- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (NYSE:CVNA) Reports Quarterly Net Income Jumping To US$216 Million

Reviewed by Simply Wall St

Carvana (NYSE:CVNA) recently reported an earnings announcement showcasing significant growth, with sales rising to USD 389 million and net income jumping to USD 216 million for the quarter. These impressive financial results, alongside corporate governance changes and the launch of new product offerings like the ADESA Simulcast platform, may have added weight to its stock price move of 49% over the past month. This gain is more significant than the recent upward trends in broader markets, including the Dow Jones and Nasdaq, which have each seen more modest increases.

Carvana has 4 possible red flags (and 1 which shouldn't be ignored) we think you should know about.

The recent earnings announcement for Carvana (NYSE:CVNA), highlighting significant sales and net income increases, appears to reinforce the company's ongoing strategy of expanding its operational capacity and enhancing customer experience. The integration of ADESA mega sites and the adoption of AI seem aligned with these goals, potentially offering further efficiency improvements and revenue growth. Over a longer-term context, Carvana's total return, accounting for share price changes and dividends, was very large at 771.67% over the past three years, showing substantial appreciation compared to the recent year-over-year performance, where Carvana outpaced both the Dow Jones and Nasdaq indexes.

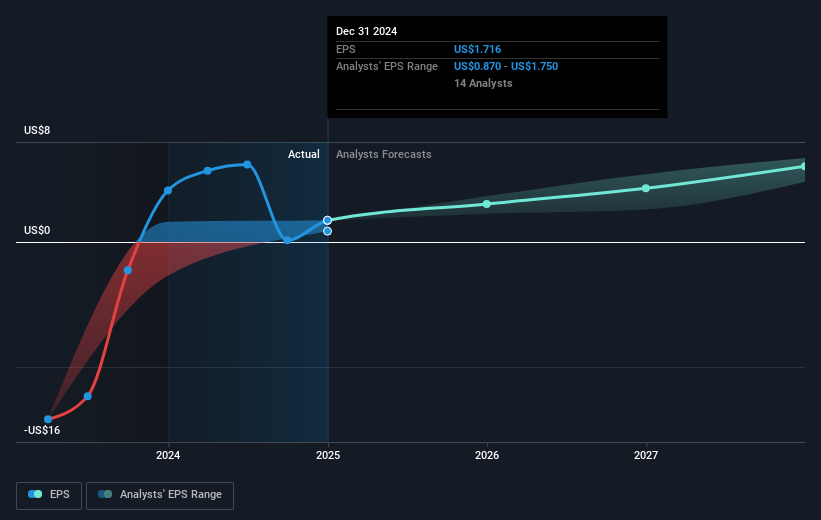

In light of this news, analyst revenue and earnings forecasts might adjust to take into account expectations of improved operational efficiencies and cost reductions. Analysts predict revenue growth at 19.8% annually and rising profit margins, though challenges such as high debt levels and competitive market conditions remain. As of 7 May 2025, Carvana's share price, standing at US$258.81, closely aligns with the consensus price target of US$259.81, indicating that the market views the stock as fairly priced in light of these forecasts. This alignment also suggests moderate expectations for near-term price changes, although there are varied opinions among analysts regarding future performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives