Last Update 04 Sep 25

Analysts maintain a Neutral stance on CubeSmart citing persistent moderation in storage sector fundamentals, muted demand expectations, and limited upside catalysts, resulting in the price target holding steady at $45.28.

Analyst Commentary

- Moderation of storage sector fundamentals expected to persist over the medium term, leading to tempered growth assumptions.

- Recent quarterly results prompted updates to financial models, reflecting softer operational trends.

- Cautious outlook as analysts project muted demand or slower revenue growth in the near future.

- Limited catalysts noted for material upside to the current business trajectory.

- Valuation deemed fair relative to sector peers, justifying Neutral positioning in the absence of strong growth drivers.

What's in the News

- No shares repurchased in the latest buyback tranche; total repurchases remain at 0 since the 2007 program announcement.

- Raised full-year 2025 guidance for same-store revenue growth to a range of negative 1.25% to 0.25%, and EPS to $1.44–$1.50.

- Issued third-quarter 2025 EPS guidance of $0.36–$0.38.

- Partnered with Precision Global Corporation to manage four Texas-based storage assets.

- Removed from the Russell 1000 Dynamic Index.

Valuation Changes

Summary of Valuation Changes for CubeSmart

- The Consensus Analyst Price Target remained effectively unchanged, at $45.28.

- The Future P/E for CubeSmart remained effectively unchanged, moving only marginally from 35.49x to 35.34x.

- The Consensus Revenue Growth forecasts for CubeSmart remained effectively unchanged, at 4.5% per annum.

Key Takeaways

- Strong demand trends and limited new supply in urban markets are driving stable occupancy, resilient revenues, and improving long-term growth prospects.

- A disciplined focus on cost control and strategic acquisitions positions the company for higher earnings growth and greater pricing power as competition eases.

- Lingering supply and demand pressures, increased costs, and macroeconomic uncertainty threaten CubeSmart's growth, margins, and resilience across both owned and managed self-storage operations.

Catalysts

About CubeSmart- A self-administered and self-managed real estate investment trust.

- Improving fundamentals in key urban markets-especially along dense corridors like New York City, where demand is driven by a growing base of urban dwellers and small businesses coupled with limited new supply-are creating a stable, resilient occupancy base and sticky customer relationships, which should steadily lift revenue and net rental income as positive trends flow through the portfolio.

- The ongoing shift toward downsizing, multi-family living, and increased mobility is underpinning a consistent and broad-based demand for storage, independent of housing market cycles, supporting occupancy stabilization and enabling gradual move-in rate recovery, both of which are poised to drive top-line revenue growth through 2025 and set a stronger baseline for 2026.

- Slower supply growth is on the horizon due to rising construction costs, high land values, and tighter borrowing conditions, signaling that new competitive pressures will ease in 2026 and beyond-allowing CubeSmart to benefit from a more favorable pricing environment and improved net operating income margins as existing supply is absorbed.

- Continued focus on expense discipline-highlighted by better-than-expected insurance renewals, tax appeals, and operating efficiencies-should moderate expense growth, resulting in higher net margins and stronger FFO as stabilizing top-line trends combine with sector-leading cost controls.

- CubeSmart's prudent capital allocation and strong balance sheet provide capacity and flexibility to pursue value-accretive acquisitions in high-barrier, core markets as transaction opportunities rise, which should enhance asset quality and earnings growth potential over time, particularly as industry consolidation accelerates.

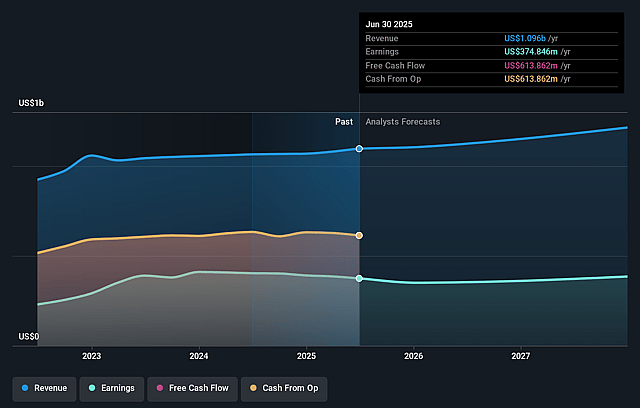

CubeSmart Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CubeSmart's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 34.2% today to 29.6% in 3 years time.

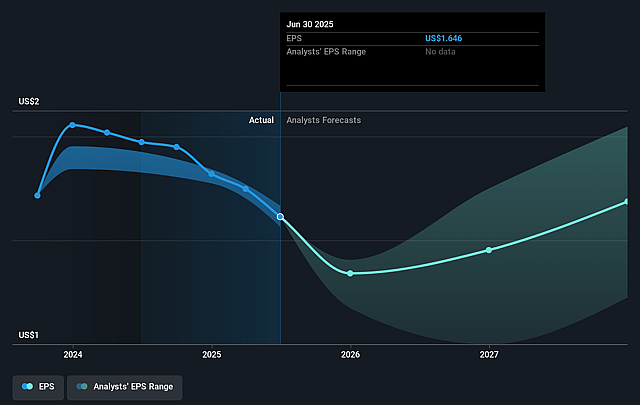

- Analysts expect earnings to reach $369.9 million (and earnings per share of $1.6) by about September 2028, down from $374.8 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $418.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.6x on those 2028 earnings, up from 24.8x today. This future PE is greater than the current PE for the US Specialized REITs industry at 30.5x.

- Analysts expect the number of shares outstanding to grow by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

CubeSmart Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent new supply in key Sunbelt markets (e.g., Florida, Arizona, Texas, Atlanta, Phoenix) is causing shorter-term occupancy and revenue pressure, with absorption and recovery timelines expected to be longer in these regions, potentially weighing on overall portfolio revenue growth and net operating income for several years.

- Slower-than-expected recovery in move-in rates and same-store revenue growth across the portfolio, with management guiding to continued negative year-over-year comps in the near term, indicates that stabilization of revenue and margin improvement will be gradual, delaying meaningful growth in earnings.

- Increasing churn in the third-party management (3PM) business due to greater transaction market activity may lead to loss of managed store count, reducing overall fee income and impacting CubeSmart's ability to scale non-owned revenue streams and operating leverage.

- Higher maintenance, repair, and recurring capital expenditures (e.g., for property upgrades and digital infrastructure), as cost efficiencies are fully realized and inflationary pressures normalize, may compress net margins and free cash flow over the medium to long term.

- Ongoing risks of broader consumer volatility and economic uncertainty-including muted housing market activity, potential negative impacts from monetary policy decisions, and a possible weaker macro backdrop-could weigh on customer demand, pricing power, and rent growth, ultimately threatening both revenue growth and earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $45.278 for CubeSmart based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $369.9 million, and it would be trading on a PE ratio of 35.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of $40.73, the analyst price target of $45.28 is 10.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.