Last Update 17 Sep 25

Fair value Increased 24%BlackGoat has increased profit margin from 16.0% to 18.0%.

Why I Began Following This Company…

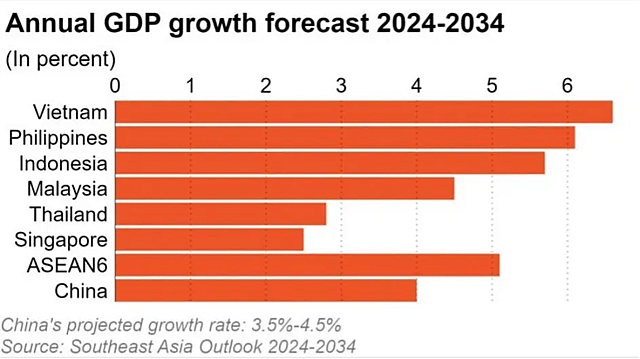

My interest in Grab begins with the region it calls home. Southeast Asia is entering a transformative decade: young, fast-growing, and increasingly digital. With a population nearly equal to Europe but much younger and more digitally native, it represents one of the most compelling consumer growth stories globally. Rising smartphone adoption, low banking penetration, and a rapid shift to digital services create fertile ground for super-apps to become indispensable infrastructure.

Grab sits at the heart of this shift. Its platform touches transportation, food, payments, and financial services, compounding network effects as more users and merchants join. The company’s balance sheet is also unusually strong for a growth story, with significant cash reserves providing both downside protection and optionality for future expansion.

While the stock has drifted sideways and shaken out impatient retail holders, institutional investors have been steadily building positions. After months of consolidation around current levels, I believe the setup is in place for a re-rating that better reflects Grab’s long-term potential.

Source 1: SEA economic data; Source 2: SEA population growth; Source 3: Smartphone penetration; Source 4: Bank account ownership; Source 5: Digital wallet usage

Company Overview

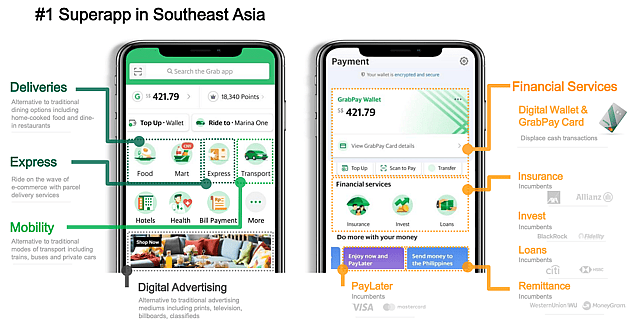

Grab is Southeast Asia’s dominant super app, spanning ride-hailing, food delivery, digital payments, fintech (banking, lending, insurance), merchant solutions, and advertising across 8 countries. Think Uber + DoorDash + PayPal + SoFi rolled into one.

Scale is unmatched: 45M monthly transacting users and 6M merchants. Its localisation edge is key: motorbike ride-hailing dominates Indonesia (112M motorbikes vs. 8.6M in the US), and QR-based GrabPay thrives where less than 70% of people have bank accounts.

Market share is entrenched: >95% in Malaysia ride-hailing, ~50% in food delivery. Uber gave up SEA in 2018, taking a 14% equity stake instead, with Dara Khosrowshahi (ex Uber CEO) now on Grab’s board. Rivals like Foodpanda and Gojek have retreated after years of losses. Smaller players like Maxim face regulatory headwinds. Grab has not just survived, it has consolidated.

This is not “SEA’s Uber.” It is a culturally native, founder-led infrastructure platform, backed by global giants like Uber, SoftBank, Toyota, DiDi, and Booking Holdings.

📊 Fundamentals

Grab has undergone a dramatic financial transformation.

- Margins: Profit margin hit 3.6% in Q2 2025, up from -8.2% from 2024.

- Revenue: $819M in Q2 2025, +23% YoY. Revenues have compounded at >20% annually for three years.

- Profitability: First GAAP net profit in Q1 2025. Now profitable for two consecutive quarters.

- Balance Sheet: $7.3B cash vs. $1.7B debt → net cash, with >37% of market cap in liquidity.

- Returns on Capital: ROCE is trending up as Grab transitions from cash-burn to monetisation.

Margins remain thin, deliberately. Grab is still in “lock-in” mode, trading profitability today for entrenched dominance tomorrow.

Growth Catalysts

Users & Network Effects

Grab’s 45M MTUs, 7M DAUs, and 119M annual users represent just 17% annual penetration of Southeast Asia’s ~700M people and only ~6% on a monthly basis. This is an enormous runway when compared with Europe or the US, where digital services already saturate most of the population. SEA’s median age of 30.9 (vs. 44.7 in Europe) means a structurally larger, digitally native consumer base will be entering their peak earning and spending years over the next two decades. Rising smartphone penetration (~80% vs. ~91% in the US) accelerates this effect.

Every incremental user strengthens Grab’s flywheel: more ride-hailing demand brings in more drivers, which draws in more merchants, which fuels ad inventory and fintech adoption. Just as Uber became habit-forming in the US, Grab is embedding itself into daily life in SEA but with a younger, faster-growing customer base and far less competition.

Ads & Fintech: The Margin Engines

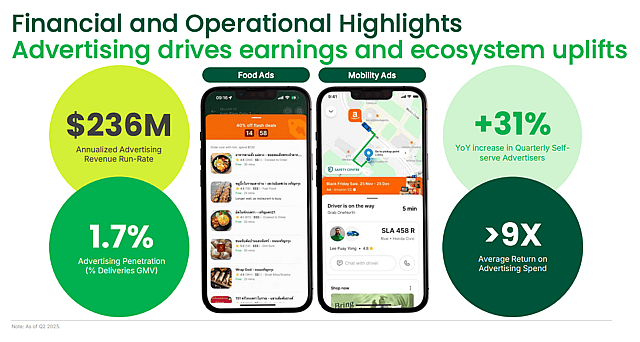

Advertising is still in its infancy. Grab runs at a $240M annualised Ad revenue pace today, with just 191K active advertisers; barely ~3% penetration of its 6M merchants. The ad take rate is 1.7%, rising as more merchants adopt self-serve ads (+31% YoY). Like Amazon a decade ago, ads are a hidden profit lever that could quietly transform Grab’s margin structure without raising take rates in mobility or deliveries.

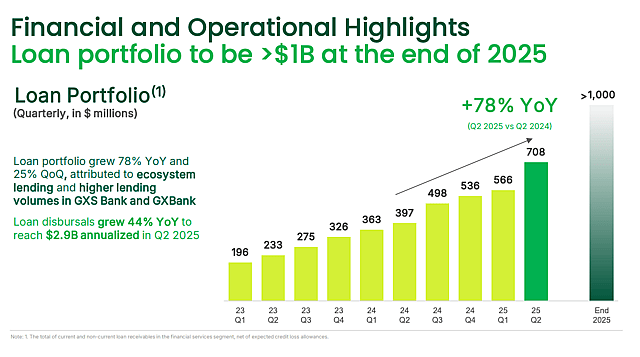

Financial services are scaling even faster. The loan book has reached $708M (+78% YoY) with disbursals at $2.9B annualised. Deposits exceed $1B across 4M accounts, with NPLs <2%. Most impressively, 90% of GXBank Malaysia’s customers came directly from Grab, at near-zero CAC, a distribution advantage traditional banks can’t match. In a region where ~30% remain unbanked and digital wallet usage is already ~83% (vs. <20% in the UK), GrabPay is positioning itself as SEA’s equivalent of Alipay. Fintech is still loss-making today, but breakeven is guided for 2026, and once profitable, it could dwarf the margins of mobility and delivery.

Consolidation Tailwinds

Grab has outlasted rivals like Foodpanda (which exited Thailand) and Gojek (which retreated from Vietnam and Thailand), while smaller local players such as Maxim face regulatory hurdles. Leveraging this shift, Grab has acquired businesses like Chope (dining reservations), Everrise (grocery retail), and Validus (SME lending), integrating them into a cohesive ecosystem with discipline and strategic intent.

Indonesia remains the true prize, the region’s largest economy. Although Grab already commands ~70% of the SEA ride-hailing market, GoTo still holds a majority in Indonesia (approximately 60% in ride-hailing and a strong position in food delivery). A successful merger or acquisition of GoTo would position Grab to consolidate more than 90% of mobility in Indonesia, solidifying its near-monopoly across SEA.

To prepare for such high-impact strategic moves, Grab raised $1.5 billion via a 0% convertible note (heavily oversubscribed) demonstrating that the company is actively building financial firepower for regional consolidation.

New Strategic Boost: Autonomous Vehicle Partnership

In a timely and forward-thinking development, a few days ago (August 19th, 2025), Grab has made a strategic equity investment in WeRide, a Nasdaq-listed autonomous driving technology firm. This partnership, expected to close by the first half of 2026, is aimed at accelerating the deployment of Level 4 robotaxis and shuttles across Southeast Asia. WeRide’s technology will be integrated into Grab’s fleet management, routing, and dispatch systems, enabling operational scalability and efficiency. Additionally, the collaboration includes training and upskilling Grab’s driver-partners for future roles within the AV ecosystem.

This isn't just a consolidation play, it also enhances Grab’s long-term moat by embedding cutting-edge autonomy into its network, positioning the company to dominate not just through mergers, but through technological leadership. Foreign entry threats are muted—Uber is not a rival but a partner and shareholder—so Gran’s path to dominance grows stronger by the day.

https://finance.yahoo.com/news/grab-invests-weride-deploy-robotaxis-173032376.html?guccounter=1

Product Velocity

Product expansion has become a moat in its own right. In April 2025, Grab staged a livestream (rare in SEA corporate culture) to unveil new features like GrabFood for One, Grab for Family, Advance Booking, and Travel Pass. This pace, of 5–10 launches per year, compounds engagement and reduces churn. Each product hooks more users into the ecosystem, making Grab harder to dislodge. In a region with still-fragmented alternatives, velocity itself becomes a defensive weapon.

Institutional Endorsements

Grab has heavyweight endorsement from both strategic and financial institutions. Uber, Toyota, SoftBank, DiDi, and Booking Holdings sit on the cap table, while long-term investors like Howard Marks (10M shares), Ray Dalio (6M), and Tiger Global (92M since 2022) have built positions in the last quarters. Over 80% of shares are institutionally owned. Importantly, insiders are not selling, reinforcing that management sees the long-term compounding story still ahead.

Public Infrastructure Integration

Grab isn’t just private infrastructure, it is increasingly embedded in public systems too. In Indonesia’s “Makan Bergizi Gratis” free-meal program, Grab delivered meals to 1,500+ students through 9 local MSMEs. Partnerships like these not only drive volume but also entrench Grab as systemic infrastructure, the kind of company governments rely on, not just tolerate. This reduces regulatory risk while cementing Grab’s role in everyday life.

https://grab4good.com/makan-bergizi-gratis/

EV & AV Edge

Grab is rolling out 50,000 EVs with BYD and running autonomous vehicle pilots in Singapore and Malaysia. While Tesla and Waymo are advancing quickly in the US, full FSD in SEA will take much longer: the roads are chaotic, motorbike-heavy, and infrastructure fragmented. That gives Grab time to adapt. Crucially, when AV adoption eventually arrives, Grab will be the platform through which it scales in SEA, just as Uber is positioning itself in the West.

Risks

Rising Incentive Spending

Grab has kept incentives (subsidies and promotions Grab gives to riders) under control in recent years, but Q2 saw a slight uptick to ~10% of GMV (vs. 9% previously). If competition intensifies, spending could creep higher again, eroding margins and delaying profitability gains.

M&A Regulatory and Execution Risk (GoTo)

The potential Grab/GoTo merger, while transformative, carries significant execution and regulatory risks. A combined entity would control more than 90% of Indonesia’s ride-hailing market, raising monopoly concerns in Southeast Asia’s largest economy. This dominance has already triggered pushback: in May, hundreds of drivers and riders staged protests across Indonesia, fearing that consolidation would reduce jobs, cut driver pay, and raise prices for consumers.

The Indonesian government has also signaled its unease. Officials are pressing for any merged entity to guarantee better welfare, fees, and bonuses for drivers, and there is political pressure to ensure GoTo remains majority-owned by Indonesian investors. That complicates negotiations, as GoTo’s shareholder base is currently almost three-quarters foreign-owned (with SoftBank and Alibaba among the largest holders).

Even if terms are agreed, regulatory approval could be slow and politically charged, delaying or diluting the financial benefits Grab expects from the deal. Overpaying for GoTo (whose current valuation is about $4.4B, down sharply from IPO levels) would also raise integration risks, especially if synergies take longer than expected to materialise.

In short, while consolidation of the Indonesian market could cement Grab’s dominance across SEA, the road to regulatory approval is fraught with uncertainty. Until a clear framework emerges, investors should treat the Grab/GoTo deal as an optional upside rather than a base-case driver.

Public Transport Expansion

Governments across Southeast Asia are investing heavily in public transport infrastructure (e.g., Penang rail expected by 2031). While timelines are long, improved alternatives could gradually reduce reliance on Grab’s mobility services.

Autonomous Driving Threat

Self-driving technology has the potential to upend the ride-hailing model by reducing or eliminating the need for human drivers. Grab could benefit in the medium term through partnerships (e.g., with WeRide) that lower costs and improve service. But in the long run, if autonomous fleets scale under competitors like Tesla, Waymo, or Baidu, Grab risks being sidelined unless it can secure access, build strong alliances, or integrate AV tech into its platform. While Southeast Asia’s complex traffic, fragmented infrastructure, and regulatory hurdles suggest adoption will lag the US and China, the shift remains a structural risk over the next decade.

Thin GAAP Margins & Heavy Share Count

Grab’s GAAP profitability remains razor-thin despite progress, and with ~4B shares outstanding, per-share metrics are diluted. This leaves little margin for error if growth slows or costs creep up.

Valuation

I assume a 20% CAGR in revenue over the next five years, driven by rising digital adoption in Southeast Asia, Grab’s ecosystem expansion, and deeper monetisation of payments and financial services.

By year five, I project net profit margins of around 15% (up from 3.6%), supported by operating leverage at scale, tighter incentive discipline, and incremental contribution from Ads and Fintech.

Applying a 35× PE multiple in year five, broadly in line with global ride-hailing peers such as Uber at about 30× and justified by Grab’s market leadership and growth runway, and discounting back at a 9% cost of equity, I arrive at a fair value of $6.02. With the stock trading today (21 August 2025) at $5.02, this implies more than 16% undervaluation.

Final Take

Before Q4 last year, Grab was largely priced as a commoditised delivery business. Starting in Q4 2024, the market began to acknowledge its broader potential, but the recognition remains incomplete. In reality, Grab is:

- Dominant in mobility and delivery, with a structural localisation moat.

- Building high-margin fintech and advertising businesses with Alipay-like upside.

- Maintaining a fortress balance sheet with over 30% net cash available for further regional expansion.

- Institutionally backed by Uber, SoftBank, Tiger Global, and Toyota.

- Founder-led with proven operating discipline.

For me, Grab is a small position designed to diversify and gain exposure to Southeast Asia’s growth story. It carries risks and may not deliver explosive returns, but I still see it as a market-beating stock and a solid way to participate in the region’s digital boom. At around $5, it looks like an attractive long-term entry point, with a seasonally weak September potentially offering even better accumulation opportunities before momentum builds into 2026.

Have other thoughts on Grab Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NasdaqGS:GRAB. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.