- United States

- /

- Specialty Stores

- /

- NYSE:W

Wayfair (NYSE:W) Leverages Cost Discipline and Branding Amid Challenges, Trading Below Fair Value

Reviewed by Simply Wall St

Click here and access our complete analysis report to understand the dynamics of Wayfair.

Competitive Advantages That Elevate Wayfair

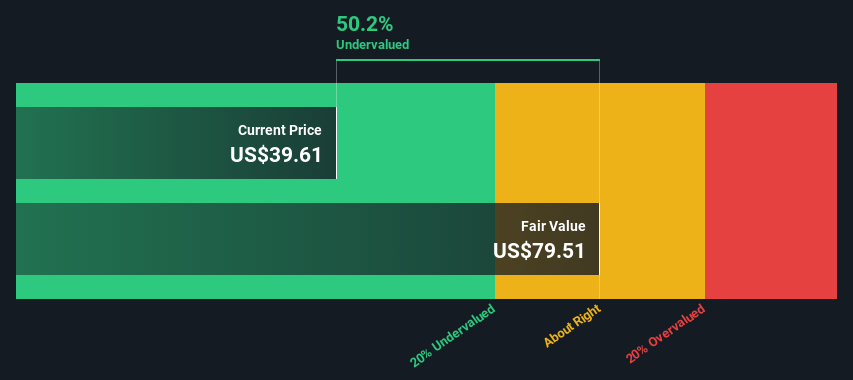

Wayfair has shown remarkable resilience, capturing additional market share in the home furnishings sector, even with ongoing challenges. CEO Niraj Shah emphasized this achievement, noting the company's ability to gain ground despite sustained obstacles. This resilience is further supported by Wayfair's strategic cost discipline, having achieved nine consecutive quarters of fixed cost compression. This efficiency has allowed the company to maintain a mid-single-digit adjusted EBITDA margin consistently. Additionally, Wayfair's advertising and brand initiatives have yielded positive results, with improved recall ratings and a top 10 ranking among major retailers. These efforts underscore the company's strategic focus on brand enhancement and operational efficiency. Furthermore, Wayfair is trading at 53.5% below its estimated fair value, suggesting potential for growth and positioning it as a potentially undervalued entity in the market.

Critical Issues Affecting the Performance of Wayfair and Areas for Growth

Wayfair faces significant challenges, including a 2% year-over-year revenue decline in Q3, as highlighted by CFO Kate Gulliver. This decline is compounded by a shift in consumer spending patterns towards lower investment purchases, reflecting increased price sensitivity. The company's profitability is further strained by rising advertising costs, which have impacted margins. Additionally, Wayfair's liabilities exceed its assets, complicating the calculation of Return on Equity. The company has also experienced shareholder dilution, with outstanding shares growing by 6.2% over the past year. These factors contribute to a complex financial situation that Wayfair must navigate to improve its market position.

Potential Strategies for Leveraging Growth and Competitive Advantage

Wayfair is actively pursuing opportunities to enhance its market position through initiatives like the Wayfair Rewards Program, designed to increase customer frequency and spending. CEO Niraj Shah explained that for $29 per year, customers gain access to exceptional value, aiming to boost order frequency. The company is also expanding its influencer marketing efforts, which have shown promising returns, with content production increasing significantly. Technological advancements, particularly in AI and machine learning, are being leveraged to improve operations and customer interactions. Co-Founder Steve Conine highlighted these initiatives as potentially disruptive and exciting for customers, indicating Wayfair's commitment to innovation and growth.

Regulatory Challenges Facing Wayfair

Wayfair operates in a challenging economic environment, with potential impacts from upcoming elections causing broader shopper pullbacks. The slowdown in the housing market also affects the home furnishings category, as noted in a Redfin analysis. Furthermore, potential changes in tariff policies pose risks to costs and supply chains, with suppliers building manufacturing capabilities in regions like Cambodia and Vietnam to mitigate future uncertainties. These external factors present significant challenges that Wayfair must address to sustain its growth trajectory and market share.

Conclusion

Wayfair's strategic cost discipline and successful branding initiatives have enabled it to maintain a stable EBITDA margin and enhance its market presence, despite a challenging economic environment. However, the company faces hurdles such as declining revenue and increased price sensitivity among consumers, which could impact its profitability if not addressed. Wayfair's initiatives, including the Rewards Program and influencer marketing, along with technological advancements, are promising strategies to drive growth and innovation. Notably, the company's current trading position at 53.5% below its estimated fair value suggests an opportunity for investors, as Wayfair's resilience and strategic initiatives may lead to improved market performance and shareholder value in the future.

Taking Advantage

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Wayfair, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Good value low.

Similar Companies

Market Insights

Community Narratives