- United States

- /

- Life Sciences

- /

- NasdaqCM:RPID

Rapid Micro Biosystems And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market shows signs of recovery with the S&P 500 and Nasdaq slightly higher, investors are closely monitoring economic indicators and policy developments. Amid these conditions, penny stocks—though a somewhat outdated term—remain an intriguing investment area for those seeking potential growth opportunities in smaller or newer companies. When supported by strong financial health, these stocks can offer unique value propositions, making them noteworthy considerations for investors looking to uncover hidden gems in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.75 | $392.12M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $3.50 | $2.08B | ✅ 3 ⚠️ 3 View Analysis > |

| Cango (NYSE:CANG) | $4.38 | $424.77M | ✅ 4 ⚠️ 1 View Analysis > |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.81 | $77.69M | ✅ 5 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ✅ 1 ⚠️ 5 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $3.53 | $443.52M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.55 | $77.35M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.81 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $140.05M | ✅ 3 ⚠️ 1 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.859 | $73.78M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Rapid Micro Biosystems (NasdaqCM:RPID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rapid Micro Biosystems, Inc. is a life sciences technology company that offers products for detecting microbial contamination in the manufacturing of pharmaceuticals, medical devices, and personal care products across various international markets, with a market cap of $111.98 million.

Operations: The company's revenue is generated from its Systems and Related LIMS Connection Software, Consumables, and Services segment, amounting to $28.05 million.

Market Cap: $111.98M

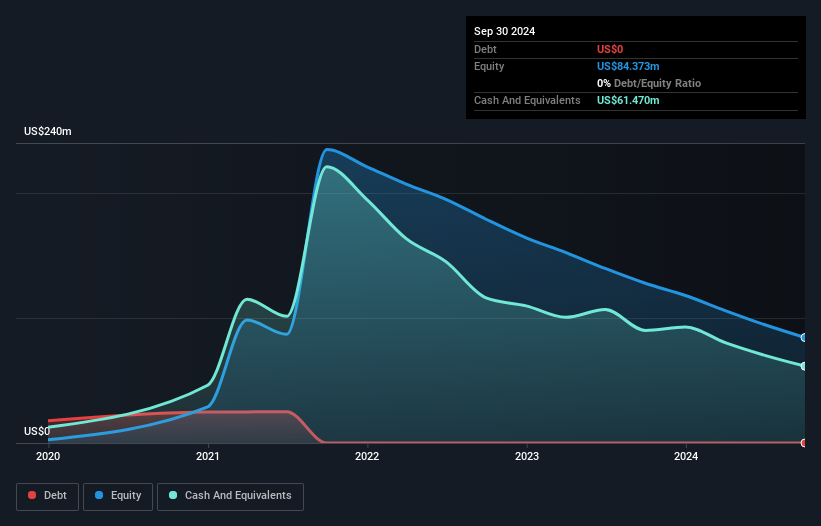

Rapid Micro Biosystems, Inc., with a market cap of US$111.98 million, has shown revenue growth from US$22.52 million to US$28.05 million year-over-year but remains unprofitable with a net loss of US$46.89 million in 2024. The company maintains a stable cash runway exceeding one year and is debt-free, providing some financial stability despite its negative return on equity of -62.23%. A recent five-year collaboration agreement with MilliporeSigma aims to enhance distribution and cost efficiencies, potentially supporting future revenue growth as the company forecasts at least US$32 million in revenue for 2025.

- Navigate through the intricacies of Rapid Micro Biosystems with our comprehensive balance sheet health report here.

- Learn about Rapid Micro Biosystems' future growth trajectory here.

AbCellera Biologics (NasdaqGS:ABCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AbCellera Biologics Inc. focuses on discovering and developing antibody-based medicines for unmet medical needs in the United States, with a market cap of approximately $727.09 million.

Operations: The company generates revenue of $28.83 million from its segment focused on the discovery and development of antibodies.

Market Cap: $727.09M

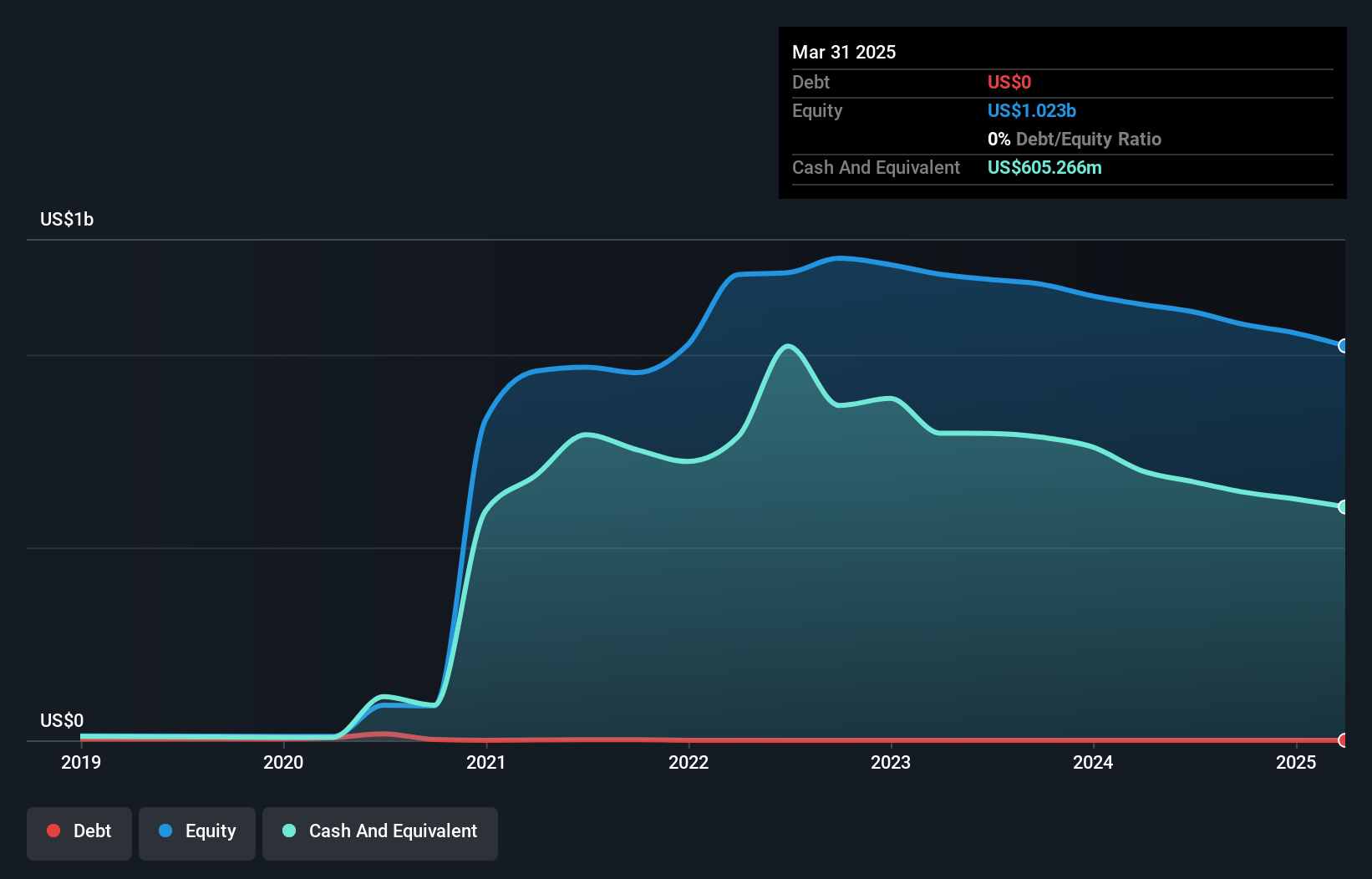

AbCellera Biologics Inc., with a market cap of US$727.09 million, reported a decline in revenue to US$28.83 million for 2024, alongside an increased net loss of US$162.86 million. Despite being unprofitable and having negative return on equity, the company remains debt-free with short-term assets significantly exceeding liabilities, offering some financial cushion. Recent strategic expansion with AbbVie Inc. into T-cell engagers for oncology could provide potential future revenue streams through milestone and royalty payments. AbCellera's management and board are experienced, though earnings are forecast to decline over the next three years while revenue is expected to grow annually by 18.76%.

- Click here to discover the nuances of AbCellera Biologics with our detailed analytical financial health report.

- Gain insights into AbCellera Biologics' future direction by reviewing our growth report.

TETRA Technologies (NYSE:TTI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc., along with its subsidiaries, operates as an energy services and solutions company with a market cap of approximately $443.52 million.

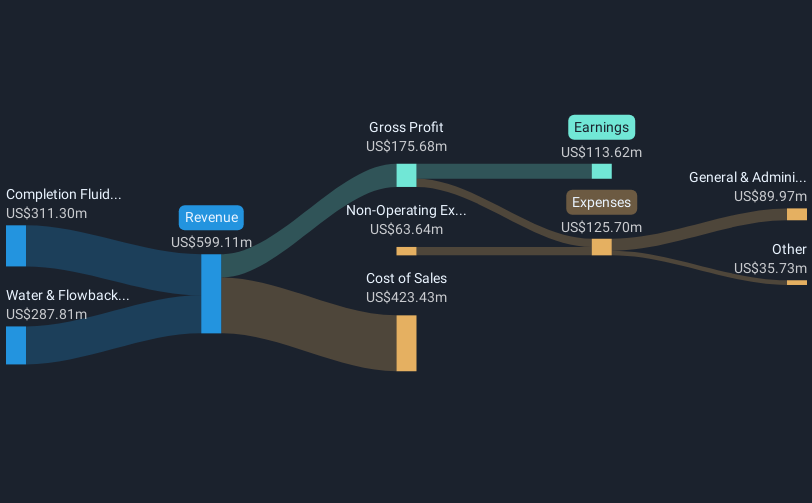

Operations: The company generates revenue through its Water & Flowback Services segment, which accounts for $287.81 million, and its Completion Fluids & Products segment, contributing $311.30 million.

Market Cap: $443.52M

TETRA Technologies, Inc., with a market cap of approximately US$443.52 million, has demonstrated significant earnings growth over the past year, reporting a net income of US$108.28 million for 2024 compared to US$25.78 million in 2023. Despite high debt levels with a net debt to equity ratio at 56.3%, the company's short-term assets exceed both short and long-term liabilities, indicating solid financial positioning. Activist investors have criticized the board's governance and strategy execution, suggesting changes that could unlock stockholder value. The company trades below its estimated fair value and analysts project further stock price appreciation by 77.1%.

- Click here and access our complete financial health analysis report to understand the dynamics of TETRA Technologies.

- Understand TETRA Technologies' earnings outlook by examining our growth report.

Summing It All Up

- Discover the full array of 756 US Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RPID

Rapid Micro Biosystems

A life sciences technology company, provides products for the detection of microbial contamination in the manufacture of pharmaceutical, medical devices, and personal care products in the United States, Germany, Switzerland, Japan, and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives