- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PDD

How a Surge in Analyst Upgrades and Options Activity Will Impact PDD Holdings (PDD) Investors

Reviewed by Simply Wall St

- Recently, PDD Holdings has seen multiple analysts raise their full-year and next fiscal year earnings forecasts, with the company earning high momentum and analyst rankings.

- Unusual options activity and upward earnings estimate revisions point to a higher level of investor confidence in the company's future prospects.

- We'll explore how the wave of analyst upgrades and renewed market optimism shapes PDD Holdings' investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

PDD Holdings Investment Narrative Recap

To be a shareholder in PDD Holdings means believing in the company’s ability to pursue large-scale investment in its e-commerce ecosystem while still driving sustainable earnings and international expansion. The recent wave of analyst upgrades and options activity reflects stronger short-term optimism, but does not fundamentally shift the biggest near-term catalyst: whether PDD’s ongoing investments will deliver improved customer and merchant engagement before competitive intensity erodes margins further. The largest risk remains that heavy spending could pressure profits if financial returns from these investments are delayed or disappoint, this news does not materially change that risk profile.

Among recent developments, PDD’s August 2025 earnings announcement stands out as most relevant. Although sales climbed compared to last year, net income and diluted EPS both declined, showing the immediate profit impact of expansive ecosystem investments. This result puts the spotlight on whether analyst optimism is warranted, given the company’s willingness to accept margin pressure in pursuit of future growth. As investors weigh this, attention naturally turns to how quickly these investments can translate to lasting benefits for shareholders.

Yet, alongside the positive market momentum, investors should not overlook the risks tied to PDD’s ongoing commitment to large-scale support programs and what could happen if...

Read the full narrative on PDD Holdings (it's free!)

PDD Holdings is projected to achieve CN¥555.7 billion in revenue and CN¥147.1 billion in earnings by 2028. This outlook assumes a 10.7% annual revenue growth rate and reflects a CN¥49.2 billion earnings increase from the current CN¥97.9 billion.

Uncover how PDD Holdings' forecasts yield a $143.36 fair value, a 14% upside to its current price.

Exploring Other Perspectives

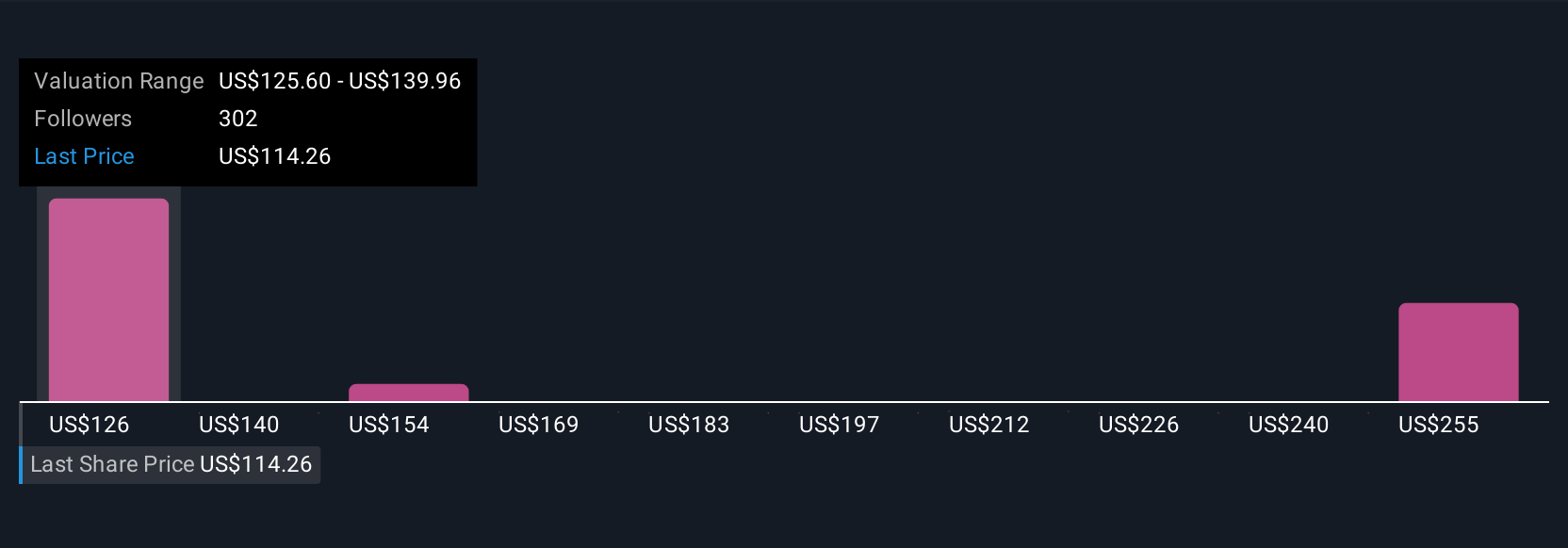

With 21 individual fair value estimates from the Simply Wall St Community ranging from US$143.36 to US$354.52, investor views span a wide spectrum. As so many weigh PDD’s heavy long-term investments against short-term profit pressures, consider how sharply opinions can differ and explore several alternative viewpoints.

Explore 21 other fair value estimates on PDD Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own PDD Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PDD Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free PDD Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PDD Holdings' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDD

PDD Holdings

A multinational commerce group that owns and operates a portfolio of businesses.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026