- United States

- /

- Machinery

- /

- NasdaqGM:SYM

April 2025's Standout Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As the United States market experiences volatile trading due to ongoing tariff discussions and fluctuating economic data, major indexes like the Dow Jones, S&P 500, and Nasdaq Composite are set for weekly gains despite recent turbulence. In such an environment, identifying stocks that may be undervalued can offer potential opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CareTrust REIT (NYSE:CTRE) | $27.67 | $54.55 | 49.3% |

| TowneBank (NasdaqGS:TOWN) | $30.76 | $61.00 | 49.6% |

| First Bancorp (NasdaqGS:FBNC) | $36.38 | $72.67 | 49.9% |

| KeyCorp (NYSE:KEY) | $13.74 | $27.10 | 49.3% |

| Moog (NYSE:MOG.A) | $159.91 | $313.65 | 49% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.35 | $18.55 | 49.6% |

| Viking Holdings (NYSE:VIK) | $39.22 | $77.21 | 49.2% |

| Verra Mobility (NasdaqCM:VRRM) | $21.73 | $43.23 | 49.7% |

| First Advantage (NasdaqGS:FA) | $13.83 | $27.54 | 49.8% |

| CNX Resources (NYSE:CNX) | $28.96 | $57.14 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

Symbotic (NasdaqGM:SYM)

Overview: Symbotic Inc. is an automation technology company that develops technologies to enhance operating efficiencies in modern warehouses, with a market cap of approximately $12.58 billion.

Operations: The company's revenue segment includes Industrial Automation & Controls, generating approximately $1.91 billion.

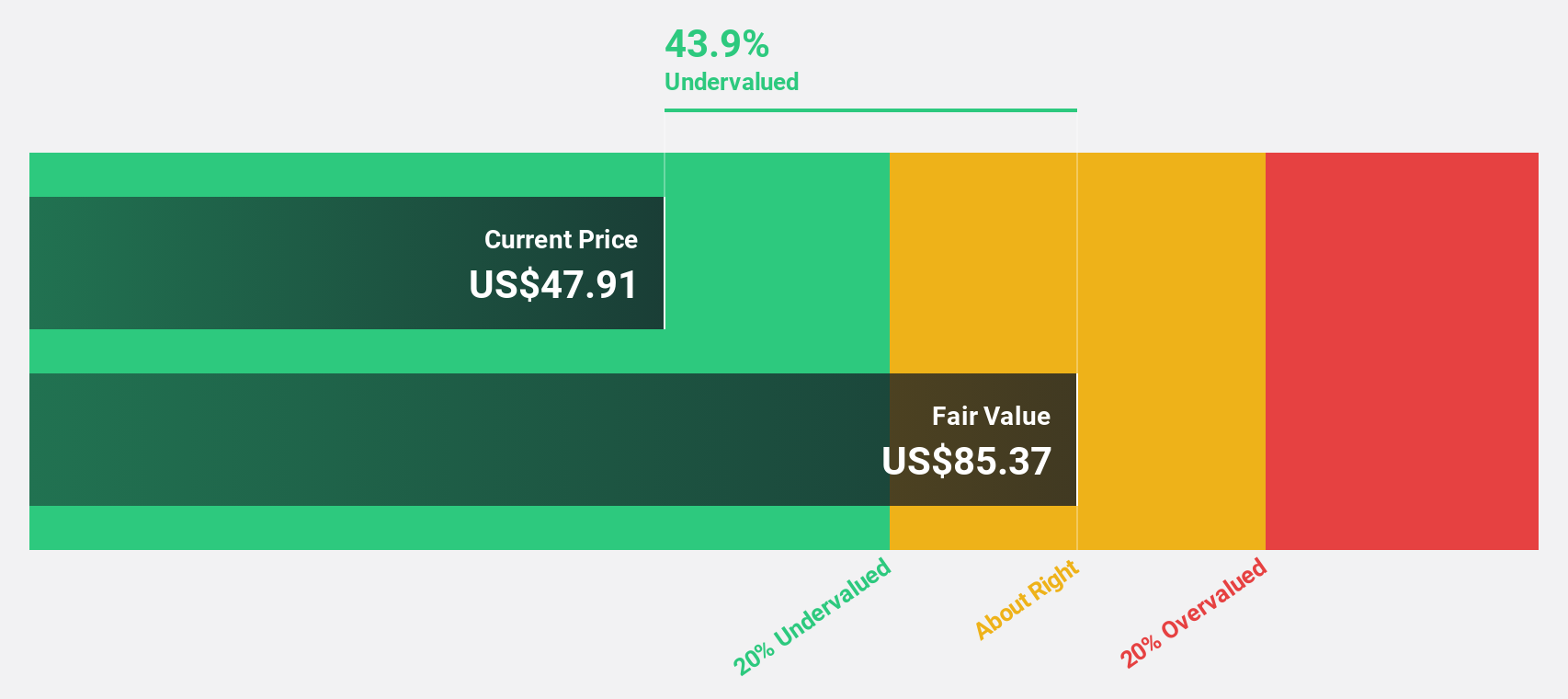

Estimated Discount To Fair Value: 38.7%

Symbotic Inc. is trading at a good value, approximately 38.7% below its estimated fair value of US$32.66, based on discounted cash flow analysis. Despite recent volatility in its share price, the company is expected to become profitable within three years and achieve annual revenue growth of 22.9%, surpassing the US market average. Recent partnerships, such as with Associated Food Stores for warehouse modernization, highlight Symbotic's strategic advancements in automation technology.

- Our expertly prepared growth report on Symbotic implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Symbotic's balance sheet health report.

Astera Labs (NasdaqGS:ALAB)

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $10.43 billion.

Operations: The company's revenue is primarily derived from its semiconductor segment, which generated $396.29 million.

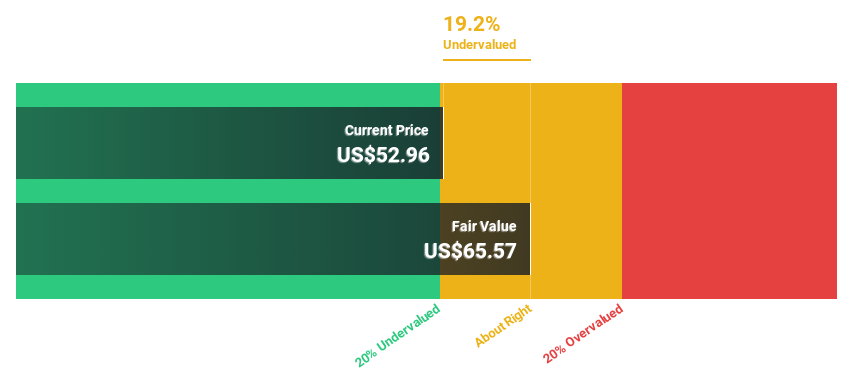

Estimated Discount To Fair Value: 22.9%

Astera Labs is trading at approximately 22.9% below its estimated fair value of US$76.38, based on discounted cash flow analysis, indicating potential undervaluation. The company reported a significant revenue increase to US$396.29 million in 2024 and is projected to maintain strong revenue growth of 24.8% annually, outpacing the broader market. Despite recent insider selling and share price volatility, Astera Labs is expected to achieve profitability within three years, with robust product developments enhancing its competitive position in AI infrastructure solutions.

- In light of our recent growth report, it seems possible that Astera Labs' financial performance will exceed current levels.

- Click here to discover the nuances of Astera Labs with our detailed financial health report.

Okta (NasdaqGS:OKTA)

Overview: Okta, Inc. operates as an identity management company both in the United States and internationally, with a market cap of approximately $17.66 billion.

Operations: Okta generates revenue from its Internet Software & Services segment, which amounts to $2.61 billion.

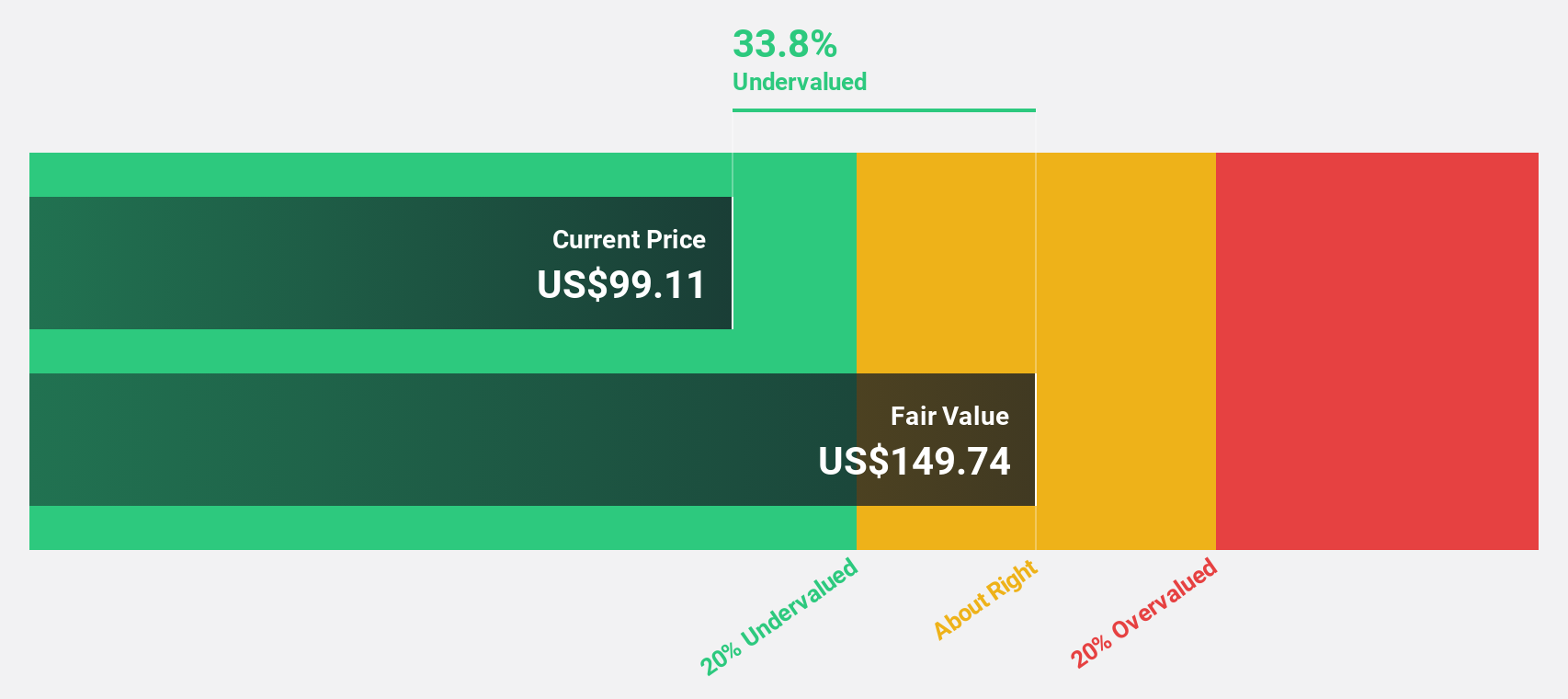

Estimated Discount To Fair Value: 25.9%

Okta is trading at approximately 25.9% below its estimated fair value of US$137.22, suggesting potential undervaluation based on discounted cash flow analysis. The company reported a significant turnaround with a net income of US$28 million for the fiscal year ending January 2025, compared to a net loss previously. Okta's earnings are projected to grow substantially at 36.5% annually, outpacing the broader market, supported by strategic partnerships and product innovations like Auth for GenAI.

- Upon reviewing our latest growth report, Okta's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Okta.

Where To Now?

- Access the full spectrum of 170 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYM

Symbotic

An automation technology company, develops technologies to enhance operating efficiencies in modern warehouses.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives