TSSI

Exploring Three Undiscovered Gems In The United States Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.8% drop, yet it remains up by 24% over the past year with earnings projected to grow by 15% annually. In this dynamic environment, identifying stocks that are undervalued or overlooked can offer unique opportunities for investors seeking to capitalize on potential growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

LINKBANCORP (NasdaqCM:LNKB)

Simply Wall St Value Rating: ★★★★★★

Overview: LINKBANCORP, Inc. is a bank holding company for The Gratz Bank, offering a range of banking products and services to individuals, families, nonprofits, and businesses in Pennsylvania with a market cap of $279.53 million.

Operations: LINKBANCORP generates revenue primarily from its banking segment, amounting to $86.14 million. The company's market cap stands at $279.53 million.

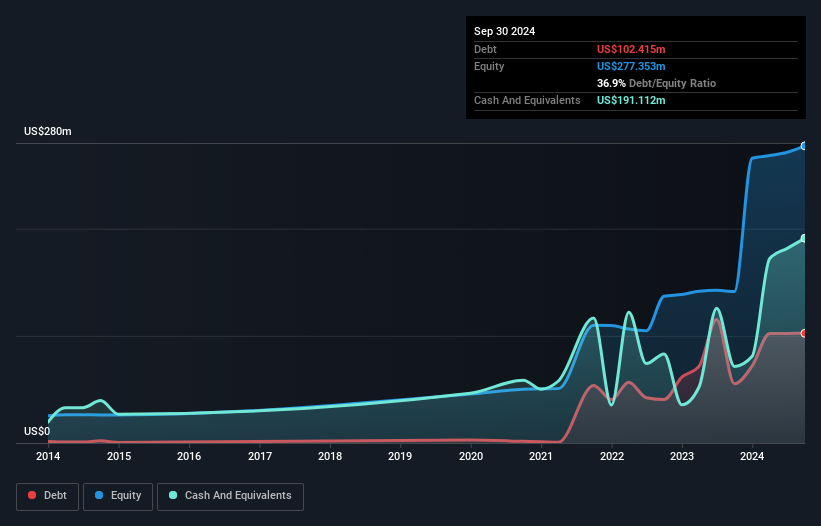

LINKBANCORP, with assets totaling US$2.9 billion and equity of US$277.4 million, has shown robust performance despite a one-off loss of US$10.4 million impacting recent financial results. Its earnings surged by 225% over the past year, outpacing the banking industry's -11% growth rate. With total deposits at US$2.4 billion and loans at US$2.2 billion, it maintains a net interest margin of 3.1%. The company boasts a low-risk funding profile with 91% liabilities from customer deposits and has an appropriate allowance for bad loans at 0.8%, indicating prudent risk management practices.

TSS (NasdaqCM:TSSI)

Simply Wall St Value Rating: ★★★★★★

Overview: TSS, Inc. specializes in providing integration technology services to support the implementation, operation, and maintenance of IT systems for enterprises and users in the United States, with a market cap of $287.86 million.

Operations: TSS, Inc. generates revenue primarily from System Integration Services, contributing $114.68 million, and Facilities services at $7.85 million.

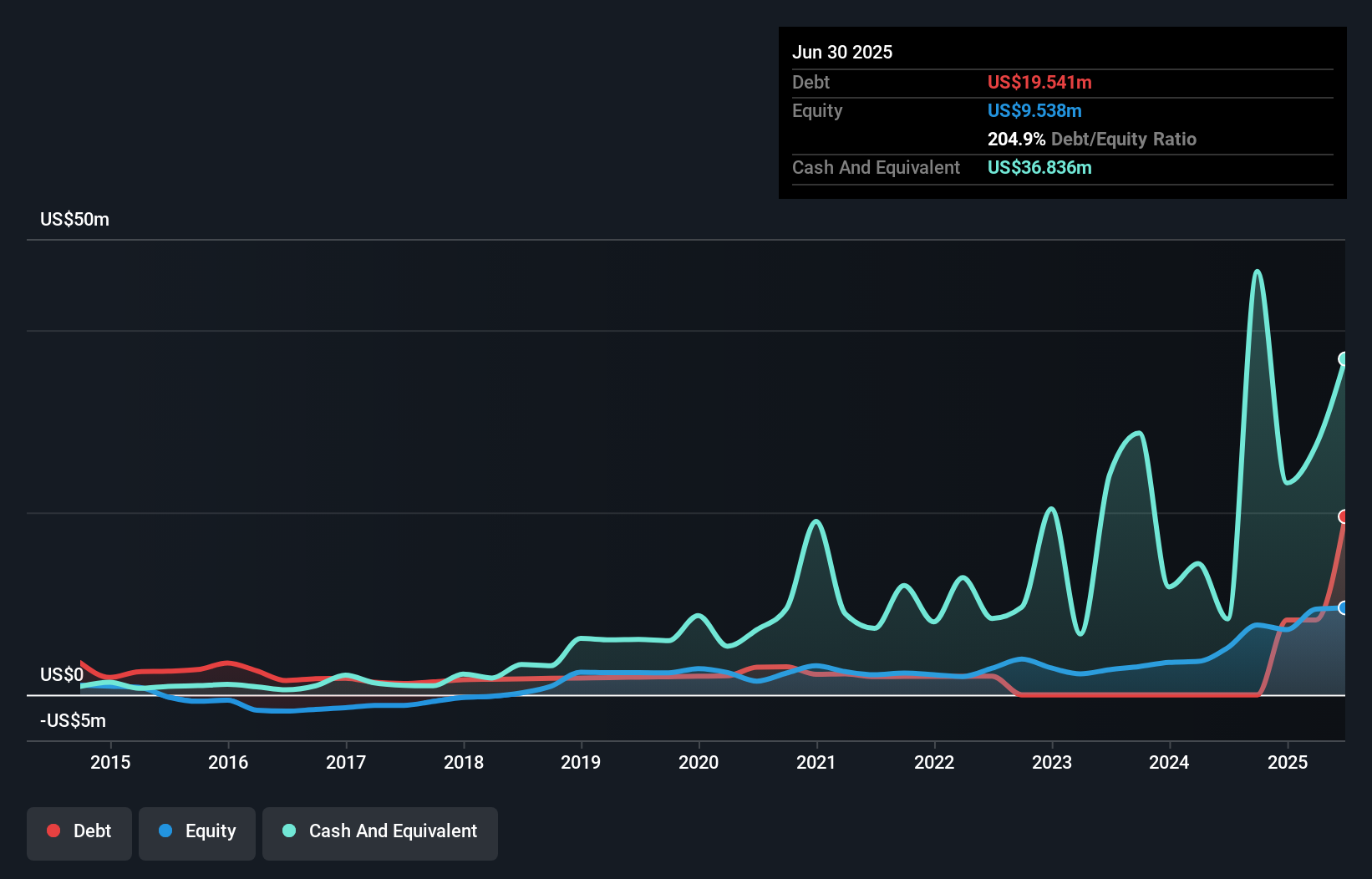

TSS, Inc., a nimble player in the tech space, has recently turned profitable with net income reaching US$2.65 million for Q3 2024, up from US$0.209 million a year prior. This marks a significant leap in performance as revenues soared to US$70.07 million from just US$8.88 million last year. The company is debt-free now, shedding an 82:1 debt-to-equity ratio over five years ago and showcasing robust free cash flow of US$19.18 million as of September 2024. Despite recent volatility in its share price, TSS trades at 6% below its estimated fair value and eyes promising growth with new multi-year customer agreements on the horizon.

- Delve into the full analysis health report here for a deeper understanding of TSS.

Explore historical data to track TSS' performance over time in our Past section.

Artesian Resources (NasdaqGS:ARTN.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Artesian Resources Corporation, with a market cap of $325.12 million, operates through its subsidiaries to provide water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Operations: Artesian Resources generates revenue primarily from its regulated utility segment, which accounts for $98.93 million. The non-utility segment contributes an additional $6.97 million to the total revenue.

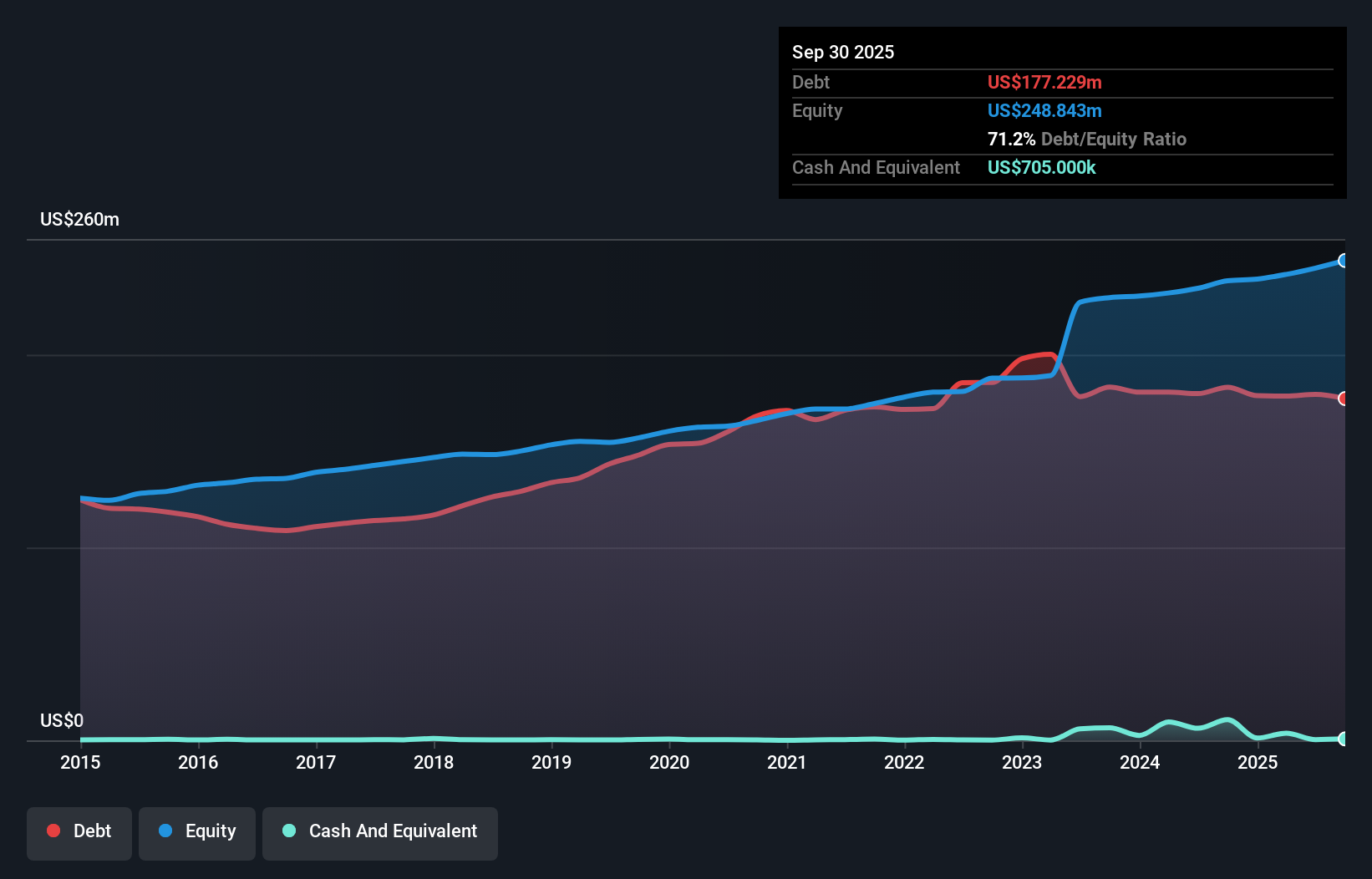

Artesian Resources, a smaller player in the water utilities sector, has demonstrated solid earnings growth of 28.9% over the past year, outpacing the industry's 14.3%. The company's debt to equity ratio improved from 94.3% to 76.8% over five years, though its net debt to equity remains high at 72.4%. Artesian's interest payments are comfortably covered by EBIT at a ratio of 3.8x, reflecting stable financial management despite high leverage levels. Recent earnings showed robust performance with third-quarter sales hitting US$29 million and net income reaching US$6.81 million, alongside a dividend boost to US$0.3014 per share quarterly.

Make It Happen

- Access the full spectrum of 244 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TSSI

TSS

Engages in the planning, design, deployment, maintenance, refresh, and take-back of end-user and enterprise systems in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives