- United States

- /

- Banks

- /

- NasdaqGS:NRIM

Top Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

The United States market has experienced a positive trend, climbing 2.7% in the last week and achieving a 9.6% increase over the past year, with earnings projections indicating an annual growth of 14% in the coming years. In this favorable environment, identifying dividend stocks that offer consistent payouts and potential for capital appreciation can be an effective strategy for investors seeking to balance income generation with growth opportunities.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.42% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 4.92% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.18% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.50% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.57% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.03% | ★★★★★★ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.12% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.52% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.68% | ★★★★★☆ |

| Omega Flex (NasdaqGM:OFLX) | 4.54% | ★★★★★☆ |

Click here to see the full list of 154 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

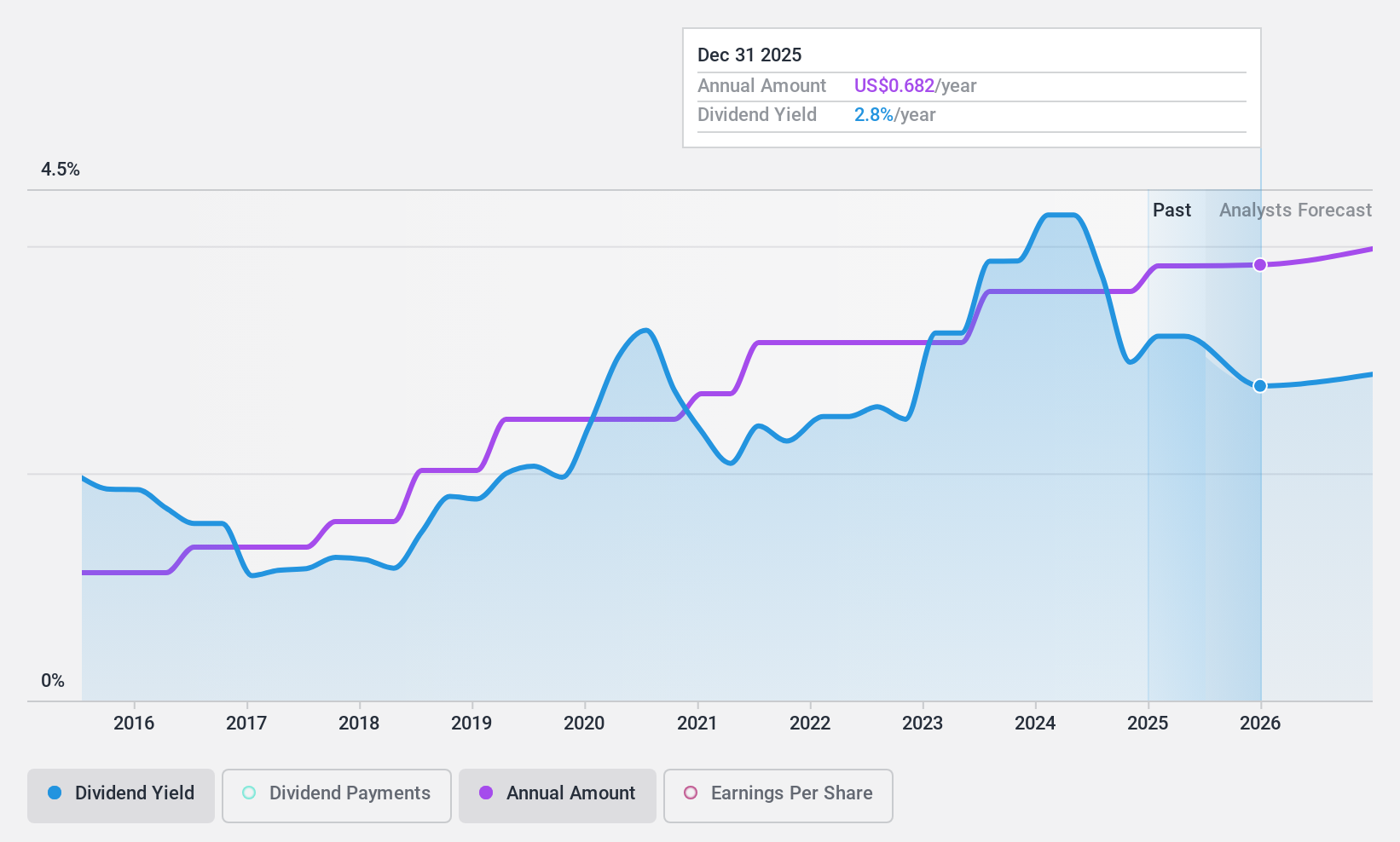

Civista Bancshares (NasdaqCM:CIVB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Civista Bancshares, Inc. is a financial holding company for Civista Bank, offering community banking services in the United States, with a market cap of $347.78 million.

Operations: Civista Bancshares, Inc. generates its revenue primarily through its banking segment, which accounts for $153.52 million.

Dividend Yield: 3%

Civista Bancshares offers a stable dividend with a payout ratio of 28.7%, indicating strong coverage by earnings. The company recently affirmed its quarterly dividend of US$0.17 per share, maintaining consistency over the past decade. While its 3.02% yield is below the top tier in the U.S., it remains reliable and has shown growth historically. Recent earnings reported an increase in net income to US$10.17 million, supporting continued dividend sustainability amidst active share buybacks totaling US$1.5 million this year.

- Click here and access our complete dividend analysis report to understand the dynamics of Civista Bancshares.

- Upon reviewing our latest valuation report, Civista Bancshares' share price might be too pessimistic.

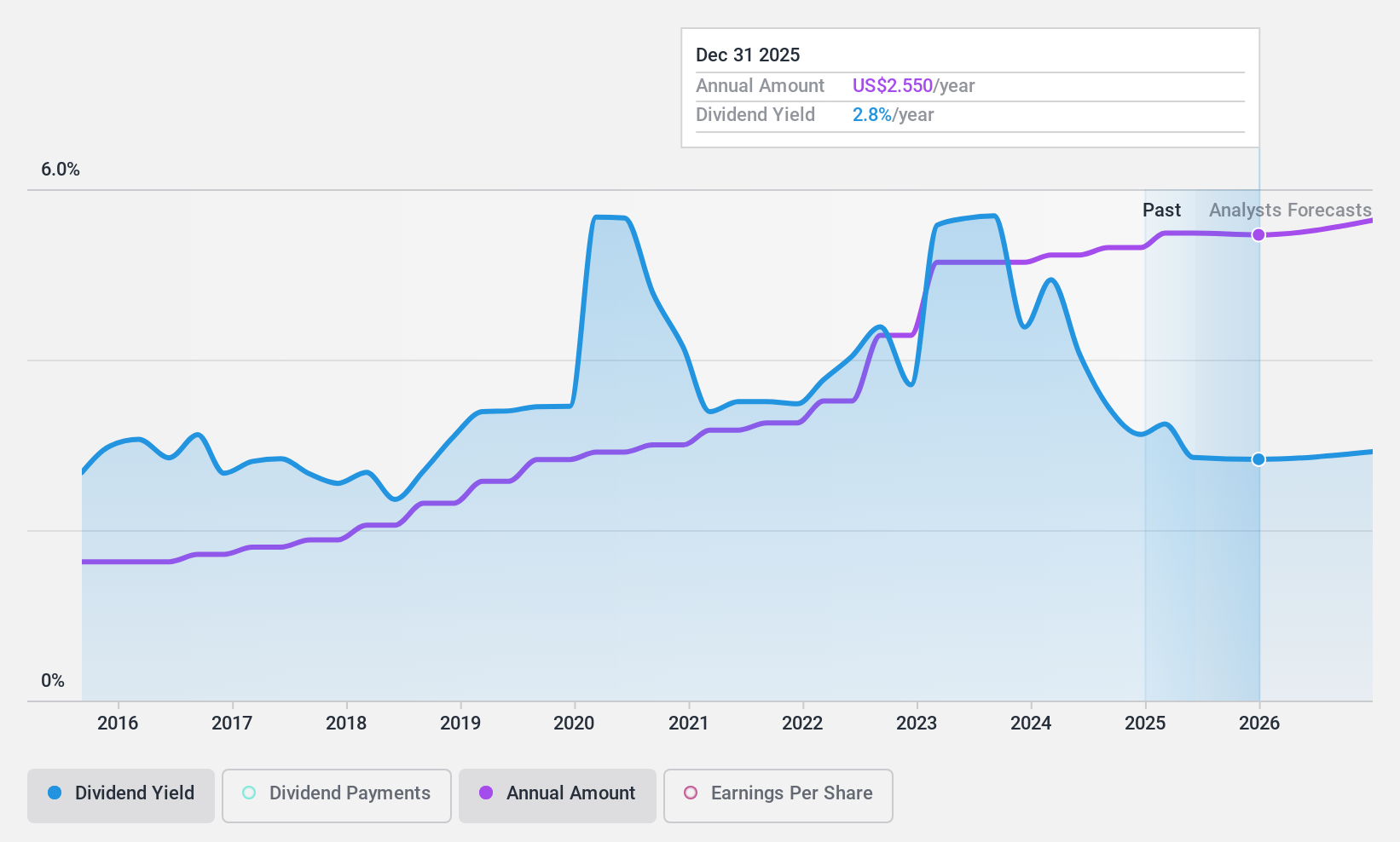

Northrim BanCorp (NasdaqGS:NRIM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northrim BanCorp, Inc. is the bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professionals, with a market cap of $449.46 million.

Operations: Northrim BanCorp's revenue segments include Specialty Finance at $10.98 million and Home Mortgage Lending at $36.79 million.

Dividend Yield: 3.2%

Northrim BanCorp demonstrates a reliable dividend history with stable payments over the past decade, supported by a low payout ratio of 33%, indicating strong earnings coverage. Despite its 3.19% yield being below the top U.S. tier, dividends have grown steadily. Recent earnings revealed a significant increase in net income to US$13.32 million for Q1 2025, enhancing dividend sustainability prospects amidst strategic financial moves like a US$150 million shelf registration filing for potential capital raising activities.

- Take a closer look at Northrim BanCorp's potential here in our dividend report.

- The valuation report we've compiled suggests that Northrim BanCorp's current price could be quite moderate.

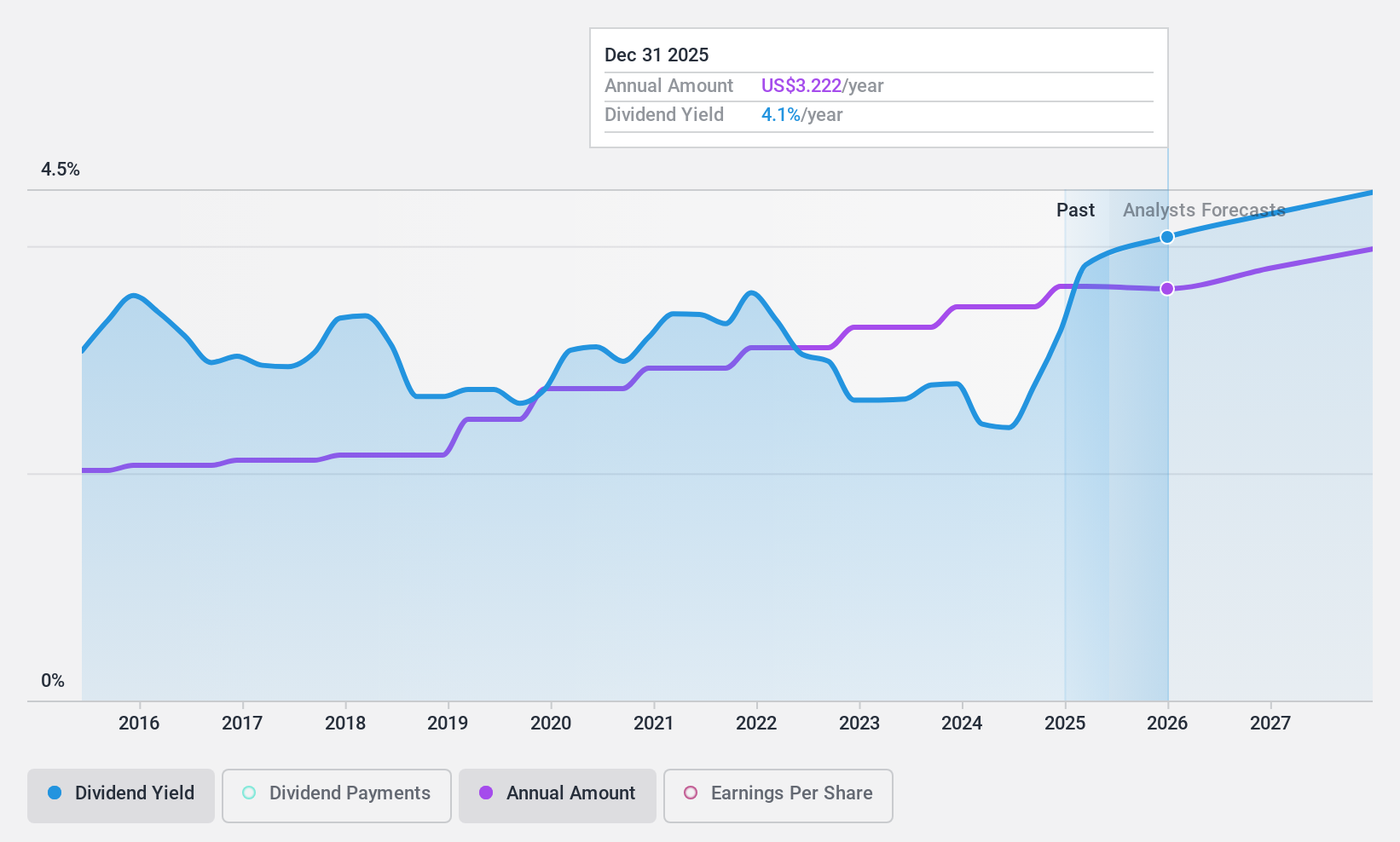

Merck (NYSE:MRK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Merck & Co., Inc. is a global healthcare company with operations spanning various segments of the pharmaceutical industry, and it has a market cap of approximately $213.16 billion.

Operations: Merck & Co., Inc. generates revenue primarily from its Pharmaceutical segment, which accounts for $57.03 billion, and its Animal Health segment, contributing $5.95 billion.

Dividend Yield: 3.8%

Merck's dividends are well-covered by earnings and cash flows, with a payout ratio of 45.3%. The dividend yield of 3.8% is stable but below the top U.S. tier. Recent expansions include a $1 billion biologics center in Delaware, enhancing its pipeline and manufacturing capabilities. Despite legal challenges over Keytruda's formulation, Merck continues to innovate with new facilities and product approvals, supporting its commitment to growth and shareholder returns amidst robust financial performance.

- Delve into the full analysis dividend report here for a deeper understanding of Merck.

- Our expertly prepared valuation report Merck implies its share price may be lower than expected.

Key Takeaways

- Discover the full array of 154 Top US Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrim BanCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NRIM

Northrim BanCorp

Operates as the bank holding company for Northrim Bank that provides commercial banking products and services to businesses and professional individuals.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives