- United States

- /

- Specialized REITs

- /

- NYSE:CUBE

How Diverging Views On Urban Rent Trends At CubeSmart (CUBE) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, analysts have highlighted CubeSmart’s improving self-storage fundamentals, pointing to stabilizing market rents, raised guidance, and strengthening trends in key urban markets such as New York City.

- The contrasting analyst opinions, with some citing muted self-storage demand while others name CubeSmart a top recovery idea for 2026, underscore how sensitive the company’s outlook is to shifts in sector pricing and occupancy.

- Next, we’ll examine how RBC’s emphasis on CubeSmart’s urban New York City footprint reshapes the company’s investment narrative and future expectations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CubeSmart Investment Narrative Recap

To own CubeSmart today, you need to believe that self storage fundamentals are genuinely stabilizing, particularly in dense urban markets like New York City, and that improving market rents can offset lingering softness elsewhere. The recent mix of analyst views, with RBC calling CubeSmart a top 2026 idea while Mizuho flags muted demand, reinforces that the key near term catalyst remains rent and occupancy trends, and the biggest risk is a slower or weaker recovery in sector pricing than current expectations suggest.

Against that backdrop, CubeSmart’s repeated 2025 guidance raises stand out, including the latest revision that nudged expected same store revenue growth closer to flat and confirmed another year of positive earnings. This matters directly for the thesis that urban strength and cost discipline can gradually stabilize the broader portfolio, even as some analysts worry about muted self storage demand and longer absorption periods in more supply heavy Sunbelt markets.

Yet beneath the improving New York City story, there is a less visible risk that investors should be aware of, particularly around sustained new supply in...

Read the full narrative on CubeSmart (it's free!)

CubeSmart's narrative projects $1.3 billion revenue and $369.9 million earnings by 2028. This requires 4.5% yearly revenue growth and a $4.9 million earnings decrease from $374.8 million today.

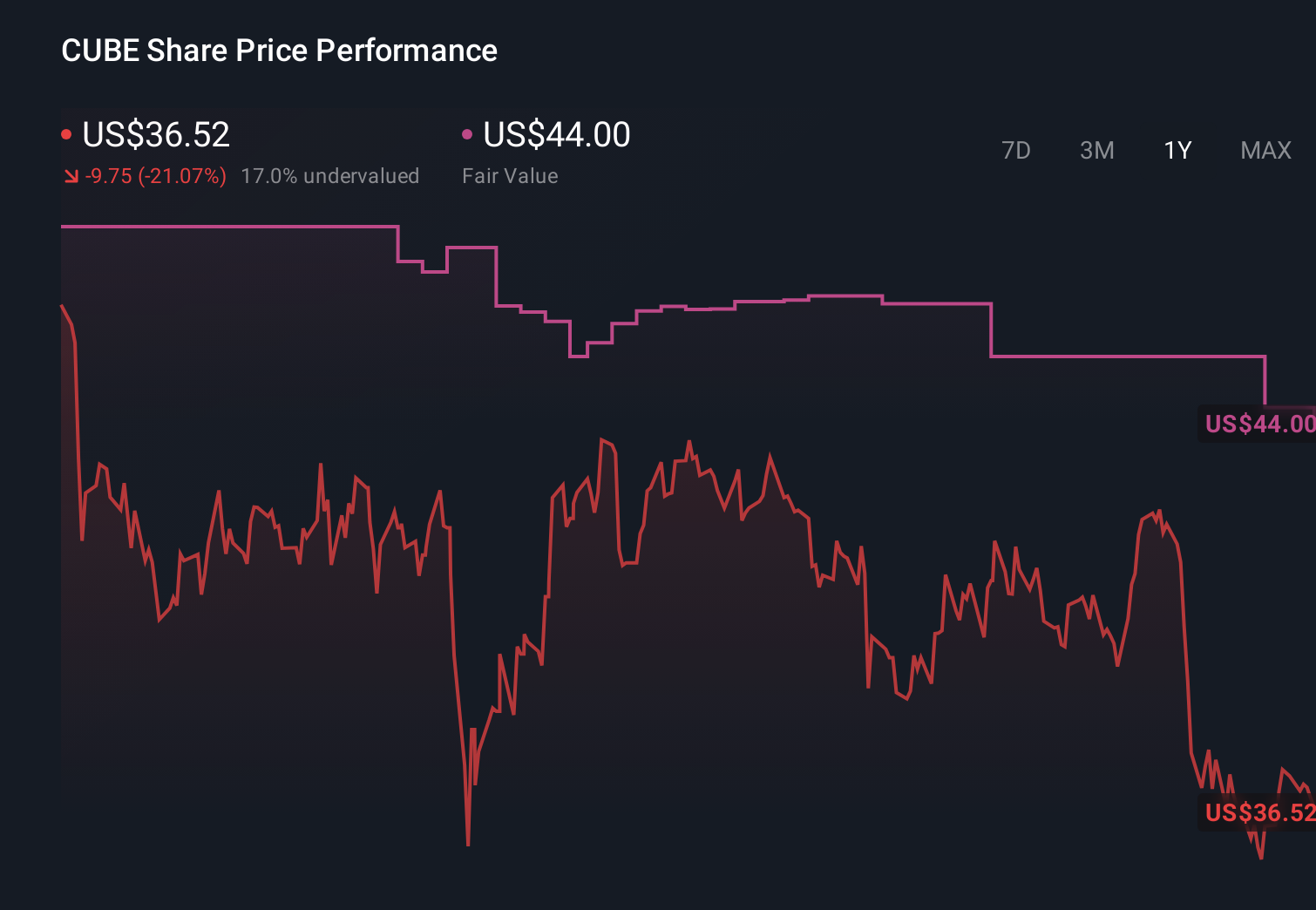

Uncover how CubeSmart's forecasts yield a $44.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$44 to about US$56.71, underscoring how far apart individual views can be. Set against this, the sector wide risk of persistent new supply in certain Sunbelt markets could keep CubeSmart’s overall revenue growth and occupancy recovery more uneven than some of those forecasts imply, so it is worth examining several contrasting opinions before deciding how this stock might fit into your portfolio.

Explore 2 other fair value estimates on CubeSmart - why the stock might be worth just $44.00!

Build Your Own CubeSmart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CubeSmart research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CubeSmart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CubeSmart's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBE

CubeSmart

A self-administered and self-managed real estate investment trust.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion