- United States

- /

- REITS

- /

- NasdaqGS:GOOD

3 Undervalued Small Caps In The United States With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 4.4%. In contrast to the last week, the market is up 19% over the past year. Earnings are expected to grow by 15% per annum over the next few years. Identifying undervalued small-cap stocks with insider buying can offer potential opportunities for investors looking to capitalize on current market conditions and future growth prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 19.6x | 0.9x | 46.27% | ★★★★★★ |

| Orion Group Holdings | NA | 0.3x | 32.78% | ★★★★★★ |

| Thryv Holdings | NA | 0.7x | 26.30% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.3x | 31.88% | ★★★★★☆ |

| Franklin Financial Services | 10.3x | 2.0x | 37.51% | ★★★★☆☆ |

| RGC Resources | 15.6x | 2.3x | 20.48% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -63.95% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -33.21% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -243.28% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

ChoiceOne Financial Services (NasdaqCM:COFS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ChoiceOne Financial Services operates as a community bank providing a range of banking services, with a market cap of approximately $0.20 billion.

Operations: ChoiceOne Financial Services generates revenue primarily from its banking segment, amounting to $83.14 million. The company's net income margin has shown variability, reaching 27.23% in the most recent period ending June 2024. Operating expenses are significant, with general and administrative expenses consistently being the largest component, totaling $47.58 million for the same period.

PE: 12.0x

ChoiceOne Financial Services, a small cap stock in the U.S., has shown promising financial performance with net income rising to US$6.59 million for Q2 2024 from US$5.21 million a year ago. They declared a quarterly dividend of $0.27 per share, consistent with previous quarters and slightly higher than last year's rate. Insider confidence is evident as insiders purchased shares recently, reflecting optimism about future growth prospects in the financial sector despite no recent share repurchases by the company.

- Click here and access our complete valuation analysis report to understand the dynamics of ChoiceOne Financial Services.

Learn about ChoiceOne Financial Services' historical performance.

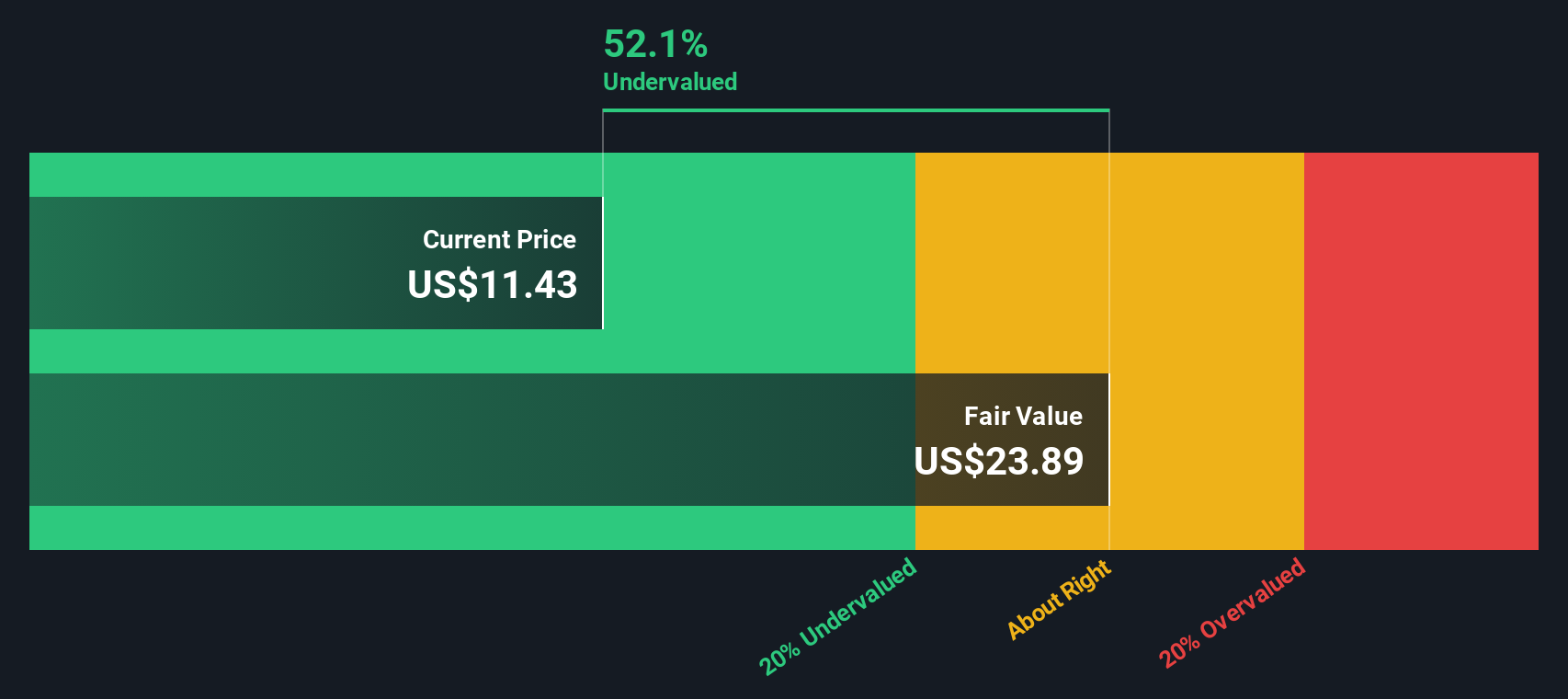

Gladstone Commercial (NasdaqGS:GOOD)

Simply Wall St Value Rating: ★★★☆☆☆

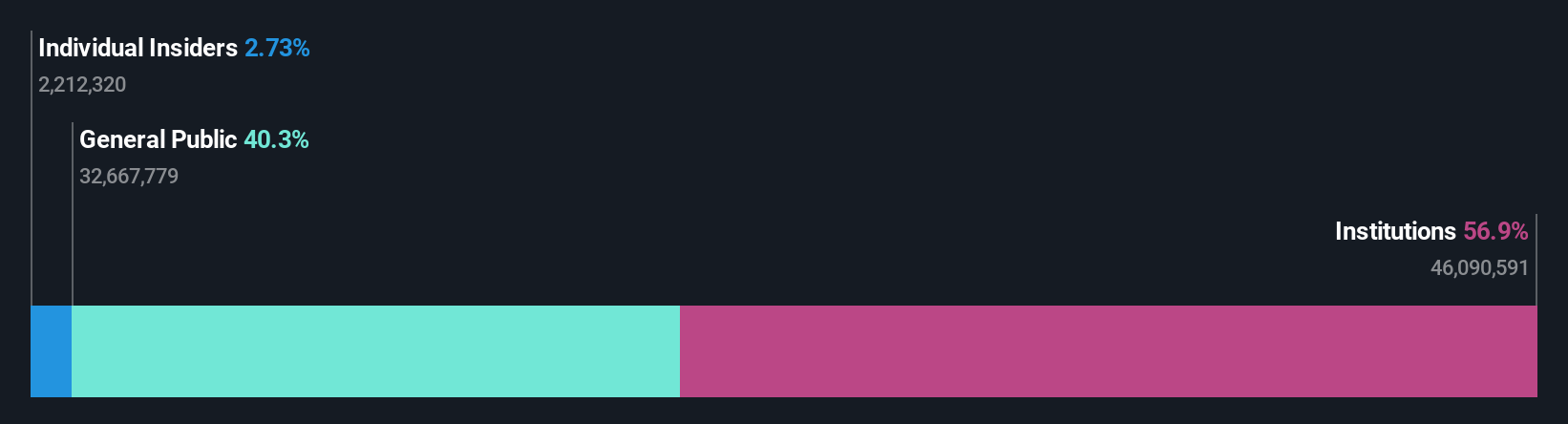

Overview: Gladstone Commercial is a real estate investment trust (REIT) specializing in commercial properties with a market cap of approximately $0.70 billion.

Operations: Gladstone Commercial generates revenue primarily from its REIT - Commercial segment, totaling $145.15 million. The company has experienced varying net income margins, with the most recent being -0.00971%. Gross profit margins have shown fluctuations, reaching up to 0.79121% in the latest period.

PE: -457.0x

Gladstone Commercial has been actively securing long-term leases and expanding its portfolio. Recent highlights include an 8-year lease extension with Elster Solutions in Raleigh, NC, and the acquisition of a Class A industrial facility in Midland, TX with a 15-year lease. Despite reporting lower revenue year-over-year for Q2 2024 (US$37.06 million vs. US$38.66 million), the company turned a net income of US$1.61 million from a previous loss. Insider confidence is evident through recent share purchases by executives over the past six months, signaling potential optimism about future growth despite current unprofitability projections over the next three years.

- Take a closer look at Gladstone Commercial's potential here in our valuation report.

Assess Gladstone Commercial's past performance with our detailed historical performance reports.

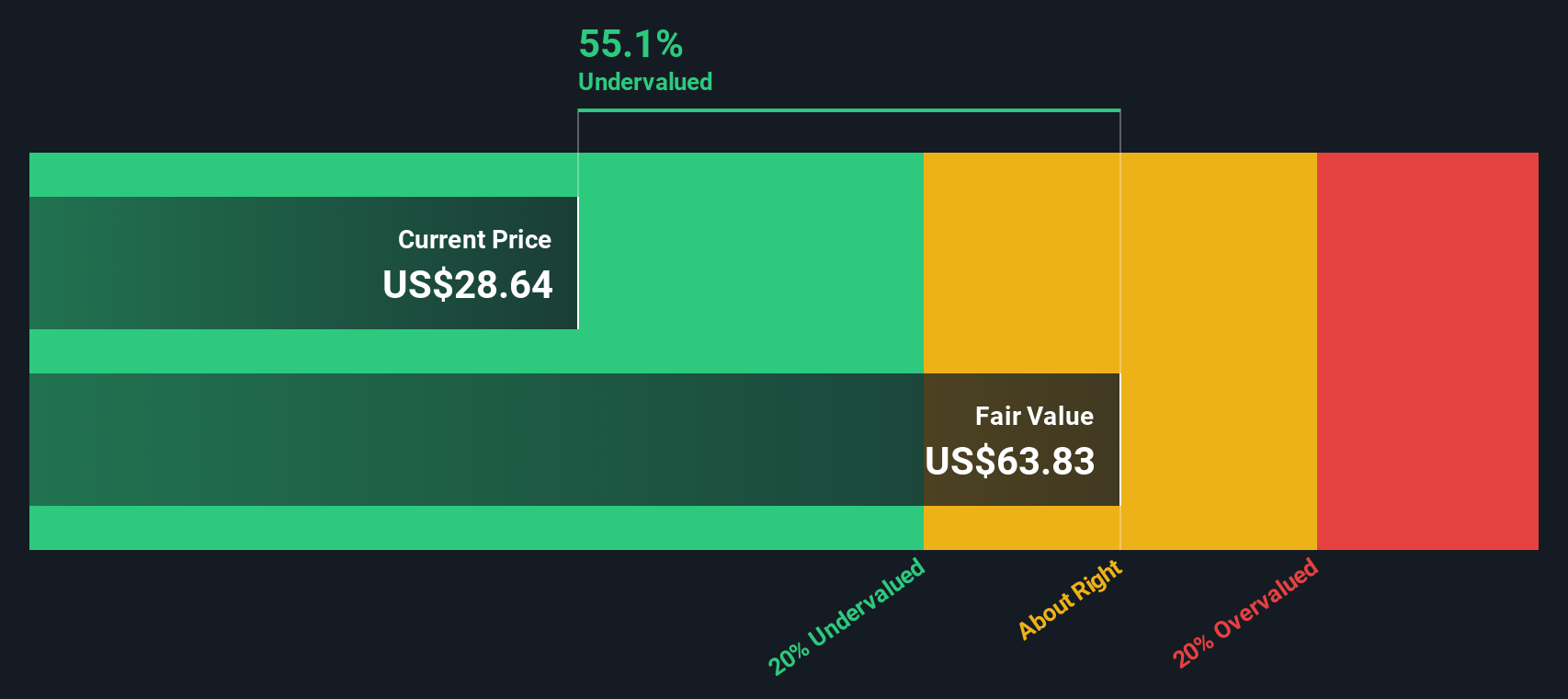

Chimera Investment (NYSE:CIM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment operates by investing on a leveraged basis in a diversified portfolio of mortgage assets and has a market cap of approximately $1.45 billion.

Operations: The company generates revenue primarily from investing in a diversified portfolio of mortgage assets. Recent data shows a gross profit margin of 89.91% and net income margin of 45.94%.

PE: 8.8x

Chimera Investment has shown insider confidence with significant share purchases over the past six months. Despite earnings forecasted to decline by 5.8% annually for the next three years, Q2 2024 net income surged to US$56.66 million from US$36.02 million a year ago, with EPS rising to US$0.42 from US$0.23. The company also completed a $65 million fixed-income offering and declared multiple preferred dividends, highlighting its commitment to shareholder returns amidst challenging market conditions.

- Navigate through the intricacies of Chimera Investment with our comprehensive valuation report here.

Turning Ideas Into Actions

- Delve into our full catalog of 58 Undervalued US Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOOD

Gladstone Commercial

A real estate investment trust focused on acquiring, owning, and operating net leased industrial and office properties across the United States.

Slight and slightly overvalued.