- United States

- /

- Metals and Mining

- /

- NYSEAM:CMCL

Exploring August 2025's Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

As August 2025 unfolds, the U.S. stock market is experiencing volatility, with recent declines driven by weak jobs data and renewed tariff concerns impacting investor sentiment. Despite these challenges, small-cap stocks in the S&P 600 may present opportunities for investors seeking value, particularly when insider buying indicates potential confidence in a company's prospects amidst broader economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 1.0x | 31.74% | ★★★★★★ |

| PCB Bancorp | 9.2x | 2.8x | 41.97% | ★★★★★☆ |

| Southside Bancshares | 10.1x | 3.4x | 45.57% | ★★★★★☆ |

| Montrose Environmental Group | NA | 1.0x | 39.07% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.8x | 36.77% | ★★★★★☆ |

| S&T Bancorp | 10.5x | 3.5x | 47.39% | ★★★★☆☆ |

| Gentherm | 30.7x | 0.7x | 36.56% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 34.28% | ★★★★☆☆ |

| Shore Bancshares | 9.5x | 2.4x | -8.61% | ★★★☆☆☆ |

| Farmland Partners | 7.0x | 8.5x | -32.82% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

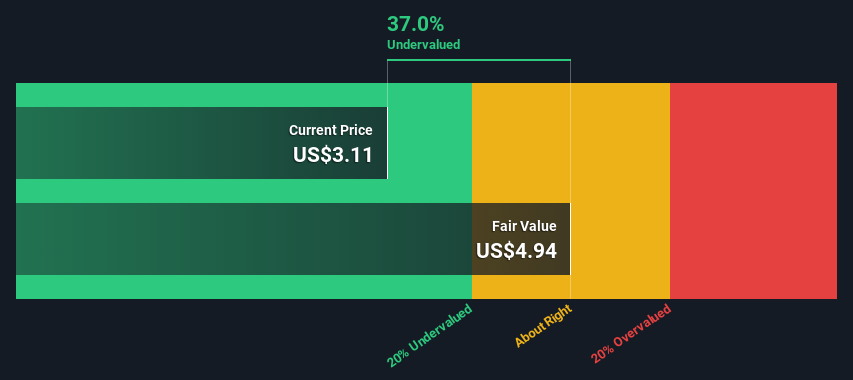

Thryv Holdings (THRY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thryv Holdings operates as a provider of software-as-a-service (SaaS) solutions and marketing services, with a market capitalization of approximately $1.04 billion.

Operations: Thryv Holdings generates revenue primarily from its SaaS and Marketing Services segments, with the former contributing $417.49 million and the latter $340.80 million. The company's gross profit margin has shown variability, reaching 66.06% as of June 2025. Key cost components include COGS, operating expenses, and significant sales & marketing expenditures which have been consistently high over various periods.

PE: -6.4x

Thryv Holdings, a company with a market cap under US$1 billion, has shown insider confidence with recent share purchases. The launch of Thryv Workforce Center™, powered by Gusto™, reflects their focus on enhancing payroll solutions for small businesses. Q2 2025 earnings reported US$210 million in sales and net income rose to US$13.93 million from last year's US$5.55 million, highlighting profitability despite sales decline. Future growth prospects are bolstered by innovative product launches and strategic board appointments like Lou Orfanos.

- Dive into the specifics of Thryv Holdings here with our thorough valuation report.

Examine Thryv Holdings' past performance report to understand how it has performed in the past.

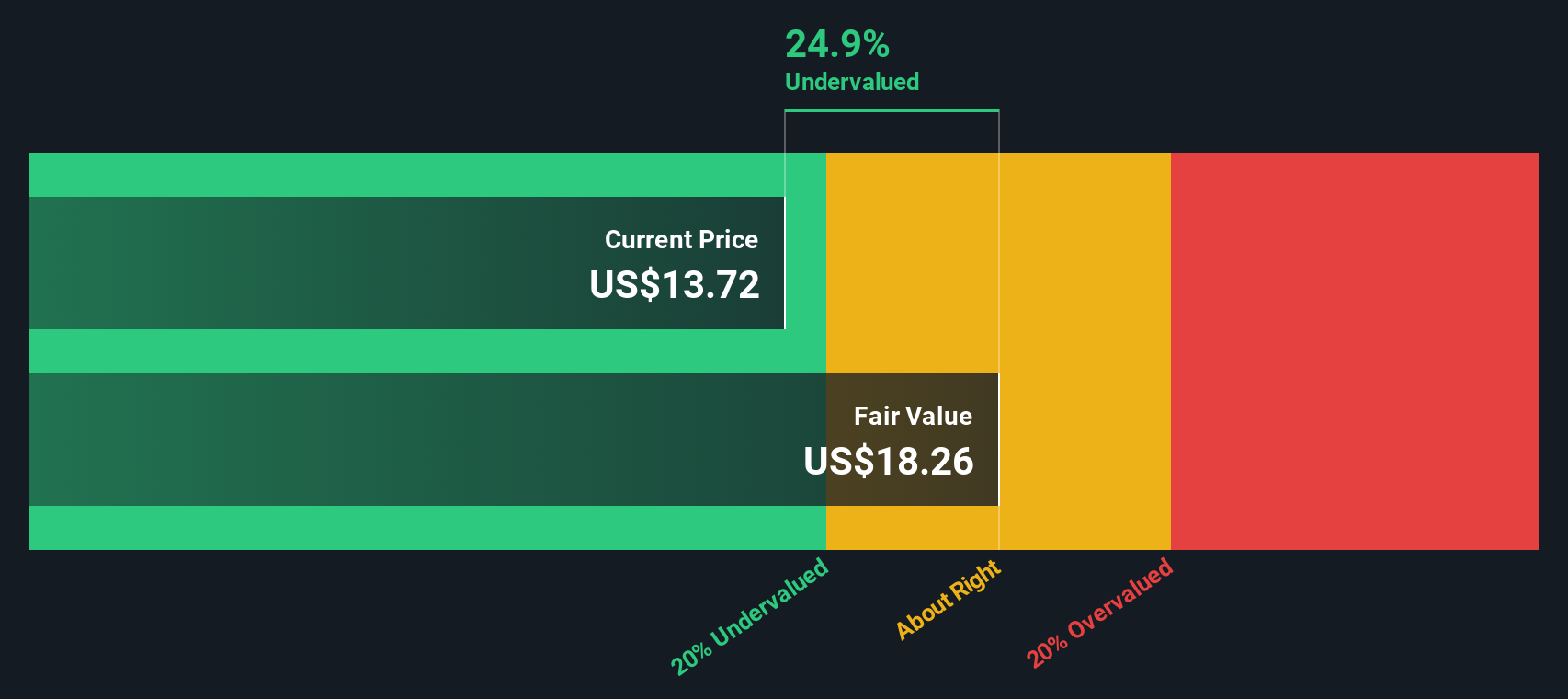

Caledonia Mining (CMCL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caledonia Mining is a mining company primarily engaged in the production and exploration of gold, with operations centered around the Blanket Mine in Zimbabwe, complemented by activities in South Africa and the Bilboes Oxide Mine, with a market cap of approximately $0.13 billion.

Operations: The company's primary revenue streams are derived from the Blanket segment, with additional contributions from operations in South Africa and the Bilboes Oxide Mine. Over recent periods, gross profit margin has shown variability, reaching 55.80% as of March 2025. Operating expenses and non-operating expenses significantly impact net income margins, which have fluctuated over time but reached 12.95% in March 2025.

PE: 15.5x

Caledonia Mining, a smaller company with promising growth potential, is capturing attention due to its recent performance and future prospects. The company reported record gold production of 21,070 ounces in Q2 2025 and increased its annual production guidance to up to 79,500 ounces. Despite relying on higher-risk external borrowing for funding, Caledonia's earnings are projected to grow by over 34% annually. Insider confidence is evident as insiders have been purchasing shares since early this year.

- Delve into the full analysis valuation report here for a deeper understanding of Caledonia Mining.

Gain insights into Caledonia Mining's past trends and performance with our Past report.

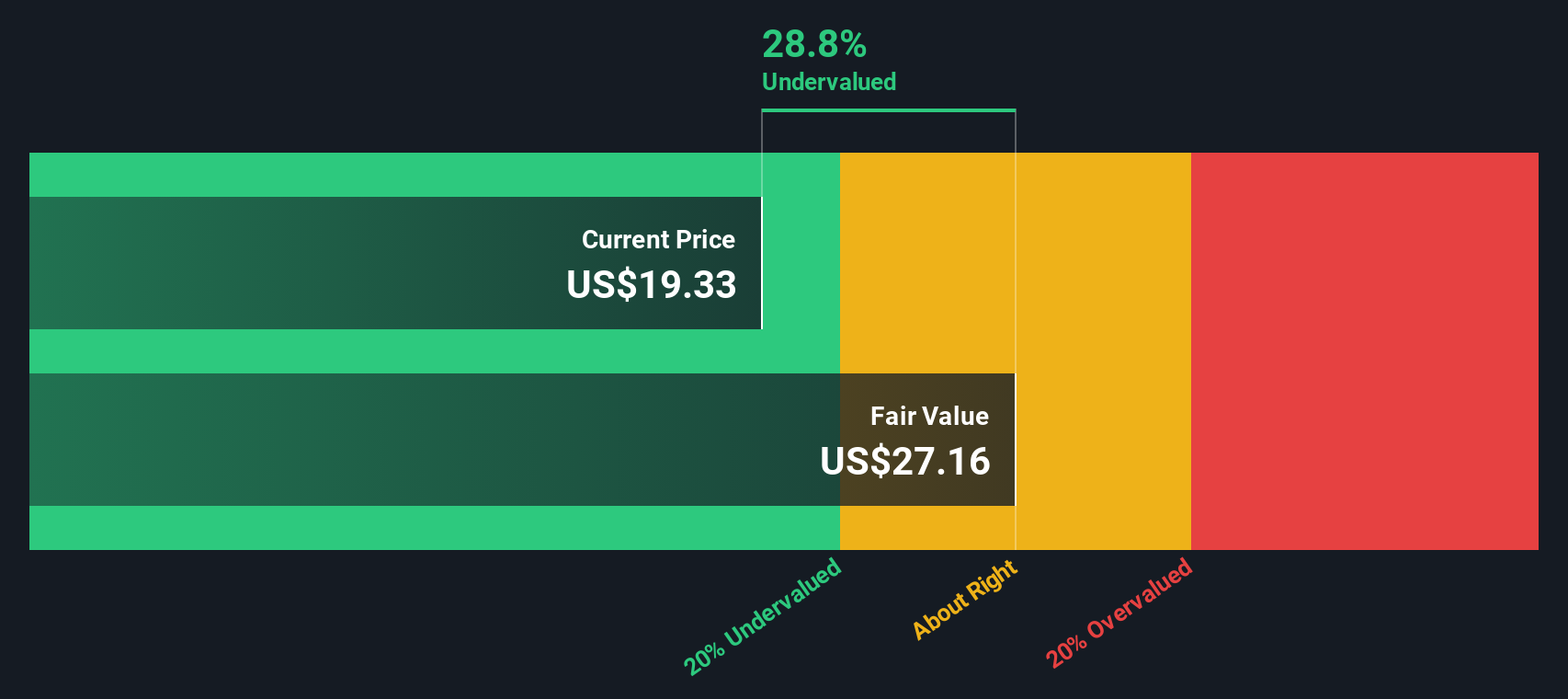

Hudson Pacific Properties (HPP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hudson Pacific Properties is a real estate investment trust that focuses on owning, operating, and acquiring office and studio properties, with a market capitalization of $1.18 billion.

Operations: The company generates revenue primarily from its Office and Studio segments, with the Office segment contributing significantly more. Over recent periods, the gross profit margin has shown a declining trend, reaching 44.10% in early 2025. Operating expenses are substantial and include significant depreciation and amortization costs.

PE: -2.4x

Hudson Pacific Properties, a small cap real estate company, is grappling with profitability challenges and has seen significant shareholder dilution over the past year. Despite these hurdles, insider confidence remains a focal point as they continue to engage in strategic board changes aimed at cost reduction. Recent financial maneuvers include a $600 million follow-on equity offering and shelf registration for $383 million. While unprofitable now, Hudson's proactive steps may position it for future growth opportunities in the market.

Taking Advantage

- Investigate our full lineup of 68 Undervalued US Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:CMCL

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion