- United States

- /

- Banks

- /

- NasdaqCM:ACNB

3 Dividend Stocks To Consider In The US With Yields Up To 5.3%

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a sluggish start to 2025, with major indices snapping losing streaks, investors are keenly observing opportunities that offer stability and income potential amidst fluctuating conditions. In this environment, dividend stocks stand out as appealing options for those seeking consistent returns; they provide regular income through dividends while potentially benefiting from capital appreciation as markets stabilize.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.62% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.31% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Polaris (NYSE:PII) | 4.56% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.69% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.83% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

Click here to see the full list of 155 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

ACNB (NasdaqCM:ACNB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ACNB Corporation is a financial holding company providing banking, insurance, and financial services to individual, business, and government customers in the United States with a market cap of $336.47 million.

Operations: ACNB Corporation's revenue is primarily derived from its banking segment, contributing $94.11 million, followed by its insurance segment at $9.78 million.

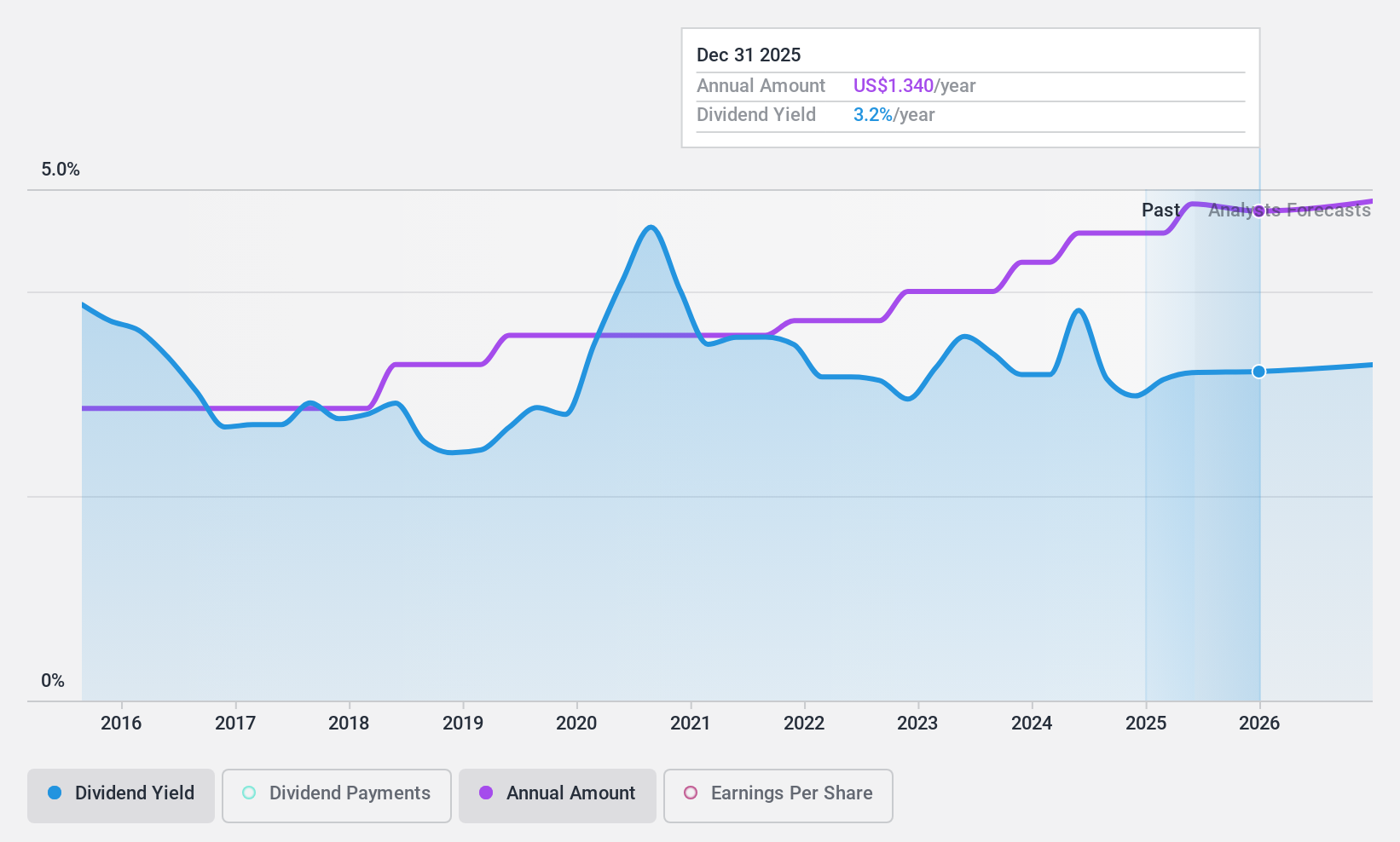

Dividend Yield: 3.3%

ACNB Corporation has maintained reliable and stable dividend payments over the past decade, with a recent 6.7% increase to US$0.32 per share for Q4 2024, resulting in US$2.7 million in aggregate dividends. Although its dividend yield of 3.25% is below the top quartile of U.S. payers, its low payout ratio of 35.9% indicates sustainability and coverage by earnings, with future forecasts suggesting continued coverage at a lower payout ratio of 30%.

- Get an in-depth perspective on ACNB's performance by reading our dividend report here.

- Our expertly prepared valuation report ACNB implies its share price may be lower than expected.

First Bancorp (NasdaqGS:FNLC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The First Bancorp, Inc., with a market cap of $302.33 million, operates as the holding company for First National Bank, offering a variety of banking products and services to individuals and businesses.

Operations: The First Bancorp, Inc. generates its revenue primarily through its banking operations, amounting to $78.19 million.

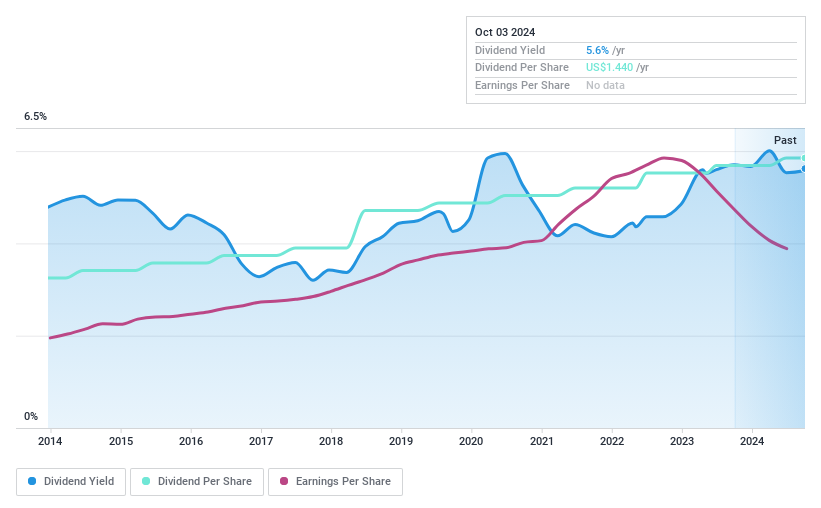

Dividend Yield: 5.3%

First Bancorp's dividends have been reliable and stable over the past decade, with a current yield of 5.31%, placing it among the top 25% of U.S. dividend payers. The company declared a quarterly cash dividend of US$0.36 per share, payable on January 16, 2025. Despite insufficient data to predict long-term sustainability, its reasonable payout ratio of 59.3% suggests current earnings coverage, though recent earnings showed slight declines in net income and EPS compared to the previous year.

- Unlock comprehensive insights into our analysis of First Bancorp stock in this dividend report.

- Our valuation report unveils the possibility First Bancorp's shares may be trading at a discount.

Weyerhaeuser (NYSE:WY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Weyerhaeuser Company, with a market cap of approximately $20.61 billion, is one of the world's largest private owners of timberlands and has been in operation since 1900.

Operations: Weyerhaeuser's revenue is primarily derived from its Timberlands segment at $2.10 billion, Wood Products at $5.26 billion, and Real Estate, Energy and Natural Resources contributing $382 million.

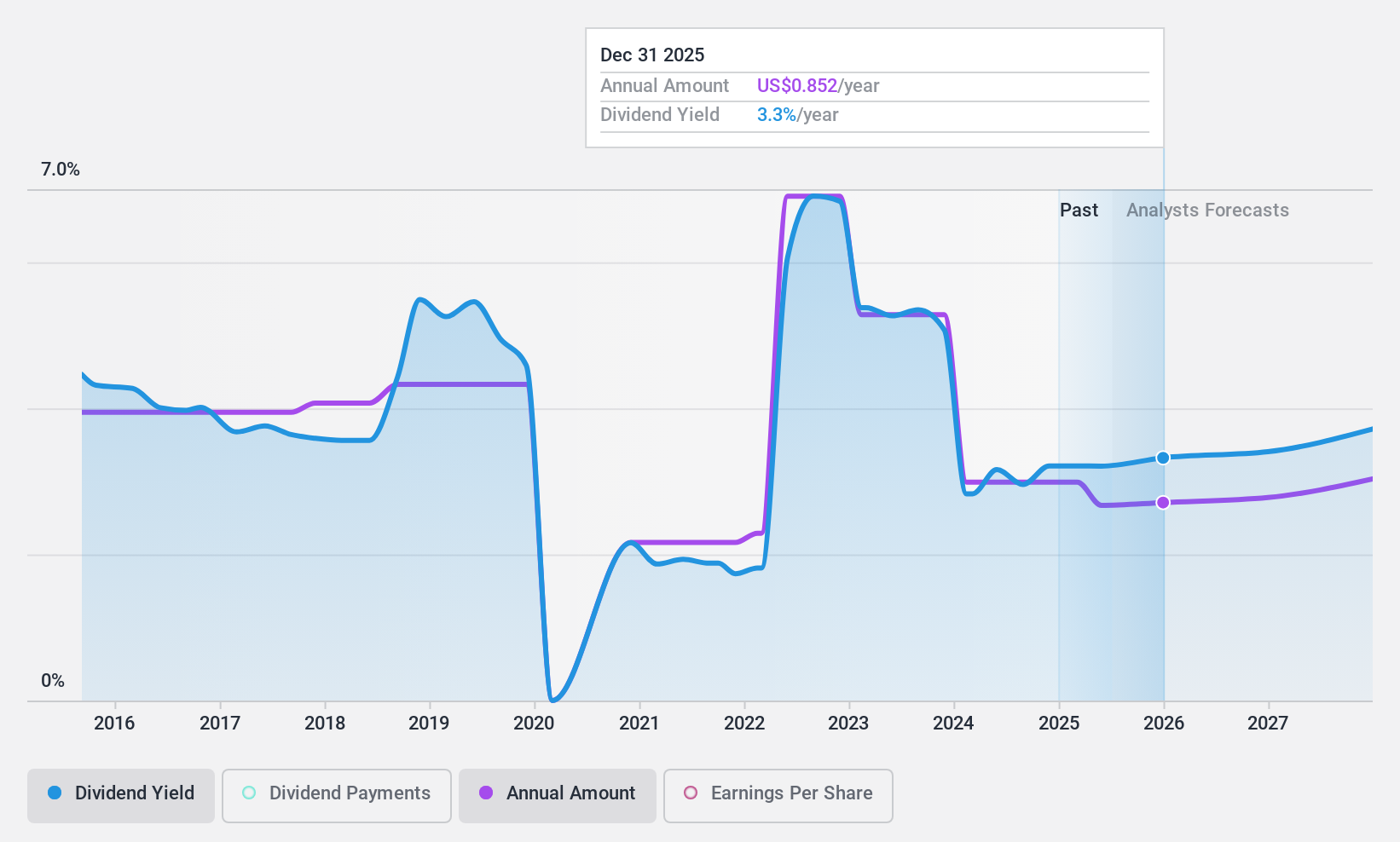

Dividend Yield: 3.3%

Weyerhaeuser's dividend yield of 3.31% is below the top quartile of U.S. dividend payers, and its dividends have been volatile over the past decade. Despite this, the company maintains a reasonable payout ratio of 53.5%, indicating earnings coverage for dividends, though cash flow coverage is tighter at 94.1%. Recent plans to invest US$500 million in expanding TimberStrand capacity in Arkansas may impact future cash flows but align with strategic growth and sustainability goals.

- Click to explore a detailed breakdown of our findings in Weyerhaeuser's dividend report.

- Our valuation report here indicates Weyerhaeuser may be undervalued.

Seize The Opportunity

- Reveal the 155 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ACNB

ACNB

A financial holding company, offers banking, insurance, and financial services to individual, business, and government customers in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives