- United States

- /

- Oil and Gas

- /

- NYSE:COP

US Dividend Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed results, with the Dow Jones Industrial Average snapping a historic losing streak and major indices fluctuating amid cautious Federal Reserve policies, investors are keenly watching for stability and growth opportunities. In this environment, dividend stocks can offer potential income streams and a measure of resilience, making them an appealing focus for those looking to navigate uncertain market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.45% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.61% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.86% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.96% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.62% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.76% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

Click here to see the full list of 164 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

ConocoPhillips (NYSE:COP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ConocoPhillips is engaged in the exploration, production, transportation, and marketing of crude oil, bitumen, natural gas, LNG, and natural gas liquids across several countries including the United States and Canada with a market cap of approximately $123.99 billion.

Operations: ConocoPhillips generates revenue from several geographic segments, including Alaska ($6.79 billion), Canada ($5.66 billion), Lower 48 ($37.36 billion), Asia Pacific ($3.12 billion), and Europe, Middle East and North Africa ($6.24 billion).

Dividend Yield: 3.9%

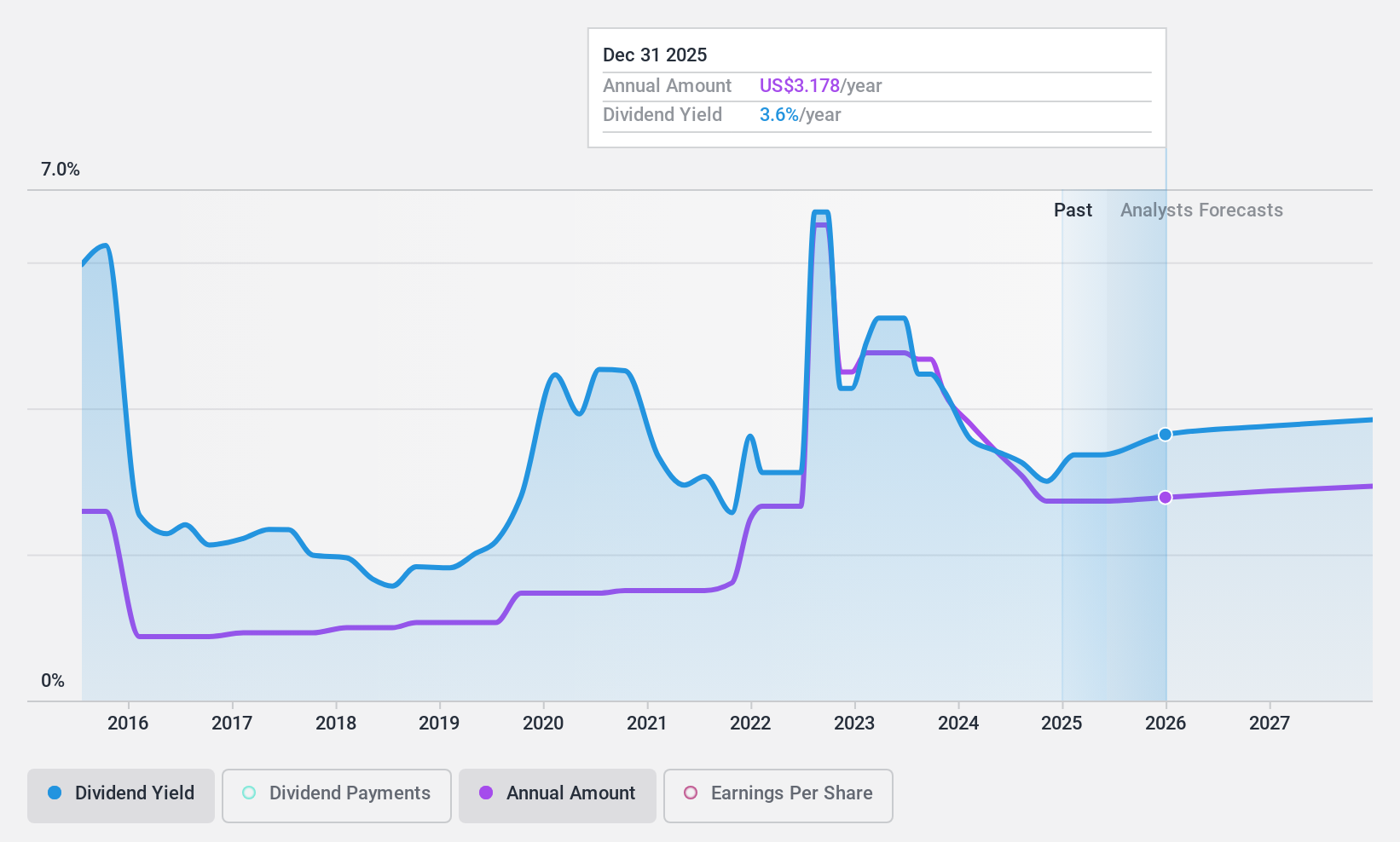

ConocoPhillips, while offering a dividend yield of 3.91%, has shown volatility in its dividend payments over the past decade, with instances of significant annual drops. However, its dividends are well-covered by earnings and cash flows, boasting payout ratios of 41.7% and 52%, respectively. Recent strategic moves include a substantial share buyback program and debt financing tied to Marathon Oil's acquisition, reflecting efforts to optimize capital structure amidst fluctuating revenue performance.

- Navigate through the intricacies of ConocoPhillips with our comprehensive dividend report here.

- The valuation report we've compiled suggests that ConocoPhillips' current price could be quite moderate.

Dillard's (NYSE:DDS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dillard's, Inc. operates retail department stores across the southeastern, southwestern, and midwestern United States with a market cap of approximately $6.91 billion.

Operations: Dillard's, Inc. generates revenue primarily through its Retail Operations segment, which accounts for $6.44 billion, supplemented by its Construction segment at $295.67 million.

Dividend Yield: 4.9%

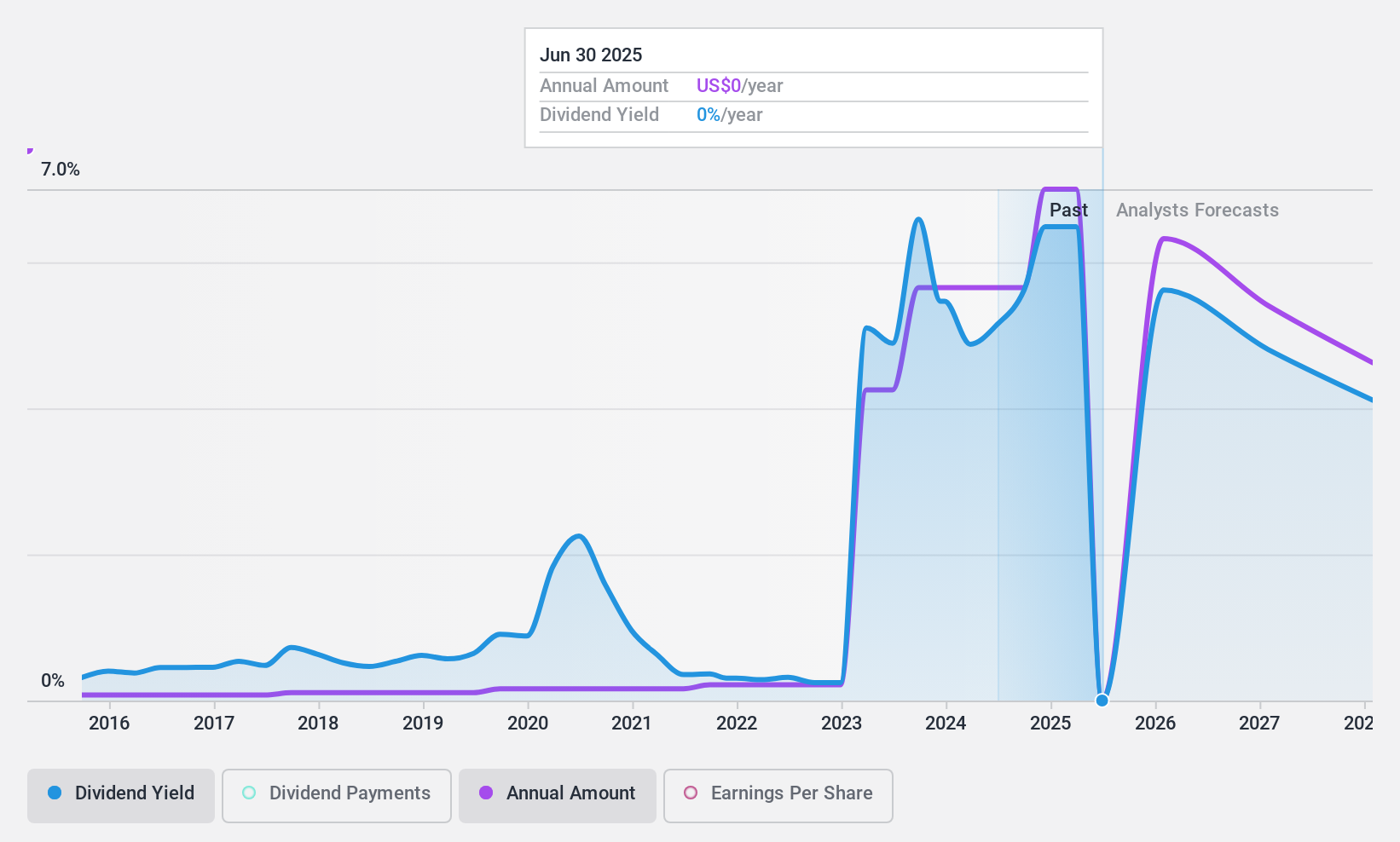

Dillard's offers a robust dividend profile, recently affirming a quarterly dividend of US$0.25 and announcing a substantial special dividend of US$25 per share. Its dividends are well-supported by earnings, with an exceptionally low payout ratio of 2.6%, and cash flows, maintaining a cash payout ratio of 50%. Despite recent declines in revenue and net income, Dillard's maintains stable and growing dividends over the past decade while actively engaging in share buybacks.

- Take a closer look at Dillard's potential here in our dividend report.

- The analysis detailed in our Dillard's valuation report hints at an deflated share price compared to its estimated value.

Genuine Parts (NYSE:GPC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Genuine Parts Company distributes automotive replacement parts and industrial parts and materials, with a market cap of $16.07 billion.

Operations: Genuine Parts Company's revenue is derived from automotive replacement parts, contributing $14.56 billion, and industrial parts and materials, including electrical/electronic materials, generating $8.74 billion.

Dividend Yield: 3.5%

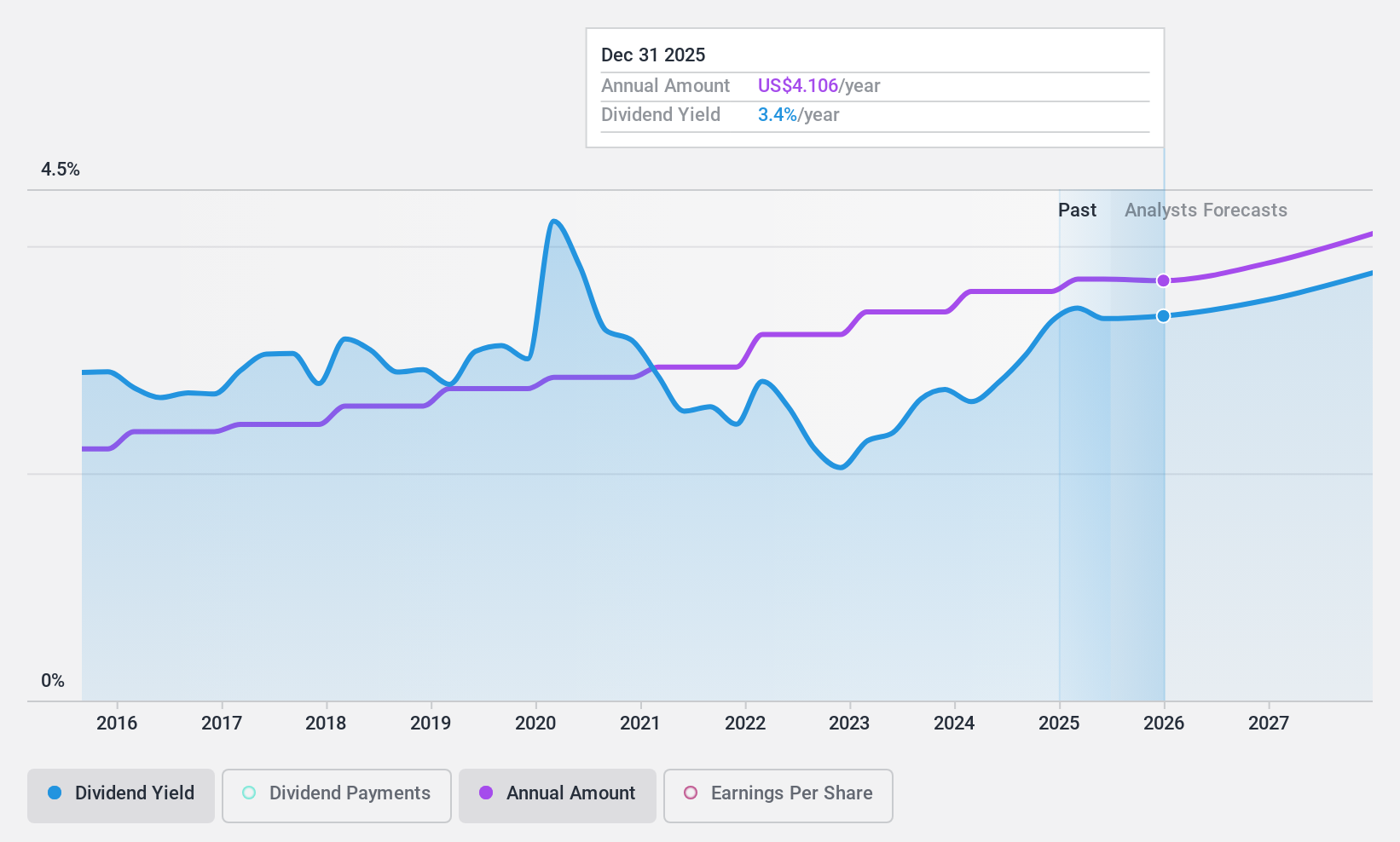

Genuine Parts Company maintains a stable dividend history, recently affirming a US$1.00 quarterly cash dividend. Despite lowered earnings guidance and decreasing net income, its dividends remain reliable and covered by earnings with a payout ratio of 50.6% and by cash flows with a 61.7% cash payout ratio. The company trades below estimated fair value but carries high debt levels, which may impact financial flexibility amid ongoing M&A rumors involving Questas Group Pty Ltd's potential acquisition discussions.

- Delve into the full analysis dividend report here for a deeper understanding of Genuine Parts.

- Insights from our recent valuation report point to the potential undervaluation of Genuine Parts shares in the market.

Key Takeaways

- Dive into all 164 of the Top US Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ConocoPhillips, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives