- United States

- /

- Specialty Stores

- /

- NYSE:WSM

Williams-Sonoma (NYSE:WSM) Reports Q1 Earnings US$1,730 Million Sales, Reiterates 2025 Guidance

Reviewed by Simply Wall St

Williams-Sonoma (NYSE:WSM) recently reported its earnings, showing increased sales of $1,730 million despite a decrease in net income. The stock experienced a notable 21.8% price increase last month, likely supported by positive market developments, such as a broader market rebound and easing bond yields. The company reaffirmed its fiscal year guidance, which could have helped bolster investor confidence. Additionally, Pottery Barn's planned expansion into the UK may have fueled optimism regarding future growth prospects. Overall, the company's news contributed positively to its share performance amid a generally rising market context.

We've identified 1 weakness for Williams-Sonoma that you should be aware of.

The recent earnings report from Williams-Sonoma, showing increased sales despite a drop in net income, aligns with the broader narrative of the company seeking to leverage innovations and strategic collaborations to boost revenues and improve margins. The 21.8% stock price surge last month, amidst easing bond yields and market optimism, suggests renewed investor confidence, potentially bolstered by the company's reaffirmation of fiscal guidance and Pottery Barn's expansion plans in the UK. These developments have likely influenced the revenue and earnings projections, reinforcing expectations of incremental growth.

Over the past five years, Williams-Sonoma's total shareholder return reached a very large 405.43%, combining both stock appreciation and dividends, a testament to its resilient business performance. While its 1-year stock performance surpassed the US Specialty Retail industry return of 15.1%, the company's shares also outpaced the broader US market's return of 9.1%. This indicates a strong position relative to peers and the market, supported by consistent shareholder value creation.

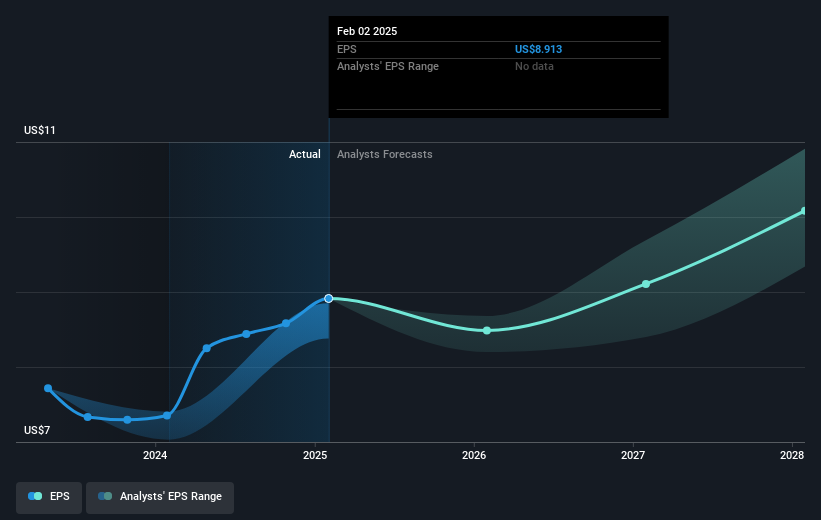

Looking ahead, analysts forecast a modest revenue growth of 2.1% annually over the next three years, with earnings expected to reach US$1.2 billion by May 2028. The current share price of US$154.41 indicates a discount of approximately 11.3% to the consensus analyst price target of US$174.03, reflecting market caution in light of potential risks like rising tariffs and economic uncertainties. Investors are encouraged to consider both current market conditions and future projections when evaluating Williams-Sonoma's potential.

Upon reviewing our latest valuation report, Williams-Sonoma's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives