- United States

- /

- Leisure

- /

- NYSE:RGR

Exploring 3 Undervalued Small Caps With Notable Insider Activity

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced a notable 14% increase over the past year with earnings forecasted to grow by 15% annually. In this context, identifying stocks that are potentially undervalued and exhibit significant insider activity can present intriguing opportunities for investors seeking to capitalize on these market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Meridian | 9.9x | 1.6x | 45.18% | ★★★★★☆ |

| Columbus McKinnon | NA | 0.5x | 40.70% | ★★★★★☆ |

| Lindblad Expeditions Holdings | NA | 1.0x | 28.31% | ★★★★★☆ |

| Montrose Environmental Group | NA | 1.0x | 36.04% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 35.42% | ★★★★★☆ |

| Citizens & Northern | 11.5x | 2.8x | 46.01% | ★★★★☆☆ |

| Southside Bancshares | 10.6x | 3.7x | 38.09% | ★★★★☆☆ |

| S&T Bancorp | 11.3x | 3.9x | 40.18% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 34.49% | ★★★★☆☆ |

| Farmland Partners | 9.1x | 9.2x | -10.64% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

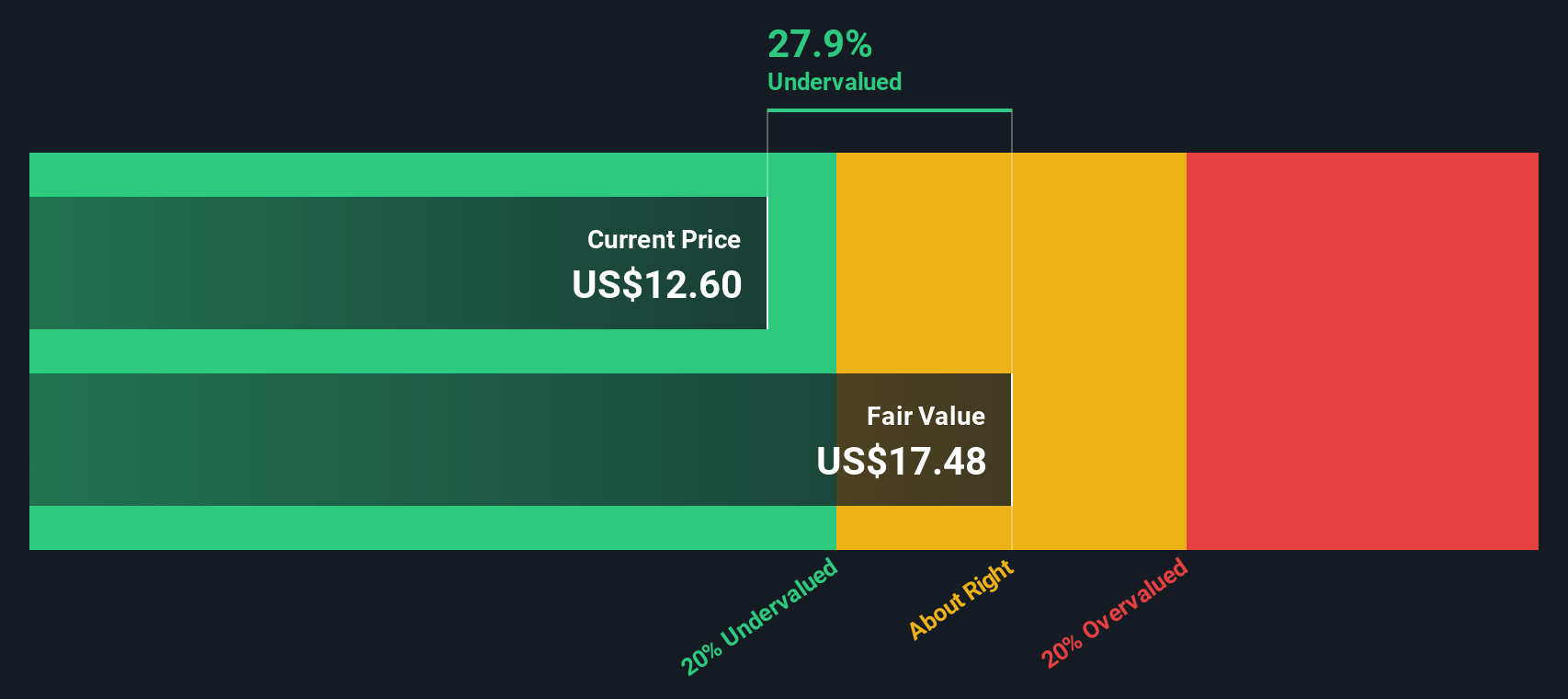

ACNB (ACNB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: ACNB is a financial services company primarily engaged in banking and insurance operations, with a market capitalization of approximately $0.32 billion.

Operations: The company's primary revenue stream comes from its banking segment, generating $104.94 million, with insurance contributing $9.79 million. Operating expenses are significant, with general and administrative expenses consistently forming a large portion of these costs. Notably, the net income margin has shown variability over time, reaching as high as 34.31% in recent periods but also dipping to lower levels like 21.87%.

PE: 18.4x

ACNB, a smaller U.S. company, has shown insider confidence with recent share repurchases totaling 143,780 shares for US$5.33 million by March 31, 2025. Despite being dropped from the Russell 2000 Dynamic Index in June 2025 and reporting a net loss of US$0.272 million for Q1 2025 compared to a net income of US$6.77 million the previous year, earnings are projected to grow at an annual rate of 37.54%.

- Get an in-depth perspective on ACNB's performance by reading our valuation report here.

Assess ACNB's past performance with our detailed historical performance reports.

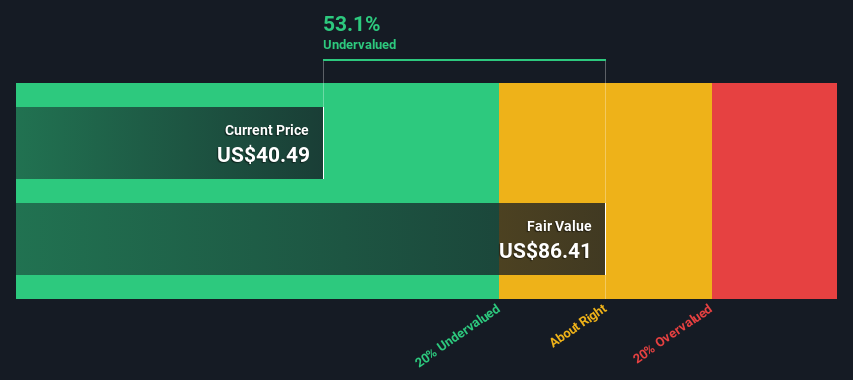

Sturm Ruger (RGR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sturm Ruger operates as a manufacturer of firearms and castings, with a market capitalization of approximately $1.02 billion.

Operations: The primary revenue stream comes from firearms, generating $531.80 million, while castings contribute $32.97 million. The gross profit margin saw fluctuations, peaking at 38.38% in October 2021 and declining to 21.37% by December 2024. Operating expenses are a significant cost factor, with sales and marketing consistently around the mid-$30 million range over recent periods.

PE: 18.9x

Sturm Ruger, a firearms manufacturer, has seen insider confidence with recent share purchases reflecting potential optimism about its future. The company reported first-quarter revenue of US$135.74 million and net income of US$7.77 million, showing slight improvement from the previous year. A flexible dividend policy ties payouts to earnings, recently declaring an 18-cent dividend per share. Recent changes in bylaws expanded board capacity and introduced new leadership, potentially steering strategic growth amidst a competitive industry landscape.

- Delve into the full analysis valuation report here for a deeper understanding of Sturm Ruger.

Understand Sturm Ruger's track record by examining our Past report.

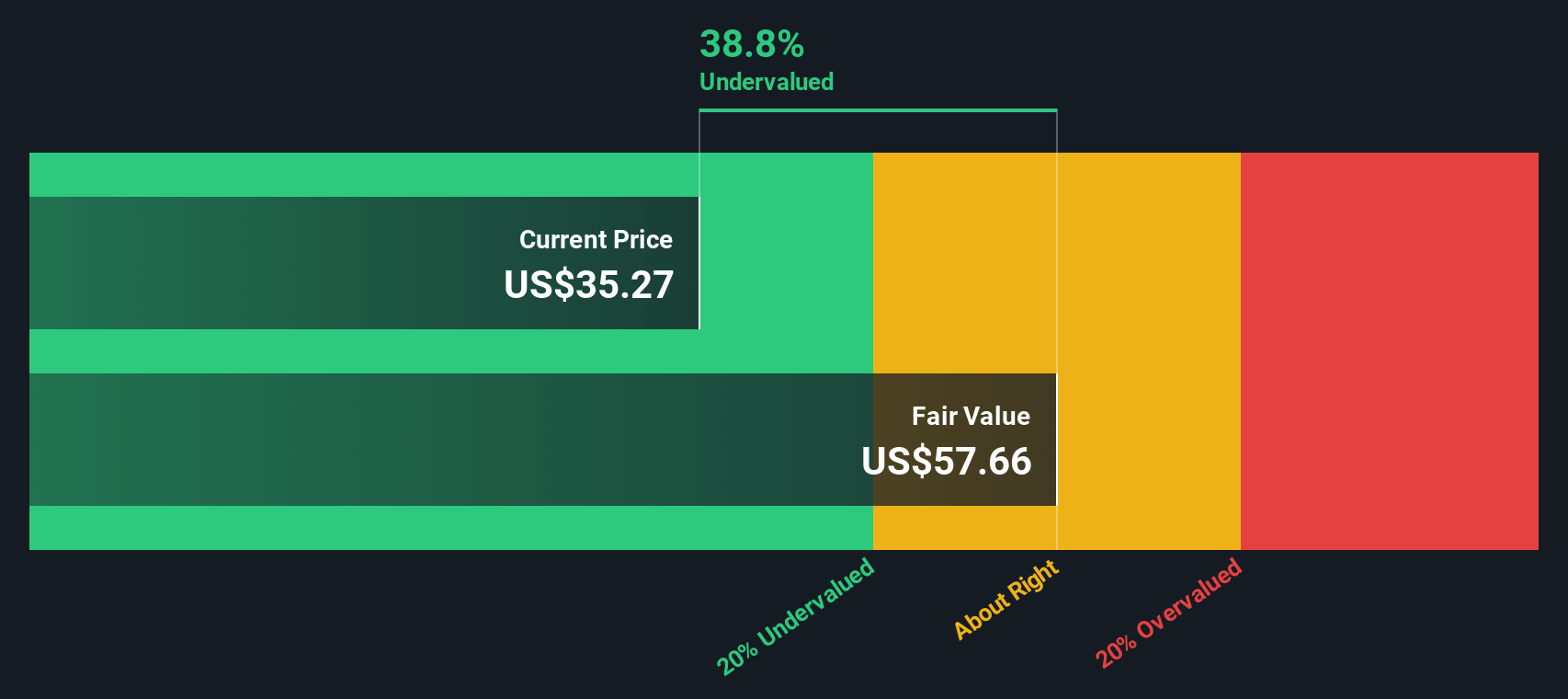

Whitestone REIT (WSR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Whitestone REIT is a real estate investment trust focused on owning and operating community-centered retail properties, with a market cap of approximately $0.50 billion.

Operations: The company generates revenue primarily from its commercial real estate operations, with the latest reported figure at $155.13 million. Key costs include COGS at $46.66 million and operating expenses totaling $57.87 million, impacting net income outcomes. Notably, the gross profit margin has shown variation over time, recently recorded at 69.92%.

PE: 20.4x

Whitestone REIT, a smaller player in the real estate sector, recently expanded its Texas footprint by acquiring two strategically located shopping centers. Despite being dropped from the Russell 2000 Dynamic Index in June 2025, insider confidence is evident with recent share purchases. The company's earnings guidance for 2025 suggests net income between US$17.1 million and US$19.2 million, though earnings are forecasted to decline over the next three years. With external borrowing as its sole funding source, financial risks persist amidst growth efforts.

Summing It All Up

- Navigate through the entire inventory of 76 Undervalued US Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RGR

Sturm Ruger

Designs, manufactures, and sells firearms under the Ruger name and trademark in the United States.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)