- United States

- /

- Banks

- /

- NasdaqGS:TCBX

Exploring Three Undervalued Small Caps In US With Insider Actions

Reviewed by Simply Wall St

The United States market has experienced a steady climb, increasing by 1.3% in the last week and 24% over the past year, with earnings projected to grow by 15% annually. In this thriving environment, identifying small-cap stocks that are perceived as undervalued with notable insider actions can offer potential opportunities for investors seeking growth within a dynamic market landscape.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Franklin Financial Services | 8.9x | 1.8x | 42.66% | ★★★★☆☆ |

| Quanex Building Products | 33.1x | 0.9x | 38.93% | ★★★★☆☆ |

| McEwen Mining | 4.2x | 2.2x | 44.96% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.7x | 33.84% | ★★★★☆☆ |

| ChromaDex | 277.3x | 4.5x | 36.19% | ★★★☆☆☆ |

| First United | 13.4x | 3.0x | 47.94% | ★★★☆☆☆ |

| RGC Resources | 17.0x | 2.4x | 22.06% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Guardian Pharmacy Services | NA | 1.1x | 38.29% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -73.17% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

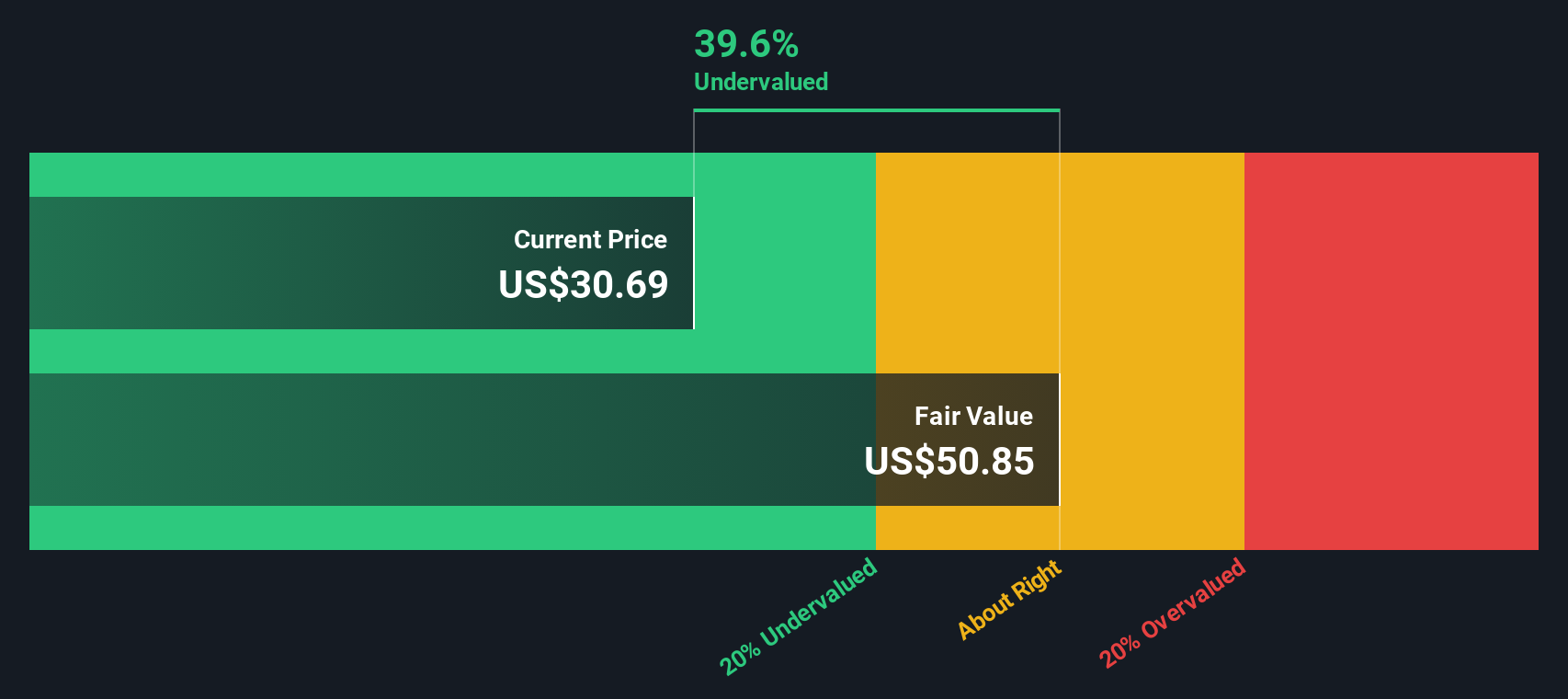

Third Coast Bancshares (NasdaqGS:TCBX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Third Coast Bancshares operates in the community banking sector with a focus on providing financial services, and it has a market capitalization of approximately $0.27 billion.

Operations: The company generates revenue primarily from community banking, with a recent figure of $158.91 million. Operating expenses are significant, with general and administrative costs reaching $88.49 million in the latest period. The net income margin has shown variability, reaching 24.46% in the most recent data point provided.

PE: 11.6x

Third Coast Bancshares, a smaller player in the U.S. market, showcases potential with its recent financial performance. In Q3 2024, net income surged to US$12.78 million from US$5.58 million the previous year, reflecting strong operational growth. Insider confidence is evident as key figures increased their holdings recently. Additionally, a quarterly cash dividend on preferred stock highlights shareholder value focus. With earnings projected to grow annually by 11%, future prospects appear promising for Third Coast Bancshares amidst industry challenges.

- Navigate through the intricacies of Third Coast Bancshares with our comprehensive valuation report here.

Explore historical data to track Third Coast Bancshares' performance over time in our Past section.

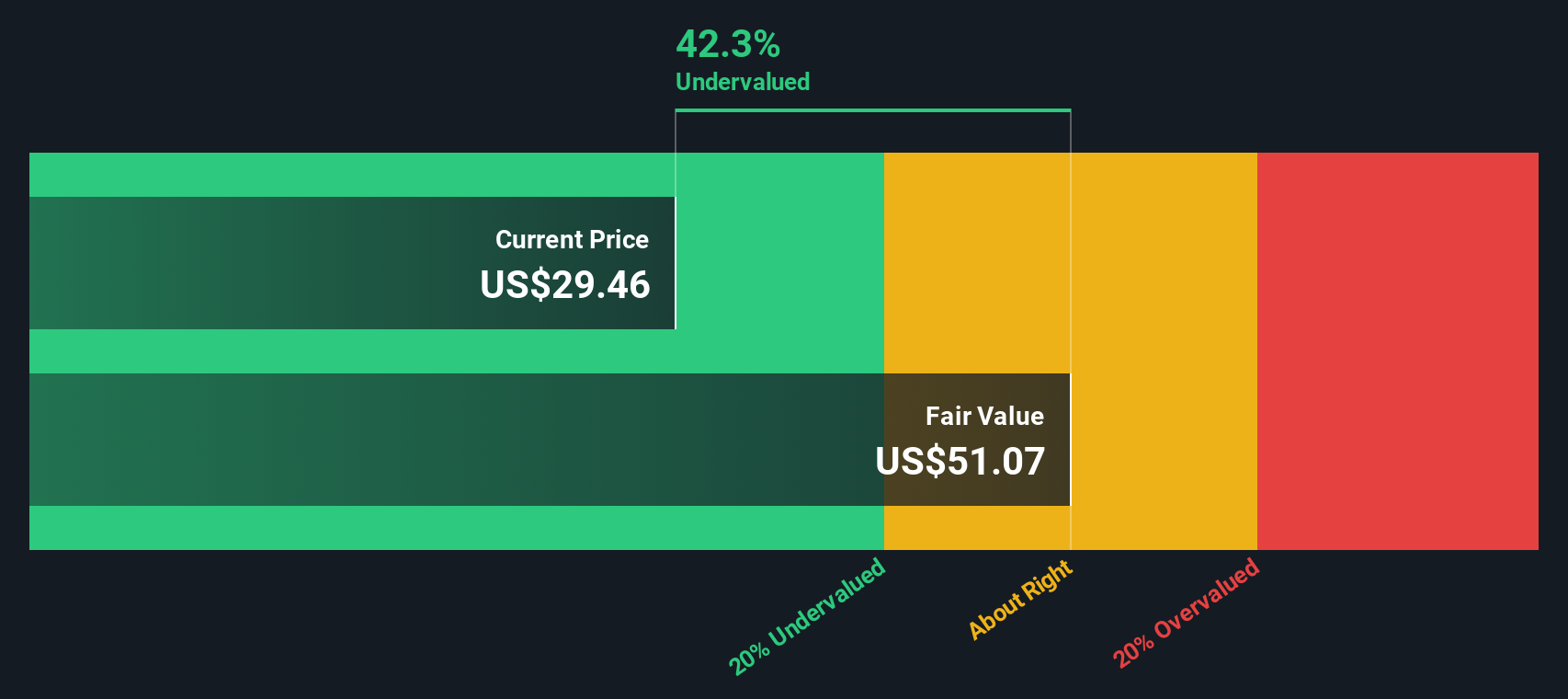

Univest Financial (NasdaqGS:UVSP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Univest Financial is a financial services company providing banking, insurance, and wealth management services with a market cap of approximately $0.82 billion.

Operations: With primary revenue streams from banking, insurance, and wealth management, the company reported a total revenue of $288.32 million for the latest period. Operating expenses consistently exceed $191 million in recent periods, with general and administrative expenses being a significant component. The net income margin has shown variability but was last recorded at 25.40%.

PE: 11.5x

Univest Financial, a smaller U.S. financial entity, shows signs of being undervalued with steady insider confidence. Recent share repurchases of 156,728 shares for US$4.19 million between July and September 2024 highlight management's belief in the company's value proposition. Despite a slight dip in net interest income to US$53.2 million for Q3 2024 from last year, net income rose to US$18.58 million, indicating efficient operations amidst challenging conditions. A dividend of $0.21 per share further underscores financial stability and commitment to shareholder returns while an expanded buyback plan suggests potential future growth opportunities.

- Delve into the full analysis valuation report here for a deeper understanding of Univest Financial.

Gain insights into Univest Financial's past trends and performance with our Past report.

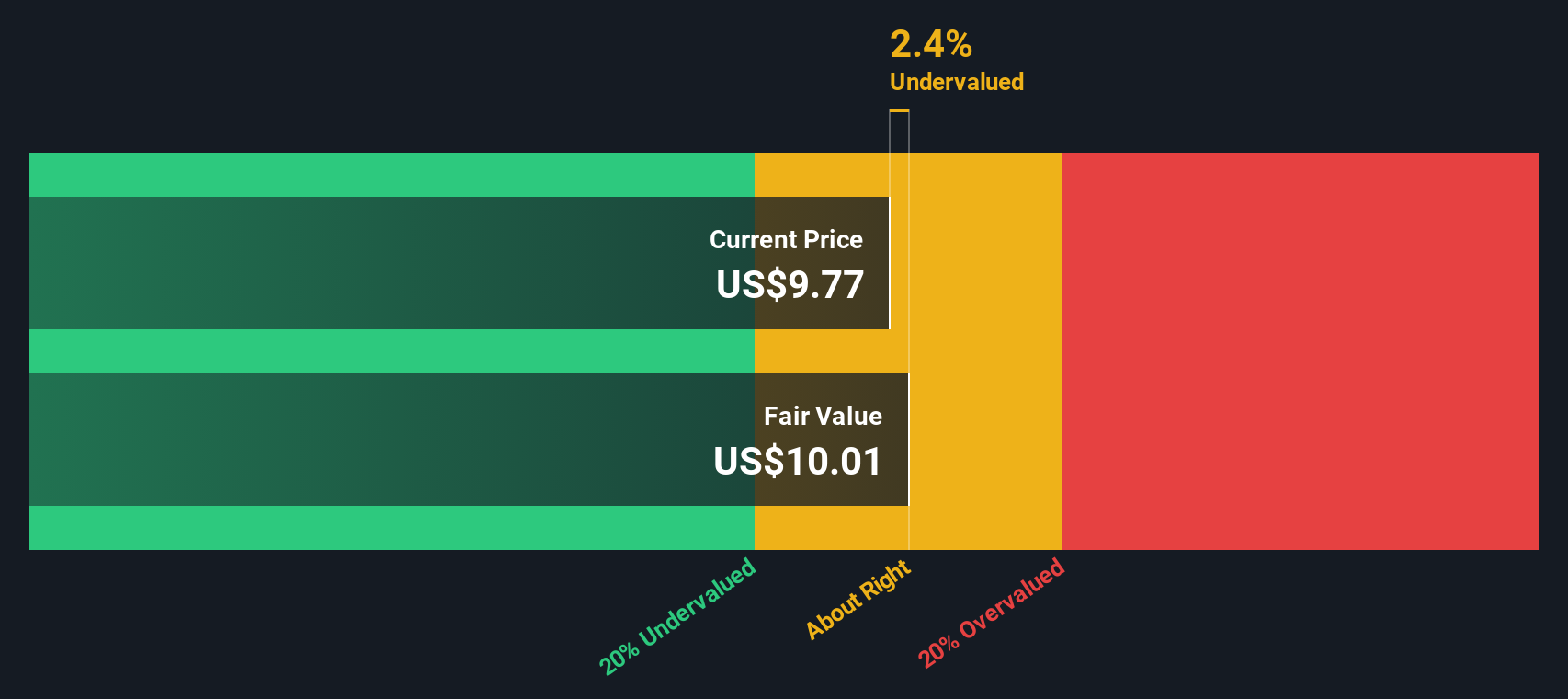

Pebblebrook Hotel Trust (NYSE:PEB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pebblebrook Hotel Trust is a real estate investment trust specializing in the ownership and management of hotels and motels, with a market capitalization of approximately $2.13 billion.

Operations: Pebblebrook Hotel Trust generates revenue primarily from its REIT - Hotels & Motels segment, with recent revenues reaching approximately $1.45 billion. The company's cost of goods sold (COGS) was around $1.08 billion, leading to a gross profit margin of 25.67%. Operating expenses and general & administrative expenses are significant components of the cost structure, impacting overall profitability.

PE: -52.4x

Pebblebrook Hotel Trust, a smaller player in the hospitality sector, shows potential despite its reliance on external borrowing for funding. Recent earnings reveal a turnaround with net income of US$43.66 million for Q3 2024 compared to a loss previously. The company has repurchased over 1.4 million shares since February 2023, signaling strategic confidence. Although facing projected year-end losses, earnings are forecasted to grow by 33.87% annually, suggesting optimism for future performance amidst dividend affirmations and buyback activities.

- Dive into the specifics of Pebblebrook Hotel Trust here with our thorough valuation report.

Understand Pebblebrook Hotel Trust's track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 39 Undervalued US Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Third Coast Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TCBX

Third Coast Bancshares

Operates as a bank holding company for Third Coast Bank, SSB that provides various commercial banking solutions to small and medium-sized businesses, and professionals.

Flawless balance sheet and undervalued.