- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Is Now the Moment to Reassess Recursion After Latest Platform Partnerships and Market Surge?

Reviewed by Bailey Pemberton

Thinking about what to do with Recursion Pharmaceuticals stock? You are not alone. The last few months have given shareholders a rollercoaster to ride, marked by bursts of optimism and hints of concern. In just the past week, the stock nudged up 3.1%, but step back a little further and the swings get much sharper. Recursion is up an impressive 23.8% in the last month. However, peel back the curtain on the longer-term picture and the story cools: year-to-date, shares are still down by 16.2%, with a 6.8% slip over the past twelve months. Looking even farther back, the three-year performance has not been kind, clocking in at negative 45.5%.

These moves have been set against a backdrop of heightened investor interest in biotech innovation, as well as a run of headlines spotlighting Recursion’s new platform partnerships and continued investment from industry heavyweights. While fresh collaborations and added funding have put the company on the radar of big pharma watchers, the market’s overall take seems torn between excitement about Recursion’s technology and caution about its path to profitability.

When it comes to valuation, Recursion Pharmaceuticals gets a score of 0 out of 6, meaning its stock is not seen as undervalued by any of the typical checks. But numbers only tell part of the story. Up next, let’s dig into the main valuation approaches for Recursion, and before you make your final call, we will explore a perspective that often gets overlooked in traditional analysis.

Recursion Pharmaceuticals scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Recursion Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and discounts them back to today's value to estimate what the business is really worth. For Recursion Pharmaceuticals, the DCF uses the latest Free Cash Flow figure, which stands at a negative $403.99 Million. Looking ahead, analysts expect Free Cash Flow to remain negative for the next two years, before turning positive in 2028 with $150 Million and continuing to rise, though more modestly, to approximately $135.68 Million by 2035.

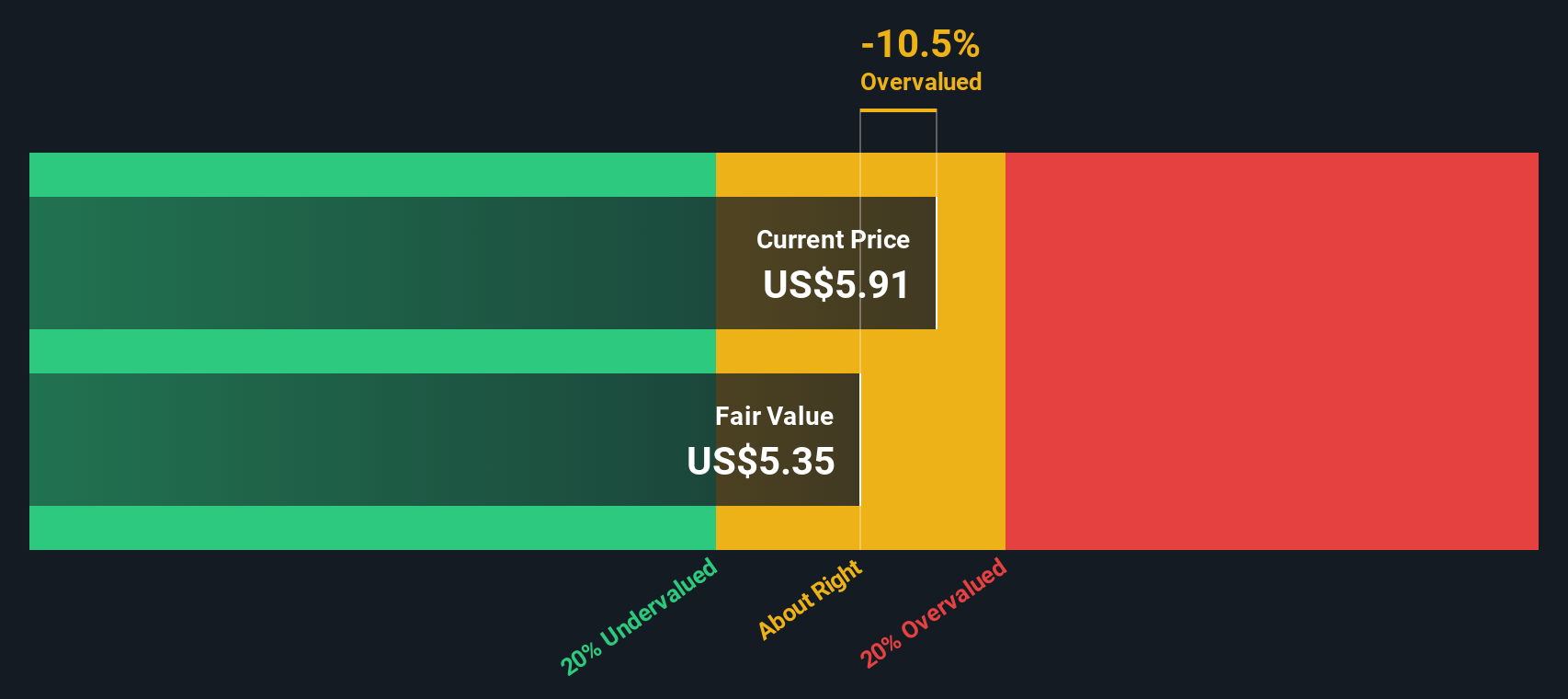

The DCF model here is a two-stage approach, with analyst estimates covering the next five years and Simply Wall St extrapolating the remaining projections. The purpose is to arrive at a fair price for the stock based entirely on what its future cash flows are likely to be worth in today’s dollars. According to this analysis, the estimated intrinsic value per share for Recursion Pharmaceuticals is $5.27.

Comparing this intrinsic value to Recursion's current share price reveals that the stock is about 14.7% overvalued by the DCF model standard.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Recursion Pharmaceuticals may be overvalued by 14.7%. Find undervalued stocks or create your own screener to find better value opportunities.

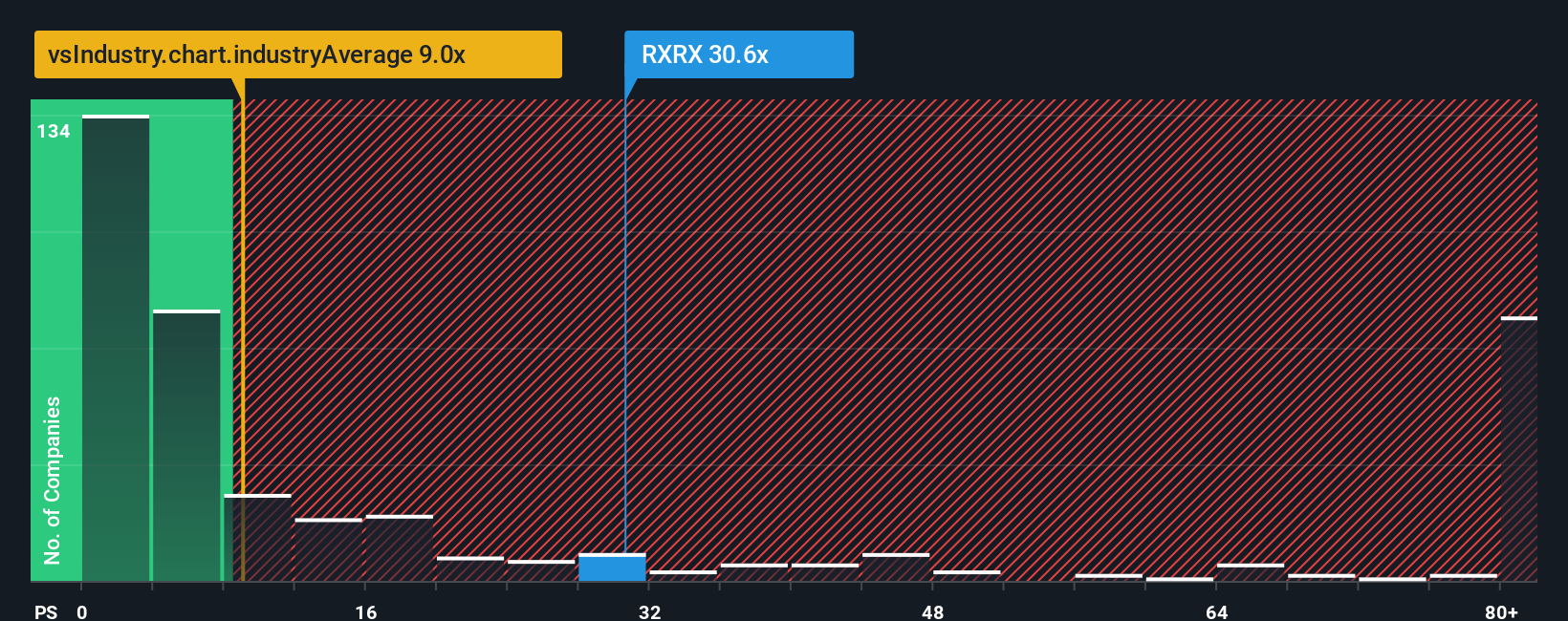

Approach 2: Recursion Pharmaceuticals Price vs Sales

The price-to-sales (P/S) ratio is a useful way to value biotech companies like Recursion Pharmaceuticals, especially when profits are elusive or inconsistent. This metric gives a clearer sense of how the market values each dollar of sales, which can be more relevant than earnings in industries focused on growth and research rather than immediate profitability.

It's important to remember that a "normal" or "fair" P/S ratio depends on factors like future growth expectations and risk. Rapidly growing companies or those with breakthrough potential often command higher multiples. In contrast, higher risks or slow growth can push them lower.

Currently, Recursion Pharmaceuticals trades at a P/S ratio of 40.87x, which is much higher than both the biotech industry average of 10.85x and the peer group average of 15.79x. This suggests the market is pricing in significant optimism around Recursion’s technology and future sales growth.

Simply Wall St’s "Fair Ratio" offers a more tailored benchmark by considering not just industry averages but also the company’s expected growth, profit margins, size, and risk profile. Instead of relying solely on broad comparisons, the Fair Ratio factors in Recursion’s unique circumstances and prospects, making it a more reliable guide for investors.

For Recursion Pharmaceuticals, the Fair Ratio is calculated at just 0.00x, significantly below the company’s current P/S ratio. Given this large difference, the stock appears substantially overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Recursion Pharmaceuticals Narrative

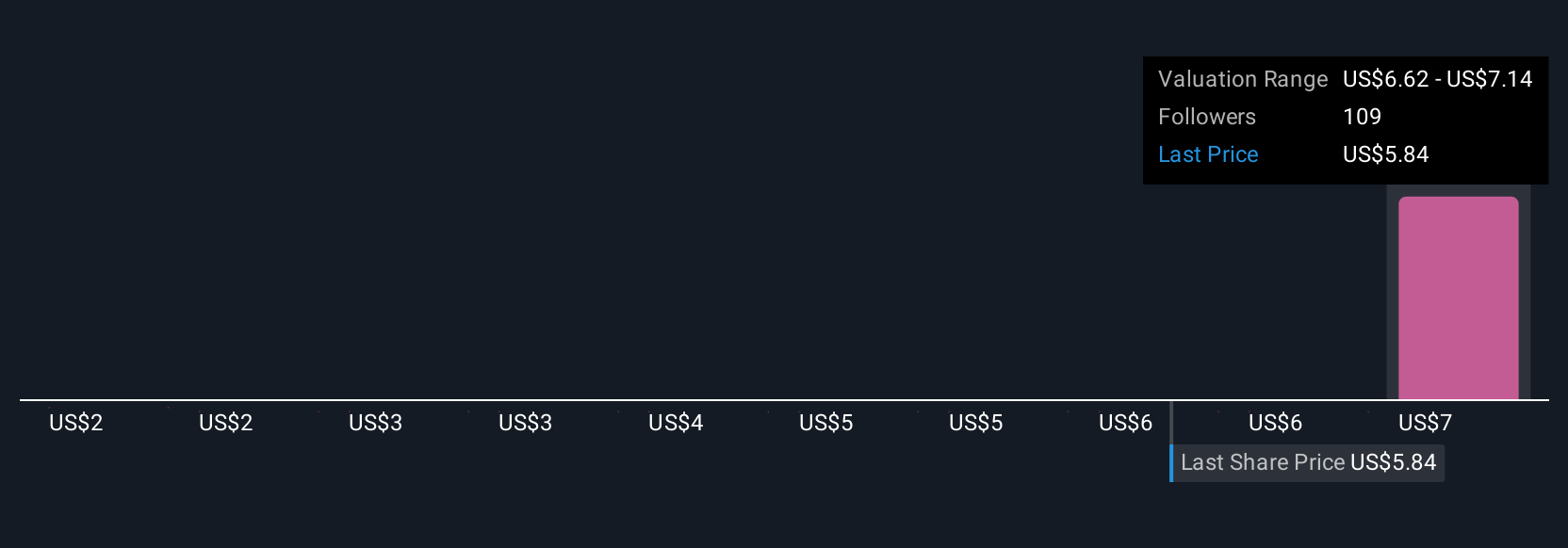

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simple, powerful stories that investors create to tie together their view of a company’s business, future performance, and fair value. They combine financial data with real-world context, such as technology trends or leadership changes.

Instead of relying solely on static models, Narratives let you ground your valuation in the real drivers behind the numbers by linking a company’s story directly to revenue, earnings forecasts, and ultimately, an actionable fair value. With Narratives on Simply Wall St’s Community page, millions of investors can easily create, share, and compare perspectives. Each Narrative automatically updates as new earnings reports or news releases become available.

This means you can quickly spot when your view of Recursion Pharmaceuticals is more optimistic or cautious compared to others, and see how the Fair Value from each Narrative compares to the current share price to guide your buy/sell decisions. For example, some investors see advanced AI breakthroughs and pharma partnerships as justification for a fair value as high as $10.00, while more cautious views that focus on early-stage risks or cash constraints place the fair value closer to $3.00.

Do you think there's more to the story for Recursion Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion