- United States

- /

- REITS

- /

- NYSE:ALEX

Undiscovered Gems In The US Including 3 Promising Small Caps

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a significant 39% increase over the past year, with earnings expected to grow by 15% annually. In this dynamic environment, identifying promising small-cap stocks that have yet to capture widespread attention can offer unique opportunities for investors seeking growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Shore Bancshares | 23.15% | 24.96% | 10.17% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Perdoceo Education (NasdaqGS:PRDO)

Simply Wall St Value Rating: ★★★★★★

Overview: Perdoceo Education Corporation offers postsecondary education through online, campus-based, and blended learning programs in the United States, with a market capitalization of approximately $1.39 billion.

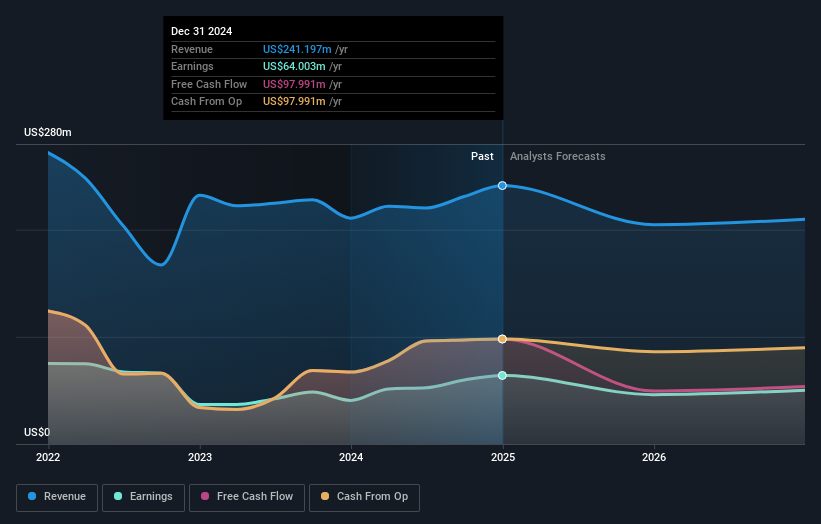

Operations: Perdoceo Education generates revenue primarily from its Colorado Technical University (CTU) and American InterContinental University (AIUS) segments, with CTU contributing approximately $451.54 million and AIUS about $210.63 million.

Perdoceo Education, a smaller player in the education sector, has been making strategic moves to bolster its financial standing. The company reported a net income of US$38.43 million for the second quarter of 2024, down from US$54.67 million the previous year, with basic earnings per share at US$0.59 compared to US$0.81 last year. Despite this dip, Perdoceo remains debt-free and trades at 52% below its estimated fair value, suggesting potential undervaluation relative to peers. Recent acquisitions like the University of St. Augustine could enhance operating income and leverage growing educational trends for future growth prospects.

Third Coast Bancshares (NasdaqGS:TCBX)

Simply Wall St Value Rating: ★★★★★★

Overview: Third Coast Bancshares, Inc. is a bank holding company for Third Coast Bank, SSB, offering commercial banking solutions to small and medium-sized businesses and professionals, with a market cap of approximately $424.93 million.

Operations: Third Coast Bancshares generates revenue primarily from its Community Banking segment, amounting to $158.91 million.

Third Coast Bancshares, with assets totaling US$4.6 billion and equity of US$450.5 million, is making waves in the banking sector. Its total deposits stand at US$4 billion while loans are at US$3.9 billion, reflecting a strong lending position supported by an appropriate allowance for bad loans at 165% and non-performing loans at just 0.6%. The bank's earnings growth of 47.9% over the past year surpasses industry averages, highlighting its robust performance and strategic positioning within Texas markets. Trading below estimated fair value by 24%, it offers potential upside for investors seeking value in financial stocks.

Alexander & Baldwin (NYSE:ALEX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alexander & Baldwin, Inc. (NYSE: ALEX) is a real estate investment trust specializing in Hawai'i commercial real estate, particularly grocery-anchored neighborhood shopping centers, with a market cap of approximately $1.36 billion.

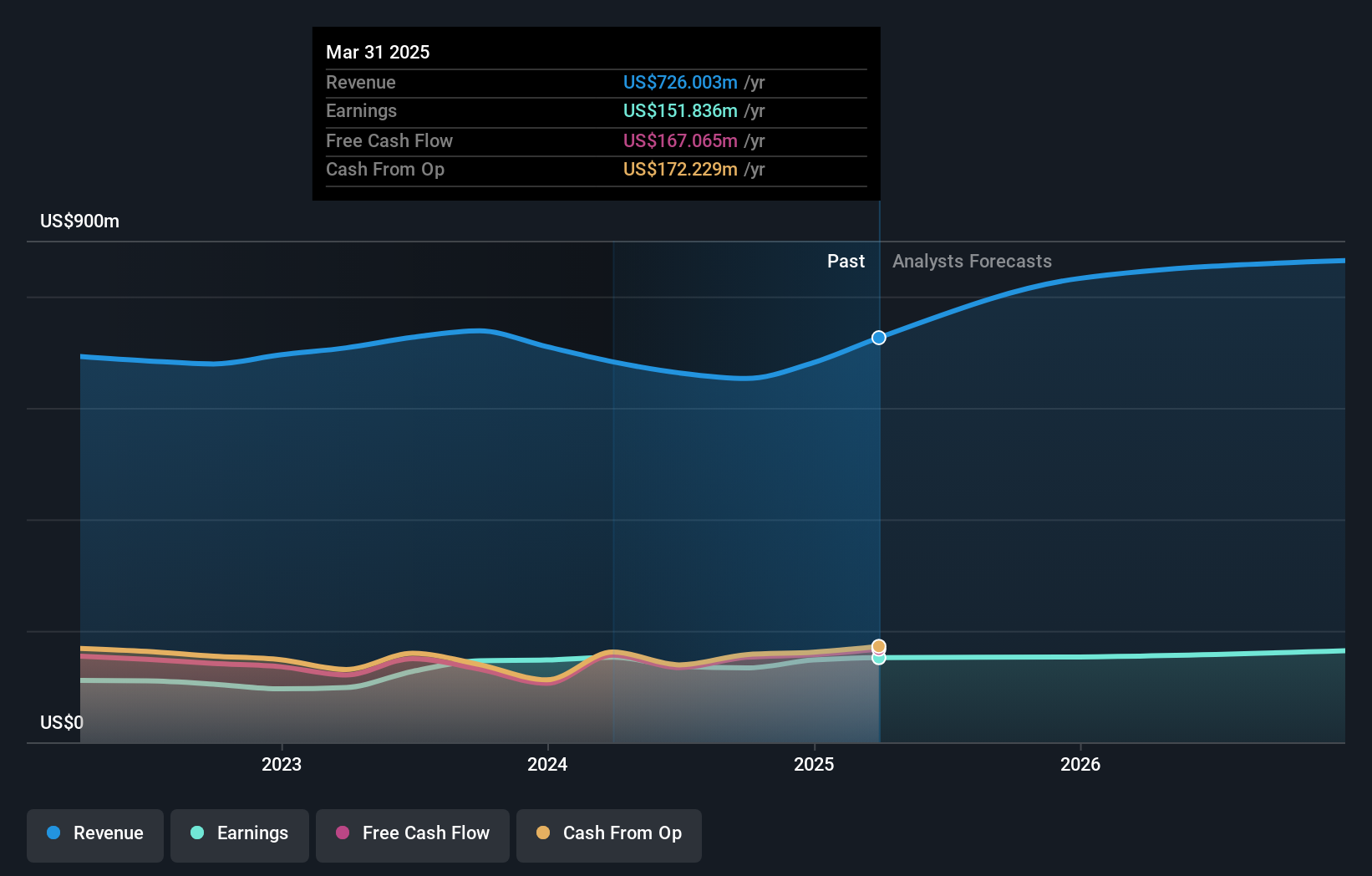

Operations: A&B generates revenue primarily from its Commercial Real Estate segment, accounting for $195.84 million, and Land Operations, contributing $31.25 million.

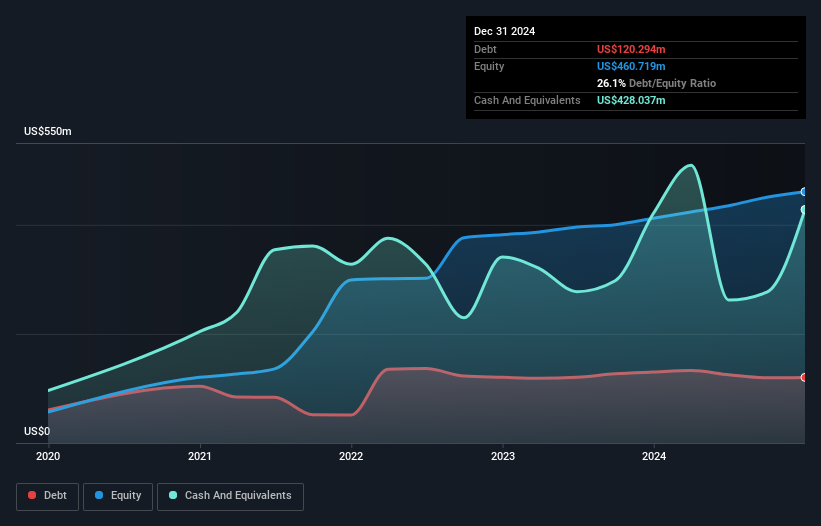

Alexander & Baldwin, a player in Hawai'i's real estate scene, has seen its earnings grow 23% over the past year, outpacing the REIT industry. Despite this growth, A&B deals with high debt levels; its net debt to equity ratio stands at 45.5%. The company is trading about 10% below estimated fair value and maintains positive free cash flow. Recent changes include a revised credit agreement reducing commitments to $450 million and extending terms until 2028. Earnings guidance for 2024 was raised recently, forecasting net income per share between US$0.74 and US$0.82, up from earlier estimates.

Turning Ideas Into Actions

- Gain an insight into the universe of 226 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALEX

Alexander & Baldwin

Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai'i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives