- United States

- /

- Specialized REITs

- /

- NYSE:FPI

Insider Buying Highlights 3 Undervalued Small Caps Across Regions

Reviewed by Simply Wall St

Amidst a backdrop of U.S.-China trade tensions and ongoing government shutdown, major stock indexes have ended lower as investors digest recent earnings reports. In this challenging market environment, identifying promising small-cap stocks can be pivotal, especially those that show resilience and potential for growth despite broader economic pressures.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 9.5x | 2.9x | 35.66% | ★★★★★☆ |

| Peoples Bancorp | 10.0x | 1.9x | 47.06% | ★★★★★☆ |

| Citizens & Northern | 11.3x | 2.8x | 41.11% | ★★★★☆☆ |

| Farmland Partners | 6.7x | 8.1x | -39.57% | ★★★★☆☆ |

| First Northern Community Bancorp | 10.0x | 2.8x | 46.30% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 32.02% | ★★★★☆☆ |

| Shore Bancshares | 9.9x | 2.6x | -78.62% | ★★★☆☆☆ |

| Auburn National Bancorporation | 13.7x | 2.9x | 22.44% | ★★★☆☆☆ |

| Arrow Financial | 14.7x | 3.2x | 20.16% | ★★★☆☆☆ |

| Chemung Financial | 21.8x | 3.0x | 49.36% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Peoples Bancorp (PEBO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Peoples Bancorp is a financial services company providing banking, investment, and insurance solutions with a market cap of approximately $1.05 billion.

Operations: Peoples Bancorp generates its revenue primarily through a robust gross profit margin, which has fluctuated between 97.78% and 100.03% over the provided periods. The company's operating expenses are dominated by general and administrative costs, consistently surpassing $60 million in earlier periods and reaching over $200 million in recent quarters. Sales and marketing expenses remain relatively low compared to other operating costs, typically under $5 million per period. Net income margins have varied significantly, ranging from approximately 8.26% to 30.88%, reflecting changes in both revenue growth and expense management strategies over time.

PE: 10.0x

Peoples Bancorp, a smaller player in the financial sector, shows promise with earnings projected to grow 8.83% annually. Recently, insider confidence was highlighted by share purchases over the past year. The company declared a quarterly dividend of US$0.41 per share and completed a buyback of 488,423 shares for US$13.85 million since January 2021, reflecting strategic capital management despite net charge-offs rising to US$6.8 million this quarter from last year's US$6 million.

- Take a closer look at Peoples Bancorp's potential here in our valuation report.

Review our historical performance report to gain insights into Peoples Bancorp's's past performance.

Peoples Financial Services (PFIS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Peoples Financial Services operates as a regional bank providing a range of banking services, with a market capitalization of approximately $0.38 billion.

Operations: Peoples Financial Services generates revenue primarily from its banking services, with recent figures indicating $165.60 million in revenue. The company consistently reports a gross profit margin of 100%, reflecting that cost of goods sold is not applicable or negligible. Operating expenses include significant allocations to general and administrative costs, which reached $85.57 million recently. Net income margins have varied, with the most recent figure at 20.36%.

PE: 14.2x

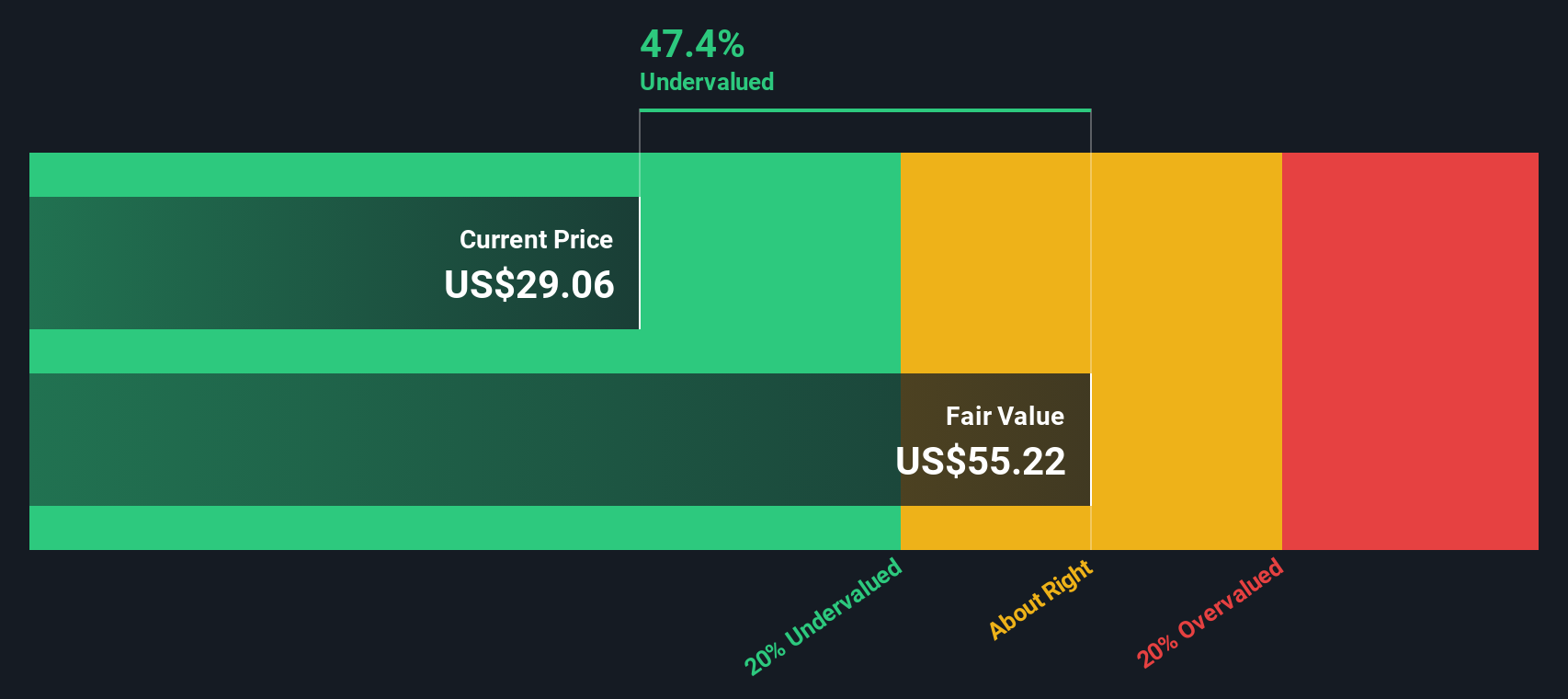

Peoples Financial Services, a smaller company in the U.S., shows promise with strong earnings growth and insider confidence. Recent financials reveal net interest income surged to US$42.2 million for Q2 2025, up from US$18.92 million a year prior, while net income rose to US$16.96 million from US$3.28 million. The company recently completed an $85 million fixed-income exchange offer and declared a quarterly dividend of $0.6175 per share, indicating potential for continued shareholder returns amidst forecasted earnings growth of 32% annually.

Farmland Partners (FPI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Farmland Partners is a real estate investment trust that primarily focuses on owning and managing high-quality farmland across the United States, with a market cap of approximately $0.52 billion.

Operations: The company generates revenue primarily through its commercial real estate investment trust (REIT) operations. Over the observed periods, the net income margin has shown significant variability, reaching as high as 1.21% in recent quarters. Operating expenses and non-operating expenses are notable components of costs, with general and administrative expenses consistently contributing to operating costs.

PE: 6.7x

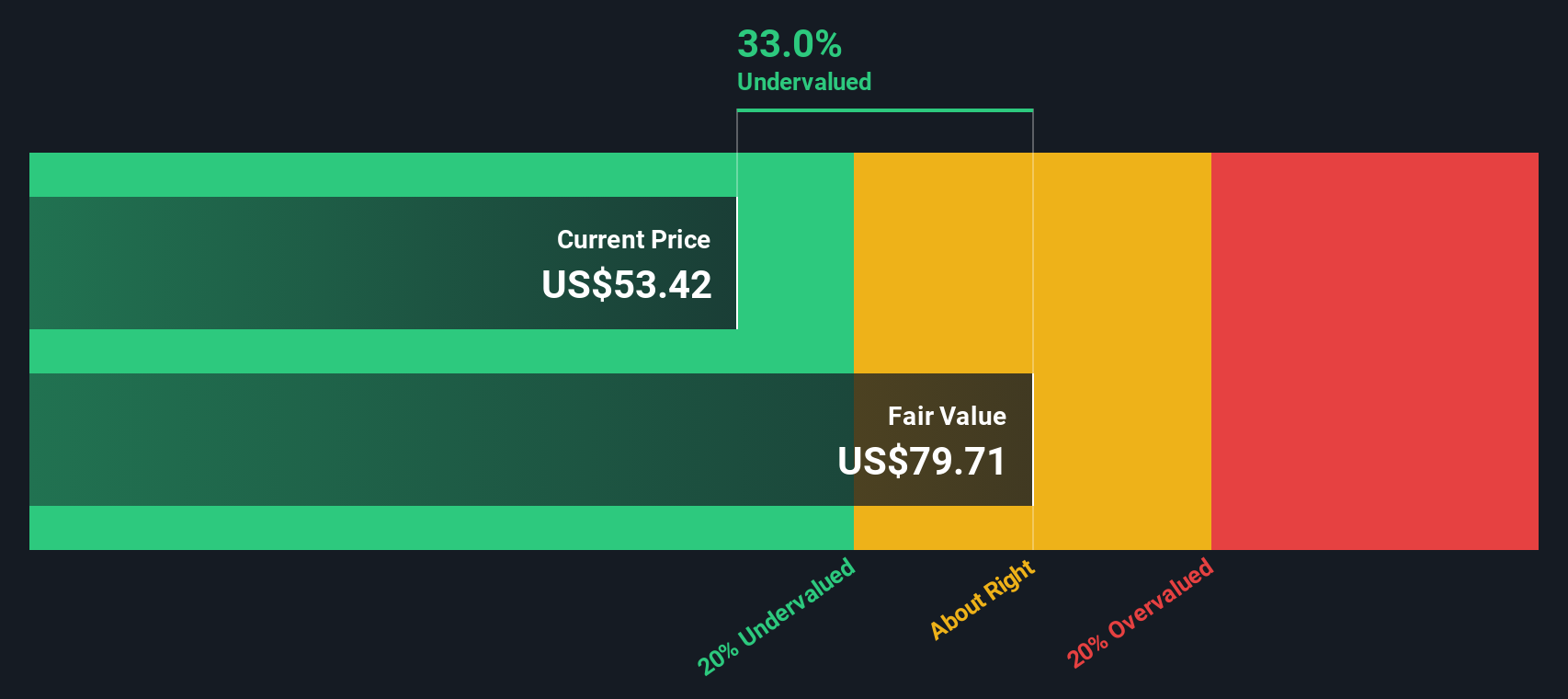

Farmland Partners, a small-cap company in the agricultural sector, recently declared a quarterly dividend of US$0.06 per share, reflecting stability despite challenges. Their Q2 2025 earnings showed net income of US$7.6 million compared to last year's loss, highlighting improved profitability. However, revenue declined to US$9.96 million from US$11.45 million year-over-year due to one-off items impacting results. Between April and July 2025, they repurchased over 2 million shares for US$25.59 million, indicating strategic confidence in their market position amidst forecasted earnings declines over the next three years.

- Navigate through the intricacies of Farmland Partners with our comprehensive valuation report here.

Evaluate Farmland Partners' historical performance by accessing our past performance report.

Taking Advantage

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 72 more companies for you to explore.Click here to unveil our expertly curated list of 75 Undervalued US Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FPI

Farmland Partners

An internally managed real estate company that owns and seeks to acquire high-quality North American farmland and makes loans to third-party farmers (both tenant and non-tenant) and landowners secured by farm real estate and/or other agricultural related assets.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives