Alibaba Group Holding (NYSE:BABA) Impressive Q3 Sales and Net Income Growth

Reviewed by Simply Wall St

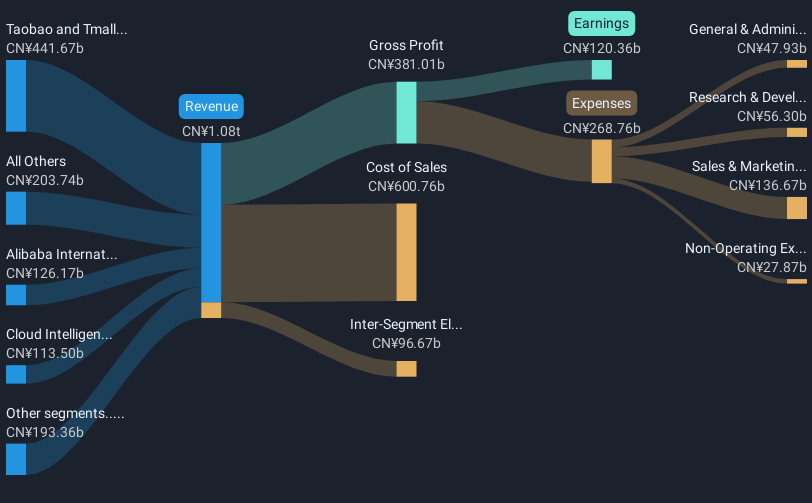

Alibaba Group Holding (NYSE:BABA) recently updated its buyback program, repurchasing 51 million shares between January 1 and March 31, 2025, accounting for 2.2% of its outstanding shares, which may have added to its stock's momentum this quarter. Complementing this, the firm's strong Q3 results showed significant growth year-over-year in sales and net income. While the broader market experienced a surge with major tech stocks also witnessing gains, Alibaba's 38% rise can partly be associated with its impressive financial performance and aggressive share buyback strategy, which aligns with the positive sentiment driving the tech sector.

Alibaba Group Holding’s recent buyback of 51 million shares not only enhances shareholder returns but also aligns with the positive quarterly momentum fueled by the company's robust financial outcomes. The share repurchase, accounting for 2.2% of outstanding shares, complements the impressive Q3 performance, positioning the company favorably within the tech sector's broader upward trend. This could potentially reinforce Alibaba's revenue and earnings forecasts, augmenting the existing narrative of growth driven by investments in AI, cloud, and partnerships.

Over the past year, Alibaba's total shareholder return reached 62.84%, significantly outperforming the US market's 5.9% return and the Multiline Retail industry's 7.6% return during the same period. The company's sustained efforts in operational efficiency and strategic repurchasing may enhance profitability and investor appeal further.

The current US$84.79 share price presents a notable discount to the consensus analyst price target of US$164.60, suggesting potential for upside if growth trajectories continue as forecasted. However, while analysts anticipate future revenue and earnings enhancement, executing on these growth strategies amidst competitive pressures will be critical for maintaining the projected path. Alibaba's price movement relative to its target emphasizes the expectations for continued financial advancement and market positioning improvements.

Review our historical performance report to gain insights into Alibaba Group Holding's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives