- United States

- /

- Life Sciences

- /

- NasdaqGS:AZTA

Insider Buying Highlights 3 Undervalued Small Caps Across Regions

Reviewed by Simply Wall St

As the Nasdaq and S&P 500 reach record highs, driven by optimism surrounding potential Federal Reserve interest rate cuts, small-cap stocks in the United States are garnering increased attention. In this dynamic market environment, identifying promising opportunities often involves examining key indicators such as insider buying activity and valuation metrics to uncover potentially undervalued small-cap companies poised for growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Angel Oak Mortgage REIT | 6.3x | 4.1x | 31.93% | ★★★★★★ |

| PCB Bancorp | 10.0x | 3.0x | 32.47% | ★★★★★☆ |

| Peoples Bancorp | 10.2x | 1.9x | 42.97% | ★★★★★☆ |

| Citizens & Northern | 11.7x | 2.9x | 39.61% | ★★★★☆☆ |

| Limbach Holdings | 34.1x | 2.2x | 34.57% | ★★★★☆☆ |

| First Northern Community Bancorp | 9.4x | 2.7x | 49.78% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 32.13% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 16.04% | ★★★★☆☆ |

| Shore Bancshares | 10.6x | 2.7x | -91.69% | ★★★☆☆☆ |

| Tilray Brands | NA | 1.6x | -0.13% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Azenta (AZTA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Azenta is a company specializing in multiomics and sample management solutions, with a market cap of approximately $4.67 billion.

Operations: Azenta generates revenue primarily from its Multiomics and Sample Management Solutions segments, with the latter contributing a larger share. Over recent periods, the company has experienced fluctuations in its gross profit margin, reaching 41.02% by September 2023. Operating expenses are significant and include general and administrative costs as well as research and development expenditures.

PE: -8.2x

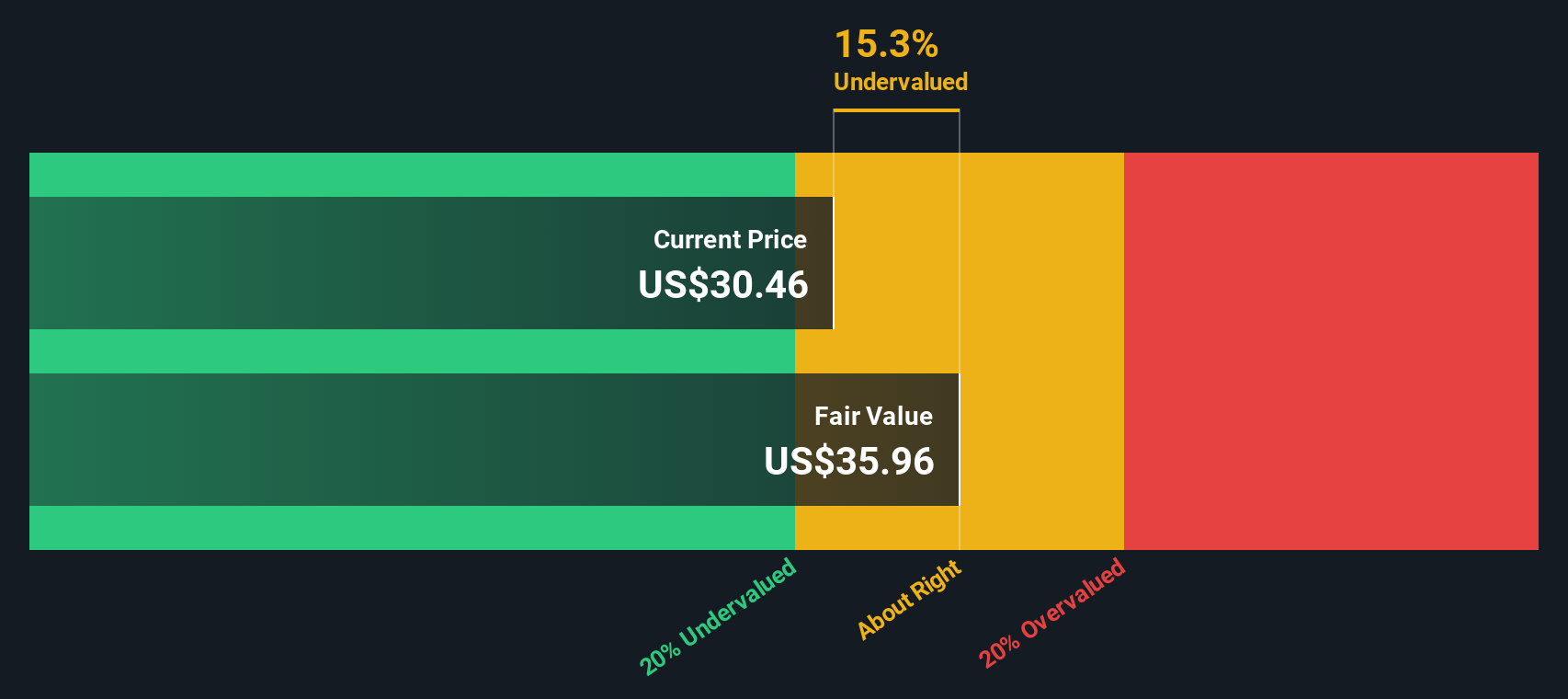

Azenta, a player in the genomic sequencing and biorepository sector, recently joined the Russell 2000 Index, highlighting its smaller market cap status. Despite a net loss of US$52.81 million in Q3 2025, revenue grew to US$434.87 million over nine months. The company's strategic alliance with Frenova and Nephronomics aims to advance precision medicine through AI-driven insights into cardio-kidney-metabolic diseases. Insider confidence is evident from recent share purchases by executives earlier this year.

- Take a closer look at Azenta's potential here in our valuation report.

Assess Azenta's past performance with our detailed historical performance reports.

Horizon Bancorp (HBNC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Horizon Bancorp operates as a commercial banking institution providing a range of financial services, with a focus on commercial banking, and has a market capitalization of approximately $0.56 billion.

Operations: Horizon Bancorp generates revenue primarily from commercial banking activities, with a recent figure of $211.58 million. The company consistently achieves a gross profit margin of 100%, indicating that all revenues contribute directly to gross profit. Operating expenses are significant, reaching $154.41 million in the latest period, impacting net income margins which have shown variability over time, with a recent margin at 24.52%.

PE: 15.8x

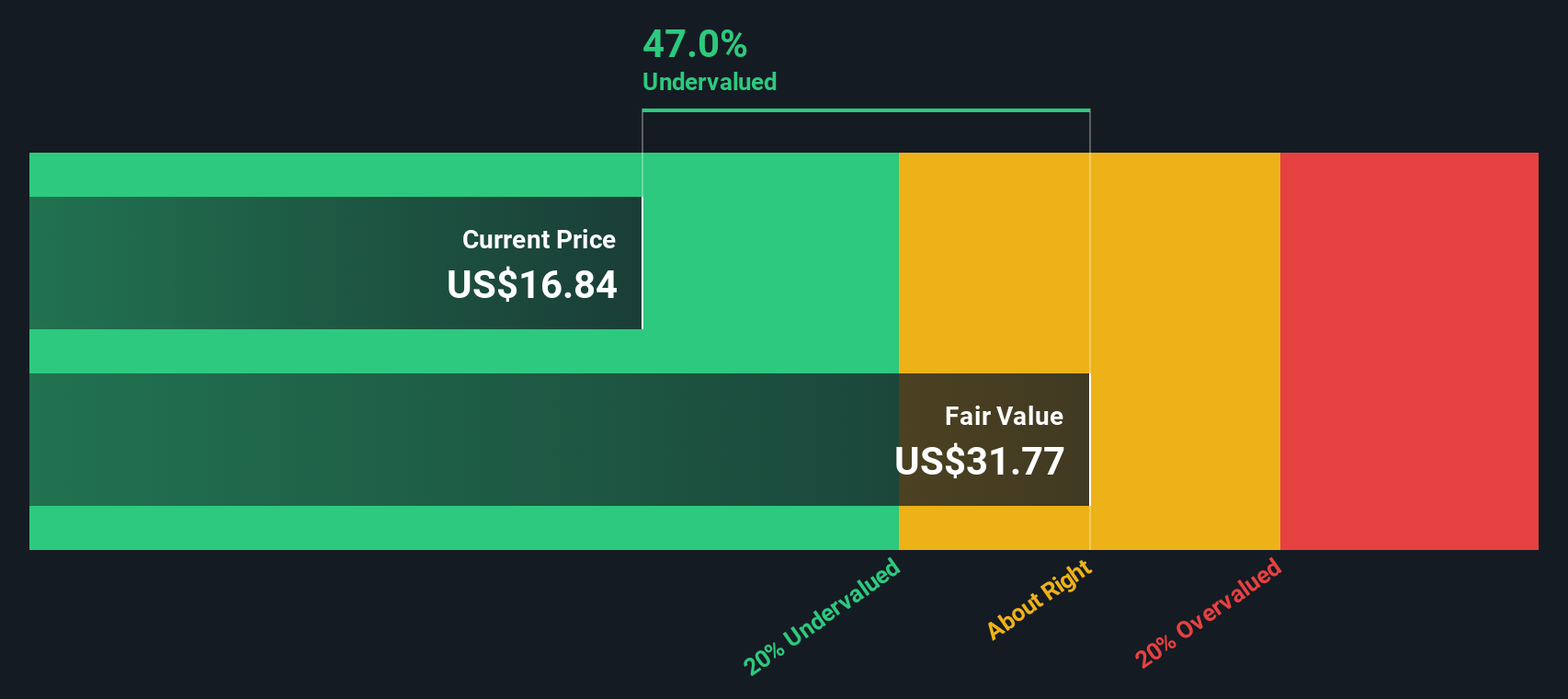

Horizon Bancorp, a smaller company in the financial sector, recently completed a $100 million debt financing to strengthen its balance sheet and refinance existing notes. Despite past shareholder dilution, insider confidence is evident with recent share purchases. Earnings for Q2 2025 showed net interest income of US$55.35 million and net income of US$20.64 million, both up from last year. The company's strategic moves suggest potential for future growth as it navigates market challenges.

Pebblebrook Hotel Trust (PEB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pebblebrook Hotel Trust is a real estate investment trust focusing on the acquisition and management of upscale, full-service hotels and resorts, with a market capitalization of approximately $2.36 billion.

Operations: Pebblebrook Hotel Trust's revenue primarily comes from its operations in the hotels and motels sector, with recent figures showing $1.47 billion in revenue. The company has experienced fluctuations in gross profit margin, most recently at 24.19%. Operating expenses and non-operating expenses significantly impact its net income, which has been negative for several periods.

PE: -21.4x

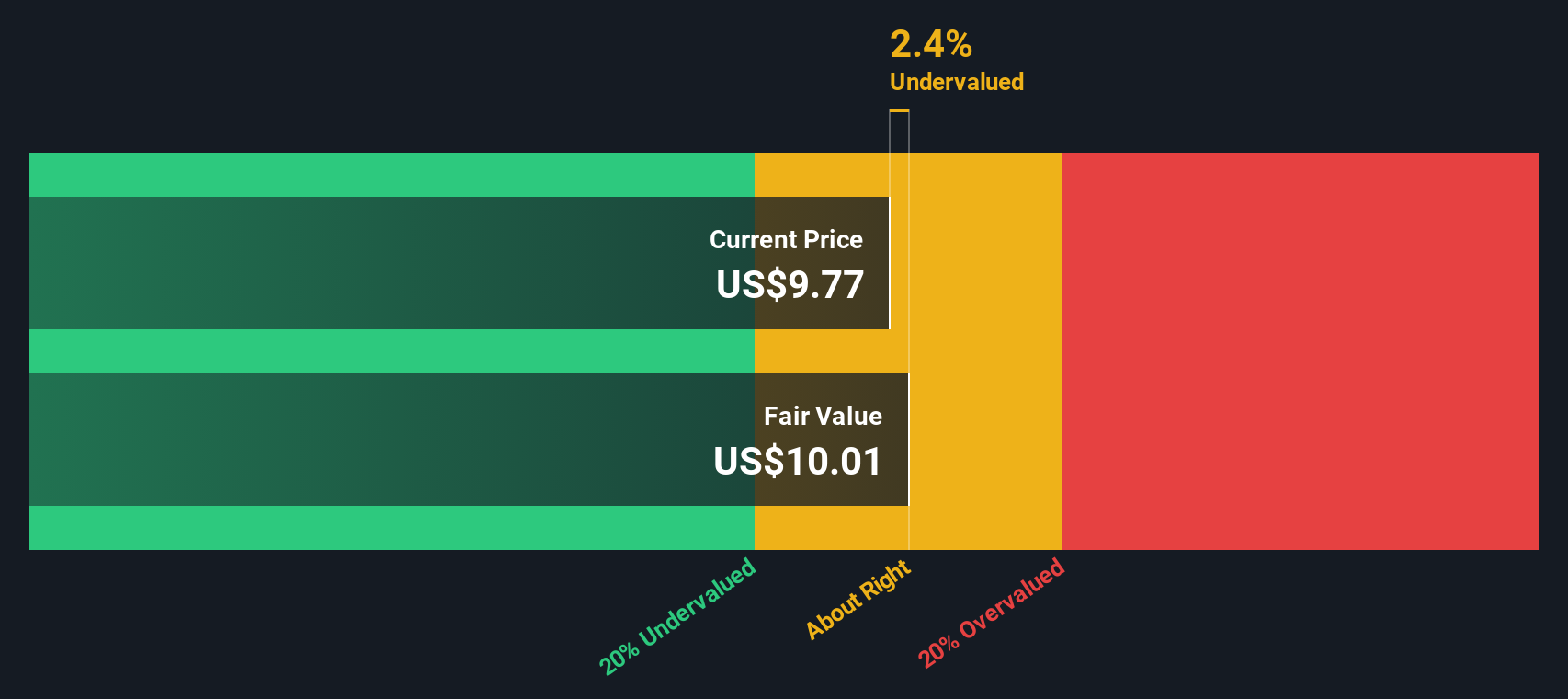

Pebblebrook Hotel Trust, a company with a focus on hospitality real estate, exhibits characteristics of an undervalued stock in the small-cap sector. Despite recent challenges, including a net loss of US$14.89 million for the first half of 2025, insider confidence is evident as Chairman & CEO Jon Bortz purchased 57,000 shares valued at US$510,030. The company's earnings guidance has been revised upward for 2025 despite ongoing macroeconomic uncertainties. Additionally, Pebblebrook declared dividends for both common and preferred shares to be paid in October 2025.

- Click here and access our complete valuation analysis report to understand the dynamics of Pebblebrook Hotel Trust.

Understand Pebblebrook Hotel Trust's track record by examining our Past report.

Summing It All Up

- Explore the 73 names from our Undervalued US Small Caps With Insider Buying screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AZTA

Azenta

Provides biological and chemical compound sample exploration and management solutions for the life sciences market in the United States, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives