Coupang (NYSE:CPNG) Can Easily Afford To Drive Business Growth

In the last few decades, the growth of online retailing has been nothing but astonishing. While global players like Amazon grew to multi-trillion dollar behemoths, regional players rose to capture niche markets.

After a launch in 2010,Coupang(NYSE:CPNG)became the largest online retailer in South Korea, focusing on the speed of delivery. The company claims 99% of its orders are delivered within 24 hours.

Yet, after the IPO debut in March, the stock has been falling steadily, followed by the lackluster earnings reports.

Since the company remains unprofitable, shareholders should pay close attention to its cash burn. For this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow)

Q2 Earnings Results

- GAAP EPS: -US$0.30 (miss by US$0.16)

- Revenue: US$4.48b (beat by US$50m)

- Gross profit: US$658m (+50% y/y)

The overall outlook remains mixed, with the Deutsche Bank joining the bull club and upgrading the stock to Buy after having it as a Hold – quoting revenue growth even through the capacity constraints of the pandemic.

Check out our latest analysis for Coupang

Will Coupang Run Out Of Money?

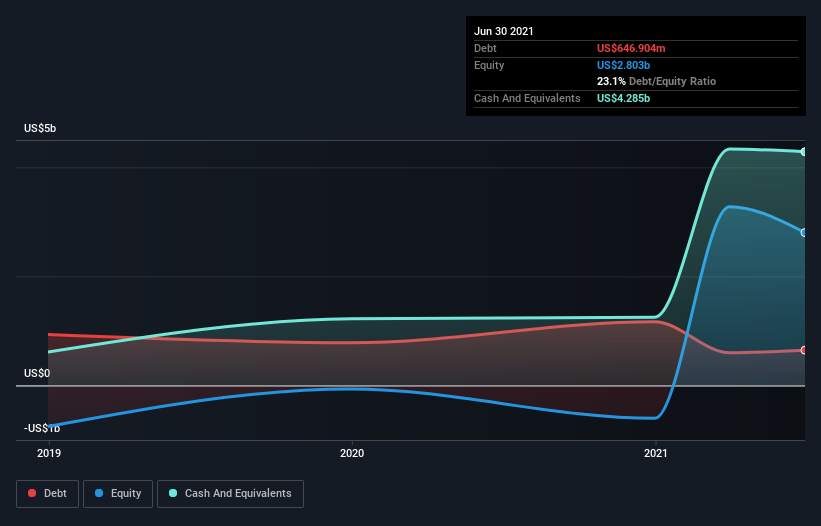

As of June 2021, Coupang had cash of US$4.3b and such minimal debt that we can ignore it for this analysis. Looking at the last year, the company burnt through US$625m.

Therefore, from June 2021, it had 6.9 years of cash runway. Notably, however, analysts think that Coupang will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Coupang Growing?

Coupang boosted investment sharply in the last year, with cash burn ramping by 75%. It seems likely that the vociferous operating revenue growth of 145% during that time may well have given management confidence to ramp investment. On balance, we'd say the company is improving over time.

Clearly, however, the crucial factor is whether the company will grow its business in the future. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Coupang Raise Cash Easily?

There's no doubt Coupang seems to be in a fairly good position when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalization to see how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalization of US$54b, Coupang's US$625m in cash burn equates to about 1.2% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is Coupang's Cash Burn A Worry?

Overall, we are relatively comfortable with the way Coupang is burning through its cash. For example, we think its revenue growth suggests that the company is on a good path. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. It's clearly positive to see that analysts are forecasting the company will break even fairly soon.

Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well-capitalized to spend as needs be. An in-depth examination of risks revealed 2 warning signs for Coupang that readers should consider before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:CPNG

Coupang

Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives